IBM's Acquisition of Lotus Development Corp.

advertisement

IBM's Acquisition of Lotus Development Corp.1

On July 5, 1995, International Business Machines (IBM) announced its acquisition of Lotus

Development Corporation for a price of $3.2 billion ($2.9 billion in net cash). Lotus was a Cambridge,

MA-based company that developed, marketed and supported software products and services for

individuals and organizations. It had gained success with the release of its first product, Lotus 1-2-3, a

financial spreadsheet program. Also successful were such subsequent products as Open Messaging

Interface (a program that allowed users to send mail without leaving the program in which they were

currently working) and Notes (a "groupware" product designed to allow groups of remote users to

collaborate simultaneously).

At the time it was acquired by IBM, Lotus had numerous software technologies in various stages of

production and development. Current software products included those being produced and marketed

as of the acquisition date as well as products in development that had reached technological feasibility.

In-process research and development (R&D) included products in development that had not attained

technological feasibility as well as future follow-on products which did not exist at the acquisition date,

but were conceptual in nature and were expected to evolve into future product lines.

As shown in Exhibit 1, Lotus had less than $1 billion of identifiable tangible and intangible net assets

in 1995. Since IBM's acquisition was accounted for as a purchase, the difference between the acquisition

price and the market value of net assets gave rise to goodwill. However, IBM recognized substantially

less goodwill than one might have expected: it assigned $1.84 billion of the acquisition price to the value

of in-process R&D. Then, in accordance with generally accepted (but somewhat controversial)

accounting practices, IBM wrote off (expensed) this value immediately.

Why is this practice controversial? Exhibit 2 explains the rationale and requirements for writing off

in-process R&D. Exhibit 3 provides contrasting views on following this practice. Exhibit 4 illustrates the

methodology IBM used to value current products and in-process R&D acquired from Lotus (the

methodology is further described in Exhibit 2). IBM's financial statements and notes for 1995 appear in

Exhibit 5.

1

This case has been adapted from "Valuation of and Accounting for Purchased Research and

Development Technology: IBM's Acquisition of Lotus" by Prof. Jennifer Francis (Duke University). The

source case was prepared as the basis for class discussion and not to illustrate either effective or

ineffective handling of an administrative situation.

1

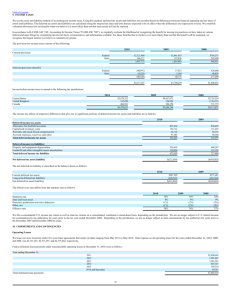

Exhibit 1

(Excerpt from IBM 10-K report for 1995)

Lotus Development Corporation

On July 5, 1995, the company acquired all outstanding shares of Lotus for approximately $3.2 billion

($2.9 billion in net cash).

The company engaged a nationally recognized, independent appraisal firm to express an opinion on the

fair market value of the assets acquired to serve as a basis for allocation of the purchase price to the

various classes of assets. The appraisal included both tangible and identifiable intangible assets, as well as

software technology. The company allocated the total purchase price as follows:

(DOLLARS IN MILLIONS)

Tangible net assets

Identifiable intangible assets

Current software products

Purchased in-process research and development

Goodwill

Deferred tax liabilities related to identifiable

intangible assets

Total

$

325

542

290

1,840

540

(291)

-------$ 3,246

The tangible net assets consisted primarily of cash, accounts receivable, land, buildings, leasehold

improvements and other personal property. The identifiable intangible assets consisted of trademarks

($369 million) and other items (including employee agreements and leasehold interests) totaling $173

million. The identifiable intangible assets and goodwill will be amortized on a straight-line basis over a

five-year period.

The software technology valuation was accomplished through the application of an income approach.

Projected debt-free income (revenue net of provision for operating expenses, income taxes and returns on

requisite assets) were discounted to a present value. This approach was used for each of the Lotus product

lines. Software technology was divided into two categories: current software products and in-process

research and development.

The fair market value of the purchased current software products was determined to be $290 million. This

amount was recorded as an asset and is being amortized on a straight-line basis over two years.

Purchased in-process research and development included the value of software products still in the

development stage and not considered to have reached the technological feasibility stage.

