solutions to Problems

advertisement

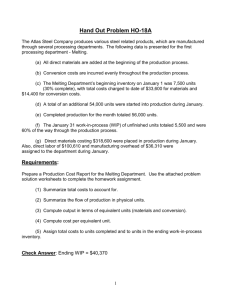

HILTON SELECT SOLUTIONS CHAPTER 4 EXERCISE 4-18 (15 MINUTES) 1. 5,500 equivalent units (refer to (a) in the following table) 2. 4,140 equivalent units (refer to (b) in the following table) CALCULATION OF EQUIVALENT UNITS: ANDROMEDA GLASS COMPANY Weighted-Average Method Percentage of Equivalent Units Completion with Physical Respect to Direct Units Conversion Material Conversion Work in process, August 1 ..... 2,000 60% Units started during August ... 3,500 Total units to account for ....... 5,500 Units completed and transferred out during August............ Work in process, August 31 ... Total units accounted for ....... Total equivalent units ............. EXERCISE 4-19 (30 MINUTES) 3,800 1,700 5,500 100% 20% 3,800 1,700 _____ (1) 5,500 3,800 340 ____ (2) 4,140 All three of these companies manufacture large amounts of relatively homogeneous products (i.e., lumber and paper). Therefore, process costing is an appropriate productcosting system. EXERCISE 4-20 (15 MINUTES) CALCULATION OF COST PER EQUIVALENT UNIT: DULUTH GLASS COMPANY Weighted-Average Method Direct Material Conversion Total Work in process, February 1 ................. $ 43,200 $ 40,300 $ 83,500 Costs incurred during February ............ 135,000 190,000 325,000 Total costs to account for ..................... $178,200 $230,300 $408,500 Equivalent units ..................................... 16,500 47,000 Costs per equivalent unit ...................... $10.80* $4.90† $15.70 *$10.80 = $178,200 ÷ 16,500 †$4.90 = $230,300 ÷ 47,000 EXERCISE 4-21 (15 MINUTES) CALCULATION OF COST PER EQUIVALENT UNIT: MONTANA LUMBER COMPANY Weighted-Average Method Direct Material Conversion Total Work in process, June 1 ........................... $ 74,900 $167,000 $ 241,900 Costs incurred during June...................... 380,700 625,000 1,005,700 Total costs to account for ........................ $455,600 $792,000 $1,247,600 Equivalent units ........................................ 6,700 1,600 Costs per equivalent unit ......................... $68* $495† $563 *$68 = $455,600 ÷ 6,700 †$495 = $792,000 ÷ 1,600 EXERCISE 4-22 (25 MINUTES) TUSCALOOSA PAPERBOARD COMPANY Weighted-Average Method Direct Material Conversion Work in process, March 1 ........................ $ 10,900 $ 28,950 Costs incurred during March .................. 112,700 160,200 Total costs to account for ....................... $123,600 $189,150 Equivalent units ....................................... 103,000 97,000 Costs per equivalent unit ........................ $1.20 $1.95 Total $ 39,850 272,900 $312,750 $3.15 1. Cost of goods completed and transferred out during March: number of units total cost per ...................... transferred out equivalent unit 2. 89,000$3.15 $280,350 Cost remaining in March 31 work in process: Direct material (14,000*$1.20) . Conversion (8,000*$1.95) ........ Total .............................................. Total costs accounted for ................ $ 16,800 15,600 32,400 $312,750 *Equivalent units in March 31 work in process: Total equivalent units (weighted average) ...................... Units completed and transferred out ............................... Equivalent units in ending work in process .................... Direct Material 103,000 (89,000) 14,000 Conversion 97,000 (89,000) 8,000 EXERCISE 4-23 (25 MINUTES) RALEIGH TEXTILES COMPANY Weighted-Average Method Direct Material Conversion Work in process, November 1 .................. $ 85,750 $ 16,900 Costs incurred during November ............ 158,000 267,300 Total costs to account for ........................ $243,750 $284,200 Equivalent units ........................................ 62,500 49,000 Costs per equivalent unit ......................... $3.90 $5.80 1. $9.70 Cost of goods completed and transferred out during November: number of units total cost per ..................... transferred out equivalent unit 2. Total $ 102,650 425,300 $527,950 47,000$9.70 $455,900 Cost remaining in November 30 work in process: Direct material (15,500*$3.90). Conversion (2,000*$5.80) ........ Total .............................................. Total costs accounted for ................ $60,450 11,600 72,050 $527,950 *Equivalent units in November 30 work in process: Total equivalent units (weighted average) ........................ Units completed and transferred out ................................. Equivalent units in ending work in process ...................... 3. Direct Material 62,500 (47,000) 15,500 Conversion 49,000 (47,000) 2,000 The electronic version of the Solutions Manual “BUILD A SPREADSHEET SOLUTIONS” is available on your Instructors CD and on the Hilton, 8e website: www.mhhe.com/hilton8e. Exercise 4-24 (45 minutes) 1. Diagram of production process: Work-in-Process Inventory: Preparation Department Batch P25 Batch S33 Accumulated by department Conversion costs: Direct-labor Manufacturing overhead Work-in-Process Inventory: Finishing Department Batch P25 Accumulated by batch Batch S33 Directmaterial costs Work-in-Process Inventory: Packaging Department Batch P25 Finished-Goods Inventory EXERCISE 4-24 (CONTINUED) 2. The product cost for each basketball is computed as follows: Professional Direct material: .................................................................... Batch P25 ($42,000 ÷ 2,000) .......................................... Batch S33 ($45,000 ÷ 4,000) .......................................... Conversion: Preparation Department .............................. Conversion: Finishing Department .................................. *Conversion: Packaging Department ................................ Total product cost .............................................................. $21.00 -07.50 6.00 .50 $35.00 Scholastic -0$11.25 7.50 6.00 -0$24.75 *The two production departments each worked on a total of 6,000 balls, but the Packaging Department handled only the 2,000 professional balls. 3. Journal entries: Work-in-Process Inventory: Preparation Department .......... Raw-Material Inventory.................................................. 39,500* 39,500 *$39,500 = $42,000 of direct material for batch P25 – $2,500 of packaging material Work-in-Process Inventory: Preparation Department .......... Raw-Material Inventory .................................................. 45,000* 45,000 *Direct-material cost for batch S33. Work-in-Process Inventory: Preparation Department .......... Applied Conversion Costs ............................................ 45,000* 45,000 *$45,000 = 6,000 units$7.50 per unit Work-in-Process Inventory: Finishing Department .............. Work-in-Process Inventory: Preparation Department *$129,500 = $39,500 + $45,000 + $45,000 129,500* 129,500 EXERCISE 4-24 (CONTINUED) Work-in-Process Inventory: Finishing Department .............. Applied Conversion Costs ............................................ 36,000* 36,000 *$36,000 = 6,000 units$6.00 per unit Work-in-Process Inventory: Packaging Department ............ Finished-Goods Inventory ...................................................... Work-in-Process Inventory: Finishing Department ..... 66,500* 99,000† 165,500 *$66,500 = $39,500 + (2,000$7.50) + (2,000$6.00). These are the costs accumulated for batch P25 only. †$99,000 = $45,000 + (4,000$7.50) + (4,000$6.00). These are the costs accumulated for batch S33 only. Work-in-Process Inventory: Packaging Department ............ Raw-Material Inventory .................................................. Applied Conversion Costs ............................................ 3,500 2,500* 1,000† *Cost of packaging material for batch P25. †$1,000 = 2,000 units$.50 per unit Finished-Goods Inventory ...................................................... Work-in-Process Inventory: Packaging Department ... *$70,000 = $66,500 + $3,500 70,000* 70,000 SOLUTIONS TO PROBLEMS PROBLEM 4-25 (45 MINUTES) 1. 2. Physical flow of units: Work in process, June 1 ........................................................................... Units started during June......................................................................... Total units to account for ......................................................................... Physical Units 40,000 190,000 230,000 Units completed and transferred out during June ................................. Work in process, June 30 ......................................................................... Total units accounted for ......................................................................... 180,000 50,000 230,000 Equivalent units: Work in process, June 1 .......... Units started during June........ Total units to account for ........ Units completed and transferred out during June ................... Work in process, June 30 ........ Total units accounted for ........ Total equivalent units .............. 3. Percentage of Completion with Physical Respect to Units Conversion 40,000 38% 190,000 230,000 180,000 50,000 230,000 100% 55% Equivalent Units Direct Material Conversion 180,000 50,000 180,000 27,500 230,000 207,500 Costs per equivalent unit: Work in process, June 1 ............... Costs incurred during June .......... Total costs to account for ............. Equivalent units ............................. Costs per equivalent unit.............. Direct Material $110,500 430,000 $540,500 230,000 $2.35 Conversion $ 22,375 320,000 $342,375 207,500 $1.65 Total $132,875 750,000 $882,875 $4.00 PROBLEM 4-25 (CONTINUED) 4. Cost of goods completed and transferred out during June: number of units total cost per ........................ transferred out equivalent unit 180,000$4.00 $720,000 50,000$2.35 $117,500 27,500$1.65 45,375 Cost remaining in June 30 work-in-process inventory: Direct material: number of cost per equivalent equivalent .......................... units of unit of direct material direct material Conversion: number of cost per equivalent equivalent ...................................... units of unit of conversion conversion Total cost of June 30 work in process ........................................................ $162,875 Check: Cost of goods completed and transferred out .............................. Cost of June 30 work-in-process inventory ................................... Total costs accounted for ............................................................... $720,000 162,875 $882,875 PROBLEM 4-30 (35 MINUTES) 1. Direct material cost was $1,390,000: JR1163 ................................ JY1065 ................................ DC0766 ............................... Total .............................. $ 225,000 710,000 455,000 $1,390,000 Texarkana Corporation’s total direct-labor payroll amounted to $134,274 for 6,394 hours of work ($134,274 ÷ $21 per hour). Thus, conversion cost was $575,460: Direct labor……………………………….…….. $134,274 Overhead applied (6,394 hours x $69)…….. 441,186 Total………………………………………….. $575,460 2. Goods completed during April cost $2,002,000 (26,000 units x $77) as the following calculations show: Physical Units Percentage Of Completion Equivalent Units With Respect to Direct Conversion Material Conversion Work in process, April 1………………. Units started during April…………….. Total units to account for…………….. 