frontier futures, inc. - Minneapolis Grain Exchange

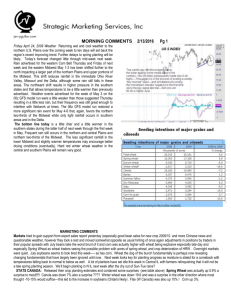

advertisement

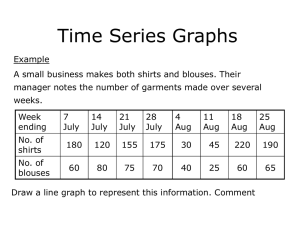

FRONTIER FUTURES, INC. 612-672-9868 www.ffutures.com th 460N Grain Exchange Building, 301 S 4 Ave, Minneapolis, MN 55415 Thursday Aug 7th, 2008 HIGH LOW LAST NET (VOLUME) MGE (U) 856 ¾ 850 856 ¾ + 3 (109) MWU8 RESISTANCE RESISTANCE SETTLE SUPPORT SUPPORT 50 DAY MA 100 DAY MA 909 888 853 ¾ 830 700 908 939 KC (U) 812 ½ 795 ½ 812 ¼ + 16 ¼ (331) KWU8 848 836 796 789 700 863 ¾ 904 WHEAT (U) 784 ¾ 764 ¾ 782 ¾ + 17 (2021) WU8 834 810 765 ¾ 746 ½ 700 833 865 CORN (Z) 535 ¼ 523 ¼ 535 ¼ + 7 ½ (8957) CZ8 563 535-538 527 ¾ 513 484 682 ½ 646 SOYBEANS (X) 1247 1222 ¼ 1241 + 19 (4188) SX8 1330-1350 1252-1271 1222 1135-1163 1045 ¼ 1473 ½ 1360 ¾ GENERAL • As of 7AM: the dollar is down .19, gold is up 6 bucks, crude is up 1.48, the S&P is down 6, and the Dow is down 64. • There is a new problem here that noone seems to want to admit to in the rush to electronic trading. The problem is the electronic marketplace isn’t working so well for US ags. A set of markets like US ags simply do not have the constant micro-equilibrium volumes that the worlds financial markets do. The old pits relied on a good measure of information flow that could be garnered by the professional market maker by standing there and observing the mechanics of the order flow. All of that is absent in the electronic marketplace, leaving marketmakers in every US ag commodity except possibly corn to the conclusion that the only way to trade on the screen is to abandon marketmaking and “go with the days trend” instead. In other words, while the government guys and the newspapers discuss and legislate ad nauseum on the “overspeculation” problem, the real problem is the vacuum caused in the micro (under 2 minute) world of commodities due to the exodus of the professional marketmaker from the industry. All moves are overdone, because they have to be since there is noone there to take the other side. The short term volatility is much, much higher than it was with pit trading, and probably will stay that way forever. This is not due to “overspeculation”, its due to the lack of information flow that the new world of screen trading has caused. Further, we have the new world of for-profit exchanges in the US keeping fees high. Remember back about 2000 when everyone told you ag exchange fees would be about a quarter a round turn if only everything traded on the screen? What a laugher. The exchanges simply took the floor broker fee for themselves, leaving everyone wondering where the cheaper rates went. There are cheaper rates, but only for members executing their own trades. So the trading companies and ag firms that wanted the cheaper rates have decided to pony up for the memberships or trading rights to save costs and execute themselves. The only problem there is those customers have never executed for themselves and are finding out that the task is not as easy as it appeared when they called their orders in. Massive resting stops, big spread orders placed all at once getting leaned on, and so on and so on are rampant on the screens as these new players learn the hard way what not to do when executing their orders in the micro sense. It turns out that it’s hard work getting volume moved in the ags. Who would have guessed. I fear the financial fund guys will never get it when it comes to placing orders for size in the world of ag commods. Again, all of this is causing more and more short term volatility. The point of all this rambling is that the marketplace as we knew it for US ags is something altogether new. Every run, whether for a day, a week, a month, or a season, is going to be faster and farther than ever before due to screen trading. Get used to it, there simply is no going back now and we are forever stuck with this new world. Immediate fills are nice, unfortunately they FRONTIER FUTURES, INC. th 460N