Acct 6331

advertisement

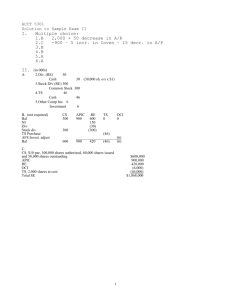

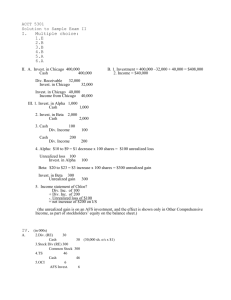

ACCT 5301 Solution to Sample Exam II I. Multiple choice: 1.B 2,000 + 50 decrease in A/R 2.C -900 – 5 incr. in Inven – 15 decr. in A/P 3.B 4.B 5.A 6.A II. (in 000s) A. 2.Div. (RE) 30 Cash 30 (30,000 sh. o/s x $1) 3.Stock Div (RE) 300 Common Stock 300 4.TS 46 Cash 46 5.Translation Adj 6 Other Comp Inc. 6 B. Bal NI Div Stock div TS Purchase Translation adjust Bal CS 300 APIC 900 300 RE 600 150 (30) (300) TS 0 OCI 0 (46) 600 900 420 (46) C. CS, $10 par, 100,000 shares authorized, 60,000 shares issued and 58,000 shares outstanding APIC RE OCI TS, 2,000 shares at cost Total SE (6) (6) $600,000 900,000 420,000 (6,000) (46,000) $1,868,000 III. Pensions A. Pension expense: Service cost $ 30,000 Interest cost 20,000 Expected return -18,000 Amortization of PSC 2,000 Amortization of gain - 750 Total pension expense $ 33,250 B. C. Journal entry for 2008: Pension expense 33,250 Pension A/L (plug) Cash Adjustment to OCI and Pension A/L OCI 38,750 Pension A/L 13,250 20,000 for 2008 38,750 (see below) Pension A/L 25,000 13,250 Entry B 38,750 Entry C (to get to Liab. balance) ====== 27,000 Balance in OCI? Liab.: Beginning: Beginning: Change: Balance: + - 285,000 - 258,000 20,000 decrease (cost) 30,000 increase (benefit) 38,750 decrease (entry C) 28,750 Balance in Pension A/L: $27,000 Liability IV. Leases A. Capital Lease A. PV of MLP = PV of Rent + PV of BPO Factors for PV: n = 5, i = 6% PVOA Adj.*to adjust to annuity due PVAD = 5,000 (4.21236)(1.06) = $22,326 PV1 PV1 = 1,000 (.74726) = Total present value = B. 1. 2. 3. 747 $23,073 Equipment 23,073 Lease Liability 23,073 Lease Liability Cash 5,000 Interest expense Lease liability Cash 1,084 3,916 5,000 18,073 x .06 plug 5,000 Depreciation expense 2,884 Accumulated Depr. 2,884 (Calc: (23,073 - 0)/8 = 2,884) B. Operating lease PV,6% n=1 43 x .9434 n=2 28 x .89 n=3 22 x .83962 n=4 18 x .79209 n=5 16 x .74726 *n=6 16 x .70496 *n=7 16 x .66506 Total = $ 40.56 = 24.92 = 18.47 = 14.26 = 11.96 = 11.28 = 10.64 $ 132.8 million *since approx. 2 payments at $16 each, just do 2 more PV1 calculations. Alt: PVOA of 2 pmts back to time 0: 2 pmts back to time 0 16(PVOA, 6%, 2)(PV1, 6%,5) = 16 x (1.83339) x (.74726) = $21.92 V. Essays 1. Capital Leases versus Operating Leases Capital leases meet FASB’s 4 criteria for the recognition of the lease as the purchase of an asset with a liability. Operating leases do not have to be capitalized, and the only thing that shows in the financials regarding the lease is the periodic lease expense as the lease payments are made. Companies prefer operating leases because they do not have to show any liability on the books, even for long-term noncancelable leases. This is called “off balance sheet financing” because the company finances the purchase of an asset without showing any of the liability (or any of the asset). This off balance sheet financing helps the company’s debt to equity ratio, and keeps the company from violating debt covenants, and from possibly having the loan called in (repaid before the due date). 2. In SFAS 87, FASB allowed smoothing of the following amounts: Prior Service Costs Unrecognized Net/Gain or loss Transition amount These items were allowed to be recogized in pension expense and pension liability in small pieces, through amortization over many years. SFAS 158 maintained the smoothing on the income statement, but now requires immediate recognition in the Pension Asset/Liability account, with the offset to Other Comprehensive Income in the Statement of Stockholders’ Equity account. Now the balance sheet reflects full liability or asset, but the income statement still only recognizes part of the total cost of the pension plan. 3.Compensation Expense for Employee Stock Options. Stock options are given to employees to encourage employees to work toward increasing the value of the company (making their options more valuable at exercise). The debate over recognition stems from the form of the compensation (eventual shares of stock rather than cash). Pro: If the company