EASTERN MEDITERRANEAN UNIVERSITY DEPARTMENT OF

advertisement

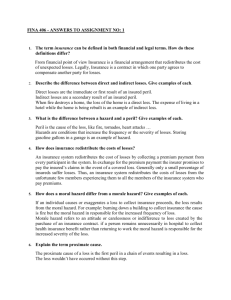

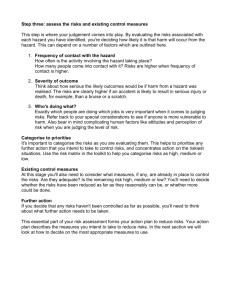

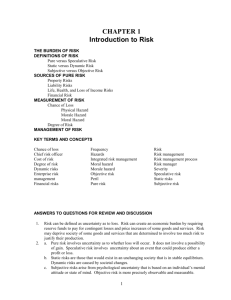

EASTERN MEDITERRANEAN UNIVERSITY DEPARTMENT OF BANKING ANF FINANCE INSU 330 Introduction to Insurance Student No.: Duration: 50 min Name: QUIZ 1 PART I Answer the following multiple questions. 1). Insurance authors have traditionally defined risk as A). any situation in which the probability of loss is one. B). any situation in which the probability of loss is zero. C). uncertainty concerning the occurrence of loss. D). the probability of a loss occurring. 2). A peril is A). An event or condition that increase the chance of loss. B). The uncertainty concerning loss. C). A measure of the accuracy with which a loss can be predicted D). The actual cause of the loss. 3). Dense fog that increases the chance of an automobile accident is an example of a A). speculative risk. B) peril. C) physical hazard. D) moral hazard. 4). Faking an accident to collect insurance proceeds is an example of a A) physical hazard. B) subjective risk. C) moral hazard. 5). Leaving the car keys in an unlocked car is an example of A). being indifference to loss because of the existence of insurance. B). moral hazard. C). physical hazard. D). peril. 1 D) morale hazard. 6). A pure risk is defined as situation in which there is A). only the possibility of loss or no loss. B). only the possibility of profit. C). a possibility of neither profit nor loss. D). a possibility of neither profit nor loss. 7). All of the following are examples of direct property losses EXCEPT A). the theft of a person’s jewelry. B). the destruction of a firm’s manufacturing plant by an earthquake. C). the expense to rent a substitute vehicle while a collision-damaged car is repaired. D). the vandalism of a person’s automobile. 8). Curt borrowed money to purchase a fishing boat. He purchased property insurance on the boat. Curt had difficulty making loan payments because he did not catch many fish and fish prices were low. Curt intentionally sunk the boat, collected from his insurer, and paid off the loan. This scenario illustrates the problem of A).Pure risk. B). subjective risk. C).moral hazard D).morale hazard 9). Paula Franklin started a dry cleaning business. The business may be successful or may fail. The type of risk that is present when a profit or loss could occur is called A). pure risk B). speculative risk C). diversified risk D). commercial risk 10).According to the law of large numbers, what happens as the number of exposures increases? A). Actual results will increasingly differ from probable results. B). Actual results will more closely approach probable results. C). Fundamental risk will decrease. D). Objective risk will increase. 11). The statement that insurance should be purchased only when losses are large and uncertain expresses: a. The central limit theorem b. The rule of adverse selection c. The law of large numbers d. The large-loss principle 2 12).The criteria for ideally insurable losses include all the following except: a. Definite losses b. Accidental losses c. A small carefully defined group of exposures d. Low probability of catastrophic loss 13).Tyler, age 35, recently purchased a house for $200,000 that is located in an area where tornadoes does frequently occur. He wants to make certain that funds are available if the house is damaged or destroyed in a tornado. Identify a private insurance coverage that would provide the desired protection. a).Homeowner insurance b).Marine Insurance c). Inland Marine Insurance d). Fire insurance 14). Nathan, age 40, owns an upscale furniture store. Nathan wants to be protected if a customer is injured while shopping in the store and sues him for the bodily injury. Identify the appropriate private insurance coverage for desired protection. a). Fire insurance b). Life and disability insurance c). Liability insurance d). Medical expense and disability PART II Answer THREE of the following questions (10 pts each). 1). what is adverse selection? How do insurers try to prevent adverse selection? 2).Why are floods and earthquakes difficult to insure in a privately operated insurance system? 3). Explain the difference between a moral hazard and a morale hazard. Give examples of each. 4). One of the characteristic of ideally insurable loss is that loss should be accidental and intentional. Explain this characteristic and bring two reasons why this requirement is necessary for a loss to be insurable. 5). Pure insurance risks ideally should have certain characteristics to be insurable by private insurers. List the five characteristics of an ideally insurable risk. 3