BMGT495_syllabus - Office of Sustainability

advertisement

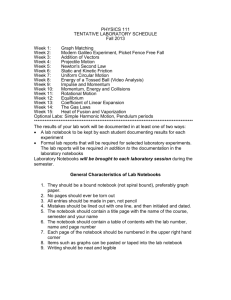

ROBERT H. SMITH SCHOOL OF BUSINESS BMGT 495 FALL 2009 Business Policies College Park Tu/Th Sec. 0301; VMH Rm. 1314, 12:30pm – 1:45pm College Park Tu/Th Sec. 0401; VMH Rm. 1314, 2:00pm – 3:15pm Instructor: Dr. Rhonda Reger Consulting Services: Capsim Telephone XXX-XXX-XXX Office: VMH 4562 Phone: 301-405-2167 Email: rreger@rhsmith.umd.edu Office Hours: Tu/Th 3:30pm – 4:30pm and by appointment. Section: Required Texts: Capstone Student Guide 2009 (in class; register for the simulation on-line before the first class) Wall Street Journal (available free from VBIC/library) Case Packet (Available from Copy Center in VMH) Comp-XM, Examination Guide 2009 (will be distributed before the Final Exam) Course Overview: Implicitly or explicitly, every firm must define the scope of its business operations and, within the chosen scope, how the firm will compete against rivals. Decisions about the scope of business constitute the firm’s corporate strategy; decisions about how to compete within chosen market segments reflect the firm’s business-level strategy. This course focuses on how a firm can develop and implement effective business-level and corporate-level strategies. The course is also about top management and the total organization. As such, it is an integrative course emphasizing a “general management” or total organizational perspective as opposed to a functional viewpoint (accounting, finance, marketing, etc.). A general management perspective is necessary because the formulation and implementation of effective strategies requires a precise understanding of the interrelationships among the different functions of the organization and the relationships of these functions to the business environment. Course Purpose and Objectives: The course is designed to help students: Apply theories, concepts and models that managers can use to develop and implement successful strategies Understand how to take a general management view of business strategic issues, one that integrates different functional perspectives into a perspective on what is best for the organization as a whole Improve business communication skills through class discussions, formal presentations, and preparing a written Annual Report. Grading: Class Contribution Wall Street Journal Notebook Capstone Simulation Team Performance in the Simulation Homework Assignments Team Annual Presentation to Stockholders (2) Annual Report with 8 years of data Final Examination 10% 20% 10% 10% 20% 10% 20% Class Contribution: This is not a traditional lecture-based course. Conceptual material will be illustrated and applied to the “real world” through rigorous class discussion of business cases (case packet and WSJ assignments), and through running a company in a simulated industry. Students can contribute to the collective learning in many ways. Your classmates and I expect all students to attend and be well prepared for each class and team meeting, having read the required materials and analyzed the assigned case studies before class. We also expect all class members to play an active role in class discussion and in your simulation teams. If all class members prepare for and actively participate in each class discussion, we will all learn more from each other and enjoy the course more. In addition, those that make consistent, meaningful contributions to class discussions will receive higher class contribution grades. We realize that people become ill, have job interviews and other obligations that may require a student to miss a class session or a team meeting from time to time. It is the obligation of every student to act as a professional in these cases: inform others of your need to miss, arrange for a classmate to take notes in your absence and to bring you up to date on any materials or decisions you missed; take on additional responsibilities to substitute for the missed obligations, etc. Students will have the opportunity to complete peer evaluations at least twice during the semester to identify both high and low contributors and to give low performers an opportunity to correct their behavior. To avoid misunderstandings, teams should set expectations in the first team meeting, assign roles and duties, and hold each other accountable for performance on a weekly basis. Most team issues can be handled within the team. Teams do have the right to terminate low performers, but this drastic step may only be taken after informal and formal corrective actions have failed within the team, and after the team has met with the professor. Terminated employees will receive 60% of the team grade. Wall Street Journal Notebook: Every student is expected to keep a notebook of Wall Street Journal articles with student-provided analysis and reflection. The journal should include a minimum of 15 articles (cut and pasted from the print edition or downloaded from the electronic edition) on the topics found in the appendix. Each article