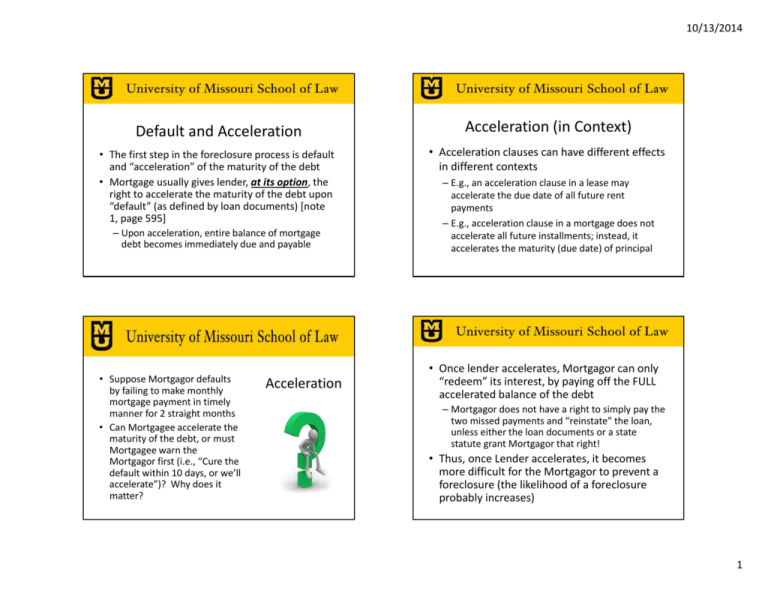

Default and Acceleration Acceleration (in Context)

