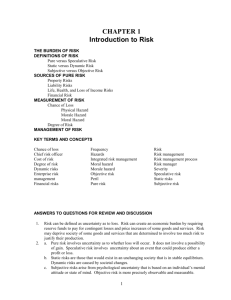

Chapter One The Concept of Risk Students learning objectives of the Chapter At the end of /after studying this chapter, students should be able to: Define the meaning of risk Differentiate among the terms of “Risk”, “Peril” and “Hazard.” Explain the relationship among Risk, uncertainty and probability concepts. Describe the classifications of risks on different basis. 1. INTRODUCTION 1.1 WHY THE STUDY OF RISK IS IMPORTANT? Risk management is the identification, measurement, and treatment of exposures to potential losses. The study of risk management is important in the following ways: Proper risk management enables a business to handle its exposures to accidental losses in the most economic, effective way. Risk management also enables a business to handle better its ordinary business risks. Free of concern about the accidental losses, a business can pursue its regular activities more aggressively and intelligently. In addition, the quality of its decisions on such matters as new construction, introducing a new product, or extending its operations into a foreign country is improved by considering how this construction or activity would affect its exposures to accidental losses if it decided to move ahead. 1.2 Definition of Risk There is no single definition of risk. Different disciplines were defining risk on the bases of perspective tendency and working condition of the subject matter. Example 1: From financial point of view, risk is defined as uncertainty to the occurrence of financial deficit/loss. 1 From Economic point of view, risk can be defined as a sudden occurrence of individual/group economic crises. Generally, Economists, behavioral scientists, risk theorists, statisticians, and actuaries each have their own concept of risk. Some of these definitions are forwarded for your consideration. Risk is the possibility of an unfortunate occurrence. Risk is a combination of hazards. Risk is unpredictability – the tendency that actual results may differ from predicted results. Risk is uncertainty of loss. Risk is the possibility loss. Example 2: the following are some the basic examples of risks which can result to uncertain able losses. The risk of being killed in auto accident The risk of house damage as a result of flooding or earth quick The risk of car collision in ice road Generally, Risk can be defined as: “a condition in which there is a possibility of an adverse deviation between a desired/expected out come from an actual one”. 1.3 Risk, uncertainty and probability relation ships The terms “risk” and “uncertainty” are often used interchangeably, but they are not the same. • Uncertainty is the indefiniteness or variance of an event. It captures the phenomenon of observations, favorable or unfavorable, falling to the left and right of a mean or median value. On the other hand Uncertainty is a term referred to a state of mind characterized by doubt, based on a lack of knowledge about what will or will not happen in the future. Risk is exposure to loss. Or, in a weapon-system acquisition context, it is a measure of the potential inability to achieve overall program objectives within defined cost, schedule, and technical constraints, and has two components: (1) the probability/likelihood of failing to achieve a particular outcome, and (2) the 2 consequences/impacts of failing to achieve that outcome. Risk and uncertainty, then, are related. Uncertainty is probability while risk is probability and consequence. Probability refers to the long run occurrences of some event or it is the relative frequency of some events. Under this relationship insurer’s main concern is to minimize risk by predicting the probability of occurrence or chance of loss. 1.4 Classification of Risks We turn our attention now to the classes into which risk can be placed, this is different from scrutinizing the actual idea of risk; we are now looking at the whole concept of risk and grouping together similar classes of risk. Of the many classes, we will look at five. 1. Objective and Subjective Risk Some authors make a careful distinction between objective risk and subjective risk. We shall briefly discuss the distinction between the two in the forthcoming paragraphs. Objective risk- is defined as the relative variation of the actual loss from expected loss. For example, assume that a fire insurer has 10,000 houses insured over a long period and, on average, 1 percent, or 100 houses burn each year. In some years as few as 90 houses may burn, while in other years, as many as 110 houses may burn. Thus, there is a variation of 10 houses from the expected number of 100, or a variation of 10 percent. This relative variation of actual loss from expected loss is known as objective risk. Objective risk declines as the number of exposures increases. More specifically, objective risk varies inversely with the square root of the number of cases under observation. In our previous example, 10,000 houses were insured, and objective risk was 10/100, or 10 per cent. Now assume that I million houses are insured. The expected number of houses that will burn is now 10,000, but the variation of actual loss from expected loss is only 100. Objective risk now is 100/10,000, or 1 per cent. Thus, as the square root of the number of houses increased from 100 in the first example to 10,000 in the second example (ten times), objective risk; declined to onetenth of its former level. Objective risk can be statistically measured by some measure of dispersion, such as the standard deviation or the coefficient of variation. Since objective risk can be measured, it is an extremely 3 useful concept for an insurer or a corporate risk manager. As the number of