Determining Pension Expense

advertisement

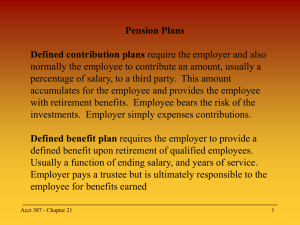

Chapter 17 Pensions and Other Postretirement Benefits DETERMINING PENSION EXPENSE COMPONENTS OF PENSION EXPENSE 1. Service Cost Service cost reflects in increase in the PBO as a result of employee service during the current year. 2. Interest Cost Interest accrued on the beginning PBO for the current year. 3. Return on Plan Assets Expected return on plan assets for the current year. The difference between the actual return and expected return in included in the calculation of deferred net loss or net gain. 4. Amortization of Prior Service Cost Prior service cost results from retroactive credit for prior service when plan is adopted or amended. The increase is cost is amortized over the future service period of the employees affected, normally the average remaining service life of the active employees. 5. Amortization of Deferred Net Loss or Net Gain Increases or decreases in PBO as a result of change in underlying assumptions and the difference between actual and expected return on plan assets. Amortization is only recorded if the net loss or net gain at the beginning of the year exceeds the greater of 1) 10% of the PBO, or 2) 10% of plan assets. This excess amount is amortization over the remaining service period of the active employees. Recording the Periodic Expense and Periodic Funding Pension expense is calculated based on accounting estimates and assumptions as described above. Cash contributions to the pension plan asset trust fund are determined by an actuary with the objective of providing funding for the future obligations. The difference between pension expense and cash contributions are recorded as prepaid pension cost (if a debit) or accrued pension cost (if a credit). Example: The following information is available for the pension plan of Spencer Company for the year 2003: Actual and expected return on plan assets Benefits paid to retirees Contributions to fund Interest/discount rate Prior service cost amortization Projected benefit obligation, January 1, 2003 Service cost $12,000 40,000 95,000 0 8,000 500,000 60,000 Pension expense for 2003 will be computed as follows: F:\course\ACCT3322\200720\module3\c17\tnotes\c17c.doc 11/10/2006 1 Chapter 17 Pensions and Other Postretirement Benefits Pension Expense for 2003 Service cost Interest cost Expected (actual) return on plan assets Amortization of prior service cost Total $60,000 50,000 (12,000) 8,000 $106,000 The journal entry to record pension expense for the year will be: Account Debit $106,000 Credit Pension expense Cash $95,000 Prepaid (accrued) pension cost 11,000 To record pension expense, pension contribution and accrued penstion cost for the year ended December 31, 2003. F:\course\ACCT3322\200720\module3\c17\tnotes\c17c.doc 11/10/2006 2