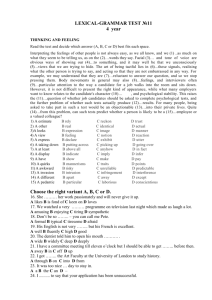

HN Accounting

advertisement

HN Accounting

Illustration of marking under the new guidelines

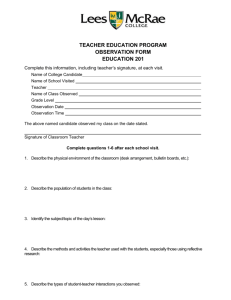

The following is a reproduction of a real candidate script for Outcome 1 of DE5C 34 Preparing

Final Accounts submitted in session 2009–2010. This has been marked using the new

guidelines to illustrate a possible approach to marking.

Below is an extract from the Unit specification for F7JT 34 Preparing Final Accounts detailing

the requirements of this particular task, with the error tolerance section highlighted.

Outcome 1

Prepare final accounts for business organisations

Knowledge and/or Skills

Business organisations

Profit and loss accounts

Balance sheets

Adjustments to the final accounts

Evidence Requirements

Candidates will need to provide evidence to demonstrate their Knowledge and/or Skills by

showing that they can:

Prepare a profit and loss account and balance sheet, from a year end trial balance, for either

a partnership or limited company operating as a trader or manufacturer.

Incorporate a minimum of eight different year end adjustments (appropriate to the type of

business) into the accounts, from the following: straight line depreciation, reducing balance

depreciation, bad debts, allowance for bad debts, accruals, prepayments, closing stock,

dividends, debenture interest, corporation tax, transfer to reserve, drawings, interest on

capital, interest on drawings, partnership salaries.

The evidence should be generated under supervised conditions with access restricted to a pro

forma layout for the relevant set of final accounts only.

The figures must be accurate within a tolerance of three arithmetic or

computational errors with a maximum of three errors of principle.

Assessment Guidelines

It is recommended that the assessment of this Outcome be completed within one and a half

hours. The assessment should be presented as a trial balance, with a minimum of eight year

end adjustments, for either a partnership or limited company (for internal use) operating as

either a trader or manufacturer. From this information candidates should prepare a profit and

loss account and balance sheet.

It is strongly recommended that a different type of business organisation be used each time the

Outcome is assessed.

July 2010

1

Below is a transcript of a candidate’s submission for Outcome 1 of DE5C 34 Preparing Final

Accounts which was presented in a college in Scotland during the academic session 2009–2010

by an HNC Accounting candidate. The assessment question will be largely familiar to centres as

it is the assessment exemplar question for DE5C 34.

Trading Profit and Loss Account of Morvern Enterprises plc

for the year ended 31 March 20X9

£000s

Turnover {Sales}

Less Cost of sales

Opening stock

+ purchases

- closing stock

GROSS PROFIT

£000s

3,900

280

1,920

2,200

300

Add any Income

Investment income

Administration costs

+ accrued

Directors salary

+ accrued

Debenture interest due

Hire of machinery

+ accrued EP#1

Depreciation: Plant

Motors

Increase in bad debt

Bad debts

£000s

1,900

2,000

144

2,144

840

3

46

4

18

2

EP#2

Profit on disposal of

discontinued operation

843

50

16

20

40

9

12

3

939 AE#1

1,209

Retained profit b/f

Net Profit before tax

Less corporation tax

Net profit after tax

120

1,329

364

1,693

104

1,589

Appropriations:

Ordinary dividend proposed

Preferential dividend proposed

General reserve

Retained profit

120

8

400

2,117 AE#2

July 2010

2

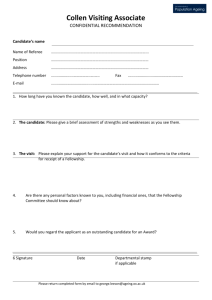

Balance Sheet of Morvern Enterprises plc as at 31 March 20X9

FIXED ASSETS

Motor vehicles

Plant

£000s

£000s

£000s

48

800

848

12

320

332

36]

480]

516

Fixed asset investment

Good will

Short term investment

1,400

320

300

CURRENT ASSETS

Stock

Debtors (- provision for bad debt)

Bank

Prepayment (machine hire)

Less Current Liabilities

Creditors

Debenture interest

Accruals

Corporation tax

EP#3

300

928 EP#4

30

2 EP#5 possibly

1,310

622

16

7

104

749

561

3,097

EP#6

Financed by:

Ordinary share capital @ £1 each

Preference shares

Reserves

Retained profit

General Reserve

8% Debentures

July 2010

Authorised Issued

1,200

1,200

100

100

2,117

400

200

4,017

3

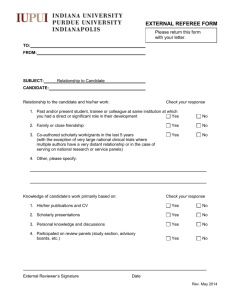

Workings:

Depreciation

Plant 5% x 800 = 40 {P}

Motor Vehicles - 25% reducing balance

MV @ cost = 48

Accum depn 12

NBV

36

25% of NBV

9 {P}

Doubtful Debts

Old provision 10

New provision 12 {P & CA} – less from debtors

Debenture interest

8% = 0.08 x 200

= 16 {P & CL}

July 2010

4

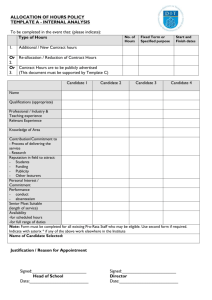

Making an assessment decision

The candidate script above illustrates one approach to marking under the new guidelines. At

each error the assessor identifies if the error is one of arithmetic (denoted AE and a number) or

one of principle (denoted EP and a number). This allows the assessor to continue to mark the

submission and keep track of the errors all the way through. The candidate can then review

his/her performance on the basis of the assessor having identified areas of weakness as has

always been the case. There are clear guidelines in the Unit specifications for candidates to

identify the threshold for their performance.

Consequential marking will still apply, as always, which is why in the Balance Sheet the

incorrect calculation of the depreciation for the second category of assets was not error of

principle number four, it was classed as the same error.

In the same vain, the error in the current assets section of the balance sheet (EP#5) where the

candidate identified correctly that the hire of machinery included a prepayment, this would not

have been an error of principle had he/she treated this figure as a prepayment in the profit and

loss account.

Consistency of approach where candidates have treated a figure incorrectly but consistently, ie

had the candidate included this figure in the current liabilities, he/she would not have had this as

an error as it follows on logically from a previous calculation, it would be marked as correct

consequentially.

He/she has treated the hire of machinery as an accrual in the P&L so it follows that this figure

should be included as a current liability. The candidate here included the figure as a current

asset, albeit correctly identifying it from the question, but not treating the figure consistently in

his/her submission, having treated it as an accrual in the profit and loss account.

For this candidate, re-assessment is required. He/she has exceeded the acceptable error

tolerance level for errors of principle. Re-assessment should be given for the entire task

following the guidelines for the task as noted in the Unit specification. In order to facilitate this,

the entire paper must be marked not just up to the point where the error tolerance for the task is

reached. This will allow the candidate to address ALL of the areas of weakness not just those

which occur in part of the submission, thus avoiding the need for further remediation.

July 2010

5