As a result of the valuation, the fair market value of the purchased in-process research and development

was determined to be $1,840 million. In accordance with applicable accounting rules, this amount was

expensed upon acquisition in the third quarter of 1995.

2

Exhibit 2

Accounting for Research and Development

FAS No. 2, “Accounting for Research and Development Costs,” requires that all R&D costs be expensed

in the period when they are incurred. This accounting treatment focuses on the degree of uncertainty

associated with the future benefits of individual R&D projects. This uncertainty causes R&D expenses

to fail the measurability test: it is not possible to recognize as an asset a resource whose future economic

benefits are neither identifiable nor objectively measurable.

FAS No. 86, “Accounting for the Costs of Computer Software…” provides a partial exception to the rule

of expensing all R&D costs as incurred. It permits the capitalization of costs incurred subsequent to

technological feasibility, but continues to require expensing of costs that precede technological feasibility.

FASB Interpretation No. 4 (FIN-4) provides additional guidance on R&D when accounting for

acquisitions. It specifies that costs of purchasing another firm should be assigned to all identifiable

tangible and intangible assets, including any that result from R&D activities of the acquired firm or are to

be used in the R&D activities of the combined enterprise. FIN-4 further states that costs of acquired

R&D should be charged to expense unless the test of alternative future use is met.

The disclosure in Exhibit 1 reveals that IBM used the Discounted Future Benefit approach to valuing the

in-process R&D acquired from Lotus. The method involves estimating the future monetary benefits

associated with an asset, and discounting those benefits to a present value using a discount rate that

reflects the riskiness of the stream of benefits. This approach is typically used to value income producing

real estate and many intangible assets. In these situations, future benefits are often measured in terms of

net-of-tax earnings, after allowing for a pre-determined return on the assets employed.

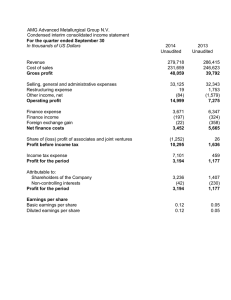

As illustrated in Exhibit 4,2 IBM computed for each acquired Lotus product the discounted value of the

projected future stream of revenue net of operating expenses, income taxes, and returns on related assets.

The company used a forecast horizon of ten years, with a terminal calculation for the perpetuity value of

the after-tax earnings of future follow-up products. Factors used to estimate product life expectancy

included the historical experience of prior versions of the software, plans with respect to releasing future

versions of the software, and industry norms. Lotus’ historical and projected experience of issuing new

product versions indicated that the typical product had an average life of two (2) to five (5) years.

2

All data in Exhibit 4 and the product descriptions associated with them are illustrative only. They

neither reflect actual technologies acquired by IBM from Lotus, nor represent actual data used. However,

for the purposes of this case, you should treat them as “real data” that are used internally and not publicly

disclosed.

Exhibit 4 shows the valuation of WordSpeak, a technology to convert oral communications into

editable (typed) documents. This technology was in the preliminary development state when IBM

acquired Lotus, and was not expected to be marketable until the year 2000. Introduction of WordSpeak

was expected to revolutionize word processing technology.

3

Exhibit 3

Comments on Writing-Off Acquired R&D

In the Sept. 97 Mergers & Acquisitions, Bryan Browning of Valuation Research Corp. wrote:

[I]t appears that some acquirers have been going to great lengths to maximize the cost allocated to R&D

and to minimize that ascribed to goodwill. The FASB and the SEC are concerned because excessive

R&D write-offs would result in low book values for companies' assets and in overstated returns on equity.

... So, for companies planning an acquisition in the near future, beware: A large allocation to R&D will

have to be supported by an expert, well-documented valuation.

