FEDERAL PERKINS LOAN APPLICATION

advertisement

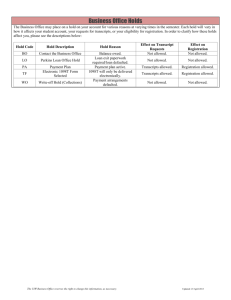

` FEDERAL PERKINS LOAN APPLICATION Please complete all four pages of this form if you wish to be considered for a Federal Perkins Loan to assist in paying your educational costs at Princeton Theological Seminary. A Federal Perkins Loan is a serious legal obligation and must be repaid. Therefore, it is extremely important that you understand your rights and responsibilities. When you, the student borrower, sign the Federal Perkins Loan Application, Federal Perkins Loan Fact Sheet, Truth in Lending Statement, and Federal Perkins Loan Master Promissory Note, it means that you do understand all your rights and responsibilities as a Federal Perkins Loan borrower. PERSONAL INFORMATION: NAME: _________________________________________________________________________________ Permanent Address: _______________________________________________________________________ Permanent Phone: _(_____) ________________________________________________________________ Current Address: __________________________________________________________________________ Current Phone: _(______)___________________Email Address: ___________________________________ Social Security #: _________________________ Date of Birth: ___________________ ID # ___________ Degree Program: _________________________ Expected Graduation Date: _________________________ Driver’s License Number (State abbreviation first): _______________________________ US Citizen Yes___ No___ Your Employer: ________________________________ Employer’s Phone: (_____)___________________________ APPLICATION REQUEST CERTIFICATION: I hereby apply for a student loan drawn from a fund created under Part E of Title IV of the Higher Education Act of 1965, as amended in the amount of $ _________ to assist in the payment of my educational expenditures while in attendance during the academic year _______‐_______. If I receive a Federal Perkins Loan, I certify that: • • • • • I agree to repay my Federal Perkins Loan. I understand that receiving a Federal Perkins Loan may reduce my eligibility for other financial aid. I am in need of the loan in order to continue my education at Princeton Theological Seminary. I will use the proceeds of the loan only for the payment of educational expenses required for my program of studies at Princeton Theological Seminary. I am not currently in default on any previous federal loan received or on a refund on a federal grant. Page 1 • • • I understand that any late payment (even one day past due) will result in my loan becoming delinquent. After 240 days past due, my loan will lapse into default. I understand that my loan disbursement, annual outstanding loan balance, my payment activity, delinquency (after 120 days) and any defaulted loan will be reported to a national credit bureau. I hereby acknowledge that the information submitted herein is true and correct, and I fully understand my obligations incurred in accepting this loan and the conditions of its repayment. I authorize PTS to contact any school I may attend, to obtain information concerning my student status, my year of study, dates of attendance, graduation, or withdrawal, my transfer to another school, or my current address. ______________________________________________________ ___________________________________ Signature of Applicant Date Defaulting on a Federal Perkins Loan may result in the garnishment of wages and Federal and State Income Tax Refunds. It will negatively affect your credit rating and credit history. To borrow Federal Perkins Loan Funds, you must complete the following documentation: • • • • • • Federal Perkins Loan Application (this document) Federal Perkins Loan Fact Sheet and Loan Counseling Certification (next page) Federal Loan Perkins Master Promissory Note (signed at the time of disbursement) Federal Perkins Loan Truth in Lending Statement (signed at the time of disbursement) Federal Perkins Loan Repayment and Disclosure Statement (Exit Interview*) Federal Perkins Loan Interview Form (Exit Interview*) *Completed before you graduate or when you cease to be enrolled at least half‐time at PTS. REFERENCES: Spouse’s Name (if applicable): __________________________________________________________________________________________ Spouse’s Address (if different than above): ________________________________________________________________________________ Spouse’s Employer: __________________________________________________________________________________ PARENT, GUARDIAN, OR FAMILY MEMBER: Name(s) __________________________________________________ Phone # _______________________________________________ Address: ____________________________________________________________________________________________________________ Employer’s Name: ____________________________________________________________________________________________________ Employer’s Address: ___________________________________________________________________________________________________ OTHER REFERENCES: Name: ___________________________________________________ Phone # ________________________________________________ Address: ______________________________________________________________________________________________________________ Relationship to you ______________________________________________________________________________________________________ Name: ___________________________________________________ Phone # __________________________________________________ Address: ________________________________________________________________________________________________________________ Relationship to you _______________________________________________________________________________________________________ Page 2 FEDERAL PERKINS LOAN FACT SHEET AND LOAN COUNSELING CERTIFICATION PART TWO PLEASE READ AND CHECK THE BOX ACKNOWLEDGING THAT YOU UNDERSTAND, AND SIGN BELOW: PTS holds the Promissory Note on my Federal Perkins Loan. Payments are made payable to PTS and mailed to Campus Partners, P. O. Box 970004, Boston, MA 02297‐0004. I understand that I will use the proceeds of the loan only for payment of educational expenses required for my Program of studies at PTS. In addition, I must maintain satisfactory progress towards my degree, as defined by the Seminary in the Student Handbook. I understand that my Federal Perkins Loan disbursement(s) will be reported to a national credit bureau. The outstanding balance of the loan(s), any delinquency (over 120 days), and defaulted loans, are reported to a national credit bureau at least annually. I understand that I must report ANY change in MY STUDENT STATUS, MY ADDRESS, and MY PARENTS’ ADDRESS to the Bursar, Princeton Theological Seminary, P. O. Box 821, Princeton NJ 08542, and to Campus Partners, P. O. Box 970004, Boston MA 02297‐0004. I understand that the annual percentage rate of 5% will be the finance charge, based on the unpaid balance. This interest will begin to accrue at the time of repayment. The minimum monthly payment will be $40.00, but it may be more if the amount borrowed requires larger payment in order for me to pay back my loan in full within the required ten (10) year payment period. The following is an estimate of the monthly payment amount needed to repay the loan balances listed, the total interest paid, and the total repayment amount. Amount Borrowed Number of Payments Payment Amount Total Interest Total Amount Paid 4000 114 44 1033 $5,033.00 5000 120 53 1364 $6,364.00 6000 120 64 1637 $7,637.00 7000 120 74 1910 $8,910.00 8000 120 85 2182 $10,182.00 9000 120 95 2455 $11,455.00 10000 120 106 2728 $12,728.00 12000 120 127 3273 $15,273.00 15000 120 159 4092 $19,092.00 I understand that my first payment will be due as follows: Page 3 • • Six (6) months, if I have Perkins Loans prior to July 1, 1987, or Nine (9) months, if I have no Perkins Loans prior to July 1, 1987 after I cease to be at least a half‐time student. Interest will begin to accrue after my grace period expires. I understand that the maximum amount that I may borrow in Federal Perkins Loans in one year is $8,000, but may be lower depending on the school’s level of funding. And that the aggregate total of Federal Perkins Loans I may borrow, including undergraduate Federal Perkins Loans, is $40,000. I also understand that I may qualify for less depending upon my demonstrated financial need and the Seminary’s authorized Federal Perkins Loan Level of Expenditures. I understand that I may be eligible for deferment or cancellation of my Federal Perkins Loan if I meet certain criteria. [Please refer to your Promissory Note for a complete description of all applicable deferment and cancellation situations.] I understand that if I fail to repay any loan as agreed, the total loan may become due and payable immediately (acceleration); and, if unresolved, my account will be referred to a collection agency; and if still unresolved, legal action will be taken against me. The following are definitions and times when such action will be taken: • • • • The loan is DELINQUENT if it is at all late, even one day. 30 days of delinquency; the loan is officially PAST DUE 120 days of delinquency; the loan is sent to a COLLECTION AGENCY, ACCELERATED, and that information is sent to a credit bureau. 240 days of delinquency, for loans paid monthly, or 270 days of delinquency for loans paid quarterly; the loan is in DEFAULT. If my loan should become past due, certain fees will begin to accrue. Late payments will be assessed a $6.00 fee. If my loan is 120 days past due, collection fees will be 25% of the amount due. If my loan is over two years past due, collection fees will be 25% of the amount due. If my loan is over two years past due, collection fees will be 35% of the amount due. If legal action is required to collect on my loan collection fees will be 40% of the amount due. I am responsible for paying all of these charges if this occurs. I understand that I have certain options to consolidate or refinance my federal Perkins Loan under the Federal Loan Consolidation Program. [Students should consider this option very carefully, especially if they owe significant amounts In student loans.] I understand that taking out a Federal Perkins Loan may affect my eligibility for other forms of financial aid. [Please see the Financial Aid Officer for more details.] I understand that, unlike Federal Stafford Loans, Federal Perkins Loans do not assess the student an origination or or insurance fee. Therefore, I will receive the full amount of what I borrow. I understand that if I cannot make payments on time, I must immediately contact the Bursar in the Seminary’s Business Office to make alternative arrangements at (800) 622‐6767, Extension 7704. IF I HAVE ANY QUESTIONS OR CONCERNS REGARDING MY APPLICATION FOR A FEDERAL PERKINS LOAN, I WILL ADDRESS THESE DURING MY COUNSELING SESSION HELD PRIOR TO MY FIRST FEDERAL PERKINS LOAN DISBURSEMENT. ________________________________________________________________ __________________________________ Signature of Applicant Date