Chapter 6

advertisement

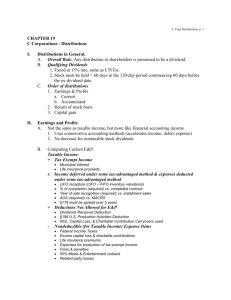

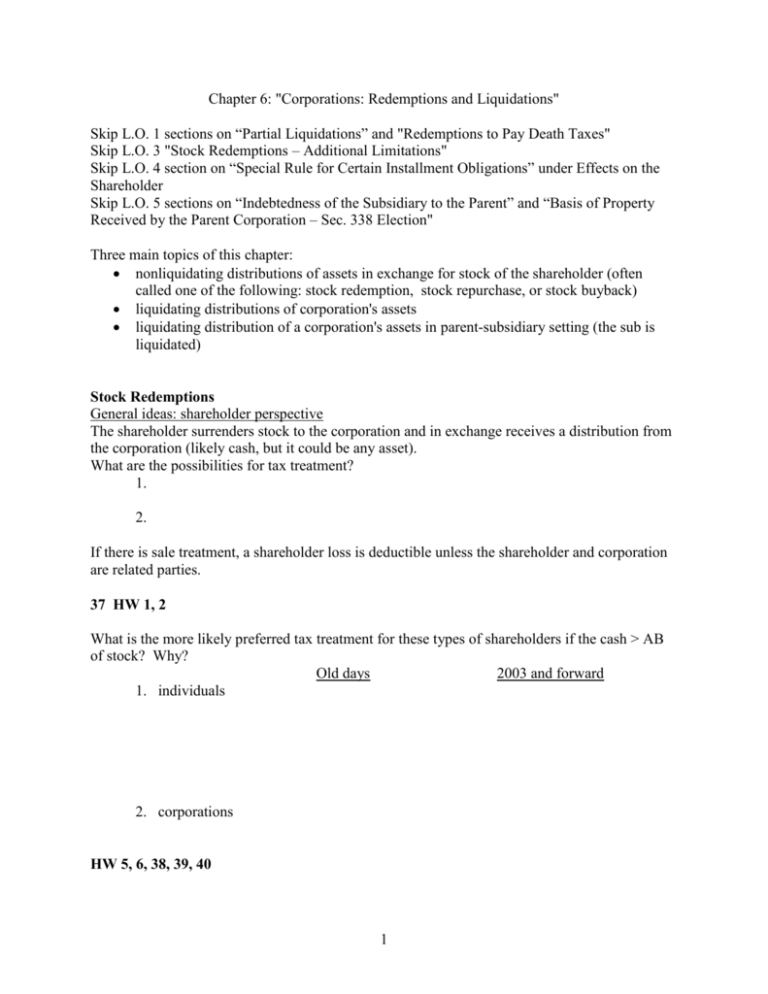

Chapter 6: "Corporations: Redemptions and Liquidations" Skip L.O. 1 sections on “Partial Liquidations” and "Redemptions to Pay Death Taxes" Skip L.O. 3 "Stock Redemptions – Additional Limitations" Skip L.O. 4 section on “Special Rule for Certain Installment Obligations” under Effects on the Shareholder Skip L.O. 5 sections on “Indebtedness of the Subsidiary to the Parent” and “Basis of Property Received by the Parent Corporation – Sec. 338 Election" Three main topics of this chapter: nonliquidating distributions of assets in exchange for stock of the shareholder (often called one of the following: stock redemption, stock repurchase, or stock buyback) liquidating distributions of corporation's assets liquidating distribution of a corporation's assets in parent-subsidiary setting (the sub is liquidated) Stock Redemptions General ideas: shareholder perspective The shareholder surrenders stock to the corporation and in exchange receives a distribution from the corporation (likely cash, but it could be any asset). What are the possibilities for tax treatment? 1. 2. If there is sale treatment, a shareholder loss is deductible unless the shareholder and corporation are related parties. 37 HW 1, 2 What is the more likely preferred tax treatment for these types of shareholders if the cash > AB of stock? Why? Old days 2003 and forward 1. individuals 2. corporations HW 5, 6, 38, 39, 40 1 Tax rules describe "qualifying" redemptions, those that will be treated as a sale of the stock. An essential feature of a qualifying redemption is that the redeeming shareholder’s ownership interest in the corporation declines sufficiently as a result of the redemption. Measure ownership percentages and compare: Pre-redemption ownership percentage = Shareholder shares (direct + attributed)//Total shares outstanding before redemption Post-redemption ownership percentage = Shareholder shares (direct + attributed)/Total shares outstanding after redemption If more than one shareholder is redeeming shares, each shareholder is considered separately, which means one shareholder could receive dividend treatment while another receives sale/exchange treatment. Change denominator for all shares redeemed in the same transaction. Handout #1, HW 4 If a shareholder redeems all shares and the redemption is treated as a dividend, the unused basis of the shares goes to shares owned indirectly. Stock Attribution Rules When measuring the shareholder's ownership interest, the stock of related parties is also considered. Attribution rules – “§318 Constructive ownership of stock” (see Exhibit 5-1 also): 1. FAMILY: A person is deemed to own all the shares owned by his/her spouse, children, grandchildren, and parents. 2. FROM ENTITIES TO OWNERS: Stock owned by an entity is deemed to be owned by an owner/beneficiary proportionately (Entities: partnerships, S Corporations, estates, trusts, and greater than or equal to 50% ownership of a corporation). 