3,000 27,000 30,000 80% Units completed and transferred out during April…………………….. Work in process, April 30…………….. Total units accounted for……………... Total equivalent units………………….. 26,000 4,000 30,000 100% 45% 26,000 4,000 26,000 1,800 30,000 27,800 PROBLEM 4-30 (CONTINUED) Work in process, April 1…………………… Costs incurred during April………………. Total costs to account for…………………. Equivalent units……………………………... Cost per equivalent unit…………………… Direct Material Conversion Total $ 230,000 1,390,000 $1,620,000 30,000 $54a $ 63,940 575,460 $639,400 27,800 $23b $ 293,940 1,965,460 $2,259,400 $77c a$1,620,000 ÷ 30,000 = $54 ÷ 27,800 = $23 c$54 + $23 = $77 b$639,400 3. The cost of the ending work-in-process inventory is $257,400: Direct material (4,000 x $54)…….. $216,000 Conversion cost (1,800 x $23)….. 41,400 Total……………………………. $257,400 4. 5. (a) No material would be added during May. All material is introduced at the start of the manufacturing process, and these units were begun in April. (b) Since the work-in-process inventory is 45% complete at the end of April, 55% of the conversion would be done in May. Given that the ending work-in-process inventory is at the 45% stage of completion, these units would not have reached the 75% point in April where TH55 is added. Therefore, there would be zero equivalent units with respect to part TH55 in the ending work-in-process inventory. PROBLEM 4-31 (50 MINUTES) The missing amounts are shown below. A completed production report follows. Work in process, October 1 (in units) .................................................................. Units completed and transferred out during October ........................................ Total equivalent units: conversion ...................................................................... 10,000 75,000 78,500 Work in process, October 1: conversion ............................................................. Costs incurred during October: direct material .................................................. Cost per equivalent unit: conversion .................................................................. Cost of goods completed and transferred out during October ......................... Cost remaining in ending work-in-process inventory: direct material ............. $ 30,225 600,000 11.85 1,556,250 44,500 PRODUCTION REPORT: FANTASIA FLOUR MILLING COMPANY Weighted-Average Method Percentage of Completion with Equivalent Units Physical Respect to Direct Units Conversion Material Conversion Work in process, October 1 .......... 10,000 15% Units started during October........ 70,000 Total units to account for ............. 80,000 Units completed and transferred out during October ............. Work in process, October 31 ........ Total units accounted for ............. Total equivalent units ................... 75,000 5,000 80,000 100% 70% 75,000 5,000 _____ 80,000 75,000 3,500 _____ 78,500 PROBLEM 4-31 (CONTINUED) Work in process, October 1 .......... Costs incurred during October .... Total costs to account for ............ Equivalent units ............................ Costs per equivalent unit ............. *$8.90 = $712,000 ÷ 80,000 †$11.85 = $930,225 ÷ 78,500 **$20.75 = $8.90 + $11.85 Direct Material $112,000 600,000 $712,000 80,000 $8.90* Conversion $ 30,225 900,000 $930,225 78,500 $11.85† Total $ 142,225 1,500,000 $1,642,225 $20.75** PROBLEM 4-31 (CONTINUED) Cost of goods completed and transferred out during October: number of units total cost per .............................. transferred out equivalent unit 75,000$20.75 $1,556,250 5,000$8.90 $44,500 3,500$11.85 41,475 Total cost of October 31 work-in-process ........................................................ $85,975 Cost remaining in October 31 work-in-process inventory: Direct material: number of cost per equivalent equivalent units of unit of ................................. direct material direct material Conversion: number of cost per equivalent equivalent units of unit of ........................................... conversion conversion Check: Cost of goods completed and transferred out ...... Cost of October 31 work-in-process inventory .... Total costs accounted for ...................................... $1,556,250 85,975 $1,642,225 PROBLEM 4-36 (35 MINUTES) 1. Conversion cost per unit in department I: direct labor manufacturing overhead units produced* $76,000 $460,000 5,500 2,000 2,500 $53.60 per uni t *Note that all of the products sold after processing in departments I, II, or III were produced orginally in department I. 2. Conversion cost per unit in department II: direct labor manufacturing overhead units produced* $44,000 $136,000 2,000 2,500 $40.00 per unit *Note that all of the products sold after processing in departments II and III were colored in department II. 3. Cost of a clear glass sheet: direct material per = unit in department I $900,000 $53.60 10,000 $143.60 per sheet conversion cost per + unit in department I PROBLEM 4-36 (CONTINUED) 4. Cost of an unetched, colored glass sheet: = cost per clear glass sheet $143.60 direct material conversion cost per + per unit in department II + unit in department II $144,000 $40.00 4,500 $215.60 per sheet 5. Cost of an etched, colored glass sheet: cost per unetched = colored glass sheet $215.60 conversion cost per + unit in department III $76,000 $147,500 2,500 $305.00 per sheet