Chapter 15

Property Transactions:

Nontaxable Exchanges

Individual Income Taxes

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

1

The Big Picture (slide 1 of 3)

• Recall the situation introduced in ‘‘The Big

Picture’’ in Chapter 14.

• Alice has changed her mind about selling the

house to her nephew for $275,000.

– Due to a recent groundbreaking for an upscale real

estate development nearby, the appraised value of

the house has increased to $600,000.

• Alice has decided she needs to do something

with the house other than let it remain vacant.

2

The Big Picture (slide 2 of 3)

• She is considering the following options:

– Sell the house for approximately $600,000

• Sales commission will be 5%.

– Convert the house to a vacation home

• It would be 100% personal use by Alice and her family.

• Sell it in two years.

– Convert the house to a vacation home

• Rent it 40% of the time and use it 60% of the time for personal use.

• Sell it in two years.

– Sell her current home and move into the inherited house.

• She has owned and lived in the current home for 15 years

• Her gain on the sale would be about $200,000.

• Since she is nearing retirement, she would live in the inherited

house for the required 2 year minimum period and then sell it.

3

The Big Picture (slide 3 of 3)

• Alice expects the inherited house to continue to

appreciate in value by about 5% per year.

• She plans on retiring in two years and moving to a

warmer climate.

– Until then, she is neutral as to which house she lives in.

• What advice can you offer Alice?

• Read the chapter and formulate your response.

4

Nontaxable Transactions

(slide 1 of 4)

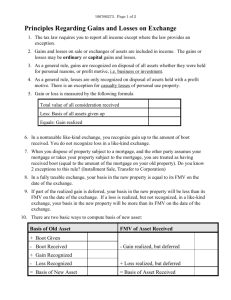

• In a nontaxable transaction, realized gain or

loss is not currently recognized

– Recognition is postponed to a future date (via a

carryover basis) rather than eliminated

5

Nontaxable Transactions

(slide 2 of 4)

• In a tax-free transaction, nonrecognition of

realized gain is permanent

6

Nontaxable Transactions

(slide 3 of 4)

• Holding period for new asset

– The holding period of the asset surrendered in a

nontaxable transaction carries over to the new

asset acquired

7

Nontaxable Transactions

(slide 4 of 4)

• Depreciation recapture

– Potential recapture from the asset surrendered

carries over to the new asset acquired in the

transaction

8

Like-Kind Exchanges

(slide 1 of 11)

• §1031 requires nontaxable treatment for gains

and losses when:

– Form of transaction is an exchange

– Assets involved are used in trade or business or

held for production of income

• However, inventory, securities, and partnership

interests do not qualify

– Asset exchanged must be like-kind in nature or

character as replacement property

9

Like-Kind Exchanges

(slide 2 of 11)

• Like-kind property defined

– Interpreted very broadly

• Real estate for real estate

– Improved for unimproved realty qualifies

– U.S. realty for foreign realty does not qualify

• Tangible personalty for tangible personalty

– Must be within the same general business asset or product

class

– Personalty used mainly in the U.S. for personalty used mainly

outside the U.S. does not qualify

– Livestock of different sexes does not qualify

10

Like-Kind Exchanges

(slide 3 of 11)

• When taxpayers involved in an exchange are

related parties

– To qualify for nontaxable exchange treatment,

related parties must not dispose of property

exchanged within the 2 year period following

exchange

– If such early disposition occurs, postponed gain is

recognized as of date of early disposition

• Dispositions due to death, involuntary conversions, and

certain non-tax avoidance transactions are not treated as

early dispositions

11

Like-Kind Exchanges

(slide 4 of 11)

• Exchange requirement

– The transaction must involve a direct exchange of

property to qualify as a like-kind exchange

– If the exchange is a delayed (nonsimultaneous)

exchange, there are time limits on its completion

• The new property must be identified within 45 days of

date old property was transferred

• The new property must be received by the earlier of the

following:

– Within 180 days of date old property was transferred

– The due date (including extensions) for tax return covering

year of transfer

12

Like-Kind Exchanges

(slide 4 of 11)

