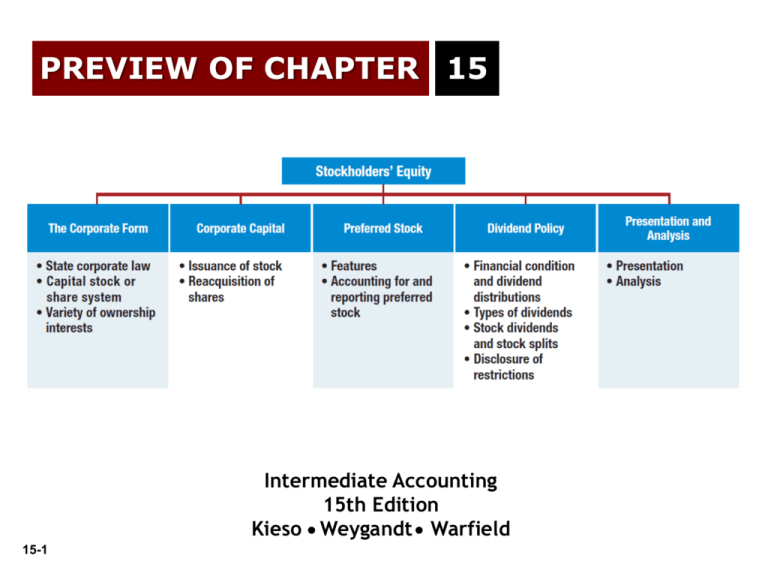

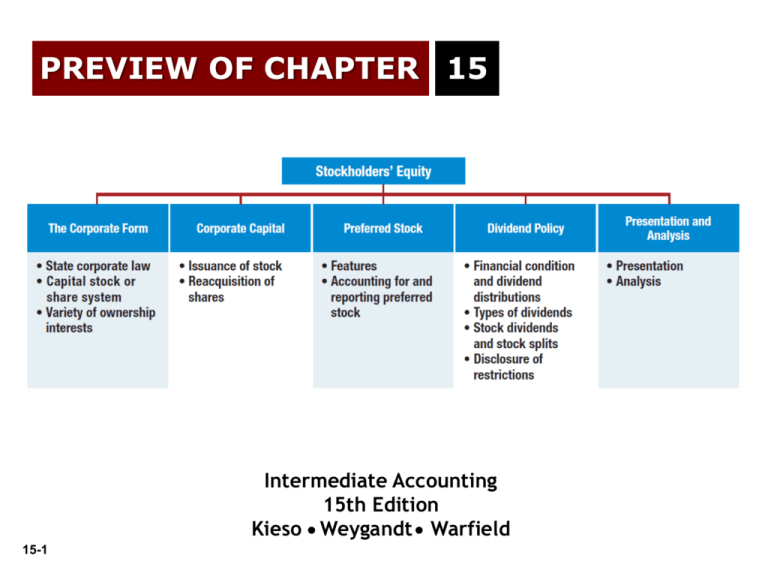

PREVIEW OF CHAPTER 15

Intermediate Accounting

15th Edition

Kieso Weygandt Warfield

15-1

15

Stockholders’ Equity

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1.

Discuss the characteristics of the

corporate form of organization.

6.

Describe the policies used in distributing

dividends.

2.

Identify the key components of

stockholders’ equity.

7.

Identify the various forms of dividend

distributions.

3.

Explain the accounting procedures for

issuing shares of stock.

8.

Explain the accounting for small and large

stock dividends, and for share splits.

4.

Describe the accounting for treasury

stock.

9.

Indicate how to present and analyze

stockholders’ equity.

5.

Explain the accounting for and reporting

of preferred stock.

15-2

Stockholders’ Equity

The

Corporate

Form

Corporate law

Capital stock

or share

system

Variety of

ownership

interests

Equity

Issuance of

stock

Reacquisition

of shares

Preferred

Stock

Dividend

Policy

Features

Financial

condition and

dividend

distributions

Accounting

for and

reporting

preferred

stock

Types of

dividends

Stock split

Disclosure of

restrictions

15-3

Presentation

and Analysis

Presentation

Analysis

Measuring Corporate Performance

Debt Versus Equity Decision

15-4

BUT: Stock financing may be necessary if debt is already at high

levels. If a corp. is growing rapidly, often the huge funding

needed for expansion can only be obtained in a public stock

offering. Also, public stock financing can provide liquidity to

insider’s investments.

Different Forms of Organization

Three primary forms of business organization

Proprietorship

One capital acct in

which is recorded

owner contributions,

drawing, and profits

One capital acct for

each partner in which

is recorded owner

contributions,

drawing, and profits

Propr. Or Partnership

Cash

Capital - contributions

Assets

Capital – net income

Capital – drawing

Cash

15-5

Corporation

Partnership

Several kinds of

capital accts: (1)

contributed capital

(stock), and (2)

earned capital

(retained earnings)

Corporation

Cash

Capital Stock

Assets

Ret. Earnings – net income

Ret. Earnings – dividends

Cash

The Corporate Form of Organization

Usually by “corporation” we mean a “C”

Corp.

There is also an “S” Corp which is legally a

corporation but is treated for tax purposes like a

partnership:

no double taxation

cannot have more than 75 shareholders

15-6

SO 1 Identify and discuss the major characteristics of a corporation.

The Corporate Form of Organization

An entity separate and distinct from its owners.