In May, 1997, Elizabeth MacDonald of the Wall Street Journal wrote:

Jack Ciesielski, editor of the Analyst's Accounting Observer, a Baltimore publication for stock analysts,

warns, "Investors should be careful of subsequent earnings posted by acquirers using this rule, because

they are a bit jazzed." Gabrielle Napolitano, a securities analyst who follows accounting issues at

Goldman Sachs, holds a similar opinion: "Acquiring companies may be assigning too high a value to this

in-process R&D, distorting subsequent earnings." …

Ciesielski says the sheer size of some of the R&D write-downs indicates that some acquiring companies

are abusing the rules by including too much goodwill. But most companies don't release the details of the

calculations they use to arrive at the write-down amounts. …

Corporate Growth Report (Weekly) in July, 1995 quoted other “experts” as saying:

"It's like manna from heaven for a company's stock." (Robert Willens, accounting analyst at Lehman

Brothers). This is the reason [FIN-4] has been a boon for high-tech acquirers this year. IBM is a prime

example. At least $ 900 million of the $ 2.6 million in goodwill BM is generating in buying Lotus will be

assigned by IBM to R&D, and thus instantly deducted from profits instead of being amortized for years.

"Investors always like to get such big charges out of the way as soon as possible," says Douglas

Robinson, a senior vice president of Computer Associates. In prior years ('93 & '94), Novell expensed a

whopping 80% of its purchase price for Unix System Laboratories and 75% of its payment for the Quattro

Pro software line.

Exhibit 4

R&D Valuation: WordSpeak

($ millions)

Product Line:

Office Software

Product:

WordSpeak, version 1.0 and beyond

Revenues

Cost of Sales

Sales & Marketing

General & Admin.

R&D

Return on Assets

Pretax Income

Taxes

Aftertax Income

1995

0

0

0

0

0

0

0

0

0

1996

0

0

0

0

0

0

0

0

0

1997

0

0

0

0

50

0

-50

-20

-30

1998

0

0

0

0

135

0

-135

-54

-81

1999

0

0

0

0

300

0

-300

-120

-180

2000

1000

315

100

115

500

100

-130

-52

-78

2001

1800

500

180

200

600

265

55

22

33

2002

2300

600

225

250

600

400

225

90

135

2003

3800

975

320

360

1000

500

645

258

387

2004

4300

1040

450

330

1350

550

580

232

348

2005+

382.8

Assume that from 2005 onward, Aftertax Income is forecasted to grow in perpetuity (i.e., forever) at 8 % per year.

Hence, using a discount rate of 16%, the PV of the forecasted Aftertax Income stream for 2005 and beyond as of

12/31/2004 is $382.8/(.16 - .08) = $4,785.0 million.