Grain Exchange Building, 301 S 4 Ave, Minneapolis, MN 55415 612-672-9868 www.ffutures.com appear to come at the small cost of massive slippage. The corn market will be okay for mid-size front month trading, but soybeans are suspect even in the front month, and wheat, my friends is a small market disaster that just happened before everyones eyes. Don’t even get me started on oats or the soy products markets. Good luck and be careful out there because it turns out the world is full of dogs and we’re all wearing milk-bone underwear. WHEAT • Tunisia is in Aug 7 for 84,000 MT of opt-origin durum and 42,000 MT of opt-origin milling wheat for Sep-Nov shipment. Iran is in Aug 9, pushed back from Aug 2, for 100,000 MT of Kazakh milling wheat for Oct/Nov shipment. Taiwan Flour Mills is in Aug 12 for 44,640 US mixed wheat for Sep 10-24 shipment. • Weekly export sales were 682,600 vs expectations of 450,000-650,000. Major buyers were Iran 141, Nigeria 133, Mexico 103, Cuba 76, and S Africa 68. Unknown cancelled 14 and Brazil cancelled 20. Sales by class were 502 HRW, 92 SRW, 58 HRS, 25 whites, and 6 durum. Opening call: 10-15 higher CORN • • • CCC is in Aug 6 for 36,860 sorghum for Somalia for Aug 24-Sep 4 shipment and 43,500 sorghum for Sudan and Somalia for Sep 5-15 shipment. Tunisia is in Aug 7 for 50,000 MT of opt-origin feed barley for Sep-Nov shipment. Old axiom #1 to remember: Dead cats, when dropped from astounding heights, do tend to bounce. Old Axiom #2 to remember: When bullish commod stories make the cover of the Wall Street Journal or your local paper, it’s time to get out of you longs. New axiom #1: When financial fund guys start talking about “a new commodities pricing paradigm”, it’s time to get out of your longs. With the exception of one time, 1973, commodities have always returned to their old levels and left what is always termed a bubble behind on the charts. This is caused by the world’s incredible capacity for finding plantable acres and the ability to create yield through larger input spending by way of fertilizer and herbicides, genetics, and even to a degree good old fashioned hard work always keeping up with population growth and demand. This last run will most likely now be the new highs to shoot for when the next crisis comes, but the function of the market right now will be to overdo what the economics of the situation calls for in pricing terms to the downside to blow out as many index funds as possible. The trend is decidedly down, and numbers like 4.35 in CZ8 are not out of the question at all. That being said, the next few days trend is dead cat bounce. Weekly export sales were 337,900 old crop and 718,500 new crop for a total of 1,056,400 vs expectations of 600,000-850,000. Major buyers were Japan 506, Mexico 285, Korea 112, Columbia 66, and Egypt 60. Unknown switched 29 to new crop. Jamaica cancelled 20 and Venezuela cancelled 16. Opening call: 5-10 higher SOYBEANS • China’s NGOIC raised its forecast for the 2008 soybean crop to 17.5 MMT, up from 16.5 the last forecast and 12.8 last year. • See bullet #2 in corn above with the only change being numbers like 8.50 in SX8 are not out of the question at all, otherwise everything applies. • Weekly export sales were 374,400 old crop and 245,200 new crop for a total of 619,600 vs expectations of 350,000-600,000. Major buyers were China 331, Mexico 69, Cuba 64, and Unknown 50. Opening call: 15-25 higher FRONTIER FUTURES, INC. th 460N Grain Exchange Building, 301 S 4 Ave, Minneapolis, MN 55415 612-672-9868 www.ffutures.com Scott O’Donnell Any statement contained herein are derived from sources believed to be reliable, but are not guaranteed as to accuracy or completeness. This is not a solicitation of any order to buy or sell by Frontier Futures, Inc. No responsibility is assumed with respect to any such statement, nor with respect to any expression of opinion herein contained. There is a risk of loss when trading commodity futures.