robert a - Cogentsolutions.us

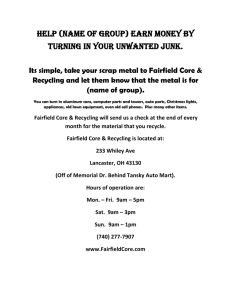

advertisement

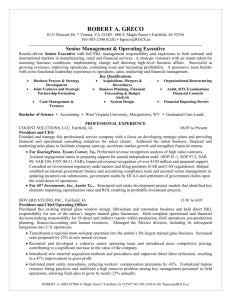

ROBERT A. GRECO 8131 Prescott Dr. Unit 101 * Vienna, Va. 22180 / 800 S. Maple Street Fairfield, IA 52556 563-503-2340 (Cell) bgreco@RGCS.us _____________________________________________________________________________________________________ Senior Management & Operating Executive Results-driven Senior Executive with full P&L management responsibility and experience in both national and international markets in manufacturing, retail and financial services. A strategic visionary with an innate talent for assessing business conditions, implementing change and directing high-level business affairs. Successful at growing revenues, improving operations, containing costs and increasing profitability. A persuasive team builder with cross-functional leadership experience in operations, sales, marketing and financial management. Business Process & Strategy Development Joint Ventures and Strategic Partnership Formation Cash Management & Treasury Federal Acquisition Regulations(FAR) Key Qualifications Acquisitions, Mergers & Divestitures/ Litigation Support Business Plan, Financial Forecasting & Budget Analysis System Design Defense Contract Review and Filings (DCAA) Manufacturing and Service Operations Change Management Organizational Restructuring & Development E-Commerce Business Strategies Audit Support /SOX Examinations / Financial Controls Bachelor of Science Accounting West Virginia University, Morgantown, WV Graduated Cum Laude PROFESSIONAL EXPERIENCE COGENT SOLUTIONS, LLC, Fairfield, IA 06/05 to Present President and CEO Founded and manage this professional service company with a focus on developing strategic plans and providing financial and operational consulting initiatives for select clients. Authored the initial business, financial and marketing/sales plans to facilitate company start-up, accelerate market growth and strengthen financial returns. For BearingPoint, Tysons Corner, Va., BearingPoint (“BE”) is a $3 billion publicly traded management and consulting company which was spun off by KPMG in 2003. BE provides consulting applications services, technology solutions and managed services to government organizations, Global 2000 companies and medium-sized businesses in the United States and internationally. In North America, BE provides consulting services through its industry groups. The Company's operating segments include North American industry groups and international operations. The North American industry groups consist of three industry groups, Public Services, Commercial Services and Financial Services. I have been providing consulting services to BE for the past 18 month at its corporate headquarters. My activities include: interfacing with managing directors and key employees in performing revenue recognition analysis of high value contracts; the review for accuracy of contract estimates to complete; and the evaluation of accounting practices in connection with 10K filing. I assist engagement teams in preparing financial audit support utilizing SOP 81-1, SOP 97-2, SAB 99, SAB 104, EITF 00-21, FAR and interface with independent outside auditors. I direct other consultants and BE employees in the completion of Incurred Cost Submissions (government reports) and the preparation of materials for DCAA audits. I have improved revenue recognition of over $150+ million contracts and the preparation of time sensitive and critical financial support. For 607 Investments, Inc, Austin TX., 607 Investments is a boutique real estate investment company. I have structured $75+ million real estate development project models that identified key elements impacting capitalization rates and ROI, resulting in million-dollar (30%) ROI. Current activities include the preparation on transaction letters of intent on several projects in the Washington DC and Austin, Texas markets and the negotiation of purchase terms and conditions. Consulting activities also include the arrangement of commercial credit and the preparation of Reg. D documents and the placement of private equity. ROBERT A. GRECO* -469-5401 (Res.) * 563-503-2340 (Cell) *bgreco@RGCS.us ROBERT A. GRECO Page 2 BOVARD STUDIO, INC., Fairfield, IA 11/01 to 6/05 President and Chief Operating Officer Purchased this existing stained glass window design, fabrication and restoration business and held up to $4.2 million in P&L responsibility for one of the nation’s largest stained glass businesses. Held complete operational and financial decision-making responsibility for 54 direct and indirect reports within production, field operations, pre-production planning, finance/accounting and human resources. Managed the Mexico division, including its subsequent integration into U.S. operations. Transitioned a regional mom-and-pop operation into the nation’s 5th largest stained glass business. Increased sales proposals by 25% and