4

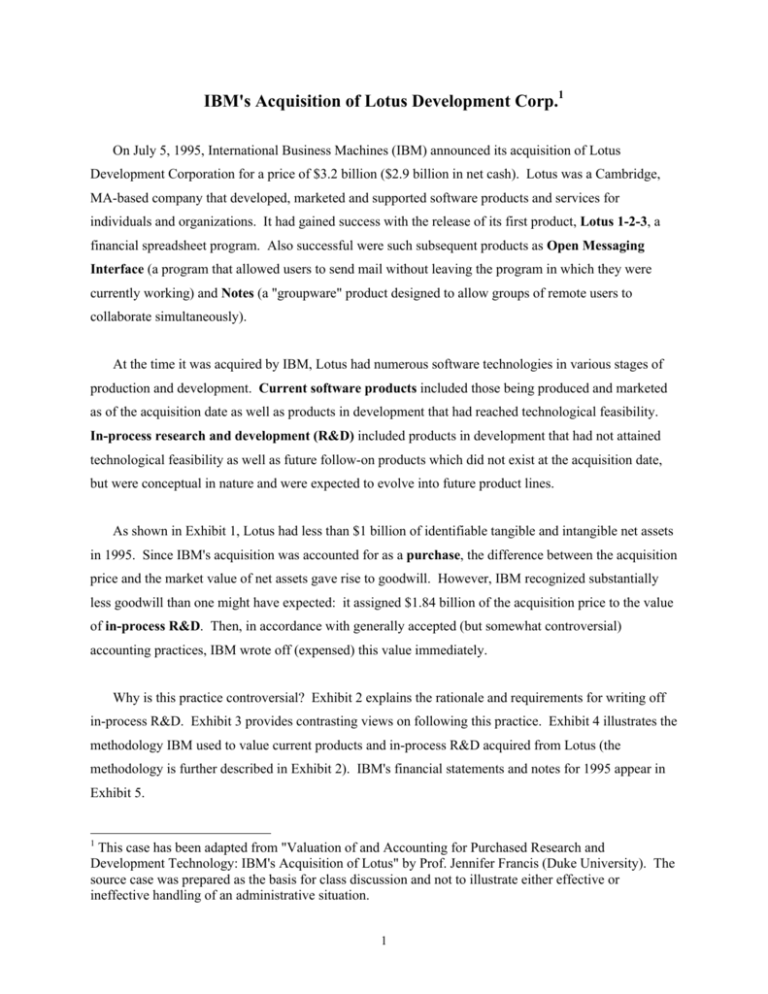

Exhibit 5: IBM Financial Statements for 1995

CONSOLIDATED STATEMENT OF OPERATIONS

International Business Machines Corporation and Subsidiary Companies

(DOLLARS IN MILLIONS EXCEPT PER SHARE AMOUNTS)

For the year ended December 31:

Revenue:

Hardware sales

Services

Software

Maintenance

Rentals and financing

Total revenue

Notes

1995

$

1994

1993

35,600

12,714

12,657

7,409

3,560

71,940

$ 32,344 $

9,715

11,346

7,222

3,425

64,052

30,591

9,711

10,953

7,295

4,166

62,716

21,862

10,042

4,428

3,651

1,590

41,573

30,367

21,300

7,769

4,680

3,635

1,384

38,768

25,284

20,696

8,279

4,310

3,545

1,738

38,568

24,148

16,766

6,010

22,776

15,916

4,363

20,279

18,282

5,558

8,945

32,785

947

725

1,377

1,227

1,113

1,273

Earnings (loss) before income taxes

7,813

5,155

(8,797)

Provision (benefit) for income taxes

H

Net earnings (loss) before change

in accounting principle

Effect of change in accounting principle

B

Net earnings (loss)

Preferred stock dividends and transaction costs

3,635

2,134

(810)

4,178

4,178

62

3,021

3,021

84

(7,987)

(114)

(8,101)

47

Cost:

Hardware sales

Services

Software

Maintenance

Rentals and financing

Total cost

Gross profit

Operating expenses:

Selling, general and administrative

Research, development and engineering

Restructuring charges

Total operating expenses

Operating income (loss)

7,591

I

J

5,005 (8,637)

Other income, principally interest

Interest expense

Net earnings (loss) applicable

to common shareholders

$

4,116

$ 2,937 $ (8,148)

===============================================================================

Per share of common stock amounts:

Before change in accounting principle

$

7.23

$ 5.02 $ (14.02)

Effect of change in accounting principle

B

(.20)

Net earnings (loss) applicable

to common shareholders

$7.23

$5.02 $ (14.22)

===============================================================================

Average number of common shares outstanding:

1995 - 569,384,029; 1994 - 584,958,699; 1993 - 573,239,240

The notes on pages 8 through 14 are an integral part of this statement.

5

CONSOLIDATED BALANCE SHEETS

International Business Machines Corporation and Subsidiary Companies

(DOLLARS IN MILLIONS)

At December 31:

Notes

1995

1994

Assets

Current assets:

Cash

$ 1,746

$ 1,240

Cash equivalents

5,513

6,682

Marketable securities

442

2,632

Notes and accounts receivable - trade,

16,450

14,018

net of allowances

Sales-type leases receivable

5,961

6,351

Other accounts receivable

991

1,164

Inventories

D

6,323

6,334

Prepaid expenses and other current assets

3,265

2,917

Total current assets

40,691

41,338

Plant, rental machines and other property

E

43,981

44,820

Less: Accumulated depreciation

27,402

28,156

Plant, rental machines and other property - net

16,579

16,664

Software, less accumulated amortization

(1995, $11,276; 1994, $10,793)

2,419

2,963

Investments and sundry assets

F

20,603

20,126

Total assets

$ 80,292

$ 81,091

============================================================================

Liabilities and Stockholders' Equity

Current liabilities:

