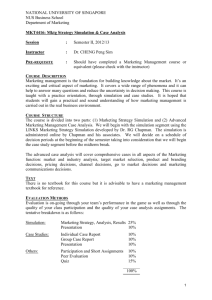

Focus/ Course Title

advertisement

Personal Finance (.5 credit) Approved May 2011 1 Income – Learning To Earn Essential Understandings: 1. You must put money in before you can take it out. 2. Good financial plans include a variety of sources of income 3. Always perform your current job as if you are working towards a promotion 4. First impressions are lasting impressions Content Standards: Sources: National Standards in Personal Finance Education, The Jump$tart Coalition for Personal Financial Literacy, 919 18th Street, N.W. Suite 300 Washington, DC 20006, http://www.jumpstartcoalition.org/guide.html, retrieved April 3, 2009. 1. Take responsibility for personal financial decisions. 2. Summarize major consumer protection laws. 3. Make financial decisions by systematically considering alternatives and consequences. 4. Develop communication strategies for Understanding financial issues. 5. Explore career options. 6. Identify sources of personal income. 7. Understand factors affecting take-home pay. 8. Develop a personal financial plan. 9. Identify the costs and benefits of various types of credit. 10. Use appropriate and cost-effective risk management strategies. 11. Identify common types of risks and basic risk management methods.. 12. Understand how saving contributes to financial well-being Essential Question: Why is it important to have a career plan? Learning Goals: Students will: Know two ways of learning about financial aid for students Understand the most important lesson to learn about handling personal finances Understand how work will affect family and choice of friends Know the best sources of job leads Know three traditional and three online sources of job leads Know what info is usually requested on an job application form Know the legal document that is required before being employed Understand how keywords can help in obtaining a job interview Understand the setting in which employers usually make hiring decisions 2 Know three things to do when preparing for a job interview Know ways to make a good impression in an interview Know topics that company policy handbooks usually cover Understand the purpose of a work permit Know three main things employers expect of new employees Understand why U.S. jobs are increasingly being performed overseas Understand how to go about selecting an institution of higher education Understand alternatives to attending a 4 year college/university Know advantages to being an entrepreneur Understand three forms of business organization Understand a limited liability company 3 Suggested Strategies Suggested Assessments Suggested Resources Mock Interviews Search local job Knowings Guest Speaker from local Human Resources department Completed Job Lead Cards Completed Job Application Completed Personal Data Sheet/Resume Completed Working Papers Poster/Brochure on Interviewing Tips Unit Test Personal Portfolio “Knowledge Matters – Personal Finance” Teachers Guide, 2008, Knowledge Matters, Florence, MA. “Personal Finance: A Lifetime Responsibility” by Dungan & Kimbrell, EMC Publishing, St Paul, MN, 2009. Student Textbook, Teachers Annotated Textbook, Math Skills Workbook (Student and Teacher’s versions),Student Activities Workbook (Student and Teacher’s versions) “Financial Literacy for Teens” by Chad Foster, Rising Books, Conyers, GA, 2004. “Checking Account Simulation” INTERNAL TRAINING SERVICES, LLC, Media, PA “Introduction to Insurance Forms” INTERNAL TRAINING SERVICES, LLC, Media, PA “Life In...United States – A Family Finance Simulation”, Family Economics & Financial Education, September 2004 Videos/DVD’s o Are you Ready to Live on Your Own? o Careful With Credit o It's Your Money: Financial Flight School o Stash that Cash: Budgeting, Savings & Investing for Teens o Debt Stress: Teen Budgeting o "21st Century Money Management Video Series o "Buying the Basics Video Series” o "Managing Your Personal Finances Video Series Value Pack DVD" o Money Matters: Mastering Basic Money Management. Linx Educational Publishing, 2004. 4 Suggested Tech Integration Content Vocabulary Lifelong Learning/21st Century Skills “Knowledge Matters – Personal Finance” Simulation Software, 2008, Knowledge Matters, Florence, MA. Online Financial Calculators Microsoft Office Wages, salary, tip, commission, entrepreneur, sole proprietorship, partnership, corporation, investing, grants, royalties, inheritance, plan of action, job leads, networking, application form, personal data sheet, work permit, resume, keywords, cover letter, W-4, W-2, allowances, exemptions, company policy handbook, gross pay, net pay, overtime, deductions, flextime, job sharing, telecommuting, WiFi, community college, trade school, apprenticeship, Productive habits of mind Read critically for a variety of purposes Core Ethical Values Quality work Communicate effectively 5 Managing Your Money Essential Understandings: 1. Establishing healthy financial habits early in life helps you to achieve your personal and financial goals 2. Your money can be shared, saved or spent 3. What you choose to do with your money should match your personal values Content Standards: Sources: National Standards in Personal Finance Education, The Jump$tart Coalition for Personal Financial Literacy, 919 18th Street, N.W. Suite 300 Washington, DC 20006, http://www.jumpstartcoalition.org/guide.html, retrieved April 3, 2009. 