CPM (Rev. 4.14)

advertisement

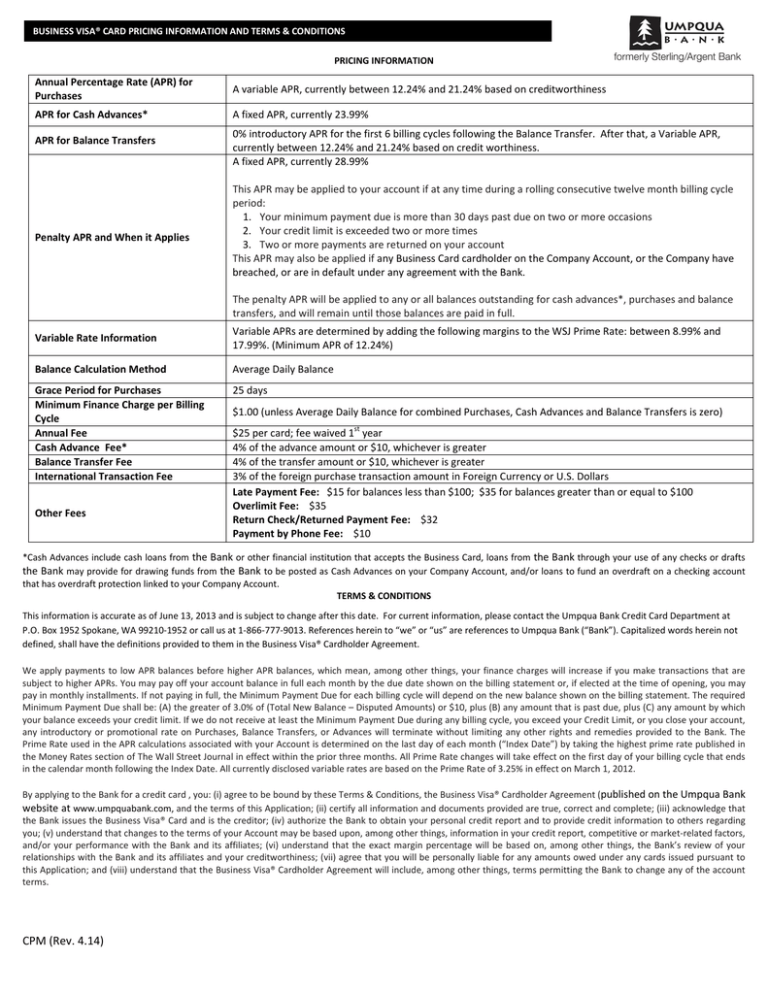

BUSINESS VISA® CARD PRICING INFORMATION AND TERMS & CONDITIONS PRICING INFORMATION Annual Percentage Rate (APR) for Purchases A variable APR, currently between 12.24% and 21.24% based on creditworthiness APR for Cash Advances* A fixed APR, currently 23.99% APR for Balance Transfers Penalty APR and When it Applies 0% introductory APR for the first 6 billing cycles following the Balance Transfer. After that, a Variable APR, currently between 12.24% and 21.24% based on credit worthiness. A fixed APR, currently 28.99% This APR may be applied to your account if at any time during a rolling consecutive twelve month billing cycle period: 1. Your minimum payment due is more than 30 days past due on two or more occasions 2. Your credit limit is exceeded two or more times 3. Two or more payments are returned on your account This APR may also be applied if any Business Card cardholder on the Company Account, or the Company have breached, or are in default under any agreement with the Bank. The penalty APR will be applied to any or all balances outstanding for cash advances*, purchases and balance transfers, and will remain until those balances are paid in full. Variable Rate Information Variable APRs are determined by adding the following margins to the WSJ Prime Rate: between 8.99% and 17.99%. (Minimum APR of 12.24%) Balance Calculation Method Average Daily Balance Grace Period for Purchases Minimum Finance Charge per Billing Cycle Annual Fee Cash Advance Fee* Balance Transfer Fee International Transaction Fee 25 days Other Fees $1.00 (unless Average Daily Balance for combined Purchases, Cash Advances and Balance Transfers is zero) st $25 per card; fee waived 1 year 4% of the advance amount or $10, whichever is greater 4% of the transfer amount or $10, whichever is greater 3% of the foreign purchase transaction amount in Foreign Currency or U.S. Dollars Late Payment Fee: $15 for balances less than $100; $35 for balances greater than or equal to $100 Overlimit Fee: $35 Return Check/Returned Payment Fee: $32 Payment by Phone Fee: $10 *Cash Advances include cash loans from the Bank or other financial institution that accepts the Business Card, loans from the Bank through your use of any checks or drafts the Bank may provide for drawing funds from the Bank to be posted as Cash Advances on your Company Account, and/or loans to fund an overdraft on a checking account that has overdraft protection linked to your Company Account. TERMS & CONDITIONS This information is accurate as of June 13, 2013 and is subject to change after this date. For current information, please contact the Umpqua Bank Credit Card Department at P.O. Box 1952 Spokane, WA 99210-1952 or call us at 1-866-777-9013. References herein to “we” or “us” are references to Umpqua Bank (“Bank”). Capitalized words herein not defined, shall have the definitions provided to them in the Business Visa® Cardholder Agreement. We apply payments to low APR balances before higher APR balances, which mean, among other things, your finance charges will increase if you make transactions that are subject to higher APRs. You may pay off your account balance in full each month by the due date shown on the billing statement or, if elected at the time of opening, you may pay in monthly installments. If not paying in full, the Minimum Payment Due for each billing cycle will depend on the new balance shown on the billing statement. The required Minimum Payment Due shall be: (A) the greater of 3.0% of (Total New Balance – Disputed Amounts) or $10, plus (B) any amount that is past due, plus (C) any amount by which your balance exceeds your credit limit. If we do not receive at least the Minimum Payment Due during any billing cycle, you exceed your Credit Limit, or you close your account, any introductory or promotional rate on Purchases, Balance Transfers, or Advances will terminate without limiting any other rights and remedies provided to the