Answers to Assignment 4

advertisement

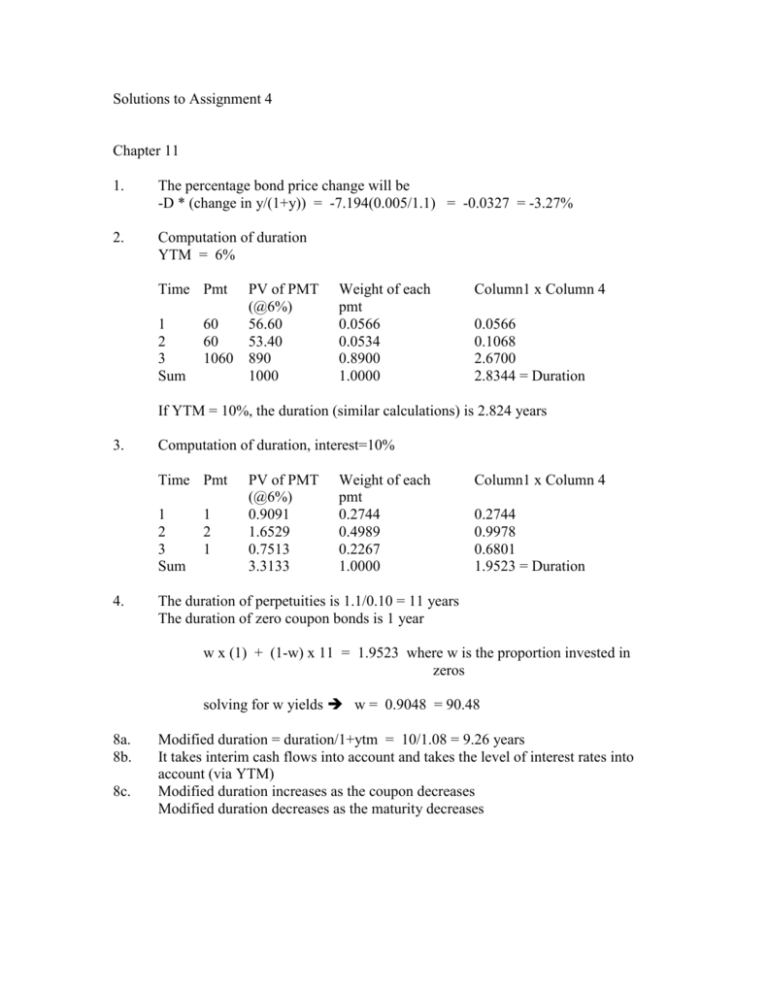

Solutions to Assignment 4 Chapter 11 1. The percentage bond price change will be -D * (change in y/(1+y)) = -7.194(0.005/1.1) = -0.0327 = -3.27% 2. Computation of duration YTM = 6% Time Pmt 1 2 3 Sum 60 60 1060 PV of PMT (@6%) 56.60 53.40 890 1000 Weight of each pmt 0.0566 0.0534 0.8900 1.0000 Column1 x Column 4 0.0566 0.1068 2.6700 2.8344 = Duration If YTM = 10%, the duration (similar calculations) is 2.824 years 3. Computation of duration, interest=10% Time Pmt 1 2 3 Sum 4. 1 2 1 PV of PMT (@6%) 0.9091 1.6529 0.7513 3.3133 Weight of each pmt 0.2744 0.4989 0.2267 1.0000 Column1 x Column 4 0.2744 0.9978 0.6801 1.9523 = Duration The duration of perpetuities is 1.1/0.10 = 11 years The duration of zero coupon bonds is 1 year w x (1) + (1-w) x 11 = 1.9523 where w is the proportion invested in zeros solving for w yields w = 0.9048 = 90.48 8a. 8b. 8c. Modified duration = duration/1+ytm = 10/1.08 = 9.26 years It takes interim cash flows into account and takes the level of interest rates into account (via YTM) Modified duration increases as the coupon decreases Modified duration decreases as the maturity decreases 11a. Duration of perpetuity = 1.05/0.05 = 21 years Duration of zeros = 5 years (w)(5) + (1-w)(21) =10 where w is the proportion invested in zeros solving for w yields w=0.6875 = 68.75% in zeros 11b. One year later: Duration of target = 9 years; duration of zeros =4 and duration of perpetuity =21 Solving for w (as above) : w= 0.7059 = 70.59% in zeros 13. The higher duration of the longer term bonds magnifies their sensitivity to interest rates changes. Thus while it can be true that rates of short-term bonds are more volatile, but the prices of long term bonds are more volatile. 14a. Scenario I: strong economic recovery with rising inflationary expectations. Interest rates and bond yields will most likely rise, and the prices of both bonds will fall. The probability that the callable bond will be called declines, and it will behave more like the non-callable bond – notice that they have similar durations when priced to maturity. The slightly lower duration of callable bonds will result in somewhat better performance in the high interest rate scenario. Scenario II: economic recession with reduced inflation expectations. Interest rates and bond yields will most likely fall. The callable bond is likely to be called. The relevant duration calculation for the callable bond is now modified duration to call. Price appreciation is limited as indicated by the lower duration. The noncallable bond, on the other hand, continues to have the same modified duration and hence has greater price appreciation. 