1. Take responsibility for personal financial decisions. 2. Find and evaluate financial information from a variety of sources. 3. Make financial decisions by systematically considering alternatives and consequences. 4. Develop communication strategies for Understanding financial issues. 5. Control personal information. 6. Explore career options. 7. Identify sources of personal income. 8. Understand factors affecting take-home pay. 9. Develop a plan for spending and saving. 10. Develop a system for keeping and using financial records. 11. Understand how to use different payment methods. 12. Apply consumer skills to purchase decisions. 13. Consider charitable giving. 14. Develop a personal financial plan. 15. Identify the costs and benefits of various types of credit. 16. Understand the purpose of a credit record and identify borrowers' credit report rights. 17. Understand ways to avoid or correct debt problems. 18. Identify common types of risks and basic risk management methods. 19. Understand how saving contributes to financial well-being. 20. Understand how investing builds wealth and helps meet financial goals. 21. Understand how taxes affect the rate of return on investments. 22. Investigate how agencies that regulate financial markets protect investors. Essential Question: What money management skills lead to successful personal financial management? 6 Learning Goals: Students will: Understand the importance of allotting some of your earnings to savings Understand how spending should reflect your value system Know the steps in setting up a financial plan Understand how to tell whether you are moving toward you goals and how to know when you have achieved them Understand the importance of sharing money and time with a cause you believe in Know causes you feel strongly about and identify one thing you would do to make the world a better place Know three ways to share time or money with a worthy cause Understand why most financial record-keeping systems have various components and know what those components might be Understand how a computer might make financial record keeping easier Know the major kinds of taxes and understand which ones affect you Know how to pay income taxes Know how to complete income tax forms Understand the importance of setting financial goals Understand the importance of linking values with goals Understand the differences between short, medium and long-term goals Understand planning involved in sharing and savings goals Understand what a budget is Understand what can be learned from adults who have achieved financial success Understand why you should include sharing and savings in budgets Understand fixed vs. variable expenses Understand which income should be included in a budget Understand the effect of unexpected gifts in a budget Estimate income and expenses Understand how to protect yourself from large, unexpected expenses Understand the features of a good budget 7 Understand the impact of not sticking to your budget Understand what should be done of a budget isn’t working Understand how checking accounts work Understand banks vs. credit unions Understand why a bank prefers customers to use ACH transactions vs. checks Identify different types of checking accounts Know checking account features Know alternatives to writing traditional checks Understand how and when checks affect the checkbook balance Understand debit vs. credit cards Understand fees that banks may charge against checking accounts Understand requirements to opening a checking account Understand electronic banking Know how to determine checking account balances Reconcile a bank account balance at the end of a month 8 Suggested Strategies Suggested Assessments Suggested Resources Suggested Tech Integration Knowledge Matters Personal Finance Simulation: Paying Your Taxes Knowledge Matters Personal Finance Simulation: Budgeting & Saving Knowledge Matters Personal Finance Simulation: Choosing & Balancing A Checking Account Knowledge Matters Personal Finance Simulation: Using Online Banking Manual Checking Simulation Unit Test Manual Checking Simulation Checking Account Comparison Research Project Credit Card Comparison Research Project Personal Portfolio “Knowledge Matters – Personal Finance” Teachers Guide, 2008, Knowledge Matters, Florence, MA. “Personal Finance: A Lifetime Responsibility” by Dungan & Kimbrell, EMC Publishing, St Paul, MN, 2009. Student Textbook, Teachers Annotated Textbook, Math Skills Workbook (Student and Teacher’s versions),Student