AU Section 700

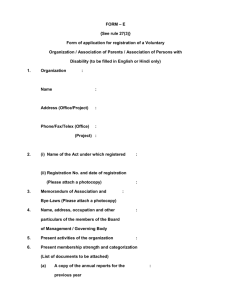

advertisement