issued shares of stock for cash, then distributed the cash to employees, then the cash bonus would definitely qualify as compensation expense to the company, very similar to the traditional salary payments. The company is giving the employee something of value (the option to buy shares of stock), and the fair value of that instrument represents a non-cash form of compensation to the employee, and should be recorded as compensation expense over the life of the option vesting period. Con: Regarding stock options, the employees are working, contributing “sweat equity”, to become owners of the company, and owners of the company do not receive salaries; they receive equity distributions through stock price increases and dividends. The company never recognizes any expense from these equity value changes. Additionally, this is not traditional compensation, as the stock options may be “under water”, where the market price is lower than the exercise price, and not worth exercising. Compensation expense for stock options (and for restricted stock as well) does not meet the definition of an expense (decrease in net assets used to generate revenues), because the recognition of compensation expense is entirely an equity transaction: Compensation Expense APIC-Stock Options xx xx (equity) (equity) No assets or liabilities are affected, and it can be argued that the pure equity transaction is equivalent to the potential owner contributing his/her time (sweat equity), rather than cash, to become an owner. When issuing stock for cash, no expense is involved. VI. Statement of Cash Flows (analysis in red) Given the following income statement and comparative balance sheets for North (all amounts are in thousands). Note that earliest year is presented first. Cash Accounts receivable Inventory Land Equip Less: Accumulated depr. Investment. Total assets Comparative Balance Sheets 12/31/06 12/31/07 $ 15 -6 $ 9 17 23 +6 SUBTRACT(OP) 7 14 +7 SUBTRACT (OP) 38 28 50 73 ( 18) ( 24) 37 37 $ 146 $ 160 Accounts payable Unearned Revenues Notes payable (long-term) Bonds payable (long-term) Add: Premium Common stock Retained earnings Total Liab. & Eq. Income Statement for 2006 Sales revenue Service revenue Gain on sale of land Cost of goods sold Depreciation expense - equipment Interest expense Other operating expenses (all cash) Income tax expense Net income $ 13 7 18 50 8 34 16 146 $ 15 +2 ADD (OP) 5 10 50 5 –3 OP 55 20 160 $ 120 30 3 –3 OP (82) ( 6)+6 OP ( 6) (11) (13) $ 35 TOP LINE OP Additional information for 2006: FOR INVESTING AND FINANCING 1. The only activities in retained earnings were for income and dividends. BRE + NI – DIV = ERE 16+35-DIV=20 DIV=31 –31 FINANCING 2. A building was purchased for $8 cash. –8 INVEST 3. Equip. was purchased with a N/P of $15. SUPP SCHEDULE 4. Land with a cost of $10 was sold at a gain of $3 . +13 INVEST 5. Payment made on N/P for $23. –23 FINANCING 6. The change in common stock was due to the issue of stock for cash. +21 FIN Required: On the next page, prepare the Statement of Cash Flows, including Indirect method fo Operating Section. Cash Flow from Operating Activity Net Income Add Depreciation Subtract Premium amort. Subtract gain Less increase in A/R Less increase in Inventory Add increase in A/Pay Less decrease in U. Rev $35 6 (3) (3) ( 6) (7) 2 (2) Net cash from operating activity $ 22 Cash Flow from Investing Activity Cash paid for equip Cash received from land $(8) 13 Net cash from investing 5 Cash Flow from Financing Activity Cash paid for dividends Cash paid on N/P Cash received from stock $ (31) (23) 21 Net cash used for financing (33) Net decrease in cash $(6) (Confirm: cash from $15 to $9) ________________________________________________ Supplementary schedule of non-cash activities: Equip purchased with N/P $15 Part 2: Operating section using direct method Sales revenue Service income Gain on sale of land COGS Depr exp Other Interest exp Income tax expense Cash from operations $120 30 3 -82 -6 -11 - 6 -13 - 6 = $ -2 = - 3 = -7 +2 = +6 = -3 = = 114 28 0 (87) 0 (11) ( 9) adjust out prem. amort (13) $22 (same as indirect method)