• Exchange requirement

– The transaction must involve a direct exchange of

property to qualify as a like-kind exchange

– If the exchange is a delayed (nonsimultaneous)

exchange, there are time limits on its completion

• The new property must be identified within 45 days of

date old property was transferred

• The new property must be received by the earlier of the

following:

– Within 180 days of date old property was transferred

– The due date (including extensions) for tax return covering

year of transfer

13

Like-Kind Exchanges

(slide 4 of 11)

• Exchange requirement

– The transaction must involve a direct exchange of

property to qualify as a like-kind exchange

– If the exchange is a delayed (nonsimultaneous)

exchange, there are time limits on its completion

• The new property must be identified within 45 days of

date old property was transferred

• The new property must be received by the earlier of the

following:

– Within 180 days of date old property was transferred

– The due date (including extensions) for tax return covering

year of transfer

14

Like-Kind Exchanges

(slide 5 of 11)

• Boot

– Any property involved in the exchange that is not

like-kind property is “boot”

– The receipt of boot causes gain recognition equal

to the lesser of boot received (FMV) or gain

realized

• No loss is recognized even when boot is received

15

Like-Kind Exchanges

(slide 6 of 11)

• Boot

– The transferor of boot property may recognize gain

or loss on that property

• Gain or loss is recognized to the extent of the difference

between the adjusted basis and the fair market value of

the boot

16

Like-Kind Exchanges

(slide 7 of 11)

• Basis in like-kind asset received:

FMV of new asset

– Gain not recognized

+ Loss not recognized

= Basis in new asset

• Basis in boot received is FMV of property

17

Like-Kind Exchanges

(slide 8 of 11)

• Basis in like-kind property using Code

approach

+

+

–

–

=

Adjusted basis of like-kind asset given

Adjusted basis of boot given

Gain recognized

FMV of boot received

Loss recognized

Basis in new asset

18

Like-Kind Exchanges

(slide 9 of 11)

• Example of an exchange with boot:

– Zak and Vira exchange equipment of same general

business asset class

– Zak: Basis = $25,000; FMV = $40,000

– Vira: Basis = $20,000; FMV = $30,000

– Vira also gives securities: Basis = $7,000;

FMV = $10,000

19

Like-Kind Exchanges

(slide 10 of 11)

Example (Cont’d)

FMV Property Rec’d

+Securities

Total FMV Rec’d

Less: Basis Property Given

Realized Gain

Boot Rec’d

Zak

$30,000

10,000

$40,000

25,000

$15,000

$10,000

Vira

$40,000

-0$40,000

30,000 *

$10,000

$ -0-

Gain Recognized

$10,000

$

-0-

*$20,000 Equip. + $10,000 Securities = $30,000

Securities: ($10,000 FMV - $7,000 basis) = $3,000 gain

recognized by Vira

20

Like-Kind Exchanges

(slide 11 of 11)

Example (Cont’d)

FMV Property Rec’d

Postponed Gain

Basis Property Rec’d

Zak

$30,000

-5,000

$25,000

Vira

$40,000

-10,000

$30,000

21

Involuntary Conversions

(slide 1 of 13)

• §1033 permits (i.e., not mandatory) nontaxable

treatment of gains if the amount reinvested in

replacement property ≥ the amount realized

• If the amount reinvested in replacement

property is < amount realized, realized gain is

recognized to the extent of the deficiency

22

Involuntary Conversions

(slide 2 of 13)

• Involuntary conversion

– Results from the destruction, theft, seizure,

requisition, condemnation, or sale or exchange

under threat of condemnation of property

• A voluntary act by taxpayer is not an involuntary

conversion

23

Involuntary Conversions

(slide 3 of 13)

• §1033 requirements

– Replacement property must be similar or related

in service or use as involuntarily converted

property

– Replacement property must be acquired within a

specified time period

24

Involuntary Conversions

(slide 4 of 13)

• Replacement property defined

– Must be similar or related in service or use as the

converted property

• Definition is interpreted very narrowly and differently

for owner-investor than for owner-user

– For business or investment real estate that is

condemned, replacement property has same

meaning as for like-kind exchanges

25

Involuntary Conversions

(slide 5 of 13)

• Taxpayer use test (owner-investor)