Activities Workbook (Student and Teacher’s versions) “Financial Literacy for Teens” by Chad Foster, Rising Books, Conyers, GA, 2004. “Checking Account Simulation” INTERNAL TRAINING SERVICES, LLC, Media, PA “Life In...United States – A Family Finance Simulation”, Family Economics & Financial Education, September 2004 Videos/DVD’s o It's Your Money: Financial Flight School o Stash that Cash: Budgeting, Savings & Investing for Teens o Debt Stress: Teen Budgeting Managing Your Personal Finances Video Series Value Pack DVD" Money Matters: Mastering Basic Money Management. Linx Educational Publishing, 2004. Knowledge Matters Personal Finance Simulation Microsoft Office (Word, Excel) Internet Webquests Handheld and online financial calculators 9 Content Vocabulary Lifelong Learning/21st Century Skills Overdraft fee, income, expenses, sharing, saving, spending, philanthropy, charities, altruism, service-learning, financial records, taxes, sales tax, property tax, estate tax, income tax, withholding, Social Security, adjusted gross income, tax deductions, budget, short term goals, medium term goals, long term goals, savings account, checking account, interest, check, debit card, commercial banks, savings and loans, credit unions, payday lenders, financial transactions, deposit, withdrawal, debit, credit transfer, loan, ACH, ATM, stop payment order, Productive habits of mind Collaborate and co-operate Read critically for a variety of purposes Core Ethical Values Quality work Access and process information Communicate effectively 10 Saving and Investing Essential Understandings: 1. Pay yourself first 2. Make saving a habit 3. Different savings vehicles carry different risks Content Standards: Sources: National Standards in Personal Finance Education, The Jump$tart Coalition for Personal Financial Literacy, 919 18th Street, N.W. Suite 300 Washington, DC 20006, http://www.jumpstartcoalition.org/guide.html, retrieved April 3, 2009. 1. Take responsibility for personal financial decisions. 2. Find and evaluate financial information from a variety of sources. 3. Make financial decisions by systematically considering alternatives and consequences. 4. Control personal information. 5. Identify sources of personal income. 6. Organize personal finances and use a budget to manage cash flow. 7. Develop a plan for spending and saving. 8. Develop a system for keeping and using financial records. 9. Understand how to use different payment methods. 10. Apply consumer skills to purchase decisions. 11. Consider charitable giving. 12. Develop a personal financial plan. 13. Understand ways to avoid or correct debt problems. 14. Summarize major consumer credit laws. 15. Understand how saving contributes to financial well-being. 16. Understand how investing builds wealth and helps meet financial goals. 17. Evaluate investment alternatives. 18. Understand how to buy and sell investments. 19. Understand how taxes affect the rate of return on investments. 20. Investigate how agencies that regulate financial markets protect investors. Essential Question: Why would a successful personal financial plan include saving and investing? 11 Learning Goals: Students will: Understand typical teen savings goals Understand saving for a purchase vs. charging a purchase Determine length of time required to save money for specific goals Understand different types of savings accounts Understand and compute compounding interest on account balances Understand stocks vs. bonds Understand mutual funds and their associated risks Know and understand several investments other than stocks, bonds, and mutual funds Understand real estate investments Understand sources of retirement income other than Social Security Understand multiple ways to learn more about investing Locate and understand information on a company’s financial performance 12 Suggested Strategies Suggested Assessments Suggested Resources Suggested Tech Integration Content Vocabulary Lifelong Learning/21st Century Skills Create a Personal Savings Plan Unit Test Savings Products Comparison Research Project Personal Portfolio Knowledge Matters Personal Finance Simulation “Life In...United States – A Family Finance Simulation”, Family Economics & Financial Education, September 2004 “Knowledge Matters – Personal Finance” Teachers Guide, 2008, Knowledge Matters, Florence, MA. “Personal Finance: A Lifetime Responsibility” by Dungan & Kimbrell, EMC Publishing, St Paul, MN, 2009. Student Textbook, Teachers Annotated Textbook, Math Skills Workbook (Student and Teacher’s versions),Student Activities Workbook (Student and Teacher’s versions) “Financial Literacy for Teens” by Chad Foster, Rising Books, Conyers, GA, 2004. Knowledge Matters Personal Finance Simulation: Intro to Investing, Risk v. Return Handheld and online financial calculators Microsoft Office Savings plan, discretionary income, liquidity, CS’s, money market account, securities, savings bonds, compounding interest, annual