Classified by Purpose

Not-for-Profit

Publicly held

For Profit

Privately held

Salvation Army

American Cancer

Society

Gates Foundation

15-7

Classified by Ownership

Nike

General Motors

IBM

General Electric

Cargill Inc.

Advantages of a Corporation

ADVANTAGES

Separate legal existence; acts of firm don’t

bind owners & vice versa.

Limited liability of owners, who generally

can’t be sued

Transferable ownership rights; you can sell

your equity quickly

Ability to acquire capital; can raise huge

amounts of cash.

Continuous life; doesn’t dissolve when an

owner dies.

Professional management (usually come at big

cost, though)

15-8

8

Disadvantages of a Corporation

DISADVANTAGES

Absentee Ownership - Management is appointed

by the board whose members are elected by

owners. Other than electing the board,

owners have little to do with THEIR company.

15-9

Extensive government regulation

Separate corporate income tax paid (one of the

highest rates in the world). Same money is

taxable to owners who receive corporate

distributions. This results in a double tax.

9

The Corporate Form of Organization

State Corporate Law

Corporation must submit articles of incorporation to the

state in which incorporation is desired.

General Motors - incorporated in Delaware.

U.S. Steel - incorporated in New Jersey.

Accounting for stockholder’s equity follows the provisions of

each states business incorporation act.

15-10

LO 1 Discuss the characteristics of the corporate form of organization.

Forming a Corporation

Forming a “C” Corporation

Initial Steps:

File application with the Secretary of State.

State grants charter.

Corporation develops by-laws.

Companies generally incorporate in a state whose laws are

favorable to the corporate form of business (Delaware, New

Jersey).

Corporations engaged in interstate commerce must obtain a

license from each state in which they do business.

15-11

SO 1 Identify and discuss the major characteristics of a corporation.

Regulation of Corporations

15-12

12

15-13

The Corporate Form of Organization

Capital Stock or Share System

In the absence of restrictive provisions, each share carries

the following rights:

1. To share proportionately in profits and losses.

2. To share proportionately in management (the right to vote

for directors).

3. To share proportionately in assets upon liquidation.

4. To share proportionately in any new issues of stock of the

same class—called the preemptive right.

15-14

LO 1 Discuss the characteristics of the corporate form of organization.

A picture illustration of shareholder rights

15-15

Stock Issue Considerations

Prenumbered

Shares

Illustration 11-4

Name of corporation

Stockholder’s

name

Signature of

corporate official

15-16

SO 1 Identify and discuss the major characteristics of a corporation.

Example of a

proxy card, where

owners vote using

an absentee

ballot. Notice

that the owners

don’t vote on

much.

15-17

17

Stock Issue Considerations

Primary Market: Corporation can issue common

stock in an IPO or Secondary Offering:

directly to investors or

indirectly through an investment banking firm.

Secondary Market: Once shares are sold, they

can be resold to other investors on U.S.

securities exchanges

15-18

New York Stock Exchange

American Stock Exchange

13 regional exchanges

NASDAQ national market

Authorized Stock...

Maximum amount of stock a corporation is allowed to sell as

authorized by corporate charter.

Issued Stock...

Number of shares of issued stock have been sold and been paid for

and that have not been cancelled.

Outstanding Stock...

Number of shares of issued stock that are being held by

stockholders (does not include shares repurchased by the corporation

and held in treasury (treasury stock)

Example: XYZ Corp. has 12 million shares authorized, 4 million

shares issued, and 3.5 million shares outstanding (0.5 million

shares held in treasury stock)

15-19

The Corporate Form of Organization

Variety of Ownership Interests

Common stock represents basic ownership interest.

Bears ultimate risks of loss.

Receives the benefits of success.

Not guaranteed dividends nor assets upon dissolution.

Preferred stock is created by contract, when

stockholders’ sacrifice certain rights (such as

the right to vote) in return for other rights or

privileges, usually dividend preference.

15-20

LO 1 Discuss the characteristics of the corporate form of organization.

129 NORTH

ORANGE

STREET

WHAT’S

YOUR

PRINCIPLE

15-21

LO 1

The Corporate Form of Organization

Variety of Ownership Interests

Common stock is the residual corporate interest.

Bears ultimate risks of loss.

Receives the benefits of success.

Not guaranteed dividends nor assets upon dissolution.

Preferred stock is a special class of stock is created by contract,

when stockholders’ sacrifice certain rights in return for other rights

or privileges, usually dividend preference.

15-22

LO 1

15

Stockholders’ Equity

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1.

Discuss the characteristics of the

corporate form of organization.

6.

Describe the policies used in distributing

dividends.

2.

Identify the key components of

stockholders’ equity.

7.

Identify the various forms of dividend

distributions.

3.

Explain the accounting procedures for

issuing shares of stock.

8.

Explain the accounting for small and large

stock dividends, and for share splits.

4.

Describe the accounting for treasury

stock.

9.

Indicate how to present and analyze

stockholders’ equity.

5.

Explain the accounting for and reporting

of preferred stock.

15-23

Corporate Capital

Common Stock

Account

Contributed

Capital

Additional Paidin Capital

Preferred Stock

Account

Account

Two Primary

Sources of

Equity

Retained Earnings

Account

Other Components:

Less:

Treasury Stock

15-24

Plus or Minus:

Accum. Other. Comprehensive

Income

LO 2 Identify the key components of stockholders’ equity.