– The properties must be used by the owner in

similar endeavors

• Example: Rental apartment building can be replaced

with a rental office building because both have same use

to owner (the production of rental income)

26

Involuntary Conversions

(slide 6 of 13)

• Functional use test (owner-user)

– The property must have the same use to the owner

as the converted property

• Example: A manufacturing plant is not replacement

property for a wholesale grocery warehouse because

each has a different function to the owner-user

27

Involuntary Conversions

(slide 7 of 13)

• Time period for replacement

– Taxpayer normally has a 2 year period after the

close of the taxable year in which gain is realized

to replace the property

• Replacement time period starts when involuntary

conversion or threat of condemnation occurs

• Replacement time period ends 2 years (3 years for

condemnation of realty) after the close of the taxable

year in which gain is realized

28

Involuntary Conversions

(slide 8 of 13)

• Example of time period for replacement

– Taxpayer’s office building is destroyed by fire on

November 4, 2012

– Taxpayer receives insurance proceeds on February

10, 2013

– Taxpayer is a calendar-year taxpayer

– Taxpayer’s replacement period is from November

4, 2012 to December 31, 2015

29

Involuntary Conversions

(slide 9 of 13)

• Nonrecognition of gain: Direct conversions

– Involuntary conversion rules mandatory

– Basis and holding period in replacement property

same as converted property

30

Involuntary Conversions

(slide 10 of 13)

• Nonrecognition of gain: Indirect conversions

– Involuntary conversion rules elective

– Gain recognized to extent amount realized (usually

insurance proceeds) exceeds investment in

replacement property

31

Involuntary Conversions

(slide 11 of 13)

• Nonrecognition of gain: Indirect conversions

– Basis in replacement property is its cost less

deferred gain

– Holding period includes that of converted property

32

Involuntary Conversions

(slide 12 of 13)

• Involuntary conversion rules do not apply to

losses

– Losses related to business and production of

income properties are recognized

– Personal casualty and theft losses are recognized

(subject to $100 floor and 10% AGI limit);

personal use asset condemnation losses are not

recognized or postponed

33

Involuntary Conversions

(slide 13 of 13)

• Involuntary conversion of personal residence

– Gain from casualty, theft, or condemnation may be

deferred as involuntary conversion (§1033) or

excluded as sale of residence (§121)

– Loss from casualty recognized (limited); loss from

condemnation not recognized

34

Example 18 - Involuntary Conversion (slide 1 of 3)

• Walt’s business building (adjusted basis $50,000) is

destroyed by fire on October 5, 2014.

– Walt is a calendar year taxpayer.

• On November 17, 2014, he receives an insurance

reimbursement of $100,000 for the loss.

– Walt invests $80,000 in a new building.

– Walt uses the other $20,000 of insurance proceeds to pay

off credit card debt.

35

Example 18 - Involuntary Conversion (slide 2 of 3)

• Walt has until December 31, 2016, to make the

new investment and qualify for the

nonrecognition election.

• Walt’s realized gain is $50,000

– $100,000 insurance proceeds received − $50,000

adjusted basis of old building

• Assuming that the replacement property

qualifies, Walt’s recognized gain is $20,000.

– $100,000 insurance proceeds − $80,000 reinvested

36

Example 18 - Involuntary Conversion (slide 3 of 3)

• Walt’s basis in the new building is $50,000.

– This is the building’s cost of $80,000 less postponed gain

of $30,000

• $50,000 realized gain − $20,000 recognized gain

• The computation of realization, recognition, and basis

would apply even if Walt was a real estate dealer and

the building destroyed by fire was part of his

inventory.

– Unlike § 1031, § 1033 generally does not exclude

inventory.

• For this $30,000 of realized gain to be postponed,

Walt must elect § 1033 deferral treatment.

37

Example 19 - Involuntary Conversion

• Assume the same facts as in the previous example, except that

Walt receives only $45,000 of insurance proceeds.

– He has a realized and recognized loss of $5,000.

– The basis of the new building is the building’s cost of $80,000.

• If the destroyed building had been held for personal use, the

recognized loss would have been subject to the following

additional limitations.