14b. If YTM on Bond B falls 75 basis points price change = -modified D x (change in y) = -6.80 x (-0.0075) = 5.1% 14c. The cash flows are uncertain due to the call feature. 20a. This swap could have been made if the investor anticipated a decline in long term interest rates and an increase in long term bond prices. The deeper discount, lower coupon bond would provide more opportunity for capital gains, greater call protection, and greater protection against declining reinvestment rates at a cost of only a modest drop in yield. 20b. This swap was probably done by an investor who believed the 24 basis point spread in yield between the two bonds was too narrow, and if it widened to a more normal level, either a capital gain would be experienced on the T-note or a capital loss would be avoided on the Phone bond or both. It could also have been done by an investor expected a decline in interest rates but who also wanted to maintain the high current coupon income and have the better call protection of the T-note 20c. This swap would have been made if the investor was bearish on the bond market. The zero coupon note would be extremely vulnerable to an increase in interest rates since the YTM is locked in. This is in contrast to the floating rate note where interest is adjusted by formula each six months to reflect the current return available. 20d. These two bonds are similar in most respects other than quality and yield. An investor who believed the yield spread between the Govt and A1 bonds was too narrow would have made the swap. 20e. ignore 28. The firm should enter a swap in which it pays a 7% fixed rate and receives LIBOR on $10 million of notional principal. Its total payments will be as follows: Interest payments on bond -(L +0.01) x 10 million Net cash flow from swap (-0.07+L) x 10 million Total 0.08 x 10 million The interest rate on the synthetic fixed rate loan is 8% Chapter 13 1. P = 2.1/0.11 = $19.09 2. c 5a. g = ROE x retention rate = 0.2 x 0.3 = 0.06 D1 = E1 x (1-retention rate) = 2 x (0.7) = 1.4 P = D1/(k-g) = 1.4/(0.12-0.06) = $23.33 P/E ratio = 23.22/2 = 11.67 5b. PVGO = P – (EPS/k) = 23.33 – (2/0.12) = 6.67 5c. if retention rate = 20%: g = 4%; D1 = 1.6 P = 1.6/(0.12-0.04) = $20 P/E = 10 PVGO = $3.33 9a. k = 0.06 + 1.25(0.14-0.06) = 0.16 = 16% g = 2/3 x 0.09 = 6% D1 = E0(1+g)(1-retention rate) = 3(1.06)(1/3) = 1.06 P = 1.06/(0.16-0.06) = $10.60 9b. Leading P/E = 10.60/3.18 = 3.33 Trailing P/E = 10.6/3 = 3.53 9c. PVGO = -8.15 The low P/E and negative PVGO is due to poor performance. ROE is 9% compared to the market cap rate of 16% 9d. The intrinsic value is $15.85. The value will increase because the firm will pay out more of its earnings rather than reinvesting them at a poor ROE. 11a. P = 8/(0.1-0.05) = $160 11b. Earnings = $12 per share;dividends = $8 so the dividend payout ratio =8/12 = 2/3 g = ROE x retention rate 0.05 = ROE x (1/3) solving for ROE yields 0.15 or 15% 11c. The price assuming that ROE = k is $120. Therefore the market is paying $40 for growth opportunities 14a. k= 0.04 + 1.15(0.1-0.04) = 0.109 = 10.9% 14b. Using the growth rate of 25%, we can get dividends for years 1-5 D1 = 0.287 (given) D2 = 0.287 x 1.25 = 0.359 2 D3 = 0.287 x (1.25) =0.449 D4 = 0.287 x (1.25)3 =0.562 D5 = 0.287 x (1.25)4 =0.702 After year 5, the growth is constant 9.3% so we can use the following equation to estimate the P5 (price in year 5) P5 = D6/(k-g) = (0.702 x 1.093)/(0.109-0.093) = 0.767/0.016 = 47.9375 Then calculate the present value of dividends D1-D5 and P5 at the required rate of return of 10.9% Price today = $30.247 14c. With these new assumptions, Disney stock has an intrinsic value below its market price. This analysis indicates a sell recommendation. Even though Disney’s 5year growth increases, so does its beta and risk premium. 16. Dividend payout ratio Growth rates Intrinsic value A 0.50 0.07 $33.33 B 0.606 0.04728 $18.97 Buy stock A since the intrinsic value is higher than the market price. 18a. Stock market return = bond yield + risk prem of stocks over bonds = 0.09 + 0.05 = 0.14 18b. ROE = EPS/estimate book value = 4.25/25 = 0.17 = 17% Dividend payout = 0.40/4.25 = 0.094 g= ROE x (1-0.094) = 0.154 = 15.4% Implied total return = dividend yield + g 0.40/53 + 0.154 = 0.162 = 16.2% 18c. Required rate of return = 14.7% (using CAPM) 18d. Good investment since the implied total return is greater than the required rate of return. Chapter 14. 1. ROA = return on sales x asset turnover . so the only way Crusty Pie can have an ROS higher than the industry average and an ROA equal to the industry average is for its ATO to be lower than the industry average. 3. ROE = (1-tax rate)((ROA + (ROA-interest rate)((D/E)) The differences can be due to different interest rates and different debt ratios 7. ROE = 18.3% (profit margin x asset turnover x 1/equity asset ratio) (0.055 x 2 x 1/0.6) 11a. ROA =EBIT/Assets = (Net income before tax + interest expense)/avg assets = (64.8+19.8)/[0.5(544.2+628)] = 0.144 = 14.4% 11b. EPS = (net income –pref dividends)/(number of shares outstanding) pref dividends = 0.08 x 25 x 600,000 = 1.2 million so EPS = $18.73 (use the average number of shares outstanding) 11c. Acid test ratio = (cash + commercial paper + receivables)/current liabs = (6.6 + 15 + 93.2)/224.4 = 0.51 11d. Interest coverage ratio = eBIT/int expense = (64.8+19.8)/19.8 = 4.3 11e. Receivables collection period = average receivables/sales x 365 = (0.5(77+93.2)/1207.6) x 365 = 25.7 days 11f. Leverage ratio = average assets/average common equity Common equity (1997 ) = 30 + 27 + 58.8 = 115.8 Common equity(1996) = 26.8 + 26.4 + 51 = 104.2 Leverage ratio = [0.5(544.2+628)] / [0.5(104.2+115.8)] = 5.33 20. c