added $1.2 million (from $3 million to $4.2 million) in new annual revenue. Recruited and developed a cohesive senior operating team and introduced more competitive pricing, contributing to a $600,000 increase in the value of the company. Introduced new material acquisition methods and procedures and improved direct labor utilization, resulting in an $800,000 (47%) improvement in gross profit. Instituted plant safety procedures, reducing workers’ compensation premiums by 43% ($50,000). Formalized human resource hiring practices and stabilized a high turnover problem among key management personnel in field operations, allowing field sales to grow by nearly $500,000 (25%) annually. Converted essential production and field construction data into a concise electronic specification for distribution to key architects, leading to a $525,000 annual increase in large contract sales. Enhanced customer communications and shortened the response time to client inquiries, improving the customer satisfaction level from 6.5 to 8.6 (on a scale of 10). ROBERT A. GRECO* -469-5401 (Res.) * 563-503-2340 (Cell) *bgreco@RGCS.us PACKAGENET, INC. (Formerly Express Shipping Centers, Inc.) Fairfield, IA 03/97 to 10/01 Board Member, Executive Vice President Held full accountability for all operational functions of this $15 million consumer service company, with a focus on the strategic development of business and technology. Managed 4 direct and 60 multi-tiered indirect reports within client relations, customer service, IT, finance/accounting and warehousing. Sourced and directed all equity and capital raising activities. Managed all Board of Directors and shareholder communications. Authored the strategic and operational business plan and participated in numerous presentations, raising $9 million in venture capital for the startup operation. Coordinated the sales development initiative and participated in all contract negotiations with more than 25 top Fortune 500 companies, generating $15 million in annual revenues. Negotiated $4 million in new loans and subsequently restructured $2.5 million in troubled debt, enabling the company to obtain required working capital and avoid bankruptcy. Introduced the concept of shipping packages utilizing the Internet and the company’s distribution network, which subsequently led to a joint venture agreement with a shipping/logistics industry software developer. Identified an international corporation interested in buying the troubled company, opened negotiations, and coordinated the due diligence effort for the $25 million transaction. ROBERT A. GRECO Page 3 EXPRESS SHIPPING CENTERS, INC., Fairfield, IA 03/93 to 03/97 Chief Financial Officer Senior Financial Executive with responsibility for strategic/operational planning and leadership of the financial, accounting and administrative functions. Established all core financial processes, as well as baseline data and metrics relating to performance and profit growth. Directed the forecasting, budgeting and cash management initiatives. Prepared a business plan and solicited major venture capitalists for equity and mezzanine investments in the start-up company, raising $5 million in private equity transactions. Established an audit team comprised of accounting and operational personnel that identified and recovered more than $1 million in prior vendor billing errors. CHICAGO HOLDINGS, INC., Pittsburgh, PA 04/90 to 03/93 Vice President Acquisitions Responsible for the identification of viable business ventures and activities for this private equity company. Developed comprehensive business plans, ensured adequate capital funding, and recruited top management talent to grow the company. Instrumental in creating the conceptual frame work for a consumer finance operation. Arranged the $5 million in capitalization which subsequently led to a $50 million IPO. Managed a consumer finance operation for a private equity group and assisted the holding company in a management buy-back that resulted in a 25% return on investment. ROBERT A. GRECO* -469-5401 (Res.) * 563-503-2340 (Cell) *bgreco@RGCS.us THE FINANCE COMPANY, Manassas, VA 04/89 to 04/90 Chief Financial Officer Held oversight for all treasury and financial operations for this $100 million automobile finance sub-prime lender. Key player in the establishment of a $75 million credit facility, enabling the company to develop a $100 million automobile paper portfolio that generated a 25% return. MARINE MIDLAND CAPITAL MARKETS CORPORATION, New York, NY 04/85 to 04/89 Director, Chief Financial and Operations Officer Led all financial and operationalinitiativesforthe$110 million municipal securities and discount brokerage divisions. Outsourced all brokerage and municipal securities operations, saving more than $2 million annually. Early Positions Included: Controller at Emanuel and Company and Audit Manager & CPA for Touche Ross. ROBERT A. GRECO* -469-5401 (Res.) * 563-503-2340 (Cell) *bgreco@RGCS.us