exposures increases, an insurer can predict its future loss experience more accurately because it can rely on the law of large numbers. The law of large numbers states that as the number of exposure units increase, the more closely will the actual loss experience approach the probable loss experience. For example as the number of homes under observation increases, the greater is the degree of accuracy in predicting the proportion of homes that will burn. Subjective risk – is defined as uncertainty based on a person’s mental condition or state of mind. For example, an individual is drinking heavily in a bar and attempts to drive home. The driver may be uncertain whether he or she will arrive home sagely without being arrested by the police for drunk driving. This mental uncertainty is called subjective risk. Often subjective risk is expressed in terms of the degree of belief. The impact of subjective risk varies depending on the individual. Two persons in the same situation may have a different perception of risk, and their conduct may be altered accordingly. If an individual experiences great mental uncertainty concerning the occurrence of a loss, that person’s conduct may be affected. High subjective risk often results in high conservative conduct, while low subjective risk may result in less conservative conduct. A driver may have been previously arrested for drunk driving and is aware that he or she has consumed too match alcohol. The driver may then compensate for mental uncertainty by getting someone else to drive him or her home or by taking a cab. Another driver in the same situation may perceive the risk of arrested as slight. The second driver may drive in more careless and reckless manner; a low subjective risk results in less conservative driving behavior. 2. Financial and Non-Financial Risk We have already said that risk implies a situation where there is uncertainty about the outcome. A financial risk is one where the outcome can be measure in monetary terms. This is easy to see in the case of material damage to property, theft of property or lost business profit following a fire. In cases of personal injury, it can also be possible to measure financial loss in terms of a court award of damages, or as a result of negotiation between lawyers and insurers. In any of these cases, the outcome of the risky situation can be measured financially. 4 There are other situations where this kind of measurement is not possible. Take the case of the choice of a new car, or the selection of an item from a restaurant menu. These could be taken as risky situations, not because the outcome will cause financial loss, but because the outcome could be uncomfortable or disliked in some other way. We could even go as far as to say that the great social decisions of life are examples of non- financial risks: the selection of a career, the choice of a marriage partner, having children. There may or may not be financial implications, but in the main the outcome is not measurable financially but by other, more human, criteria. In the world of business we are primarily concerned with risks, which have a financially measurable outcome. 3. Pure and speculative Risks The second risk classification also concerns the outcome. It distinguishes between those situations where there is only the possibility of loss and those where a gain may also result. I/ Pure risks: involve two possible outcomes: a loss or, at best, no loss. The outcome can only be unfavorable to us, or leave us in the same position as we enjoyed before the event occurred. The risk of a motor accident, fire at a factory, theft of goods from a store, or injury at work is all pure risks with no element of gain. It is a loss or no loss that can result from such risks. The major types of pure risks that are associated with great financial and economic insecurity include personal risks, property risks, and liability risks. Classification of pure risks A. Personal Risks – are risks that directly affect an individual; they involve the possibility of the complete loss or reduction of earned income, extra expenses, and the depletion of financial assets. In other words, they refer to the possibility of loss to a person such as: death, disability, loss of earning power etc. there are four major personal risks. Risk of premature death – this refers to the death of a household head with unfulfilled financial obligations. These can include dependents to support, a mortgage to be paid off, or children to educate. If the surviving family members lack additional sources of 5 income or have insufficient financial assets to replace the lost income, financial hardship can result. Premature death can cause financial problems only if the deceased has dependents to support or dies with unsatisfied financial obligations. Thus, the death of a child age ten is not “premature” in the economic sense. There are at least four costs that results from the premature death of a household head. First, the human life value of the family head is lost forever. The human life value is defined as the present value of the family is share of the deceased breadwinner’s future earnings. This loss can be substantial. Second, the additional expenses may be incurred because of burial and probate costs, estate and inheritance taxes, and any remaining medical expenses third, the family’s income from all sources may be inadequate just in terms of its basic needs finally certain non-economic costs are also incurred, such as the emotional grief of the surviving spouse and the loss of guidance and a role model for the children. Risk of old age- the major risk associated with old age is insufficient income during retirement. When older workers retire, they