percentage yield (APY), return, rule of 72, stocks, bonds, dividends, capital gain, common stock, preferred stock, NYSE, NASDAQ, blue chip stocks, Dow Jones Industrial Average, bull market, bear market, S&P 500, Fortune 500, futures, commodities, options, penny stocks, mutual funds, no-load funds, load funds, real estate, collectibles, pension, vested, profit-sharing plan, stock-bonus plan, 401k, 403b, IRA’s, Roth IRA, SEP-IRA, broker, financial adviser, annual report Productive habits of mind Collaborate and co-operate Read critically for a variety of purposes Core Ethical Values Quality work Access and process information Communicate effectively 13 Spending Wisely Essential Understandings: 1. Separating your needs from your wants will help in making wise financial decisions 2. Investing time to research purchases will help reduce personal spending 3. Total cost of goods and services involve more than just the purchase price Content Standards: Content Standards: Sources: National Standards in Personal Finance Education, The Jump$tart Coalition for Personal Financial Literacy, 919 18th Street, N.W. Suite 300 Washington, DC 20006, http://www.jumpstartcoalition.org/guide.html, retrieved April 3, 2009. 1. Take responsibility for personal financial decisions. 2. Find and evaluate financial information from a variety of sources. 3. Summarize major consumer protection laws. 4. Make financial decisions by systematically considering alternatives and consequences. 5. Control personal information. 6. Explore career options. 7. Identify sources of personal income. 8. Understand factors affecting take-home pay. 9. Develop a plan for spending and saving. 10. Develop a system for keeping and using financial records. 11. Understand how to use different payment methods. 12. Apply consumer skills to purchase decisions. 13. Develop a personal financial plan. 14. Understand ways to avoid or correct debt problems. 15. Summarize major consumer credit laws. 16. Identify common types of risks and basic risk management methods. Essential Question: Why do we buy the things we buy? How can we improve our spending habits and choices to build a successful financial plan? Learning Goals: Students will: Understand the difference between needs v. wants Know factors to consider when going comparison shopping Understand marketing tools/tactics used by companies to encourage overspending Understand effective advertising elements Understand brands 14 Understand how companies capture consumers’ interests Understand why so many advertisements target young people Understand product warranties Understand the kinds of information provided by consumer advocate groups Understand planning for smart buying decisions Research and understand mass transit Understand the most common form of private transportation Create a list of estimated costs of car ownership Research automobile makes and models Understand how to search for a used car Create a list of items to check for when examining a used car Understand reasons to NOT buy a car Understand the purpose and application of lemon laws Understand preventative maintenance and give examples Research reliable automobile service stations Know and understand common expenses associated with moving into an apartment Know and understand three common types of housing structures Understand reasons why people might choose renting vs. home ownership Understand and calculate down payments Understand why someone might offer more than the asking price for a home Research and understand the different types of mortgage products Understand which mortgage type presents the least risk to the homebuyer Understand current food buying trends Understand product label nutritional information Understand how to judge the freshness of foods Calculate and Understand clothing expenses as a percentage for a typical family Understand how to check for quality in clothing purchases 15 Know locations to find bargains on new clothes Understand influences in the clothing buying process Understand the consumer movement of the early 1960’s Understand ways that manufacturers communicate with consumers Know how consumers can provide feedback to companies about their products Identify government agencies that address consumer issues Know the four basic consumer rights Understand how competition among producers helps consumers Understand ways to resolve disputes with a producer or seller Understand how to recognize pyramid schemes, phishing, and other type of consumer fraud 16 Suggested Strategies Suggested Assessments Suggested Resources Create a Personal Spending Plan Product Warranty Comparison Project Consumer Protection Webquest Project Portfolio Unit Test Knowledge Matters Personal Finance Simulation “Life In...United States – A Family Finance Simulation”, Family Economics & Financial Education, September 2004 “Knowledge Matters – Personal Finance” Teachers Guide, 2008, Knowledge Matters, Florence, MA. “Personal