3. FROM OWNERS TO ENTITIES: All stock owned by an owner/beneficiary is deemed to be owned by the entity (again, count corporation only if greater than or equal to 50% rule is met). The attribution rules apply to all types of redemptions discussed below but family attribution can be waived in one situation. “Chain” attribution gets more complicated than noted above. Handout # 2 HW 41 2 Qualifying Redemptions – Details §302(b) provides the following redemptions will receive sale/exchange treatment: 1. redemptions that are not essentially equivalent to a dividend 2. redemptions that are substantially disproportionate 3. redemptions that are in complete termination of the shareholder's interest Only one of the provisions must be met in order to meet "qualifying redemption." If no provision is met, the redemption is treated as a dividend. §302(b)(1) Not Essentially Equivalent to a Dividend (“NEED”) The issue here is whether the shareholder's interest in the corporation has been meaningfully reduced. These things are considered: voting control, rights to share in corporate earnings, right to receive corporate assets in liquidation. This provision is not clear cut. If a shareholder owns more than 50% directly or indirectly after the redemption, it cannot be a sale (because the shareholder still controls the corporation). If "NEED" then sale/exchange treatment; otherwise, dividend treatment. Revenue ruling and case scenarios: 1. Shareholder's ownership % dropped to 50%. The other 50% is owned by a single unrelated party. 2. Shareholder's ownership % dropped to 50%. The ownership of the other 50% is dispersed. 3. 43.6% before and 40 % after. 45% before and 42.8% after. 4. 27% before and 22% after and shareholder took no part in management. 5. Tiny to teeny ownership percentage. Handout #3, HW 42 3 §302(b)(2) Substantially disproportionate distributions A redemption is disproportionate if after the redemption the shareholder's ownership percentage is both: Less than 50% Less than 80% of the % owned before the redemption If disproportionate then sale/exchange treatment; otherwise, dividend treatment. Look at Handout #3 again, 43 §302(b)(3) Complete termination of shareholder's interest If a shareholder terminates the entire interest in the corporation, the redemption will be treated as a sale/exchange. In many cases, this standard is easily met. In some cases, this standard could be impossible to meet because of attribution rules. Family attribution rules can be waived in this complete termination setting if the former shareholder: 1. has no interest in the corporation after the redemption for at least 10 years (interests not ok: shareholder, officer, director, employee; ok to be creditor) AND 2. agrees to notify the IRS of any prohibited interest within the 10 years Implication: the sale/exchange treatment could be changed to dividend treatment It's ok to receive shares within 10 years if shares are received via an inheritance. Look at handout #3 again, 44 HW 12, 13, 14, 45 Effect of Redemption on Redeeming Corporation From the corporation’s perspective, a distribution has been made. Assuming cash distributions: There is no effect on taxable income. E&P reduction: If shareholder has dividend, reduce E&P by amount of cash If shareholder has sale treatment, reduce E&P by the lesser of the amount the corporation pays for the stock or prorata based on the amount of outstanding shares redeemed 43 facts, HW 50 Non-cash assets distributed The tax treatment is consistent with distributions not in exchange for stock (CH 5). 4 Corporation taxable income increases for gains with liabilities > FMV of asset treated as “deemed FMV.” Losses are not deductible. The E&P reduction is based on CH 6 rules. Shareholder taxable income is based on CH 6 rules for dividend or sale treatment. The shareholder’s AB of property received = _____. 