lose their normal work earnings. Unless they have accumulated sufficient financial assets on which to draw, or have access to other sources of retirement income, such a social security or a private pension, they will be confronted with a serious problem of economic insecurity. Risk of poor health – poor health is another important personal risk. The risk of poor health includes both catastrophic medical bills and the loss of earned income. Unless persons have adequate health insurance or other sources of income to meet these expenditures, they will be financially insecure. In particular, the inability of some persons to pay catastrophic medical bills is a major cause of personal bankruptcy. The loss of earned income is another major cause of financial insecurity if the disability, there is a substantial loss of earned income, medical bills are incurred, employee benefits may be lost or reduced, savings are often depleted, and someone must take care of the disabled person. Risk of unemployment – the risk of unemployment is another major threat to financial security. Unemployment can result from a business cycle downsizing, from 6 technological and structural changes in the economy, from seasonal factors, and from fluctuations in the labor market. Regardless of the cause, unemployment can cause financial insecurity in at least three ways. First, the worker loses his or her earned income. Unless there is adequate replacement income or past savings on which to draw, the unemployed worker will be financially insecure. Second, because of economic conditions, the worker may be able to work only part-time. The reduced income may be insufficient in terms of the worker’s needs. Finally, if the duration of unemployment is extended over a long period, past savings may be exhausted. B. Property Risk This refers to losses associated with ownership of property. Persons owning property are exposed to the risk of having their property damaged or lost from numerous causes. Property risk stems from diverse perils accompanied by different hazards: physical, moral or morale. Real estate and personal property can be damaged or destroyed because of fire, lightening, tornadoes, windstorms, and numerous other causes. Generally speaking, property losses can be classified in at least four ways, based on: The class of property affected The cause of the loss Whether the loss is direct or indirect, and The nature of the firm’s interest in the property I. Classification Based on property class Property may be divided in two broad classes, Real estate or land and its appurtenant or attachments. Vacant land, an office building a manufacturing plant, warehouse, or some other structure illustrates real estate. Personal property or property that is movable and not attached to land. Personal property includes such items as machinery, pottery, and dies, furniture and fixtures, raw materials, goods in process, finished goods, merchandise for sale, supplies and money and securities. Personal property is also commonly divided into two subclasses: 7 o Personal property in use and o Personal property for sale. II. Classification based on the cause of the loss One classification divides the causes of property loss in to three classes. These are a. Physical Cause – Physical perils include such natural forces as fire, windstorms, and explosions that damage or destroy property b. Social Cause – social perils are A deviations from expected individual conduct such as theft, vandalism embezzlement, or B aberrations in group behavior such as strikes or riots c. Economic – Economic perils may be due to external or internal forces. E.g. a debtor may be unable to pay off an account receivable because of an economic recession or a contractor may not complete a project on schedule because of a management error. Please note that two or more of these perils may be involved in one loss. More or less related classifications, especially to the first, classify perils as: (a) physical. (b) Human, or (c) Economic. In fact, as you could note, the only difference is that human perils include social perils and those economic perils, such as management errors, that are internal to the firm. III. Direct Versus Indirect Loss Losses to property may be classified as either direct loss or indirect loss. Each of this group is discussed below. Direct loss- a direct loss is defined as a financial loss that results from the physical damage destruction, or theft of the property. For example, assume that you own a restaurant, and the building is insured by a property insurance policy. If the building is damage by a fire, the physical damage to the property is known as direct loss. In other words, property suffers a direct loss when the property itself is directly damaged or destroyed or disappears because of contact with a physical or social peril. Indirect or consequential loss- an indirect loss is a financial loss that results indirectly from the occurrence of a direct physical damage destruction or theft. Thus, in addition to the physical damage loss, the restaurant would lose profits for several months while it is being 8 rebuilt. The loss of profits would be a consequential loss. Other examples of consequential loss would be the loss of the use of the building, the loss of rents, and the loss of a market. Extra expenses are another type of indirect or consequential loss. For examples, suppose you own a newspaper, bank or dairy. If a loss occurs, you must continue operate regardless of cost; otherwise, you will lose customers to your competitors. It may be necessary to set up a temporary operation at some alternative location, and substantial extra expenses would then be incurred. IV. Classification based on the