Finance: A Lifetime Responsibility” by Dungan & Kimbrell, EMC Publishing, St Paul, MN, 2009. Student Textbook, Teachers Annotated Textbook, Math Skills Workbook (Student and Teacher’s versions),Student Activities Workbook (Student and Teacher’s versions) “Financial Literacy for Teens” by Chad Foster, Rising Books, Conyers, GA, 2004 "Buying the Basics Video Series (Includes all 3 videos)" Money Matters: Mastering Basic Money Management. Linx Educational Publishing, 2004. Suggested Tech Integration Content Vocabulary Knowledge Matters Personal Finance Simulation: Shopping Knowledge Matters Personal Finance Simulation: Finding an Apartment Knowledge Matters Personal Finance Simulation: Buying a Car Consumer Protection Webquest Microsoft Office Handheld and online financial calculators Consumers, comparison shopping, opportunity cost, brand, advertising agencies, marketing tactics, mass transit, commuter service, public transportation, Amtrak, Blue Book, preventative maintenance, MPG, depreciation, trade-ins, repossessed, VIN number, title, invoice price, sticker price, lemon laws, cosign, dormitory, multifamily housing, condomin8ium, manufactured homes, landlord, tenant, security deposit, housing subsidies, equity, mortgage, collateral, foreclosure, preapproval, fixed rate mortgage, adjustable rate mortgage (ARM), escrow account, liens, deed, organic foods, UPC code, national brands, house brands, generics, pack date, pull date, expiration date, unit pricing, caveat emptor, boycott, product standards, deregulation, fraud 17 Lifelong Learning/21st Century Skills Productive habits of mind Collaborate and co-operate Read critically for a variety of purposes Core Ethical Values Quality work Access and process information Communicate effectively 18 Credit and Debt Essential Understandings: 1. Consumer credit has become an important part of the American economy. 2. There are many advantages and disadvantages to using credit. 3. A person’s credit score is a reflection of their reliability in managing and paying back money Content Standards: Content Standards: Sources: National Standards in Personal Finance Education, The Jump$tart Coalition for Personal Financial Literacy, 919 18th Street, N.W. Suite 300 Washington, DC 20006, http://www.jumpstartcoalition.org/guide.html, retrieved April 3, 2009. 1. Take responsibility for personal financial decisions. 2. Find and evaluate financial information from a variety of sources. 3. Make financial decisions by systematically considering alternatives and consequences. 4. Develop communication strategies for Understanding financial issues. 5. Control personal information. 6. Identify sources of personal income. 7. Develop a plan for spending and saving. 8. Develop a system for keeping and using financial records. 9. Understand how to use different payment methods. 10. Apply consumer skills to purchase decisions. 11. Develop a personal financial plan 12. Identify the costs and benefits of various types of credit. 13. Understand the purpose of a credit record and identify borrowers' credit report rights. 14. Understand ways to avoid or correct debt problems. 15. Summarize major consumer credit laws. 13. Identify common types of risks and basic risk management methods. Essential Question: Why is managing personal credit and debt essential to successful financial management? Learning Goals: Students will: Understand the advantages and disadvantages of using credit Understand what can be done to avoid credit fraud and identity theft Understand current types of credit currently available Understand revolving credit accounts Identify good sources of loans Know four factors to be considered when figuring out the cost of credit 19 Understand credit card contracts vs. loan contracts Know four laws that protect the consumer in credit transactions Identify the warning signs of becoming overly indebted Understand actions to take to get debt under control Understand how a credit counselor assists people in solving their money problems Suggested Strategies Suggested Assessments Suggested Resources Suggested Tech Integration Content Vocabulary Compare Loan Sources and Costs Complete applications for credit cards, auto loans, personal loans, revolving credit Write a dispute letter to a creditor Unit Test Personal Portfolio Completed loan/credit applications Essay on how to establish and maintain a favorable credit rating Knowledge Matters Personal Finance Simulation “Life In...United States – A Family Finance Simulation”, Family Economics & Financial Education, September 2004 “Knowledge Matters – Personal Finance” Teachers Guide, 2008, Knowledge Matters, Florence, MA. “Personal Finance: A Lifetime Responsibility” by Dungan & Kimbrell, EMC Publishing, St Paul, MN, 2009. Student Textbook, Teachers Annotated Textbook, Math Skills Workbook (Student and Teacher’s versions),Student Activities Workbook (Student and Teacher’s versions) “Financial Literacy for Teens” by