Types and Terms of Credit

advertisement

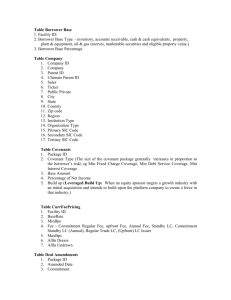

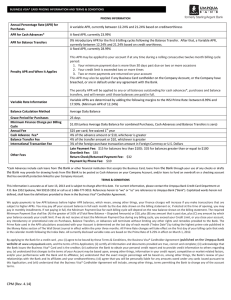

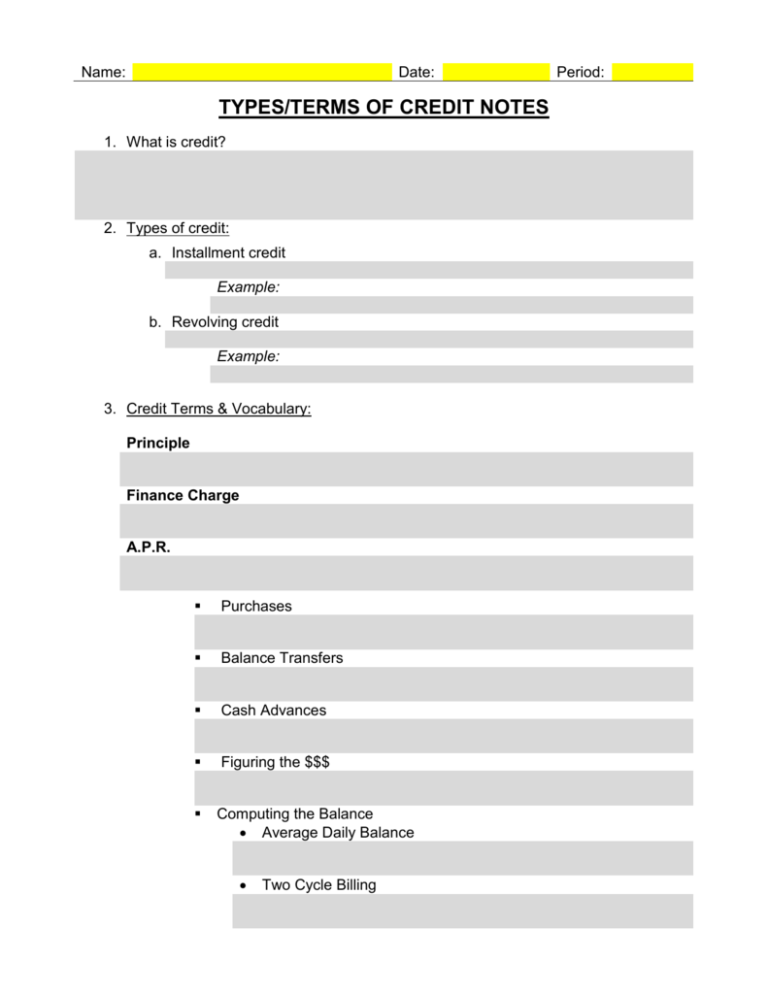

Name: Date: TYPES/TERMS OF CREDIT NOTES 1. What is credit? 2. Types of credit: a. Installment credit Example: b. Revolving credit Example: 3. Credit Terms & Vocabulary: Principle Finance Charge A.P.R. Purchases Balance Transfers Cash Advances Figuring the $$$ Computing the Balance Average Daily Balance Two Cycle Billing Period: Adjusted Balance Introductory APR Fixed Rate APR Variable APR Minimum Payment Credit Limit Grace Period Fees Late Payment Fee Over-limit Fee Balance Transfer Fee Cash Advance Fee Annual Fee 4. What has changed? (2009 Credit CARD Legislation – effective 2/22/10) 5. Differences in Debt Good debt: Example: Bad debt: Example: BENEFITS of CREDIT 6. The 3 C’s of credit are, Explain: C DISADVANTAGES of CREDIT C 7. Types of Credit Cards: a. Retail card b. Bank card c. Secured card d. Rewards card e. Affinity card 8. What should you look for when selecting a credit card? and C 9. What can you do to protect your credit card account? 10. How do these laws protect your use of credit? Truth in Lending Law - Fair Credit Billing Act - Equal Credit Opportunity Act - Remember.... Unauthorized Charges - Resources to learn more: What have you learned?