chapter 1 - Holy Family University

advertisement

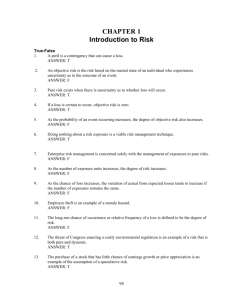

CHAPTER 1 Introduction to Risk THE BURDEN OF RISK DEFINITIONS OF RISK Pure versus Speculative Risk Static versus Dynamic Risk Subjective versus Objective Risk SOURCES OF PURE RISK Property Risks Liability Risks Life, Health, and Loss of Income Risks Financial Risk MEASUREMENT OF RISK Chance of Loss Physical Hazard Morale Hazard Moral Hazard Degree of Risk MANAGEMENT OF RISK KEY TERMS AND CONCEPTS Chance of loss Chief risk officer Cost of risk Degree of risk Dynamic risks Enterprise risk management Financial risks Frequency Hazards Integrated risk management Moral hazard Morale hazard Objective risk Peril Pure risk Risk Risk management Risk management process Risk manager Severity Speculative risk Static risks Subjective risk ANSWERS TO QUESTIONS FOR REVIEW AND DISCUSSION 1. 2. Risk can be defined as uncertainty as to loss. Risk can create an economic burden by requiring reserve funds to pay for contingent losses and price increases of some goods and services. Risk may deprive society of some goods and services that are determined to involve too much risk to justify their production. a. Pure risk involves uncertainty as to whether loss will occur. It does not involve a possibility of gain. Speculative risk involves uncertainty about an event that could produce either a profit or loss. b. Static risks are those that would exist in an unchanging society that is in stable equilibrium. Dynamic risks are caused by societal changes. c. Subjective risks arise from psychological uncertainty that is based on an individual’s mental attitude or state of mind. Objective risk is more precisely observable and measurable. 1 2 Chapter 1: Introduction to Risk 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Windstorm, flood, and other natural disasters are examples of risks that are both pure and static. A peril is a specific contingency that may cause loss. A hazard is a condition that introduces or increases the chance of loss from the existence of a given peril. Examples of perils include fire, windstorm, collision, war, etc. Examples of hazards include oily rags, icy roads, a dishonest employee, a careless driver, etc. a Morale b. Moral c. Morale d. Moral e. Physical Risk management is the process used to systematically manage exposures to pure risk. The four steps are: (1) identify risks, (2) evaluate risks, (3) select risk management techniques, and (4) implement and review decisions. Traditionally, risk management has dealt primarily with pure risks. Enterprise risk management considers all of an entity’s risks together, both pure and speculative. As a loss becomes more and more certain to happen, there is less and less uncertainty that it will not happen. If a point is finally reached when an event is certain to occur, then there is no risk at all. Company ABC: (70 - 60) / 65 = 15 percent Company XYZ: (80 - 50) / 65 = 46 percent a. Collision or oil spill b. Flood c. Fire or explosion d. Death e. Theft or vandalism Answers will vary. It can be pointed out that the mathematical value of the game is (0.90 × $1,000) + (0.10 × $100,000) = $10,900, and a “gambler” should choose the game. Most students will probably choose the cash. Since most persons are risk-averting and will take the certain amount, ventures like the game, similar to real-life investments bearing considerable risk and low probabilities for hitting it big (e.g., oil drilling), are not widely sought. Hence, the capital cost of such ventures must be high in order to overcome risk. This high cost is the economic burden imposed by risk because it will produce higher consumer prices for the final product. A has the greater risk. B has the greater probability of loss. Using the objective risk formula (Probable Variation of Loss / Probable Losses), we get 3 / 2 = 150% for A and 12 / 30 = 40% for B. The probable loss is 2 / 100 = 2% for A and 30 / 1,000 = 3% for B. This question opens an opportunity to discuss subjective risk and its effect on economic or buyer behavior. Information and explanation is a major industry today, and much of its effort is designed to smooth the course of commerce by reducing perceived risk in the minds of customers. Information reduces perceived risk by making it easier for the buyer to understand the product and the ways in which the product will solve problems for the buyer. The purpose, of course, is to make it easier for the buyer to come to an intelligent buying decision. Risk is defined as uncertainty as to loss, and variation is a measure of uncertainty. Expected annual loss is not a measure of uncertainty. There is a higher degree of risk when there is a lower probability of occurrence because as a loss becomes more certain to occur there is less uncertainty that it will not occur. Risk would totally disappear only when the probability of occurrence is 0% and 100%. Property losses would be easiest to estimate because the value of the property concerned can help in estimating the maximum possible loss. Liability risks would be difficult to estimate because they are subject to wide variation and are contingent on several factors both within and outside of the company’s direct control. Personal risks are also difficult to estimate because evaluation Chapter 1: Introduction to Risk involves such problems as placing a value on human life or health, which can be a very difficult undertaking. 3