Chad Foster, Rising Books, Conyers, GA, 2004 DVD “Careful With Credit” Money Matters: Mastering Basic Money Management. Linx Educational Publishing, 2004. Knowledge Matters Personal Finance Simulation: Getting a Credit Card Knowledge Matters Personal Finance Simulation: Fixing Your Credit Handheld and online financial calculators Microsoft Office Grace period, universal default, bankruptcy, credit fraud, identity theft, creditors, installment credit, credit cards, annual percentage rate (APR), revolving account, secured loans, line of credit, loan consolidation, loan sharks, principal, finance charges, appraisal, origination fee, assets, liabilities, net worth, credit bureau, money order, credit counselors, debt management plan (DMP), garnishment 20 Lifelong Learning/21st Century Skills Productive habits of mind Collaborate and co-operate Read critically for a variety of purposes Core Ethical Values Quality work Access and process information Communicate effectively 21 Financial Risk Management Essential Understandings: 1. Insurance protects consumers financially from risks 2. Smart insurance choices are part of a successful financial plan Content Standards: Content Standards: Sources: National Standards in Personal Finance Education, The Jump$tart Coalition for Personal Financial Literacy, 919 18th Street, N.W. Suite 300 Washington, DC 20006, http://www.jumpstartcoalition.org/guide.html, retrieved April 3, 2009. 1. Take responsibility for personal financial decisions. 2. Find and evaluate financial information from a variety of sources. 3. Make financial decisions by systematically considering alternatives and consequences. 4. Develop communication strategies for Understanding financial issues. 5. Develop a plan for spending and saving. 6. Develop a system for keeping and using financial records. 7. Apply consumer skills to purchase decisions. 8. Develop a personal financial plan. 9. Examine the purpose and importance of a will. 10. Identify common types of risks and basic risk management methods. 11. Understand the purpose and importance of property and liability insurance protection. 12. Understand the purpose and importance of health, disability, and life insurance protection. 13. Investigate how agencies that regulate financial markets protect investors. Essential Question: Why are insurance products an important part of a healthy financial plan? Learning Goals: Students will: Understand the basic types of car insurance coverage Understand ways to control car insurance premiums Know steps to take in the event of an automobile accident Understand the four types of coverage found in a standard homeowner’s policy Understand the types of events covered under homeowners liability insurance Understand why renters need property insurance Know discounts available to policyholders Identify three situations that are considered “high risk” by insurance companies 22 Understand the types of health care coverage Understand how to get good insurance if it is not offered by the employer Understand managed care Understand what is covered under disability insurance Understand why a young person should consider life insurance Understand annuities Suggested Strategies Suggested Assessments Suggested Resources Guest Speaker from insurance industry Automobile Insurance Comparison Project Health Insurance Comparison Project Homeowners/Renters Insurance Comparison Project Knowledge Matters Personal Finance Simulation “Life In...United States – A Family Finance Simulation”, Family Economics & Financial Education, September 2004 “Knowledge Matters – Personal Finance” Teachers Guide, 2008, Knowledge Matters, Florence, MA. “Personal Finance: A Lifetime Responsibility” by Dungan & Kimbrell, EMC Publishing, St Paul, MN, 2009. Student Textbook, Teachers Annotated Textbook, Math Skills Workbook (Student and Teacher’s versions) ,Student Activities Workbook (Student and Teacher’s versions) “Financial Literacy for Teens” by Chad Foster, Rising Books, Conyers, GA, 2004 “Introduction to Insurance Forms” INTERNAL TRAINING SERVICES, LLC, Media, PA Suggested Tech Integration Content Vocabulary Knowledge Matters Personal Finance Simulation Handheld and online financial calculators Microsoft Office Liability, bodily injury, property damage, collision, deductible, comprehensive, medical payments, personal injury protection (PIP), endorsement exclusions, premium, structural damage coverage, personal property coverage, replacement cost coverage, Fair Access to Insurance Requirements (FAIR) Plan, coinsurance, co-pay, COBRA, Medicare, Medicaid, managed care, health savings account (HSA), flexible spending account, disability insurance, beneficiary, term life insurance, whole life insurance, annuity, 23 Lifelong Learning/21st Century Skills Productive habits of mind Collaborate and co-operate Read critically for a variety of purposes Core Ethical Values Quality work Access and process information Communicate effectively 24