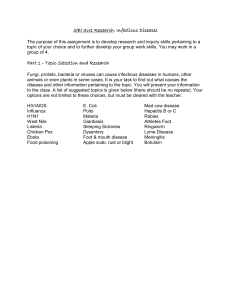

WFCSBE - Consultant Manual

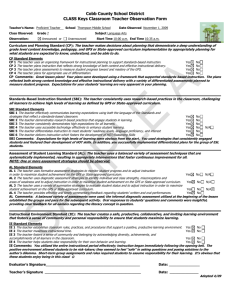

advertisement