Consumer surplus, following Marshall, is traditionally defined as the

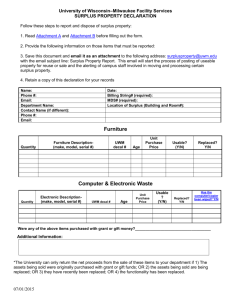

advertisement

Consumer Surplus Consumer surplus, following Dupuit and Marshall, is a monetary measure of the benefits to consumers from being able to buy what they want at the going price. It is used to evaluate the gains from policy changes: Cost-Benefit Analysis recognizes that much of the benefit may accrue in the form of surplus and so is not measured in actual market transactions. Consumer surplus is traditionally depicted as the area below the (ordinary, or Marshallian) demand curve and above the horizontal line representing price. To illustrate, suppose that there are 10 individuals, whose individual reservation values (maximum willingness to pay) range from $10 down to $1 in one dollar decrements. All consumers with reservation values above the market price buy, and each buyer enjoys a surplus equal to her reservation value minus the amount paid. So, if the market price is $6.50, four consumers buy, with surpluses ranging from $0.50 to $3.50, for a total (aggregate) consumer surplus of $8. This consumer surplus equals the gross benefit ($34 in the above example) minus consumer expenditures. A drop in price to $5.50 raises consumer surplus to $12.50: $1 extra accrues to each previous consumer directly from the price reduction, and one more consumer (who then enjoys $0.50 surplus) is induced to buy. The same idea applies to a consumer buying several units of a good (or when many consumers each buy several units). Suppose the demand system above represents the valuations of a single consumer for successive units purchased: the consumer will buy until the value of another unit falls below the price charged. At a price of $6.50 she buys 4 units and enjoys $8 in surplus. A price drop to $5.50 will induce her to buy more. Her surplus gain is $4.50, (more than the $4 saved on the previous 4 units). While the marginal unit purchased is valued at the price, all other (infra-marginal) units provide surplus. Total consumer surplus aggregates these gains over all units purchased by all buyers. The simple procedure described above gives the exact measure of the true benefit to consumers only under certain restrictive conditions. If there are “wealth effects,” the consumer’s willingness-to-pay for the marginal unit changes with the amount paid for the previous units. There is, thus, not just one measure of surplus change, but many. Most prominently are the Equivalent Variation (the additional money needed to make the consumer just as well off as the price change) and the Compensating Variation (the money that could be taken away after the price change to leave the consumer as well off as before). The consumer surplus change is bracketed between the Equivalent and Compensating Variations. Fortunately, for small changes or when the good in question attracts a small fraction of expenditure, it has been shown that these three measures give similar results. Consumer surplus counts $1 in surplus the same irrespective of how deserving the recipient might be. Critics argue that it overemphasizes the preferences of the wealthy, insofar as they have greater willingness-to-pay. Defenders of consumer surplus argue that it is a useful in measuring economic efficiency, while redistribution issues should be addressed separately.