Taxes

Short-term debt

Accounts payable

Compensation and benefits

Deferred income

Other accrued expenses and liabilities

Total current liabilities

Long-term debt

Other liabilities

Deferred income taxes

Total liabilities

Contingencies

H

G

G

H

$

2,634

11,569

4,511

2,914

3,469

6,551

31,648

10,060

14,354

1,807

57,869

$

1,771

9,570

3,778

2,702

3,475

7,930

29,226

12,548

14,023

1,881

57,678

Stockholders' equity:

Preferred stock, par value $.01 per share shares authorized: 150,000,000

shares issued: 1995 - 2,610,711;

1994 - 11,145,000

253

1,081

Common stock, par value $1.25 per share shares authorized: 750,000,000

shares issued: 1995 - 548,199,013;

1994 - 588,180,244

7,488

7,342

Retained earnings

11,630

12,352

Translation adjustments

3,036

2,672

Treasury stock, at cost (shares: 1995 - 424,583;

1994 - 469,500)

(41)

(34)

Net unrealized gain on marketable securities

57

Total stockholders' equity

22,423

23,413

Total liabilities and stockholders' equity

$ 80,292

$81,091

============================================================================

The notes on pages 8 through 14 are an integral part of this statement.

6

CONSOLIDATED STATEMENT OF CASH FLOWS

International Business Machines Corporation and Subsidiary Companies

(DOLLARS IN MILLIONS)

For the year ended December 31:

1995

Cash flow from operating activities:

Net earnings (loss)

Adjustments to reconcile net earnings(loss)

to cash provided from operating activities:

Effect of change in accounting principle

Effect of restructuring charges

Depreciation

Deferred income taxes

Amortization of software

Purchased in-process research and development

(Gain) loss on disposition of fixed

and other assets

Other changes that provided (used) cash:

Receivables

Inventories

Other assets

Accounts payable

Other liabilities

Net cash provided from operating activities

Cash flow from investing activities:

Payments for plant, rental machines

and other property

Proceeds from disposition of plant, rental machines

and other property

Acquisition of Lotus Development Corporation - net

Investment in software

Purchases of marketable securities and other

investments

Proceeds from marketable securities and other

investments

Proceeds from the sale of Federal Systems Company

Net cash used in investing activities

1994

1993

$4,178

$3,021

$(8,101)

(2,119)

3,955

1,392

1,647

1,840

114

(2,772) 5,230

4,197

4,710

825 (1,335)

2,098

1,951

-

(339)

(11)

151

(530)

107

(1,100)

659

1,018

10,708

653

1,518

187

305

1,772

11,793

1,185

583

1,865

359

1,615

8,327

(4,744)

(3,078) (3,154)

1,561

(2,880)

(823)

900

793

(1,361) (1,507)

(1,315)

(3,866) (2,721)

3,149

(5,052)

2,476

2,387

1,503

(3,426) (4,202)

Cash flow from financing activities:

Proceeds from new debt

6,636

5,335 11,794

Short-term borrowings less than 90 days - net

2,557

(1,948) (5,247)

Payments to settle debt

(9,460) (9,445) (8,741)

Preferred stock transactions - net

(870)

(10) 1,091

Common stock transactions - net

(4,656)

318

122

Cash dividends paid

(591)

(662)

(933)

Net cash used in financing activities

(6,384) (6,412) (1,914)

Effect of exchange rate changes on cash and

cash equivalents

65

106

(796)

Net change in cash and cash equivalents

(663)

2,061

1,415

Cash and cash equivalents at January 1

7,922

5,861

4,446

Cash and cash equivalents at December 31

$7,259

$7,922 $5,861

================================================================================

Supplemental data:

Cash paid during the year for:

Income taxes*

$1,453

$ 649 $ 813

Interest

$1,720

$2,132 $2,410

================================================================================

*Prior years restated to include withholding taxes paid on repatriation

of dividends and royalties from foreign subsidiaries.

The notes on pages 8 through 14 are an integral part of this statement.

7

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

A

SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The consolidated financial statements include the accounts of International

Business Machines Corporation and its majority-owned subsidiary companies.