advertisement

10/13/2014 Default and Acceleration Acceleration (in Context) • The first step in the foreclosure process is default and “acceleration” of the maturity of the debt • Mortgage usually gives lender, at its option, the right to accelerate the maturity of the debt upon “default” (as defined by loan documents) [note 1, page 595] • Acceleration clauses can have different effects in different contexts – Upon acceleration, entire balance of mortgage debt becomes immediately due and payable • Suppose Mortgagor defaults by failing to make monthly mortgage payment in timely manner for 2 straight months • Can Mortgagee accelerate the maturity of the debt, or must Mortgagee warn the Mortgagor first (i.e., “Cure the default within 10 days, or we’ll accelerate”)? Why does it matter? Acceleration – E.g., an acceleration clause in a lease may accelerate the due date of all future rent payments – E.g., acceleration clause in a mortgage does not accelerate all future installments; instead, it accelerates the maturity (due date) of principal • Once lender accelerates, Mortgagor can only “redeem” its interest, by paying off the FULL accelerated balance of the debt – Mortgagor does not have a right to simply pay the two missed payments and “reinstate” the loan, unless either the loan documents or a state statute grant Mortgagor that right! • Thus, once Lender accelerates, it becomes more difficult for the Mortgagor to prevent a foreclosure (the likelihood of a foreclosure probably increases) 1 10/13/2014 Graf v. Hope Building Corp. Acceleration • HBC owned land on which Graf held mortgage • Common law: After default, Mortgagee need not give Mortgagor notice, or a right to cure, prior to acceleration, unless a state statute or the loan documents so require – Mortgagor is deemed to be know when he/she is supposed to perform • Compare Fannie/Freddie single‐family DOT [¶ 22, p. 1259] – Under ¶ 22, Mortgagee agrees to give Mortgagor notice and a 30‐day cure period, as a precondition to Mortgagee’s acceleration of the maturity of the debt • Is Graf’s conduct here sensible? Why wouldn’t/shouldn’t Graf accept HBC’s tender of the missed payments and reinstate the mortgage loan? • Should the court treat Graf’s decision to accelerate the loan, and foreclose on the property, as unconscionable (and impermissible) on these facts? • Why was this a 4‐3 case? Questions – Interest‐only payments, with principal due in “balloon” payment on January 1, 1935 – Mortgage: entire balance can be accelerated if default in payment continues uncured for 20 days • July 1927 payment was too low (math error) – Graf: “we’ll correct it as soon as our president returns from Europe,” but that didn’t happen • When 20 days ran out, Graf accelerated the debt, w/out further notice, began foreclosure • HBC tendered the late payments, and asked to reinstate the loan, but Graf refused • Common law: After a proper acceleration, mortgagor cannot unilaterally “reinstate” the mortgage by making the missed payments, but can only “redeem” the land by paying the full accelerated balance • Unless the Mortgagee consents, Borrower can “reinstate” the mortgage only if: – State statute gives Borrower this right (e.g., CA statute, note 6, p. 599), or – Loan documents so provide (e.g., Fannie/Freddie single‐family form, p. 1252, ¶ 19 would allow reinstatement) 2 10/13/2014 • Graf majority: acceleration for untimely payment is not inherently unconscionable – Court will not intervene absent “fraud, bad faith, or unconscionable conduct” [Restatement § 8.1] • Comments to § 8.1 reinforce this view: – “important policy goal of predictability in mortgage remedies” [comment e] – want to avoid “difficult and time‐consuming judicial inquiries into such matters as the degree of mortgagor’s negligence, the relative hardship that acceleration imposes, and other subjective concerns” [comment e] • The real hardship in Graf is a function of the economic circumstances of the time – By 1930, the crash had begun – HBC could have reinstated and made its monthly payments going forward, but it couldn’t get refinancing to pay off the full accelerated balance • Graf is somewhat analogous to the current market for commercial real estate projects, but – Many current lenders are choosing NOT to start foreclose (“extend and pretend”) Acceleration and “Insecurity” • Sometimes, a mortgage note provides that the mortgagee can accelerate the maturity of debt “if mortgagee deems itself insecure” [p. 602] • Such provisions are called insecurity clauses – The exercise of an insecurity clause in any contract (e.g., a promissory note) is governed by U.C.C. § 1‐ 309 – Lender can accelerate under an insecurity clause only if lender “in good faith believes that the prospect of payment or performance is impaired” • By contrast, Graf is not an “insecurity” case; lender in Graf was accelerating based on “objective” default (untimely payment) Freddie Mac v. Taylor • Taylor (soldier on duty in the Philippines) had made 4 mortgage payments more than 20 days late (lender had accepted these late payments without objection) • He mailed his Sept. 1973 payment 28 days late – By time Lender received it, Oct. 1973 payment was past due, so Lender returned Sept. 1973 payment • Why did Lender do this? Would you have advised Lender to do this? 3 10/13/2014 • Courts have often held that waiver may prevent lender from accelerating even when the loan documents seem to permit it [note 5, page 597] – Classic example: lender accepts payments 10 days late, w/out objection, for 20 months in a row, then accelerates after the next late payment, w/out prior warning to borrower – Course of performance (late payment) = waiver of lender’s ability to demand timely performance in accordance with loan documents • Lender in Taylor was concerned that further acceptance of late payments would be viewed as a waiver of the right to insist on timely payment • Would you have advised the Lender in Taylor to return the Sept. 1973 payment to the Borrower? • If not, what could or should the Lender have done differently? Questions § 1‐303(a). A “course of performance” is a sequence of conduct between the parties to a particular transaction that exists if: (1) the agreement of the parties with respect to the transaction involves repeated occasions for performance by a party; and (2) the other party, with knowledge of the nature of the performance and opportunity for objection to it, accepts the performance or acquiesces in it without objection.... § 1‐303(d). A course of performance ... is relevant in ascertaining the meaning of the parties’ agreement, may give particular meaning to specific terms of the agreement, and may supplement or qualify the terms of the agreement. § 1‐303(f).... [A] course of performance is relevant to show a waiver or modification of any term inconsistent with the course of performance. • There’s almost never a good reason for a lender to return a payment that the borrower makes that is an unconditional payment – The risk of waiver is better addressed and managed by clear communication with the Borrower – E.g., if lender has already accelerated: “Our accepting this payment does not reinstate your mortgage, which is still in default.” – E.g., if lender has not already accelerated: “Our acceptance of this payment does not waive your obligation to make timely payments in the future.” 4 10/13/2014 “Conditional” Payment Freddie Mac v. Taylor • In this situation, however, Lender should reject and return any payment that the borrower makes that is “conditional” • Court held acceleration was unconscionable (thus, Taylor could reinstate by making the missed payments) • Is this consistent w/Graf and the Restatement? – E.g., Borrower tenders three missed payments by check on which memo line says “For reinstatement of Loan # 34918” – Lender’s acceptance of this check may well raise inference that Lender has agreed to reinstate the loan – Arguably so, b/c in Taylor, it was the Lender’s practices contributed to the confusion – By contrast, in Graf, there was no serious question about propriety of Lender’s conduct (it was harsh, but it was clear/unambiguous) 5