attached file.. - Hadasit Bio

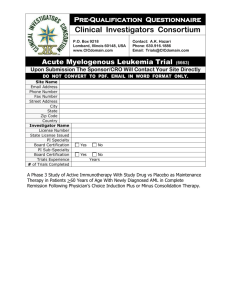

advertisement

Research Department Noa Weisberg noa@ibi.co.il +972-3-5193443 December 27, 2006 HADASIT Hadasit – 2007 will be an interesting year Recommendation: High Risk BUY In 2007, we expect that the investments of Hadasit in several companies will ripen and that we will see progress in the development of companies in its portfolio. Previous Rec.: High Risk BUY Target Price: NIS 9.20 Previous Target: NIS 9.50 Market Price: NIS 7.10 Sector: Biotech Symbol: HDST Traded: TASE Hadasit holds an interest in nine companies in various stages of development for different products in a variety of medical fields. Companies working on inflammatory diseases include ProtAb, KAHR, Verto and Tolarex. Holdings in oncology companies include TK Signal and InCure while holdings in tissue treatment include CellCure and Thrombotech. In addition Hadasit has holdings in publicly traded Ortec (Nasdaq). An R&D company such as Hadasit is fueled by progress in the clinical trials of the companies in its portfolio. The companies in which Hadasit has invested focus on large markets with unmet needs. Each of the companies has the potential to address a target market in excess of $1B. Each step forward in its clinical trials increases the probability that product development will reach a successful conclusion and that the product will be brought to market. Verto: This company is developing a treatment for Lupus disease. Present treatment deals only with symptoms of the disease, focusing on repression of the immune system as a whole. Insofar as the immune system plays an important role, its repression results in severe side-effects. Another procedural approach in use today is plasmapheresis in which the patient's blood is replaced with blood free of antibodies. Verto is developing an extracorporeal immunoadsorbtion column (the Lupusorb column) to improve the plasmapheresis procedure. The Lupusorb column uses a peptide called VRT101 which is thought to tie specifically only to the autoimmune antibodies produced by the body which cause damage to the kidneys. On completion of the procedure, the patient's blood, including all vital components, is returned to his body with the exclusion of the autoimmune antibodies causing the disease. At the end of October the company announced approval for a European patent protecting the peptide's structure and use. Institutional Helsinki approval has been received. We expect the company to receive Helsinki approval for the start of clinical trials from the Ministry of Heath within the next few weeks so that Stage I clinical trials may get underway in the beginning of 2007. The trial will include 10 patients with results expected four months after the start. Development of the product is expected to reach completion during the course of 2007 so that Verto will be able to receive European marketing approval in 1H2008 and FDA approval in 1H2009. Thrombotech: This company is developing a treatment for stroke caused by the formation of blood clots that block the flow of blood to the brain causing irreversible damage. Treatment available today is tPA which assists This document was prepared by the Research Department of the I.B.I. Group. It is based on information published by the companies reviewed as well as on estimates and evaluations that, by the nature of things, may prove to have been outdated or insufficient. For these reasons this document is addressed only to professional institutional investors as ancillary material and should not serve as the exclusive basis for any investment decisions. This document and the information therein should not be construed as counsel or an invitation to purchase (or sell) the securities mentioned and is not meant to replace counsel that takes into account the special characteristics and needs of each individual. The I.B.I. Group bears no responsibility for any damage caused to any party as a result of reliance on this document. The I.B.I. Group holds some or all of the securities reviewed in this document for itself and for its clients and may, from time to time, act as a purchaser or seller of each of these securities. 9 Ahad Haam St.. Shalom Tower, 26th Floor, Tel Aviv 65251, Tel: +972-3-519-3411, Fax: +972-3-517-5411, www.ibi.co.il, email: ibi@ibi.co.il Research Department in dissolving the clot, however use of this treatment is very low: tPA, which was approved in 1996, is currently used in only 3-5% of cases. Estimates indicate that some 400,000 people a year could be candidates for such treatment in the USA alone. The reason that this treatment is not more widely used is that side effects include excessive bleeding, damage to the nervous system, etc. Strokes are the number one cause of various disabilities and the number three cause of fatalities (after heart disease and cancer). Research on the peptide developed by Thrombotech appeared in the September 2006 edition of the respected publication, Nature Medicines. The research noted that in a variety of animal models, use of the tPA together with thrombotech's peptide showed good results with significantly lower side-effects. A number of peptides are being developed for administration with tPA but Thrombotech's peptide is the only one with a proven ability to lower the most significant sideeffect -- excessive bleeding. An article published in Nature Neuroscience indicated that there is a possibility that in cases where tPA cannot be administered, Thrombotech's peptide could be able to work independently (Stand Alone). The company is conducting negotiations relating to entry of a strategic investor. Phase I Clinical Trials are expected to get underway during the second half of 2007. Tolarex: This Company is developing a device for treating GVHD (Graft vs. Host Disease) which is the main reason for failure of implants. There is at present no treatment for this disease. Pre-IND