Investments in business entities in which IBM does not have control, but has

the ability to exercise significant influence over operating and financial

policies (generally 20 - 50 percent ownership), are accounted for by the

equity method. Other investments are accounted for by the cost method.

Revenue

Revenue from hardware sales or sales-type leases is recognized when the

product is shipped. Revenue from one-time-charge licensed software is

recognized when the program is shipped with an appropriate deferral for postcontract customer support. This deferral is earned over the support period.

Revenue from monthly software licenses is recognized as license fees accrue;

from maintenance and services over the contractual period or as the services

are performed; from rentals and operating leases, monthly as the fees accrue;

and from financing at level rates of return over the term of the lease or

receivable. Revenue is reduced for estimated customer returns and allowances.

Selling Expenses

Selling expenses are charged against income as incurred.

Income Taxes

Income tax expense is based on reported earnings before income taxes.

Deferred income taxes reflect the impact of temporary differences between

assets and liabilities recognized for financial reporting purposes and such

amounts recognized for tax purposes. In accordance with Statement of

Financial Accounting Standards (SFAS) 109, "Accounting for Income Taxes,"

these deferred taxes are measured by applying currently enacted tax laws.

Cash Equivalents

All highly liquid investments with a maturity of three months or less at date

of purchase are carried at fair value and considered to be cash equivalents.

Inventories

Raw materials, work in process, and finished goods are stated at the lower of

average cost or market.

Depreciation

Plant, rental machines and other property are carried at cost, and

depreciated over their estimated useful lives using the straight-line method.

8

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

Software

Costs related to the conceptual formulation and design of licensed programs

are expensed as research and development. Costs incurred subsequent to

establishment of technological feasibility to produce the finished product

are capitalized. The annual amortization of the capitalized amounts is the

greater of the amount computed based on the estimated revenue distribution

over the products' revenue-producing lives, or the straight-line method, and

is applied over periods ranging up to four years. Periodic reviews are

performed to ensure that unamortized program costs remain recoverable from

future revenues. Costs to support or service licensed programs are charged

against income as incurred, or when related revenue is recognized, whichever

occurs first.

Retirement Plans and Nonpension Postretirement Benefits

Current service costs of retirement plans and postretirement healthcare and

life insurance benefits are accrued for in the period. Prior service costs

resulting from amendments to the plans are amortized over the average

remaining service period of employees expected to receive benefits.

Goodwill

Goodwill is charged to earnings on a straight-line basis over the periods

estimated to be benefited, currently not exceeding five years.

Common Stock

Common stock refers to the $1.25 par value capital stock, as designated in

the company's Certificate of Incorporation. Earnings (loss) per common share

amounts are computed by dividing earnings (loss) after deduction of preferred

stock dividends and transaction costs by the average number of common shares

outstanding in the period.

B

ACCOUNTING CHANGES

The company implemented new accounting standards in 1995, 1994 and 1993. None

of these standards had a material effect on the financial position or results

of operations of the company.

Management uses estimates in preparing the consolidated financial statements,

in conformity with generally accepted accounting principles. Significant

estimates include collectibility of accounts receivable, warranty costs,

profitability on long-term contracts, as well as recoverability of

capitalized software costs, long-term fixed assets and residual values. The

company regularly assesses these estimates and, while actual results may

differ from these estimates, management believes that material changes will

not occur in the near term.

D

INVENTORY

At December 31:

1995

1994

$ 1,241

$ 1,442

4,990

4,636

92

256

$ 6,323

$ 6,334

(DOLLARS IN MILLIONS)

Finished goods

Work in process

Raw materials

Total

9

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

E

PLANT, RENTAL MACHINES AND OTHER PROPERTY

At December 31:

1995

1994

$ 1,348

$ 1,437

12,653

13,093

26,658

27,084

40,659

41,614

25,604

26,299

15,055

15,315

(DOLLARS IN MILLIONS)

Land and land improvements

Buildings

Plant, laboratory and office equipment

Less: Accumulated depreciation

Rental machines and parts

Less: Accumulated depreciation

Total

F

3,322

1,798

1,524

3,206

1,857

1,349

$16,579

$16,664

INVESTMENTS AND SUNDRY ASSETS

(DOLLARS IN MILLIONS)