– The loss of $5,000 would have been limited to the decline in fair

market value of the property, and

– The amount of the loss would have been reduced first by $100 and then

by 10% of AGI (refer to Chapter 7).

38

Sale of Residence

(slide 1 of 7)

• Loss on sale

– As with other personal use assets, a realized loss

on the sale of a personal residence is not

recognized

39

Sale of Residence

(slide 2 of 7)

• Gain on sale

– Realized gain on sale of principal residence is

subject to taxation

– Realized gain may be partly or wholly excluded

under §121

40

Sale of Residence

(slide 3 of 7)

• §121 provides for exclusion of up to $250,000

of gain on the sale of a principal residence

• Taxpayer must own and use as principal residence for at

least 2 years during the 5 year period ending on date of

sale

41

Sale of Residence

(slide 4 of 7)

• Amount of Exclusion

– $250,000 maximum

– Realized gain is calculated in normal manner

– Amount realized on sale is reduced by selling

expenses such as advertising, broker’s

commissions, and legal fees

42

Sale of Residence

(slide 5 of 7)

• Amount of Exclusion (cont’d)

– For a married couple filing jointly, the $250,000 max is

increased to $500,000 if the following requirements are

met:

• Either spouse meets the 2 year ownership req’t,

• Both spouses meet the 2 year use req’t,

• Neither spouse is ineligible due to the sale of another principal

residence within the prior 2 years

– Starting in 2008, a surviving spouse can continue to use the

$500,000 exclusion amount on the sale of a personal

residence for the next two years following the year of the

deceased spouse’s death

43

Sale of Residence

(slide 6 of 7)

• §121 cannot be used within 2 years of its last use

except in special situations, such as:

• Change in place of employment,

• Health,

• Other unforeseen circumstances

• Under these circumstances, only a portion of the

exclusion is available, calculated as follows:

Max Exclusion amount × number of qualifying months

24 months

44

Sale of Residence

(slide 7 of 7)

Effect of Renting on Principal Residence Requirement. The

renting of the taxpayer’s principal residence prior to sale does not

affect qualifying for the § 121 exclusion as long as the ownership

and occupancy requirements are satisfied.

•The residence thus does not have to be the principal residence on

the date of sale.

•Negative effect of renting. Any realized gain that is attributable

to depreciation is not eligible for the § 121 exclusion.

45

The Big Picture - Example 26

Sale Of A Residence - § 121 (slide 1 of 2)

• Return to the facts of The Big Picture on p. 15-1.

• Recall that one of Alice’s options is to sell her current

house and move into the inherited house.

• Assume that Alice, who is single, sells her current

personal residence (adjusted basis of $130,000) for

$348,000.

– She has owned and lived in the house for 15 years.

– Her selling expenses are $18,000.

– Prior to the sale, Alice pays $1,000 to make some

repairs and paint the two bathrooms.

46

The Big Picture - Example 26

Sale Of A Residence - § 121 (slide 2 of 2)

• Her recognized gain would be calculated as follows:

Amount realized ($348,000 - $18,000)

Adjusted basis

Realized gain

§ 121 exclusion

Recognized gain

$ 330,000

(130,000)

$ 200,000

(200,000)

$

–0–

• Since the available § 121 exclusion of $250,000

would exceed Alice’s realized gain of $200,000, her

recognized gain would be $0.

47

The Big Picture - Example 27

Sale Of A Residence - § 121

• Continue with The Big Picture and the facts of

Example 26, except that the selling price is $490,000.

Amount realized ($490,000 - $18,000)

Adjusted basis

Realized gain

§ 121 exclusion

Recognized gain

$ 472,000

(130,000)

$ 342,000

(250,000)

$ 92,000

• Since the realized gain of $342,000 > the § 121

exclusion of $250,000, Alice’s recognized gain would

be $92,000

48

Other Nonrecognition Provisions

(slide 1 of 6)

• Several additional nonrecognition provisions

are available:

– Under §1032, a corporation does not recognize

gain or loss on the receipt of money or other

property in exchange for its stock (including

treasury stock)

49

Other Nonrecognition Provisions

(slide 2 of 6)

• Under §1035, no gain or loss is recognized

from the exchange of certain insurance

contracts or policies

50

Other Nonrecognition Provisions

(slide 3 of 6)