STOCKHOLDERS’ EQUITY OUTLINE (or Shareholders’ Equity)

Paid-In Capital or Contributed Capital

Capital Stock

Preferred Stock, $par, % dividend, cumulative or participating, # of shares

authorized, issued and outstanding

Common Stock, $par, # of shares authorized, issued and outstanding

Less: Treasury Stock, # of shares (if par value method, which is rare)

Common Stock Subscribed, # of shares (very rare to have this)

Common Stock Dividend Distributable, # of shares

Additional Paid-In Capital (or Contrib. Cap. in Excess of Par, or Premium on CS)

Excess Over Par - Common

Excess Over Par - Preferred

Excess Over Par - Treasury

Donated Capital (from gov’t sources only)

Earned Capital

Retained Earnings

Appropriated (set aside for a certain purpose)

Unappropriated

Accumulated Other Comprehensive Income (Unrealized gains/losses on AFS securities, excess

of min. pension liability over UPSC, foreign currency translation gains/losses, or

deferred compensation expense from stock options)

Contra Equity Items:

Less: Treasury Stock, # of shares (if cost method, which is common)

Less: Subscriptions Receivable (very rare to have this)

TOTAL STOCKHOLDERS’ EQUITY

15-25

15

Stockholders’ Equity

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1.

Discuss the characteristics of the

corporate form of organization.

6.

Describe the policies used in distributing

dividends.

2.

Identify the key components of

stockholders’ equity.

7.

Identify the various forms of dividend

distributions.

3.

Explain the accounting procedures for

issuing shares of stock.

8.

Explain the accounting for small and large

stock dividends, and for share splits.

4.

Describe the accounting for treasury

stock.

9.

Indicate how to present and analyze

stockholders’ equity.

5.

Explain the accounting for and reporting

of preferred stock.

15-26

Corporate Capital

Issuance of Stock

Shares authorized - Shares sold - Shares issued

Accounting problems:

1. Par value stock.

2. No-par stock.

3. Stock issued in combination with other securities.

4. Stock issued in noncash transactions.

5. Costs of issuing stock.

15-27

LO 3

Corporate Capital

Par Value Stock

Low par values help companies avoid a contingent liability.

Corporations maintain accounts for:

15-28

Preferred Stock or Common Stock.

Paid-in Capital in Excess of Par (also called Additional

Paid-in Capital or Premium on Common Stock or

Contributed Capital in Excess of Par)

LO 3

Corporate Capital

Par Value Stock

-- Par value for bonds is easy to understand – it equals the face

or maturity value of the debt

-- Par value for stock is more tricky – it constitutes minimum

legal capital; because stockholders are contingently liable to

contribute capital up to the legal minimum, par is usually set very

low. For example, Ford’s par is $.01 and Pepsi’s is 1 2/3 cents.

This minimizes the chance of stock being sold for less than par.

E.g. If $5 par stock was sold for $4, the stockholder may have

to contribute the difference ($1) to the company in the case of

bankruptcy, because min. legal capital is $5.

-- Dividend rates are often expressed as a percent of par. For

example, a 6% dividend on preferred stock with par of $100

equals $6.00.

-- Some states allow a stated value to substitute for par value

(e.g. Nike, P&G.) Although some legal differences exist between

stated and par values, for accounting purposes they are treated

identically.

15-29

LO 3

Corporate Capital

Illustration: Blue Diamond Corporation issued 300 shares of $10

par value common stock for $4,500. Prepare the journal entry to

record the issuance of the shares.

Cash

15-30

4,500

Common Stock (300 x $10)

3,000

Paid-in Capital in Excess of Par Value

1,500

LO 3

Corporate Capital

Illustration: Some states require that no-par stock have a stated

value. If a company issued 1,000 of the shares with a $5 stated

value at $15 per share for cash, it makes the following entry.

Cash

Common Stock

Paid-in Capital in Excess of Stated Value

15-31

15,000

5,000

10,000

LO 3

Corporate Capital

No-Par Stock

-- Many states now allow stock to be issued without a par

value. This is becoming increasingly common.

-- Advantages of no par stock: it avoids contingent liability

for shareholders, and avoids confusion between par and

fair values.

-- Disadvantages of no par stock: some states levy a high tax

on no par stock (e.g. Deleware); also, some states consider

the total amount of no par stock to be legal capital, which

could reduce the flexibility in paying dividends

15-32

LO 3

Corporate Capital

Illustration: Muroor Electronics Corporation is organized with

authorized common stock of 10,000 shares without par value. If

Muroor Electronics issues 500 shares for cash at $10 per share, it

makes the following entry.

Cash

Common Stock

15-33

5,000

5,000

LO 3

Corporate Capital

Stock Issued with Other Securities (Lump-Sum)

Two methods of allocating proceeds:

1. Proportional method.

2. Incremental method.

15-34

LO 3

Corporate Capital

Illustration: Beveridge Corporation issued 300 shares of $10 par

value common stock and 100 shares of $50 par value preferred stock

for a lump sum of $13,500. Common stock had a recent market value

of $20 per share, and preferred stock had a recent market value of $90

per share.

Use the Proportional Method to record the sale of these shares

because a recent price is available for both common and preferred

shares.

15-35

LO 3

Corporate Capital

Prepare the

journal entry

to record

issuance of

shares.