Net investment in sales-type leases**

Less: Current portion - net

Deferred taxes

Prepaid pension cost

Non-current customer loan receivables

Installment payment receivables

Investments in business alliances

Goodwill, less accumulated amortization

(1995, $913; 1994, $648)

Other investments and sundry assets

Total

At December 31:

1995

1994

$14,007

$14,751

5,961

6,351

8,046

8,400

3,376

4,533

2,535

1,528

2,390

2,398

844

817

509

380

870

2,033

$20,603

427

1,643

$20,126

**These leases relate principally to IBM equipment and are generally for terms ranging from three

to five years.

G

DEBT

Short-term debt

At December 31:

1995

1994

$ 4,933

$ 2,544

3,755

2,977

2,881

4,049

$11,569

$ 9,570

=======

=======

The weighted-average interest rates for commercial paper at December 31, 1995

and 1994, were approximately 5.7 percent and 4.9 percent, respectively. The

weighted-average interest rates for short-term loans at December 31, 1995 and

1994, were approximately 6.6 percent for both years.

(DOLLARS IN MILLIONS)

Commercial paper

Short-term loans

Long-term debt: Current maturities

Total

10

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

Long-term debt

At December 31:

1995

1994

(DOLLARS IN MILLIONS)

Maturities

U.S. Dollars:

Debentures:

7%

2025

$ 600

7%

2045

150

7-1/2%

2013

550

8-3/8%

2019

750

Notes :

5-1/2% to 7-1/2%

1996-2002 3,025

7-1/2% to 9-1/2%

1996-2001

186

Medium-term note program: 5.8% average 1996-2008 1,730

Other U.S. dollars: 5.4% to 7.9%

1996-2012

416

7,407

Other currencies

Less: Net unamortized discount

550

750

3,325

641

2,803

558

8,627

12,964 16,618

23

21

12,941 16,597

2,881

4,049

$10,060 $12,548

======= =======

Less: Current maturities

Total

H

$

TAXES

(DOLLARS IN MILLIONS)

U.S. federal:

Current

Deferred

Net deferred investment tax credits

1995

U.S. state and local:

Current

Deferred

Non-U.S.:

Current

Deferred

Total provision (benefit) for income taxes

Social security, real estate, personal property

and other taxes

Total taxes

11

1994

$

1993

$

85

1,075

------1,160

49

74

------123

$

(4)

(890)

(51)

-------(945)

65

------65

68

------68

26

23

-------49

2,093

317

------2,410

-------

1,192

751

------1,943

-------

554

(468)

-------86

--------

3,635

2,134

(810)

2,566

------$ 6,201

=======

2,465

------$ 4,599

=======

2,614

-------$ 1,804

========

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

The effect of tax law changes on deferred tax assets and liabilities did not

have a significant impact on the company's effective tax rate in 1995 and

1994 and had a beneficial impact of $170 million in 1993.

The significant components of deferred tax assets and liabilities included on

the balance sheet were as follows:

At December 31:

(DOLLARS IN MILLIONS)

1995

1994*

Deferred Tax Assets

Retiree medical benefits

Restructuring charges

Capitalized research and development

Foreign tax credits

Alternative minimum tax credits

Inventory

Doubtful accounts

General business credits

Equity alliances

Employee benefits

Intracompany sales and services

Foreign tax loss carryforwards

State and local tax loss carryforwards

Warranty

Software income deferred

Depreciation

Retirement benefits

U.S. federal tax loss carryforwards

Other

Gross deferred tax assets

Less: Valuation allowance

Total deferred tax assets

Deferred Tax Liabilities

Sales-type leases

Retirement benefits

Depreciation

Software costs deferred

Other

Gross deferred tax liabilities

$ 2,632

2,003

1,772

1,183

859

674

517

452

407

405

325

303

236

233

205

172

101

2,800

15,279

3,868

$11,411

$ 2,500

2,446

2,057

1,380

738

633

453

452

445

363

357

469

370

163

199

249

127

230

2,564

16,195

4,551

$11,644

$ 2,898

1,919

1,787

967

1,320

------$ 8,891

$ 2,862

1,061

1,653

1,283

823

------$ 7,682

The estimated reversal periods for the largest deductible temporary differences are:

Retiree Medical - 1 to 30 years; Restructuring - 1 to 7 years.