• Under §1036, a shareholder does not recognize

gain or loss on the exchange of common stock

for common stock or preferred stock for

preferred stock in same corporation

51

Other Nonrecognition Provisions

(slide 4 of 6)

• Under §1038, no loss is recognized from the

repossession of real property sold on an

installment basis

– Gain is recognized to a limited extent

52

Other Nonrecognition Provisions

(slide 5 of 6)

• Under §1041, transfers of property between

spouses or former spouses incident to divorce

are nontaxable

53

Other Nonrecognition Provisions

(slide 6 of 6)

• Under §1044, if the amount realized from the

sale of publicly traded securities is reinvested

in common stock or a partnership interest of a

specialized small business investment

company, realized gain is not recognized

– Amounts not reinvested will trigger recognition of

gain to extent of deficiency

– Statutory limits are imposed on the amount of gain

qualified for this treatment

– Only individuals and C corporations qualify

54

Other Nonrecognition Provisions

(slide 6 of 6)

• Under §1044, if the amount realized from the

sale of publicly traded securities is reinvested

in common stock or a partnership interest of a

specialized small business investment

company, realized gain is not recognized

– Amounts not reinvested will trigger recognition of

gain to extent of deficiency

– Statutory limits are imposed on the amount of gain

qualified for this treatment

– Only individuals and C corporations qualify

55

Refocus On The Big Picture (slide 1 of 5)

• Alice needs to be aware of the different tax consequences of

her proposals.

• Sale of the inherited house.

– This is by far the simplest transaction for Alice.

– Based on the available data, her recognized gain would be:

Amount realized ($600,000 - $30,000)

$ 570,000

Adjusted basis

(475,000)

Recognized gain

$ 95,000

• Because the sale of the house is not eligible for the § 121

exclusion, the tax liability is $14,250 ($95,000 X 15%).

• Alice’s net cash flow would be $555,750

– $570,000- $14,250.

56

Refocus On The Big Picture (slide 2 of 5)

• Conversion into a vacation home.

– Only personal use.

• With this alternative, the only tax benefit Alice would

receive is the deduction for property taxes .

• She would continue to incur upkeep costs (e.g.,

repairs, utilities, insurance).

• At the end of the 2 year period, the sales results are

similar to those of a current sale.

• The sale of the house would not be eligible for the

§ 121 exclusion.

57

Refocus On The Big Picture (slide 3 of 5)

• Conversion into a vacation home

– 60% personal use and 40% rental use.

• Alice would be able to deduct 40% of the costs

– e.g., Property taxes, agent’s management fee, depreciation,

maintenance and repairs, utilities, and insurance.

– However, this amount cannot exceed the rent income generated.

• The remaining 60% of the property taxes can be claimed as an

itemized deduction.

• At the end of the 2 year period, the sales results would be

similar to those of a current sale.

• In determining recognized gain, adjusted basis must be

reduced by the amount of the depreciation claimed.

• The sale of the house would not be eligible for the § 121

exclusion.

58

Refocus On The Big Picture (slide 4 of 5)

• Sale of present home now with sale of inherited home in 2

years.

• This option would enable Alice to qualify for the § 121

exclusion for each sale.

• She would satisfy the 2 year ownership and the 2 year use

requirements, and the allowance of the § 121 exclusion only

once every 2 years.

• Alice must be careful to occupy the inherited residence for at

least 2 years.

– Also, the period between the sales of the 1st and 2nd houses must be

greater than 2 years.

• Qualifying for the § 121 exclusion of up to $250,000 would

allow Alice to avoid any Federal income tax liability.

59

Refocus On The Big Picture (slide 5 of 5)

• With this information, Alice can make an informed

choice.

• In all likelihood, she probably will select the strategy

of selling her current house now and the inherited

house in the future.

• A noneconomic benefit of this option is that she will

have to sell only one house at the time of her

retirement.

60

If you have any comments or suggestions concerning this

PowerPoint Presentation for South-Western Federal

Taxation, please contact:

Dr. Donald R. Trippeer, CPA

trippedr@oneonta.edu

SUNY Oneonta

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

61