will be presented during the course of 2Q07. Clinical trials are expected to begin sometime in 2007. We will be updating our model when trials get underway to reflect the decline in risk. ProtAB: is developing treatments for autoimmune diseases such as rheumatoid arthritis and Type I diabetes. The former disease is characterized by activation of the body's immune system against itself causing damage to joint tissue. In ordinary cases of inflammation, there is a balance between signals encouraging the inflammatory process and those suppressing it. Presently available treatments focus on suppressing the inflammatory process while ProtAB is developing a treatment that will support an anti-inflammatory process. ProtAB is expected to begin phase I Clinical Trials in July 2007. There is a chance that, due to the high cost of development, the treatment will be developed in conjunction with a strategic partner. Candidates for this role, which requires experience in the field of monoclonal antibodies, include: Talecris, Kamada, Omrix and Baxter. KAHR: is developing a protein (PP14) which can regulate the immune system when it attacks itself, as in the case of autoimmune diseases. Development of the process for producing the material has been completed. The first step will be development of a treatment for Multiple Sclerosis followed by an examination of treatment for Psoriasis. Like ProtAB, KAHR is working on a drug with a high cost of development. phase I Clinical Trials are scheduled to start towards the end of 2007. Hadasit Bio Holdings 2 Research Department CellCure: This Company has been valued in our model on the basis of Hadasit's investment. In order to be eligible for an exclusive license for other indications in addition to Parkinson's disease, the company must raise $3M in capital before March 2008 (non-dilutive sources). To date, CellCure has risen approximately $2M and expects to be able to raise the full sum. The company received ca. $750K from the Michael J. Fox Fund which focuses on Parkinson's disease and $200K from the ALS Fund as well as a commitment for $300K from the Genesis Consortium. The investment of the MJF Fund represents a validation of the potential of this treatment as well as appreciation of the company's capabilities. Additionally, CellCure has begun to examine the possibility of developing a stem-cell based product for treating Age-Related Macular Degeneration. The model looks relatively simple and regulatory considerations are likely to be easier. Hapto: The company was acquired by Ortec (OTCI) whose share price has declined by 50% over the past three months. Following a change of management the company is seeking to raise capital. Ortec expects to file a product for FDA approval at the end of December but its future depends on raising capital. Ortec recently received a Letter of Approval from the FDA, a precondition for receipt of marketing approval for its leading product. InCure: Development work is proceeding. phase I Clinical Trials, which were expected to get underway in 1Q07, have been postponed until the second quarter. Hadasit has invested $100,000 as a loan which can be converted into equity until July 1, 2008. Conversion will be at a valuation of $250,000 for Incure. The delay of clinical trials is attributed to an extension of R&D. TK Signal: This Company is developing markers (the leading marker is called F-TKS040) which facilitate PET scans for identification of cancer. The marker ties to EGFR receptors which are essentially the "gas pedal" fueling cell division that allows cancerous growths to develop. Due to its ability to tie to the receptor, the marker can and exclusively to cancer cells. Development costs for TK Signal are significantly lower than for competitors thanks to the presence of a cyclotron device in the Hadassah Hospital that is available to the company. During the past quarter the company completed a private placement that raised $2M in capital. Clinical trials are expected to get underway during the second quarter of 2007. Hadasit Bio Holdings 3 Research Department NAV Total Value ($ M) TK Signal Verto CellCure Thrombot ech Incure Tolarex Hapto ProtAB KAHR 13.21 8.23 Share of Hadassit (%) 25.10% 74.60% $M NIS M 3.31 6.14 3.31 14.00 25.95 14.00 13.77 16.04 4.75 29.80% 66.60% 93.50% 4.10 10.68 4.45 17.33 45.14 18.78 4.89 1.30 3.25 4.25% 100.00% 80.00% 0.21 1.30 2.60 0.88 5.51 10.98 $36.11 NIS152.57 Total Market Cap (NIS M) Value per Share (NIS) Estimated Value (NIS M) Target Share Price (NIS) Discount Value Potential at the end of 2007 (NIS M) Representing a potential target share price: Valuation Method DCF DCF Cap Rate 20% 20% 6.63 6.14 3.31 22% 20% 20% 7.18 16.03 8.89 30% 30% 0.21 2.61 2.60 Investment DCF DCF DCF Value of OTCI.OB DCF DCF Value after Progress in 2007 ($M) $53.59 114.90 6.95 152.57 9.23 32.79% 226.43 NIS 13.70 Summary We estimate that at least 5 of the nine companies held by Hadassit will begin clinical Trials in 2007. Beyond procedural progress, the importance of reaching the clinical trial stage lies in the fact that the regulatory authorities will examine results and provide external verification first for the product . Fulfillment of clinical development targets will facilitate financing for the portfolio companies (funds raised through the issue of convertible bonds will be released on achievement of milestones). This will allow more aggressive support in moving the remaining companies towards more advanced stages of clinical testing and lowering the risk involved. All of the companies are developing products aimed at fulfilling unmet medical needs targeted at markets in excess of $1B. For the reasons stated above, we believe that an investment in this company could generate a superior reward in 2007. Note, however, that an investment in companies in early stages of clinical trials does entail risk. Hadasit Bio Holdings 4 Research Department Hadasit Bio Holdings 5