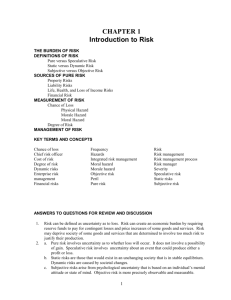

Today's Outline

advertisement

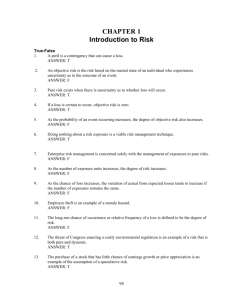

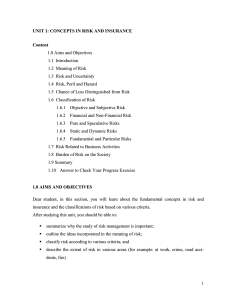

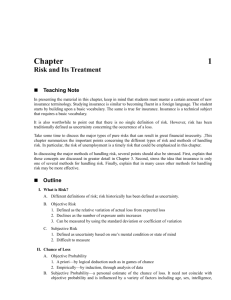

Today’s Outline • What is Risk • Chance of Loss • Peril vs. Hazard • Basic Categories of Risk • Types of Pure Risk • Burden of Risk on Society • Methods of Handling Risk 1 What is risk? Risk: Uncertainty concerning the occurrence of a loss - A possibility of a loss Chance of a loss – a measurable probability of a loss (number between 0 and 1) Ex: Objective Risk vs. Subjective Risk – Objective risk - the relative variation of actual loss from expected loss • Can be statistically calculated using a measure of dispersion such as the standard deviation and the coefficient of variation. – Subjective risk - uncertainty based on a person’s mental condition or state of mind Note: Two persons in the same situation may have different perceptions of risk 2 Also note: High subjective risk often results in conservative behavior . Loss - the undesired, unplanned reduction of economic value. Note: A loss is different from planned expenses. Expenses are the planned reduction of economic value Ex: depreciation Expenses are not the proper subject of insurance. Chance of loss: The probability of a loss occurring Objective Probability vs. Subjective Probability Objective probability - the long-run relative frequency of an event assuming an infinite number of observations and no change in the underlying conditions - Can be determined by deductive reasoning or statistical analysis Ex: Use mortality data to determine the probability that an individual will die before age 50. 3 Subjective probability –an individual’s personal estimate of the chance of loss • Note: A person’s perception of the chance of loss may differ from the objective probability Peril vs Hazard • peril - the cause of the loss Ex: In an auto accident, the collision is the peril Ex: fire is the peril in a house burning down Ex: Peril of property damage include: lightning, windstorm tornado • hazard - a condition that increases the chance of loss • 4 types of hazards: 1. Physical hazards - physical conditions that increase the chance of loss Ex: icy roads, defective wiring, defective lock 2. Moral hazard – individual dishonesty or character defects that increase the chance of loss Ex: faking an accident, inflating claim amount 4 3. Morale Hazard -carelessness or indifference to a loss because of the existence of insurance (someone else will have to pay for it) Ex: leaving keys in an unlocked car Ex Because of Morale hazards, the insured need some incentive to prevent loss → insurance contracts seldom provide full coverage (has deductible). 4. Legal Hazard - characteristics of legal system or regulatory environment that increase the chance of loss Ex: large damage awards in liability lawsuits Ex: WV and medical malpractice lawsuits Ex Increasing inability of juries to understand details of a case 5 Basic Categories of Risk A. Pure vs. Speculative Risk - pure risk - risk in which there are only the possibilities of loss or no loss - outcome is either adverse or neutral - something tragic happens or it doesn’t Ex: earthquake, job-related accident, lightning, flood, property damage due to a fire - speculative risk - risk in which profit, breaking even or loss are possible Ex: gambling, buying stock Notes: 1) The law of large numbers- The law or large numbers- can be readily applied to pure risk Not so easily applied to speculative risk Pure risk → the ability to predict future loss experience Speculative risk → difficult to predict future loss experience 6 2) Private insurance covers pure risk not speculative risk 3) Society can actually benefit from loss of a speculative risk. Society never benefits from the occurrence of a pure risk Ex: Advance in technology drives some firms out of business Society benefits because of the lower cost production of a product B. Fundamental vs. Particular Risk – fundamental (nondiversifiable) risk - affects the entire economy or large numbers of persons or groups Ex: hurricane, tornado, a successful terrorist plot Note: Often considered the responsibility of government – particular risk - affects only the individual Ex: car theft, your house catches fire Note: In many cases government insurance or social insurance programs may be necessary to cover fundamental risks Ex: FEMA and flood insurance, State unemployment compensation programs 7 C. Enterprise Risk – Enterprise risk encompasses all major risks faced by a business firm. Includes: - pure risk - speculative risk - strategic risk - operational risk- risks from business operation - financial risk- uncertainty of loss because of adverse changes in commodity prices, interest rates, foreign exchange rates and the value of money. Types of Pure Risks Recall: Pure risks have the possibilities of loss or no loss. Private insurance is useful because the law or large numbers can be readily applied. Major types of pure risks that can create great financial insecurity: 1) Personal risks 2) Property risks 3) Liability risks Personal risks – risks that directly affect an individual. - involve the possibility of a loss or reduction in income, extra expenses or depletion of financial assets: – Premature death of family head Life insurance needed – Insufficient income during retirement 8 • Most workers are not saving enough for a comfortable retirement Retirement planning needed – Poor health (catastrophic medical bills and loss of earned income) Health Insurance needed – Involuntary unemployment Unemployment insurance programs and social insurance needed • Property risks involve the possibility of losses associated with the destruction or theft of property: – Physical damage to home and personal property from fire, tornado, vandalism, or other causes Home, auto and commercial property insurance needed – Direct loss vs. indirect loss • A direct loss is a financial loss that results from the physical damage, destruction, or theft of the property, such as fire damage to a restaurant • An indirect loss results indirectly from the occurrence of a direct physical damage or theft loss, such as lost profits due to inability to operate after a fire Note: insurance companies differentiate between direct and indirect loss in insurance contracts. 9 • Liability risks involve the possibility of being held liable for bodily injury or property damage to someone else - There is no maximum upper limit with respect to the amount of the loss - A lien can be placed on your income and financial assets - Defense costs can be enormous 10 • The presence of risk results in three major burdens on society: 1. In the absence of insurance, individuals would have to maintain large emergency funds 2. The risk of a liability lawsuit may discourage innovation, depriving society of certain goods and services 3. Risk causes worry and fear Methods of Handling Risks: • Avoidance • Loss control – Loss prevention - activities to reduce the frequency of losses – Loss reduction - activities to reduce the severity of losses • Retention – An individual or firm retains all or part of a loss – Loss retention may be active or passive • Noninsurance transfers – A risk may be transferred to another party through contracts, hedging, or incorporation • Insurance 11