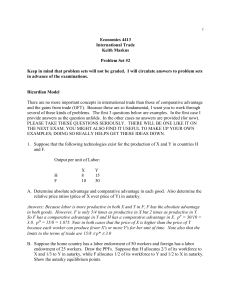

The Classical Model of International Trade

advertisement