36 HW 7 Complete Liquidations of a Corporation This is generally a recognition transaction. Basic ideas The liquidation can take one of these forms: corporate assets are distributed to the shareholders (taxable to corporation) and then the shareholders hold the assets or sell the assets (taxable to shareholder when assets received) corporation sells assets (taxable to corporation) and distributes after-tax cash proceeds to shareholders (taxable to shareholder when cash received) The tax results are the same no matter the form. There are special nonrecognition rules for the corporation for some assets that would generate losses. Effect of Complete Liquidation on Distributing Corporation: General Rule General rule Gains and losses are recognized by the corporation on each asset: FMV - AB = gain (loss) The character depends on the type of asset distributed or sold. The minimum amount to measure a gain is liability relief (recall: applies when liability relief > FMV property). Effect of Complete Liquidation on Shareholder Shareholder recognizes capital gain or loss = net FMV assets received minus AB stock AB of any asset received = FMV Handout #4, HW 54 5 Effect of Complete Liquidation on Distributing Corporation: Limitations on loss recognition There are two scenarios that prevent loss recognition: related-party situations and built-in loss situations (Figure 5-2 is helpful). Both scenarios could apply. 1. Related-party loss limits (shareholder directly or indirectly owns more than 50% of stock; related parties defined in §267): Corporate losses are disallowed on distributions to related parties if distribution of the loss asset is not prorata OR the loss asset distributed is disqualified property Prorata means each shareholder receives a share of the loss asset distributed = to the shareholder’s ownership in the corporation. Disqualified property: property acquired via §351 transaction or capital contribution during the five year period prior to the liquidation If there is disallowed loss, the disallowed amount = RP % of asset received x total loss. 58, HW 55 2. Built-in loss limits (recall how there could be a built in loss) Corporate built-in losses are not allowed on sales or distributions of property that was acquired via §351 transaction or capital contribution and such property acquisition was motivated principally by tax avoidance. Built in loss: FMV < AB at the time the property is acquired by the corporation. (Loss subsequent to corporate acquisition date is allowed.) A tax avoidance motive is presumed if the acquisition happened during the two-year period prior to the liquidation. If the two-year time frame applies, the taxpayer has the burden of proof to show there was a business purpose. Handout #5 HW 56, 57 6 Complete Liquidation of a Subsidiary (Parent - Sub when 80% or more ownership) This is generally a nonrecognition transaction. The liquidating subsidiary recognizes no gain or loss. The parent corporation recognizes no gain or loss on receipt of subsidiary assets. The AB of assets distributed to the parent = carryover. Other tax attributes also carryover. The parent's basis in the sub stock disappears. Exception to general rules when there is/are minority shareholder(s): There is recognition of gain (but not losses) by the liquidating subsidiary with respect to any distributions to minority shareholders of the subsidiary. The minority shareholders recognize capital gain or loss with respect to distributions and the AB of assets distributed to the minority shareholders = FMV. 61 HW 63 7