should be followed by the student’s analysis of the situation discussed in the article including: (1) the key strategic issues, (2) theory or models from this course or other business school courses that help structure analysis of the information provided in the article, (3) the student’s original analysis of the situation (not a summary of the facts or analysis provided in the article!), and (4) recommendations to the top management team of the company(ies) discussed in the article. Additional specific questions per topic area are included in the appendix. Notebooks will be checked twice during the semester. Students should have a minimum of 5 articles completed by the first check and 10 articles by the second check. All articles in the notebook must be published between August 31, 2009 and December 1, 2009. The notebook will account for twenty (20) percent of the course grade. The grade will be determined by the quality of the student-provided analysis in the notebook and the quality of the chosen articles. Capstone Business Simulation: Capstone® is an Internet/PC-based simulation that is designed to give teams of students the opportunity to craft strategies, to make business decisions and to be held accountable for the performance of the firm. Simulations offer students the change to come as close as possible to managing a real company to develop an understanding of many of the challenges encountered when managing a business. You and your team members will assume the role of the top management team of one of the companies in the industry. Over the eight year timeframe of the simulation, your team will encounter a range of strategic issues that will force you to integrate your knowledge of accounting, finance, marketing, operations, and strategic management. 2 Complete details of the simulation are included in the Student Guide 2009 and online at Capsim.com. Your grade for Capstone (50% of the total course grade) will be based on four criteria: (1) your team’s performance in the simulation (10%), (2) homework assignments, (3) your team’s two stockholder presentations (10% each x 2), and (4) your team’s Annual Report (10%). Capstone Simulation Performance: Ten (10) percent of your course grade will be determined by how well your Capstone company performs relative to the other companies in your industry. We will discuss in class the specific criteria that will be used to evaluate your company’s performance. Capstone Homework Assignments. Teams will complete X homework assignments during the semester. These homework assignments will become parts of the final annual report. The first homework assignment is to complete a mission statement, guiding principles and objectives. The second homework assignment is to complete a strategy statement for your team. Assignment due dates are found on the schedule. Capstone Stockholder Presentation: Each of the Capstone teams will make two Stockholder Presentations, each worth ten (10) percent of your course grade.. The presentations are designed to give you experience presenting to potential stockholders of an organization. Your goals in the presentation will be (1) to convince investors (your fellow classmates) to invest their money in your company, (2) to fairly state your company’s past performance, and (3) to provide forward looking guidance to potential stockholders as to your strategies and expected future performance without disclosing confidential competitive information. Capstone Annual Report: Each team will complete an Annual Report and 10-K (a combined report) worth ten (10) percent of your course grade. “The annual report to shareholders is the principal document used by most public companies to disclose corporate information to their shareholders. It is usually a state-of-the-company report, including an opening letter from the Chief Executive Officer, financial data, results of continuing operations, market segment information, new product plans, subsidiary activities, and research and development activities on future programs. The Form 10-K, which must be filed with the SEC, typically contains more detailed information about the company’s financial condition than the annual report.” (downloaded on January 21, 2009 from http://www.sec.gov/answers/annrep.htm ). Your annual report should focus on the last year’s performance, but also disclose data and trend lines for the entire 8 year history of your firm. Both presentations and annual reports should only include true, factual statements about your team and company. Forward looking statements should be clearly identified. Final Examination: Individual students will make four sets of decisions for the Andrews Corporation within the Comp-XM simulation. Your competition will be three companies run by the computer. This creates a level playing field for all—all students go up against a standard set of competitors. As with the semester long team simulation, the quality of your decisions directly affects the position of your company. Performance is evaluated using