xxxxxx - Accounting

advertisement

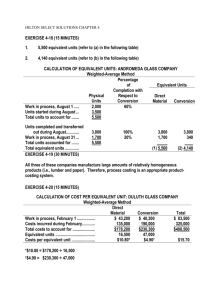

Hand Out Problem HO-18A The Atlas Steel Company produces various steel related products, which are manufactured through several processing departments. The following data is presented for the first processing department - Melting. (a) All direct materials are added at the beginning of the production process. (b) Conversion costs are incurred evenly throughout the production process. (c) The Melting Department’s beginning inventory on January 1 was 7,500 units (30% complete), with total costs charged to date of $33,600 for materials and $14,400 for conversion costs. (d) A total of an additional 54,000 units were started into production during January. (e) Completed production for the month totaled 56,000 units. (f) The January 31 work-in-process (WIP) of unfinished units totaled 5,500 and were 60% of the way through the production process. (g) Direct materials costing $318,600 were placed in production during January. Also, direct labor of $100,610 and manufacturing overhead of $36,310 were assigned to the department during January. Requirements: Prepare a Production Cost Report for the Melting Department. Use the attached problem solution worksheets to complete the homework assignment. (1) Summarize total costs to account for. (2) Summarize the flow of production in physical units. (3) Compute output in terms of equivalent units (materials and conversion). (4) Compute cost per equivalent unit. (5) Assign total costs to units completed and to units in the ending work-in-process inventory. Check Answer: Ending WIP = $40,370 1 Problem HO-18A (Solution Worksheet) ATLAS STEEL COMPANY Production Cost Report - Melting Department For the Month Ended January 31, 20XX 2 Costs Charged to Production: (1) Costs of beginning work-in-process: Direct materials…………………………$ Conversion costs…….………………... (2) Costs incurred this period: Direct materials…………………………$ Conversion costs………………………. Total costs to account for……....………........ $ $ Unit Accountability Information: Units to account for: Beginning work-in-process….... Units started this period……….. Total units to accounted for…... Units accounted for: Completed & transferred out….. Ending work-in-process……...... Total units accounted for…….… Continued 3 Equivalent Units of Production: Equivalent Units Units to complete beginning work-in-process: Materials Conversion Direct materials ( x %)……………….……….......... Conversion ( x %)…………......……………............ Units started and completed ( %)...….................. x Units of ending work-in-process: Direct materials ( x %)…..…..……………............... Conversion ( x %)…..………………………………... Equivalent units of production..…………………….................. Costs per Equivalent Unit: Costs Materials Conversion Unit costs: Costs incurred this period ……………........... $ Total equivalent units…………………............ ÷ Cost per equivalent unit………………............ $ Cost Assignment and Reconciliation: Cost of beginning work-in-process…………...................... $ ÷ $ $ Cost to complete beginning work-in-process: Direct materials ( EU x $ )…………….... $ Conversion ( EU x $ )………………....... Cost of units started and completed this period: Direct materials ( EU x $ ).…………...... $ Conversion ( EU x $ )…………...…….... Total cost of goods finished this period………................... Cost of ending work-in-process: Direct materials ( EU x $ Conversion ( EU x $ $ )…….……...... $ )………….............. Total costs accounted for……………………….......................... 4 $ Problem HO-18A Supporting Schedule (Equivalent Unit Computations) Materials: Production Units Status Beginning Inventory ( Physical Units Factor Added Equivalent Units Physical Units Factor Added Equivalent Units )........... Started and Completed.................... Ending Inventory ( )................. Total Equivalent Units.................. Conversion: Production Units Status Beginning Inventory ( )........... Started and Completed.................... Ending Inventory ( )................. Total Equivalent Units.................. 5 Production Cost Report (Example) Costs Charged to Production: (1) Costs of beginning work-in-process: Direct materials…………………………$ 24,550 Conversion costs………………………. 3,600 (2) Costs incurred this period: Direct materials…………………………$ 50,000 Conversion costs…………………….... 9,690 Total costs to account for………....….... $ 28,150 59,690 $ 87,840 Unit Accountability Information: Units to account for: Beginning work-in-process……... 500 Units started this period………....1,000 Total units to accounted for….....1,500 Units accounted for: Completed & transferred out….... 1,100 Ending work-in-process…..……... 400 Total units accounted for………… 1,500 Equivalent Units of Production: Equivalent Units Materials Conversion 0 150 600 600 Beginning work-in-process: Direct materials (500 x 0%)……………………….………... Conversion (500 x 30%)……………….…………………..... Started and completed………………………….................... Ending work-in-process: Direct materials ( 400 x 100%)…………..….......……........ Conversion (400 x 25%)…………………………………….. Equivalent units of production………………………........... Costs per Equivalent Unit: Unit costs: Costs incurred this period …………….. Total equivalent units…………………... Cost per equivalent unit………………... 400 Materials Costs Conversion $50,000 ÷ 1,000 $ 50.00 $9,690 ÷ 850 $11.40 Cost Assignment and Reconciliation: Cost of beginning work-in-process………...….................. Cost to complete beginning work-in-process: Direct materials ( 0 EU x $50.00)…………….............. $ 6 100 850 1,000 $28,150 0 Conversion (150 EU x $11.40)………………............... 1,710 Cost of units started and completed this period: Direct materials (600 EU x $50.00)…………............... $30,000 Conversion (600 EU x $11.40)……………….............. 6,840 Total cost of goods finished this period………............... Cost of ending work-in-process: Direct materials (400 EU x $50.00)…….........……...... $20,000 Conversion (100 EU x $11.40)…………...................... 1,140 Total costs accounted for…....……………………............. 7 1,710 36,840 $66,700 21,140 $87,840