Leasing

advertisement

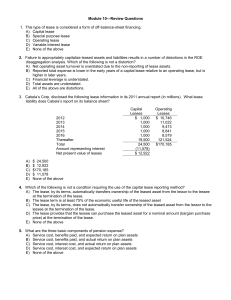

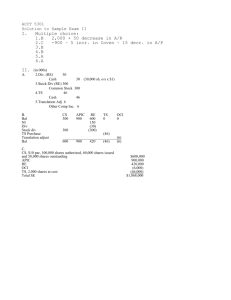

Module 10 Reporting and Analyzing Off-Balance Sheet Financing: Leases Pensions Off-Balance Sheet Financing Off-balance sheet financing means that either assets or liabilities, or both, are not reported on the face of the balance sheet. Companies try to make their companies look better to the markets with window dressing: “unreal” higher returns and lower risk. Empirical evidence suggests that analysts adjust balance sheets to include assets and liabilities that managers exclude. Leasing A lease is a contract between the owner of an asset (the lessor) and the party desiring to use that asset (the lessee). Generally, leases provide for the following terms: 1. Lessee uses asset over lease term. 2. Lessee pays rent and upkeeps the asset. 3. Lessor keeps title and retakes asset at the lease term. Capital vs. Operating Leases GAAP identifies for two different approaches in the reporting of leases by the lessee: Capital lease method – In essence a purchase: Either title transfers at end of lease or bargain purchase available or >75% of economic life or PV of rents are >90% of purchase price. both the leased asset and the lease liability are reported on the balance sheet--results in depreciation and interest expenses. Operating lease method – not a capital lease. The rent expense is the payment. Operating vs. Capital Leases For the lessee: 1. The lease asset is not reported on the balance sheet – return on net operating assets (RNOA) is higher. 2. The lease liability is not recorded– FLEV is lower. 3. For ROE: operating returns are higher and non-operating returns are lower: company appears more stable, less risky. 4. During the early years of the lease term, rent expense reported for an operating lease is lower than the depreciation plus interest expense reported for a capital lease. This means that net income is higher in those early years with an operating lease: ROE & EPS are overstated. Capitalizing Operating Leases for Analysis Purposes 1. 2. 3. Determine the discount rate. Compute the present value of future operating lease payments. Adjust the financials to include the present value of the lease asset and lease liability. Capitalization of Delta’s Operating Leases on the Balance Sheet Adjustments to the Income Statement Remove rent expense from operating expense. Add depreciation expense from the lease assets to operating expense and add interest expense from the lease obligation as a nonoperating expense. Capitalization of Delta’s’ Operating Leases Pensions Generally two types of plans: Defined contribution plan. Typically defines the contribution as a % of employee salary with both employer and employee paying in. Example: 6.5% of salary paid by both employer and employee with the funds held by an external company, typically an insurance company. Defined benefit plan. This plan has the company make periodic payments to an employee after retirement: Typically a % of ending salary times # of years worked. Example, 2.25% * 30 years * $50,000 = $33,750 per year. Accounting for Defined Contribution Plans From an accounting standpoint, defined contribution plans offer no problems. The company’s contribution is recorded as an expense in the income statement when paid or accrued. Two Accounting Issues Related to Defined Benefit Plans The appropriate balance sheet presentation of the pension investments and obligation. 1. Companies report the net pension liability on their balance sheet. Underfunded plans are reported on the balance sheet as a longterm liability. Overfunded plans are reported as a long-term asset. The treatment of fluctuations in pension investments and obligations in the income statement. 2. The FASB allows companies to report pension income based on expected long-term returns on pension investments (rather than actual investment returns), and to defer the recognition of unrealized gains and losses on both pension investments and pension obligations. Plan Assets and PBO Computations Balance Sheet Presentation PBO Components Service cost – the increase in the pension obligation due to employees working another year for the employer. Interest cost – the increase in the pension obligation due to the accrual of an additional year of interest. Benefits paid to employees – the company’s obligation is reduced as benefits are paid to employees. Pension Expense Global Accounting Leases - IFRS lease standards currently allow for operating leases, but the standards are such that it is very difficult for a lease agreement to qualify as an operating lease. Pensions - U.S. GAAP permits deferral of actuarial gains and losses and then amortizes them to net income over time. IFRS companies can recognize all actuarial gains and losses in comprehensive income in the year they occur.