Common shares

Preferred shares

Allocation:

Issue price

Allocation %

Total

Cash

Number

300

100

Common

$ 13,500

40%

$

5,400

Amount

Total

x $

20.00 = $ 6,000

x

90.00

9,000

Fair Market Value $ 15,000

Preferred

$

13,500

60%

$

8,100

Proportional

Method

13,500

Preferred Stock (100 x $50)

15-36

Percent

40%

60%

100%

5,000

Paid-in Capital in Excess of Par – Preferred PLUG

3,100

Common Stock (300 x $10)

3,000

Paid-in Capital in Excess of Par – Common PLUG

2,400

8,100

5,400

LO 3

Corporate Capital

Illustration: Beveridge Corporation issued 300 shares of $10 par value

common stock and 100 shares of $50 par value preferred stock for a

lump sum of $13,500. The common stock had a recent market value of

$20 per share, and the value of preferred stock is unknown.

Use the Incremental Method to record the sale of these shares because

a recent price is available for only common or preferred shares, but not

both.

15-37

LO 3

Corporate Capital

Prepare the

journal entry

to record

issuance of

shares.

Common shares

Preferred shares

Allocation:

Issue price

Ordinary

Total

Cash

15-38

Number

300

100

Common

$

6,000

Amount

Total

x $

20.00 = $ 6,000

x

Fair Market Value $ 6,000

Preferred

$

13,500

(6,000)

$

7,500

Incremental

Method

13,500

Preferred Stock (100 x $50)

5,000

Paid-in Capital in Excess of Par – Preferred PLUG

2,500

Common Stock (300 x $10)

3,000

Paid-in Capital in Excess of Par – Common PLUG

3,000

7,500

6,000

LO 3

Corporate Capital

Stock Issued in Noncash Transactions

The general rule: Companies should record stock issued

for services or property other than cash at the

fair value of the stock issued or

fair value of the noncash consideration received,

whichever is more clearly determinable.

15-39

LO 3

Corporate Capital

Illustration: The following series of transactions illustrates the

procedure for recording the issuance of 10,000 shares of $10 par

value common stock for a patent for Arganda Company, in

various circumstances.

1. Arganda cannot readily determine the fair value of the patent,

but it knows the fair value of the stock is $140,000.

Patents

140,000

Common Stock

Paid-in Capital in Excess of Par - Common

15-40

100,000

40,000

LO 3

Corporate Capital

2. Arganda cannot readily determine the fair value of the stock,

but it determines the fair value of the patent is $150,000.

Patents

150,000

Common stock

Paid-in Capital in Excess of Par - Common

15-41

100,000

50,000

LO 3

Corporate Capital

3. Arganda cannot readily determine the fair value of the stock

nor the fair value of the patent. An independent consultant

values the patent at $125,000 based on discounted expected

cash flows.

Patents

125,000

Common stock

Paid-in Capital in Excess of Par - Common

15-42

100,000

25,000

LO 3

Corporate Capital

Costs of Issuing Stock

Direct costs incurred to sell stock, such as

underwriting costs,

accounting and legal fees,

printing costs, and

taxes,

should be reported as a reduction of the amounts paid in (Paid-in

Capital in Excess of Par).

15-43

LO 3

DISAPPEARING

WHAT’S YOUR RECEIVABLE

PRINCIPLE

15-44

LO 3

15

Stockholders’ Equity

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1.

Discuss the characteristics of the

corporate form of organization.

6.

Describe the policies used in distributing

dividends.

2.

Identify the key components of

stockholders’ equity.

7.

Identify the various forms of dividend

distributions.

3.

Explain the accounting procedures for

issuing shares of stock.

8.

Explain the accounting for small and large

stock dividends, and for share splits.

4.

Describe the accounting for treasury

stock.

9.

Indicate how to present and analyze

stockholders’ equity.

5.

Explain the accounting for and reporting

of preferred stock.

15-45

Treasury Stock

Reasons for stock buybacks include:

(1) have shares to distribute to employees in

stock option plans (ESOPs) without dealing

with issue costs & regulations (e.g. Honeywell)

(2) tax-efficient distribution of cash to

owners without raising dividend expectations

(3) support the stock price by creating

demand (e.g. IBM, or 1987 market crash)

Stockholders

Treasurer’s

vault at

Netflix

15-46

Treasury Stock

Reasons for stock buybacks (cont.):

(4) increase earnings per share

(5) provide shares for potential corporate

takeovers where stock is exchanged

(6) avoid a hostile takeover (e.g. Reebok, CBS)

(7) increase ROE (return on equity) by

increasing debt-equity ratio

15-47

Treasury Stock

More stock has been repurchased than issued in recent

years!

15-48

15-49

Corporate Capital

Purchase of Treasury Stock

Two acceptable methods:

Cost method (more widely used).

Par or Stated value method.

Treasury stock reduces

stockholders’ equity.

15-50

LO 4 Describe the accounting for treasury stock.

Corporate Capital

Illustration: Cripe Company issued 100,000 shares of $1 par value

common stock at a price of $10 per share. In addition, it has retained

earnings of $300,000.

On January 20, Cripe acquires 10,000 of its shares at $11 per share.

Cripe records the reacquisition as follows.

Treasury Stock

Cash

15-51

110,000

110,000

LO 4

Corporate Capital

Sale of Treasury Stock

Above Cost

Below Cost

Both increase total assets and stockholders’ equity.

If TS was purchased at several different costs, a

LIFO/FIFO assumption must be made

When a debit plug is needed, always first reduce any

balance in APIC-TS and then debit retained earnings

15-52

LO 4 Describe the accounting for treasury stock.

Corporate Capital

Sale of Treasury Stock above Cost. Pacific acquired 10,000

treasury share at $11 per share. It now sells 1,000 shares at $15

per share on March 10. Pacific records the entry as follows.