a Balanced Scorecard that gauges results across four areas: financial, internal business process, customer, and learning and growth. In addition, you will complete a series of five sets of quizzes called Board Queries that ask questions related to the simulation environment. For example, you might be asked to conduct a break-even analysis on an increase in production automation or calculate the effect additional borrowing will have on your financial ratios. The exam will also include questions from the lectures and cases discussed in class. The Board Query quizzes use multiple choice and essay formats. For both parts of the final exam, you will work as an individual, which means all success will be attributed to your efforts. This is your opportunity to show your strategic vision, tactical abilities and business knowledge. The final examination accounts for twenty (20) percent of the course grade. Academic Integrity: 3 Assignments and presentations must be your own work, in your own words. Using outside materials is generally acceptable as long as you clearly identify the source. The key point is to make clear which ideas and text were developed by you or your group members, and which came from others. False or fabricated information is unacceptable. The integrity of your reports and presentations should meet the highest standards, whether as a student, consultant, or manager. Singular and isolated lapses of ethics, integrity, or professionalism have had devastating consequences on careers. Students are encouraged to discuss cases, exchange ideas, collaborate and cooperate with others in the class where appropriate. New ideas often arise from such interactions. While collaboration and brainstorming are thus encouraged, you need to always keep clear what value you have added, separate from the ideas of others. Academic dishonesty, as defined by university policy, will not be tolerated in any form. Activities that constitute academic dishonesty in this course include: (1) copying text passages verbatim or paraphrasing those passages in your paper without referencing the original source (including from the Internet); (2) consulting those who have already taken BMGT 495 about cases or assignments before they are due; and (3) working with others on individual assignments; working with non-team members on team assignments. You are not allowed to share written or electronic notes, outlines or "key points" in anticipation of completing written assignments. Papers that are judged to be substantially similar in content will be submitted to University procedures. Academic dishonesty cheapens the value of your degree and undermines the quality of your education. The University's Code of Academic Integrity is designed to ensure that the principles of academic honesty and integrity are upheld. All students are expected to adhere to this Code. The Smith School does not tolerate academic dishonesty. All acts of academic dishonesty will be dealt with in accordance with the provisions of this code. Please visit the following website for more information on the University's Code of Academic Integrity: http://www.studentconduct.umd.edu/aca/honorpledge.html An original, signed copy of the honor pledge must be turned into the professor’s office after you complete the final exam, and no later than 4:00 pm on December 18th: I pledge on my honor that I have not given or received any unauthorized assistance on the final examination. Signature: ___________________________ Date: ________________ Accommodations for Students with Disabilities: The University has a legal obligation to provide appropriate accommodations for students with documented disabilities. In order to ascertain what accommodations may need to be provided, I ask that students with disabilities inform me of their needs within two weeks of the start of the semester. 4 PROPOSED CLASS SCHEDULE Session Sept 1 Topic Course Introduction Assignment Log onto: http://www.msimediaplayer.com/registration.htm Sept 3 Sept 8 Mission Statements & Objectives Assignment to Teams The External Environment: General and Industry Environment Course number C28408 Complete Rehearsal Rounds before class for bonus points. Complete Rehearsal Rounds for regular credit Complete Practice Round 1 before 3 am (before class). Sept 10 The External Environment: Competitor Analysis Sept 15 The Internal Environment: Resources, Capabilities, and Core Competencies Complete Practice Round 2 before 3 am (before class). Sept 17 Business Level Strategy: Low Cost, Differentiation, Focus, Integrated low cost/differentiation Homework 1: Mission Statement & Objectives and Strategy Statement Due in Class Sept 22 Business Level Strategy: Sources of Low Cost Advantage, Risks Homework 2: Strategy Statement Due in Class Sept 24 Business Level Strategy: Sources of Differentiation, Risks Competition Round 1 Due before 3 am (before class) Sept 29 Business Level Strategy: Integrated versus Stuck in the middle Oct 1 HR Module enabled beginning in Round 2 Oct 6 Oct 8 Oct 