nature of the firm’s interest in the property Property refers to a bundle of rights that form part of the tangible physical assets, but which independently possess certain economic value. The exposures that result from these interests may be property including net income or liability exposures. Only the direct and indirect property loss exposures are considered below. Owners. The clearest property interest is sole ownership. An ownership interest may result from a purchase, a foreclosure on a mortgage, a conditional sales contract, a gift or from some other event. If the property suffers a direct or indirect loss, the owner bears the amount of that loss. If a business owns only part of the property, it bears only part of the loss. Secured creditors. A secured creditor has an interest in property pledged as security for the loan, because the creditor is ability to collect from the debtors diminishes if the property is damaged or destroyed. The potential loss is the unpaid balance of the loan. C. Liability Risk Liability risk is the possibility of loss arising from intentional or unintentional damage made to other persons or to their property. One would be legally obliged to pay for the damages he inflicted upon other persons or their property. A court of law may order you to pay substantial damages to the person you have injured. Liability risks are of great importance for several reasons. First, there is no maximum upper limit with respect to the amount of the loss. You can be sued for any amount. In contrast, if you own a property, there is a maximum limit on the loss. For example, if your automobile has an actual cash value of Br. 10,000, the maximum physical damage loss is Br. 10,000. But if you are 9 negligent and cause an accident that results in serious bodily injury to the other driver, you can be sued for any amount – Br. 50,000, Br. 500,000, Br. 1 million or more – by the person you have injured. Second, although the experience is painful, you can afford to lose your present financial assets, but you can never afford to lose your future income and assets. Assume that you are sued and are required by the court to pay a substantial judgment to the person you have injured. If you do not carry liability insurance or are underinsured, your future income and assets can be attached to satisfy the judgment. If you declare bankruptcy to avoid payment of the judgment, your ability to obtain credit will be severely impaired. Finally, legal defense costs can be enormous. If you are sued and have no liability insurance, the cost of hiring an attorney to defend you in a court of law can be staggering. II/ Speculative Risk 1. The alternative to pure risks is speculative risk, where there are two possible outcomes – gain or loss. Speculative risk is defined as a situation in which either profits or loss is possible. Investing money in shares is a good example. The investment may result in a loss or possibly a break –even position, but the reason it was made was for its prospect of gain. People are more adverse to pure risks as compared to speculative risks. In speculative risk situation, people may deliberately create the risk when they realize that the favorable outcome is, indeed, so promising. It is important to distinguish between pure and speculative risks for three reasons. First, private insures generally insure only pure risks. With some exceptions, speculative risks are not considered insurable and other techniques for coping with risk must be used. (One exception is that some insurers will insure institutional portfolio investments and municipal bonds against loss). Second, the law of large numbers can be applied more easily to pure risks than to speculative risks. The law of large numbers is important since it enables insurers to predict losses in advance 10 In contrast; it is generally more difficult to apply the law of large numbers to speculative risks in order to predict future loss experience. Finally, Society may benefit from a speculative risk even though a loss occurs, but it is harmed if a pure risk is present and a loss occurs. For example, a firm may develop a new technological process for producing computers more cheaply and, as a result, may force a competitor into bankruptcy, society benefits since the computers are produced more efficiently and at a lower cost. However, society will not benefit when most pure risks occur, as for example, if a flood occurs or an earthquake devastates an area. In the world of business there are both pure and speculative risks. Take the case of a food manufacturer. He has a large factory with sophisticated machinery and production lines. He produces a range of foodstuffs for both the home and export markets. 4. Static and Dynamic Risks Dynamic risk originates from changes in the overall economy such as price level changes in consumer tastes, income distribution, technological changes, political changes and the like. They are less predictable and hence beyond the control of risk managers. Static risks, on the other hand, refer to those losses that can take place even though there were no changes in the overall economy. They are losses arising from causes other than changes in the economy. Unlike dynamic risks, they are predictable and could be controlled to some extent by taking loss prevention measures. Many of the perils fall under this category. 5. Fundamental and particular Risks The final classification relates to both the cause and effect of risk. Fundamental risks are those, which arise from causes outside the control of any one individual or even a group of individuals. In addition, the effect of fundamental risks is felt by large numbers of people. This classification would include earthquakes, floods famine, volcanoes and other natural ‘disasters’. However it would not be accurate to limit fundamental risk to naturally occurring perils. Social change political intervention and war are all capable of being interpreted as fundamental risks. 