Cash

15,000

Treasury Stock

11,000

Paid-in Capital from Treasury Stock

4,000

NOTE: If TS was purchased at several

different costs, a LIFO/FIFO

assumption must be made

15-53

LO 4 Describe the accounting for treasury stock.

Corporate Capital

Sale of Treasury Stock below Cost. Pacific sells an additional

1,000 treasury shares on March 21 at $8 per share, it records

the sale as follows.

Cash

8,000

**Paid-in Capital from Treasury Stock

3,000

Treasury Stock

11,000

** IMPORTANT RULE: When a debit

plug is needed, always first reduce

any balance in APIC-TS and then

debit retained earnings

15-54

LO 4 Describe the accounting for treasury stock.

Corporate Capital

Illustration 15-5

Illustration: Assume that Pacific sells an additional 1,000

shares at $8 per share on April 10.

Cash

8,000

Paid-in Capital from Treasury Stock

1,000

Retained Earnings

2,000

Treasury Stock

15-55

11,000

LO 4 Describe the accounting for treasury stock.

Corporate Capital

Retiring Treasury Stock

Decision results in

cancellation of the treasury stock and

a reduction in the number of shares of issued

stock.

15-56

LO 4 Describe the accounting for treasury stock.

Corporate Capital

Illustration: The stockholders’ equity section for Cripe after

purchase of the treasury stock.

Illustration 15-5

15-57

LO 4

Cancelled stock certificate

15-58

15

Stockholders’ Equity

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1.

Discuss the characteristics of the

corporate form of organization.

6.

Describe the policies used in distributing

dividends.

2.

Identify the key components of

stockholders’ equity.

7.

Identify the various forms of dividend

distributions.

3.

Explain the accounting procedures for

issuing shares of stock.

8.

Explain the accounting for small and large

stock dividends, and for share splits.

4.

Describe the accounting for treasury

stock.

9.

Indicate how to present and analyze

stockholders’ equity.

5.

Explain the accounting for and reporting

of preferred stock.

15-59

Preferred Stock

Features often associated with preferred stock.

1.

Preference as to dividends.

2.

Preference as to assets in the event of liquidation.

3.

Convertible into common stock.

4.

Callable at the option of the corporation.

5.

Nonvoting.

Companies with preferred stock:

http://www.dividendyieldhunter.com/preferred-stocks-sortedalphabetically

15-60

LO 5

Preferred Stock

Illustration: Bishop Co. issues 10,000 shares of $10 par value

preferred stock for $12 cash per share. Bishop records the

issuance as follows:

Cash

120,000

Preferred stock

Paid-in Capital in Excess of Par - Preferred

15-61

100,000

20,000

LO 5

15

Stockholders’ Equity

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1.

Discuss the characteristics of the

corporate form of organization.

6.

Describe the policies used in distributing

dividends.

2.

Identify the key components of

stockholders’ equity.

7.

Identify the various forms of dividend

distributions.

3.

Explain the accounting procedures for

issuing shares of stock.

8.

Explain the accounting for small and large

stock dividends, and for share splits.

4.

Describe the accounting for treasury

stock.

9.

Indicate how to present and analyze

stockholders’ equity.

5.

Explain the accounting for and reporting

of preferred stock.

15-62

Dividend Policy

Few companies pay dividends in amounts equal to their

legally available retained earnings. Why?

15-63

Maintain agreements with creditors.

Meet state incorporation requirements.

To finance growth or expansion.

To smooth out dividend payments.

To build up a cushion against possible losses.

LO 6

Dividend Policy

Dividend distributions generally are based on

accumulated profits (retained earnings).

Few companies pay dividends in amounts equal to

their legally available retained earnings. Why?

Maintain agreements with creditors.

Meet state incorporation requirements.

To finance growth or expansion.

To smooth out dividend payments.

To build up a cushion against possible losses.

15-64

LO 6 Describe the policies used in distributing dividends.

15-65

15

Stockholders’ Equity

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1.

Discuss the characteristics of the

corporate form of organization.

6.

Describe the policies used in distributing

dividends.

2.

Identify the key components of

stockholders’ equity.

7.

Identify the various forms of dividend

distributions.

3.

Explain the accounting procedures for

issuing shares of stock.

8.

Explain the accounting for small and large

stock dividends, and for share splits.

4.

Describe the accounting for treasury

stock.

9.

Indicate how to present and analyze

stockholders’ equity.

5.

Explain the accounting for and reporting

of preferred stock.

15-66

Dividend Policy

Types of Dividends

1. Cash dividends.

3. Liquidating dividends.

2. Property dividends.

4. Stock dividends.

All dividends, except for stock dividends, reduce the total

stockholders’ equity in the corporation. All dividends, except

liquidating dividends, reduce retained earnings.

15-67

LO 7

Dividend Policy

Cash Dividends

Board of directors vote on the declaration of cash

dividends.

A declared cash dividend is a liability.

Companies do not

declare or pay cash

dividends on treasury

stock.

Three dates:

a. Date of declaration

b. Date of record

c. Date of payment

See http://seekingalpha.com/news/dividends

15-68

LO 7

Dividend Dates

Dividends require information concerning three dates:

The Ex-Dividend Date is two business days before the date of

record. This is the date on which anyone acquiring the stock does

not get the dividend. In this example, it is Dec. 18.