13 Sustainability and the Triple Bottom Line. Oct 15 Oct 20 TQM/Sustainability Module enabled beginning in Round 4. All teams present for 10 minutes each. Competition Round 2 Due before 3 am (before class) WSJ Notebooks at least 1/3 complete. Bring Notebooks to class. Competition Round 3 Due before 3 am (before class) Homework 3: Sustainability and the triple bottom line. Competition Round 4 Due before 3 am (before class) Presentation to Stockholders 5 Oct 22 Oct 27 Oct 29 Corporate Level Strategy Acquisition and Restructuring Strategies Downsizing, Downscoping, Bankruptcy, Turnarounds International and Global Strategy: Globalization, multidomestic strategies, exporting CASE: Danaher ? Competition Round 5 Due before 3 am (before class) Nov 3 Cooperative Strategy: Joint Ventures, Alliances, consortia CASE: ??? Nov 5 Implementing Strategy: Structure, Systems, People, Style, Culture Competition Round 6 Due before 3 am (before class) Nov 10 WSJ Notebooks at least 2/3 Implementing Strategy: Leadership, Leadership Development, Executive Succession complete. Bring Notebooks to class. Nov 12 Implementing Strategy: Leadership, Competition Round 7 Leadership Development, Executive Succession Due before 3 am (before class) Nov 17 Implementing Strategy: Leadership, CASE: ??? Leadership Development, Executive Succession Final Review & Annual Report requirements Competition Round 8 Due before 3 am (before class) Work on Presentation to Shareholders and Annual Reports Thanksgiving Holiday Work on Presentation to Shareholders and WSJ Notebooks due in class. Annual Reports Presentations to Shareholders Presentations to Shareholders Class Wrap up and Course Evaluations Presentations to Shareholders Nov 19 Nov 24 Nov 26 Dec 1 Dec 3 Dec 8 Dec 10 Dec 1218 The Final Exam will be available on-line beginning at 8 am on December 12. Students are to complete the exam individually without help for any others and must bring a signed copy of the University Honor Code to my office after completing the exam. These must be in my office by 4 pm on Friday, December 18th. Only an original, signed copy of the Honor Pledge will be accepted (no electronic copies). Annual Reports due Final Exam must be completed on line by 3 pm on Friday, December 18. 6 Note: As we progress through the course, it may prove necessary to make adjustments to the schedule. You will be notified in advance of any changes. 7 Appendix 1: Wall Street Journal Notebook Required Topics Every student is expected to keep a notebook of Wall Street Journal articles with student-provided analysis and reflection. The journal should include a minimum of 15 articles (cut and pasted from the print edition or downloaded from the electronic edition) on the topics found in this appendix. Each article should be followed by the student’s analysis of the situation discussed in the article including: (1) the key strategic issues, (2) theory or models from this course or other business school courses that help structure analysis of the information provided in the article, (3) the student’s original analysis of the situation (not a summary of the facts or analysis provided in the article!), and (4) recommendations to the top management team of the company(ies) discussed in the article. Additional specific questions per topic area are included in this appendix. Notebooks will be checked twice during the semester. Students should have a minimum of 5 articles completed by the first check and 10 articles by the second check. All articles in the notebook must be published between August 31, 2009 and December 1, 2009. The notebook will account for twenty (20) percent of the course grade. The grade will be determined by the quality of the student-provided analysis in the notebook and the quality of the chosen articles. Students may turn in additional articles for extra credit, with analysis and recommendations, beyond these requirements. Credit will only be given if the following are included for each article: 1) a copy of the article; 2) analysis using methods and models learned in this class and other business school courses; and 3) recommendations from the student (acting as an outside consultant) to the top management team of the company(ies) featured in the article. Students may also include current articles from other publications (with analysis and recommendations) for extra credit, but 15 of the articles MUST come from the current term of the Wall Street Journal. (August 31, 2009 to December 1, 2009). Please use this form as the Table of Contents for your Notebook. Topic 1. Value Based Management Purpose, Vision (evidence the company cares about something beyond making money) 2. Industry Analysis (Porter’s five forces; profit potential of an industry) 3. Market Segmentation Title of Article/Company(ies) Questions to Consider (among others) Pages in Notebook What evidence do you have that the company is sincere about their purpose? Has the vision or sense of purpose helped or hurt the firm? Why do some industries outperform others year