Bank. The Prime Rate used in the APR calculations associated with your Account is determined on the last day of each month (“Index Date”) by taking the highest prime rate published in the Money Rates section of The Wall Street Journal in effect within the prior three months. All Prime Rate changes will take effect on the first day of your billing cycle that ends in the calendar month following the Index Date. All currently disclosed variable rates are based on the Prime Rate of 3.25% in effect on March 1, 2012. By applying to the Bank for a credit card , you: (i) agree to be bound by these Terms & Conditions, the Business Visa® Cardholder Agreement (published on the Umpqua Bank website at www.umpquabank.com, and the terms of this Application; (ii) certify all information and documents provided are true, correct and complete; (iii) acknowledge that the Bank issues the Business Visa® Card and is the creditor; (iv) authorize the Bank to obtain your personal credit report and to provide credit information to others regarding you; (v) understand that changes to the terms of your Account may be based upon, among other things, information in your credit report, competitive or market-related factors, and/or your performance with the Bank and its affiliates; (vi) understand that the exact margin percentage will be based on, among other things, the Bank’s review of your relationships with the Bank and its affiliates and your creditworthiness; (vii) agree that you will be personally liable for any amounts owed under any cards issued pursuant to this Application; and (viii) understand that the Business Visa® Cardholder Agreement will include, among other things, terms permitting the Bank to change any of the account terms. CPM (Rev. 4.14) USA Patriot Act. To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account. When you apply for an account, we will ask for your name, address, date of birth and other information that will allow us to identify you. We may also ask you to provide us with other identifying documents. Right of Setoff. To the extent permitted by applicable law, the Bank reserves a right of setoff in all Company, Principal Signer, and Additional Cardholder accounts with the Bank (whether checking, savings or other account), including all existing accounts and all such accounts that may be opened in the future. Company, Principal Signers, and Additional Cardholders authorizes the Bank, to the extent permitted by applicable law, to charge or setoff all sums owing on the Indebtedness (limited, in the case of an Additional Cardholder account, to the amount owed on the card of such Additional Cardholder) against any and all such accounts, and, at the Bank’s option, to administratively freeze all such accounts to allow the Bank to protect the Bank’s charge and setoff rights provided in this paragraph or otherwise. State Law Disclosures. Notice to New York State Residents: Consumer reports may be requested in connection with the processing of your application and any resulting account. Upon request, we will inform you of the names and addresses of any consumer reporting agencies which have provided us with such reports. Notice to Ohio Residents: Ohio laws against discrimination require that all creditors make credit equally available to all creditworthy customers, and that credit reporting agencies maintain separate credit histories on each individual upon request. The Ohio Civil Rights Commission administers compliance with this law. Notice to Married Wisconsin Residents: No agreement, individual statement, or court order applying to marital property will adversely affect the creditor’s interest unless the creditor, prior to the time credit is extended, is furnished with a copy of the agreement, statement, or order, or has actual knowledge of the adverse provision when the obligation to the creditor is incurred. Notice to California Residents: Regardless of your marital status, you may apply for credit in your name alone. CPM (Rev. 4.14)