See http://seekingalpha.com/news/dividends

15-69

15-70

70

Dividend Policy

Illustration: David Freight Corp. on June 10 declared a cash dividend

of 50 cents a share on 1.8 million shares payable July 16 to all

stockholders of record June 24.

At date of declaration (June 10)

Retained Earnings

900,000

Dividends Payable

At date of record (June 24)

900,000

No entry

At date of payment (July 16)

Dividends Payable

Cash

15-71

900,000

900,000

LO 7

Property Dividend

Property Dividends

Dividends

payable in

assets other

than cash.

Restate at fair

value the

property it will

distribute,

recognizing any

gain or loss.

15-72

Dividend Policy

Types of Dividends

1. Cash dividends.

3. Liquidating dividends.

2. Property dividends.

4. Stock dividends.

All dividends, except for stock dividends, reduce the total

stockholders’ equity in the corporation. All dividends, except

liquidating dividends, reduce retained earnings.

15-73

LO 7

Property Dividend

Illustration: A dividend is declared Jan. 5th and paid

Jan. 25th, in bonds held as an investment; the bonds have

a book value of $100,000 and a fair market value of

$135,000.

Debit

Date of Declaration

Investment in bonds

Gain on investment

35,000

and

Retained earnings

Property dividend payable

135,000

Credit

35,000

135,000

Date of Issuance

Property dividend payable

Investment in bonds

15-74

135,000

135,000

LO 7 Identify the various forms of dividend distributions.

Dividend Policy

Types of Dividends

1. Cash dividends.

3. Liquidating dividends.

2. Property dividends.

4. Stock dividends.

All dividends, except for stock dividends, reduce the total

stockholders’ equity in the corporation. All dividends, except

liquidating dividends, reduce retained earnings.

15-75

LO 7

Liquidating Dividends

Liquidating Dividends

Any dividend not based on earnings that reduces

corporate paid-in capital.

A liquidating dividend, which is paid out of

additional paid-in capital, is the only dividend not

paid out of retained earnings.

Is called “liquidating” because owners are

receiving some of their original capital back,

thus liquidating their investment

15-76

LO 7 Identify the various forms of dividend distributions.

Dividend Policy

Illustration: Horaney Mines Inc. issued a “dividend” to its common

stockholders of $1,200,000. The cash dividend announcement noted

stockholders should consider $900,000 as income and the remainder a

return of capital. Horaney Mines records the dividend as follows.

Date of declaration

Retained Earnings

900,000

Paid-in Capital in Excess of Par-Common

300,000

Dividends Payable

1,200,000

Date of payment

Dividends Payable

Cash

15-77

1,200,000

1,200,000

LO 7

15

Stockholders’ Equity

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1.

Discuss the characteristics of the

corporate form of organization.

6.

Describe the policies used in distributing

dividends.

2.

Identify the key components of

stockholders’ equity.

7.

Identify the various forms of dividend

distributions.

3.

Explain the accounting procedures for

issuing shares of stock.

8.

Explain the accounting for small and large

stock dividends, and for share splits.

4.

Describe the accounting for treasury

stock.

9.

Indicate how to present and analyze

stockholders’ equity.

5.

Explain the accounting for and reporting

of preferred stock.

15-78

Stock Dividends

Reasons why corporations issue stock dividends:

1. To achieve the same effect as a stock split,

which is to lower the share price to within a

popular trading range.

2. To satisfy stockholders’ dividend expectations

without spending cash.

3. To increase the marketability of the corporation’s

stock.

4. To emphasize that a portion of stockholders’

equity has been permanently reinvested in the

business.

15-79

Stock Dividends

Pro rata distribution of the corporation’s own stock.

Results in decrease in retained earnings and increase in paid-in

capital (called capitalization of retained earnings)

15-80

Effect of Stock

Dividend

10% Stock

Before

Total Stkhlders' Equity $

# shares

Price per share

Your shares

Price per share

1,500,000

100,000

$

Dividend

$ 1,500,000

10,000

15.00

100

$

15.00

TL value of your shares $

1,500.00

110,000

$

10

CONCLUSION: you have more shares, each worth

proportionately less; NO CHANGE IN WEALTH

15-81

After

13.64

110

$

13.64

$ 1,500.00

Stock Dividends

Stock Dividends Are:

When a stock dividend is more than 20-25% (large stock

dividend), it essentially serves as a stock split and thus is

done at par value, not market value.

When a stock dividend is less than 20–25 percent of the

common shares outstanding, company transfers fair

market value from retained earnings (small stock

dividend).

O% to 20%

SMALL

15-82

20% to 25%

NO MAN’S LAND

25% TO 100%+

LARGE

Small Stock Dividend

Illustration: HH Inc. has 5,000 shares issued and

outstanding. The per share par value is $1, book value

$32 and market value is $40.

10% stock dividend is declared

Debit

Retained earnings

20,000

Common stock dividend distributable

Additional paid-in capital

Credit

500

19,500

Stock issued

Common stock div. distributable

Common stock

15-83

500

500

LO 8 Explain the accounting for small and large stock

dividends, and for stock splits.

Large Stock Dividend

Illustration: HH Inc. has 5,000 shares issued and

outstanding. The per share par value is $1, book

value $32 and market value is $40.

50% stock dividend is declared

Retained earnings

Common stock dividend distributable

Debit

2,500

Credit

2,500

Stock issued

Common stock dividend distributable

Common stock

15-84

2,500

2,500

LO 8 Explain the accounting for small and large stock

dividends, and for stock splits.