after year (e.g., pharmaceuticals) while others are chronic low performers (i.e., airlines), and why are some cyclical, while others are recession proof? How can multiple firms in the same industry do well by adopting different strategies to serve different industry segments? Are 8 4. Positioning in an industry as a source of competitive advantage 5. Internal sources of competitive advantage such as brands, leadership, intangible resources 6. Competitive Rivalry and competitive dynamics—firms reacting to the actions of competitors in an industry 7. Turnaround or Chapter 11 Bankruptcy 8. Sustainability some segments more attractive than others? Is it possible for one firm to serve all segments well? Why do some firms consistently outperform their rivals? Have they carved out the most profitable niche? Or are they better managed and out-execute their rivals? Why can’t other firms seem to copy these industry leaders? Unlike sports, where each game ends and a winner is declared, rivalry in business sometimes continues for years or even decades (e.g., Coke vs. Pepsi). Is this rivalry destructive and weakens the companies, or is it constructive, and renders the companies stronger? What caused the company to get into trouble in the first place? Are the actions the management has taken addressing the problem and allowing the company to emerge as strong or stronger? At what cost in terms of lost jobs, divisions sold, loss of stockholder value, etc? Could the company have avoided the problem or were events really beyond their foresight or control? If the company has entered Chapter 11 of the U.S. Bankruptcy Code (Reorganization): Same questions as above; plus: What steps are needed to emerge from bankruptcy as a going concern, or should the company liquidate? Increasingly, leading corporations in Europe, the U.S. and elsewhere are pursuing the “triple bottom 9 9. Major legal problems/major public relations problems (e.g., like Valdez oil spill; lead in toys) 10. Mergers & Acquisitions 11. Spin-offs (converting a division of a multidivisional firm into a standalone company); corporate downsizing (cutting the budget; usually cutting headcount, without getting rid of businesses), or downscoping (narrowing the scope of businesses in the line” of people, planet, and prosperity. Some critics say these actions are simple public relations moves. In your article, what evidence is provided that the company is sincerely interested in being part of a sustainable future? What evidence is there that this corporation is not sincere, but rather just seeking “good press”? What is the purpose of business? Is it only to provide prosperity for its owners (e.g., maximize shareholder’s wealth), or do major corporations have a responsibility to be a good citizen and neighbor (e.g., provide social and environmental value as well as economic value)? Could the company have avoided the problem? What caused it? How should they address it? How can they avoid long term harm to their reputation, sales, and profits? Is this a merger of equals or an acquisition of one firm by another? Why are they merging (what benefits do they expect)? At what cost? Since up to 70% of all acquisitions fail, do you think this one will be successful, and why? The economy is bad so there will be many articles about downsizing, spinoffs, and downscoping. Are these being done in this case for short term financial reasons only? Will the long term competitiveness of the firm be harmed? Might there be other ways to achieve the same goal? 10 portfolio by selling divisions to others or closing down business units). 12. Entrepreneurs, CEO and Wall Street pay and bonuses 13. Leadership & Executive Succession 14. International/global strategy 15. A company or business leader you admire The US has the highest income disparity in the industrialized world between the upper echelons of large companies and the average white collar worker at the same companies. The gap has grown much wider in the last 20 years. Do entrepreneurs, CEOs, investment bankers, and hedge fund managers assume downside risk, or do they only enjoy upside rewards in good times and no real risk in bad times? Are they worth what they are paid? Steven Jobs’ recent medical problems and Apple’s related stock price plunge reminds us that leadership matters. How does it matter? What makes a good leader? Are all leaders equally good in all situations or do different situations call for different types of leaders? How can companies “grow” leaders for the future? Why kind of leader will you be? How does this firm enter new markets (joint ventures, acquisitions, greenfield)? Does it pursue a global strategy or a multidomestic strategy or a hybrid? Has it been successful? What could it do better in the future? Why do you admire this company or leader? What are you doing to be more like this person or to join this organization (or one similar to it) so that you can learn more from them? 11 Additional topics of the student’s choice Additional articles on the same topics 12