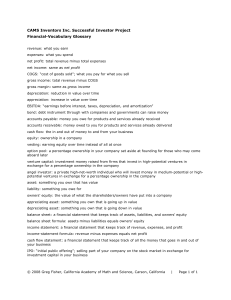

full-summary-be322

advertisement