Stock Dividend vs. Split

Stock Split and Stock Dividend Differentiated

If the stock dividend is large, it has the same effect on

market price as a stock split.

A stock dividend of more than 20–25 percent of the

number of shares previously outstanding is called a large

stock dividend.

With a large stock dividend, transfer from retained

earnings to capital stock the par value of the stock

issued.

15-85

LO 8 Explain the accounting for small and large stock

dividends, and for stock splits.

Dividend Policy

Stock Split

To reduce the market value of shares.

No entry recorded for a stock split.

Decrease par value and increase number of shares.

Illustration 15-10

15-86

LO 8

SPLITSVILLE

WHAT’S

YOUR PRINCIPLE

15-87

LO 8

Stock Splits

• typically two-for-one, which would double the number of shares,

each share worth half as much as before, thus generating no real

economic value.

• does not change any components of stockholders' equity except the

number of shares increases, the par value decreases. The market

value should remain the same – it simply divides the pie into more

pieces but the pie stays the same size in total.

• however, usually viewed as a positive signal. Studies show that

stocks that split have returns outperforming those that don't.

Obviously, stocks would only split when their value has been rising

significantly.

• reasons for splits:

(1) popular trading range, where shares are traded for cheaper

commissions in round lots (100 shares)

(2) sends a positive signal

(3) benefits brokers and others who make their living processing

stock transactions

• Going against the grain: consider Warren Buffet and his BerkshireHathaway stock (BRKA).

15-88

Stock Split

Illustration: HH Inc. has 5,000 shares issued and

outstanding. The per share par value is $1, book

value $32 and market value is $40.

2 for 1 Stock Split

No Entry -- Disclosure that par is now $.50 and

shares outstanding are 10,000.

15-89

LO 8 Explain the accounting for small and large stock

dividends, and for stock splits.

Reverse Splits

• results in less shares each worth more; not as common as

forward stock splits

• reasons for reverse stock splits:

(1) avoid penny stock labels; however this can be viewed as

additional bad news (e.g. when Webvan, a now defunct internet

grocer, did a 1-for-25 reverse stock split)

(2) increase marketability of stock when price is within popular

trading range

(3) force out small shareholders to gain control (e.g. in 1-for-3000

reverse split, anyone owning less than 3000 shares will end up

with a partial share and their investment will be liquidated. Then

the company can undergo a 1-for-3000 stock split to restore the

stock to its original price!)

(4) meet minimum stock prices required on some exchanges

(Nasdaq de-lists stocks with prices less than $1 for 30 days). But

some exchanges have rules that preclude reverse stock splits for

this purpose.

(5) reduce trading costs to investors

15-90

Dividend Policy

Illustration: Luna Steel, Inc. declared a 30 percent share dividend on

November 20, payable December 29 to stockholders of record

December 12. At the date of declaration, 1,000,000 shares, par value

$10, are outstanding and with a fair value of $200 per share. The

entries are:

15-91

LO 8

15-92

DIVIDENDS UP, DIVIDENDS DOWN

15-93

LO 8

Dividend Policy

Restrictions on Retained Earnings

Restrictions are best disclosed by note.

Restrictions may be based on the retention of a certain

retained earnings balance, the ability to maintain certain

working capital requirements, additional borrowing, and

other considerations.

Illustration 15-12

Disclosure of Restrictions on

Retained Earnings and Dividends

15-94

LO 8

Summary of Dividend Entries

15-95

15

Stockholders’ Equity

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1.

Discuss the characteristics of the

corporate form of organization.

6.

Describe the policies used in distributing

dividends.

2.

Identify the key components of

stockholders’ equity.

7.

Identify the various forms of dividend

distributions.

3.

Explain the accounting procedures for

issuing shares of stock.

8.

Explain the accounting for small and large

stock dividends, and for share splits.

4.

Describe the accounting for treasury

stock.

9.

Indicate how to present and analyze

stockholders’ equity.

5.

Explain the accounting for and reporting

of preferred stock.

15-96

Presentation and Analysis of Equity

Presentation

15-97

Illustration 15-13

LO 9

Presentation and Analysis of Equity

Statement of Stockholders’ Equity

Illustration 15-14

15-98

LO 9

Presentation and Analysis of Equity

Analysis

Analysts use stockholders’ equity ratios to evaluate a

company’s profitability and long-term solvency.

Three ratios:

1. Rate of return on common stock equity.

2. Payout ratio.

3. Book value per share.

15-99

LO 9

Analysis

Rate of Return on Common Stock Equity

Illustration: Marshall's Inc. had net income of $360,000, declared

and paid preferred dividends of $54,000, and average common

stockholders’ equity of $2,550,000.

Illustration 15-15

Ratio shows how many dollars of net income the company earned

for each dollar invested by the owners.

15-100

LO 9

Analysis

Payout Ratio

Illustration: Midgley Co. has cash dividends of $100,000 and net

income of $500,000, and no preferred stock outstanding.

Illustration 15-16

In the fourth quarter of 2011, 36 percent of the earnings of the

S&P 500 was distributed via dividends.

15-101

LO 9

Analysis

Book Value per Share

Illustration: Uretz Corporation’s common stockholders’ equity is

$1,000,000 and it has 100,000 shares of common stock outstanding

Illustration 15-17

Amount each share would receive if the company were liquidated

on the basis of amounts reported on the balance sheet.