11 In contrast to this form of risk, which is impersonal in origin and widespread in effect, we have particular risks. Particular risks are much more personal both in their cause and effect. This would include many of the risks we have already mentioned such as fire, work related injury and motor accidents. All of these risks arise from individual causes and affect individuals in their consequences. What is interesting is the way in which risks can change classification. This does support the views that risk is a dynamic concept and that our view of it can be modified as time passes. Much of this movement in classification has been from particular to fundamental. Unemployment was regarded; as a particular risk for much of the early part of this century, there was almost the implication that being unemployed was the fault of the individual. However, the technological unemployment of the seventies and eighties has changed that view, and we now talk about people suffering unemployment. As a consequence of changes in our industrial and commercial world, the emphasis has moved away from the individual to society as a whole. The evidence of this is seen in the financial provision made for those who are unemployed, in almost all industrialized countries. A similar move has taken place concerning injury in motor accidents, injury at work and injury caused by faulty products. In each of these cases society has decided that those who are injured should be able to receive financial compensation. It does this by passing legislation which ensures either that suitable insurance is in force or that those who are injured need not have the burden of in the main, particular risks are insurable while fundamental risks are not, but it is difficult to generalize as views in the insurance market place change from time to time. We could say that fundamental risks are normally so uncontrollable widespread and indiscriminate that they should be the responsibility of society as a whole. The geographical factor is often important, particularly for natural hazards such as flood and earthquake. In many parts of the world these risks would be regarded as fundamental and not insurable, but in the United Kingdom they are insurable. The discussion up to this point has been intended to give a rounded view of the nature of the concept of risk itself. It may have seemed rather philosophical at times, but it has been useful to 12 explore ideas rather than simply accept definitions. We now move on to the much more practical and objective question of the cost of risk 1.5. PERILS AND HAZARD We have looked at the notion of uncertainty, the fact that there are different levels of risk, and the final component of risk, which we will look at, is the cause of the eventual loss. We often use the word risk to mean both the event, which will give rise to some loss and the factors, which may influence the outcome of a loss. When we think about cause, we must be clear that there are at least these two aspects to it. We can see this if we think back to the two houses on the riverbank and the risk of flood. The risk of flood does not really make sense, what we mean is the risk of flood damage. Flood is the cause of the loss and the fact that one of the houses was right on the bank of the river influences the outcome. Flood is the peril and the proximity of the house to the river is the hazard. The peril is the prime cause; it is what will give rise to the loss. Often it is beyond the control of anyone who may be involved. In this way we can say that storm, fire, theft, motor accident and explosion are all perils. Factors that may influence the outcome are referred to as hazards. Hazards refer to the conditions that create or increase the chance of loss. These hazards are not themselves the cause of the loss, but they can increase or decrease the effect should a peril operates. In fact, hazards would facilitate the occurrence of perils. The consideration of hazard would facilitate the occurrence of perils. The consideration of hazard is important when an insurance company is deciding whether or not it should insure some risk and what premium to charge. There are three major types of hazards: I/ Physical hazard II/ Moral hazard III/ Morale hazard A physical hazard is a physical condition that increases the likelihood of loss. It relates to the physical characteristics of the item or the property exposed to the risk, such as the nature of construction of a building, the nature of the road. Examples: Icy, rough roads that increase the likelihood of an auto accident, etc) loose security protection at a shop or factory, or the proximity of houses to a riverbank. 13 Moral hazard is dishonesty or character defects in an individual that increases the frequency or severity of loss. It is related with the human aspects which may influence the outcome. This usually refers to the attitude of the insured person. Examples: Examples of moral hazard include taking an accident to collect from an insurer, submitting a fraudulent claim, inflating the amount of the claim, and intentionally burning unsold merchandise that is insured. Morale hazard: refers to the carelessness or indifference to loss because of the existence of insurance. Some insured’s are careless or indifferent to a loss because they have insurance. Examples: leaving car keys in unlocked car, which increases the chance of theft, leaving the door unlocked that allows a burglar to enter, etc. 14