Anchoring on Credit Spreads

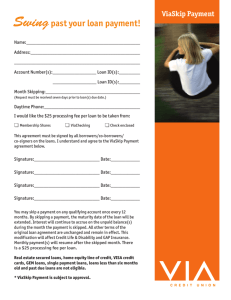

advertisement