15-102

LO 9

APPENDIX

15A

DIVIDEND PREFERENCES AND BOOK VALUE

PER SHARE

Dividend Preferences

Illustration: In 2014, Mason Company is to distribute $50,000 as

cash dividends, its outstanding common stock have a par value of

$400,000, and its 6 percent preferred stock have a par value of

$100,000.

1. If the preferred stock are noncumulative and nonparticipating:

Illustration 15A-1

15-103

LO 10 Explain the different types of preferred stock dividends

and their effect on book value per share.

APPENDIX

15A

DIVIDEND PREFERENCES AND BOOK VALUE

PER SHARE

Illustration: In 2014, Mason Company is to distribute $50,000 as

cash dividends, its outstanding common stock has a par value of

$400,000, and its 6 percent preferred stock has a par value of

$100,000.

2. If the preferred stock is cumulative and non-participating, and

Mason Company did not pay dividends on the preferred stock in

the preceding two years:

Illustration 15A-2

15-104

LO 10

APPENDIX

15A

DIVIDEND PREFERENCES AND BOOK VALUE

PER SHARE

3. If the preferred stock is noncumulative and is fully participating:

Illustration 15A-3

15-105

LO 10

APPENDIX

15A

DIVIDEND PREFERENCES AND BOOK VALUE

PER SHARE

Illustration: In 2014, Mason Company is to distribute $50,000 as

cash dividends, its outstanding common stock has a par value of

$400,000, and its 6 percent preferred stock has a par value of

$100,000.

4. If the preferred stock is cumulative and fully participating, and

Mason Company did not pay dividends on the preferred stock in

the preceding two years:

Illustration 15A-4

15-106

LO 10

APPENDIX

15A

DIVIDEND PREFERENCES AND BOOK VALUE

PER SHARE

Book Value Per Share

Book value per share is computed as net assets divided by

outstanding stock at the end of the year. The computation becomes

more complicated if a company has preferred stock.

Illustration 15A-5

15-107

LO 10

APPENDIX

15A

DIVIDEND PREFERENCES AND BOOK VALUE

PER SHARE

Assume that the same facts exist except that the 5 percent preferred

stock is cumulative, participating up to 8 percent, and that dividends

for three years before the current year are in arrears.

Illustration 15A-6

15-108

LO 10

RELEVANT FACTS - Similarities

15-109

The accounting for the issuance of shares and purchase of treasury

stock are similar under both IFRS and GAAP.

The accounting for declaration and payment of dividends and the

accounting for stock splits are similar under both IFRS and GAAP.

LO 11 Compare the procedures for accounting for

stockholders’ equity under GAAP and IFRS.

RELEVANT FACTS - Differences

15-110

Major differences relate to terminology used, introduction of concepts

such as revaluation surplus, and presentation of stockholders’ equity

information.

Many countries have different investor groups than the United States.

For example, in Germany, financial institutions like banks are not only

the major creditors but often are the largest shareholders as well.

The accounting for treasury share retirements differs between IFRS and

GAAP. Under GAAP, a company has three options: (1) charge the

excess of the cost of treasury shares over par value to retained

earnings, (2) allocate the difference between paid-in capital and retained

earnings, or (3) charge the entire amount to paid-in capital. Under IFRS,

the excess may have to be charged to paid-in capital, depending on the

original transaction related to the issuance of the shares.

LO 11

RELEVANT FACTS - Differences

15-111

The statement of changes in equity is usually referred to as the

statement of stockholders’ equity (or shareholders’ equity) under GAAP.

Both IFRS and GAAP use the term retained earnings. However, IFRS

relies on the term “reserve” as a dumping ground for other types of

equity transactions, such as other comprehensive income items as well

as various types of unusual transactions related to convertible debt and

share option contracts. GAAP relies on the account Accumulated Other

Comprehensive Income (Loss).

Under IFRS, it is common to report “revaluation surplus” related to

increases or decreases in items such as property, plant, and equipment;

mineral resources; and intangible assets. The term surplus is generally

not used in GAAP. In addition, unrealized gains on the above items are

not reported in the financial statements under GAAP.

LO 11

ON THE HORIZON

The IASB and the FASB are currently working on a project related to financial

statement presentation. An important part of this study is to determine whether

certain line items, subtotals, and totals should be clearly defined and required

to be displayed in the financial statements. For example, it is likely that the

statement of changes in equity and its presentation will be examined closely. In

addition, the options of how to present other comprehensive income under

GAAP will change in any converged standard.

15-112

LO 11

IFRS SELF-TEST QUESTION

Under IFRS, the amount of capital received in excess of par value

would be credited to:

a. Retained Earnings.

b. Contributed Capital.

c.

Share Premium.

d. Par value is not used under IFRS.

15-113

LO 11

IFRS SELF-TEST QUESTION

The term reserves is used under IFRS with reference to all of the

following except:

a. gains and losses on revaluation of property, plant, and

equipment.

b. capital received in excess of the par value of issued shares.

c.

retained earnings.

d. fair value differences.

15-114

LO 11

IFRS SELF-TEST QUESTION

Under IFRS, a purchase by a company of its own shares results in:

a. an increase in treasury shares.

b. a decrease in assets.

c.

a decrease in equity.

d. All of the above.

15-115

LO 11

Copyright

Copyright © 2013 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Copyright Act without the

express written permission of the copyright owner is unlawful.

Request for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc. The purchaser

may make back-up copies for his/her own use only and not for

distribution or resale. The Publisher assumes no responsibility for

errors, omissions, or damages, caused by the use of these

programs or from the use of the information contained herein.

15-116