The valuation allowance applies to U.S. federal tax credits, state and local net deferred tax assets and net operating loss

carryforwards, and net operating losses in certain foreign jurisdictions that may expire before the company can utilize them. The

net change in the total valuation allowance for the year ended December 31, 1995, was a decrease of $683 million, of which

approximately $600 million was due to the realization of previously unrecognized benefits in the current year. It is reasonably

possible that the deferred tax asset valuation allowance could decrease significantly in the near term, depending on the company's

ability to generate sufficient taxable income in multiple tax jurisdictions.

12

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

The consolidated effective income tax rate was 47 percent in 1995, 41 percent in 1994

and (9) percent in 1993.

A reconciliation of the company's effective tax rate to the statutory U.S.

federal tax rate is as follows:

For the year ended December 31:

1995

1994*

1993*

Statutory rate

U.S. valuation allowance

Foreign tax differential

State and local - net

Other

35%

(2)

2

1

2

----

35%

5

1

----

(35)%

20

7

(1)

----

38%

9

---47%

41%

---41%

(9)%

----(9)%

Effective rate before purchased in-process

research and development

Purchased in-process research and development

Effective rate

*Reclassified to conform to 1995 presentation.

For tax return purposes, the company has available tax credit carryforwards of

approximately $2,866 million, of which $67 million expire in 1996, $776 million expire

in 1998, $692 million expire in 1999 and the remainder thereafter. The company also

has state and local, and foreign tax loss carryforwards, the tax effect of which is

$539 million. Most of these carryforwards are available for ten or more years.

Undistributed earnings of non-U.S. subsidiaries included in consolidated

retained earnings amounted to $12,565 million at December 31, 1995, $11,280

million at December 31, 1994 and $10,915 million at December 31, 1993. These

earnings, which reflect full provision for non-U.S. income taxes, are

indefinitely reinvested in non-U.S. operations or will be remitted substantially free

of additional tax. Accordingly, no material provision has been made for taxes that

might be payable upon remittance of such earnings, nor is it practicable to determine

the amount of this liability.

I ADVERTISING

The company expenses advertising costs as incurred. Advertising expense amounted to

$1,219 million, $977 million and $716 million in 1995, 1994 and 1993, respectively.

J RESEARCH, DEVELOPMENT AND ENGINEERING

Research, development and engineering expenses amounted to $6,010 million in

1995, $4,363 million in 1994 and $5,558 million in 1993. Expenditures for

product-related engineering included in these amounts were $783 million, $981

million and $1,127 million in 1995, 1994 and 1993, respectively.

Expenditures of $5,227 million in 1995, $3,382 million in 1994 and $4,431

million in 1993 were made for research and development activities covering basic

scientific research and the application of scientific advances to the

development of new and improved products and their uses. Of these amounts,

software-related activities were $2,997 million, $793 million and $1,097 million in

1995, 1994 and 1993, respectively.

Included in the 1995 research, development and engineering expenses as part of software-related

activities was a $1,840 million charge for purchased in-process research and development in connection

with the acquisition of Lotus in July 1995.

13

P RENTAL EXPENSE AND LEASE COMMITMENTS

Rental expense, including amounts charged to inventories and fixed assets and

excluding amounts charged to restructuring, was $1,145 million in 1995, $1,276

million in 1994 and $1,686 million in 1993. The table below depicts gross

minimum rental commitments, under non-cancelable leases; amounts related to

vacant space, which the company had reserved for in restructuring charges and

other actions; and sublease income commitments. These amounts generally reflect

activities related to office space.

(DOLLARS IN MILLIONS)

1996

Gross rental commitments

$1,191

Vacant space

424

Sublease income commitments

105

1997

$1,035

374

94

14

1998

$ 930

333

82

1999

$ 794

259

68

2000

$ 694

236

60

Beyond

2000

$2,263

590

109