4) Characteristic Line the relationship between return of the stock

advertisement

ISSN NO.: 2320-8236 Vol: 2, Issue: 4

IJRSMS

1 Empirical Study on Effects of Enterprise Governance on

Organizational

Dr M Arif Khattak, Dr Syed Umar Farooq, Shehiryar Ahmed,

2 A Study On “Financial Inclusion – Just a Buzzword or a Reality”

Dr. Suresh Chandra Bihari, Nihar Ranjan Samal

3 A study on trust in online shopping of youth in Pune: A factor

analysis

Vinay Kumar, Dr. Ujwala Dange

4 A Comparative Analysis of the Financial Ratios of Selected Banks in the

India for the period of 2011-2014

Rohit Bansal

5 Characteristic Line the relationship between return of the stock and the

market: A study with reference to selected companies in the Indian

Stock Market

Neeraj Gupta, Dr. Anil Vashisht, Ashwin Gedam

6 Risk and Return Strategy in Indian Stock market- A study on selected

portfolio

Anubhav Srivastava

7 Marital Satisfaction and Well Being Among Fraternal Polyandrous and

Monogamous Tribal People of Kinnaur

Sunder Kala Negi, Hoshiar Singh

8 Impact of occupational stress on job involvement in nursing

personnel

Dr. Deepa Pandey

9 Entrepreneurship in Health Care With Special Reference to Kerala State

SHYNI. MC

10 Employee Job Satisfaction: A Review of Literature

Prof(Dr) Ipseeta Satpathy, Dr.Sasmita Mishra, Monalisa Mohapatra

11 Antisocial and Imperative Behavior In Adolescents: A Threat to Social

Well Being

Anu Teotia

12 Analysis of Literature to Deduce the Determinants of Organizational

Citizenship Behavior

NIHARIKA SINGH, DR. BAJRANG D. KOLEKAR

13 An Introduction to Consumer Neuro-Marketing

Dr. Ankur Goutam

14 A Conceptual Study to Know the Relationship between Information

Technology and Human Resource Information Systems

Dr. Vibha Gupta, Ms. Sylvia R. Masih

15 Problems and Suggestions Regarding SHGs – A Case study of Mewat

District of Haryana

Parul Mittal

16 A study about poverty conditions and food consumption pattern among

pregnant women residing in urban slums of Varanasi district

Kalpna Gupta, Sadhana Singh Rajpoot

17 OTC Drug Promotion: Awareness and Attitude Among Indian

Consumers

Vipender Khatik

18 A Saga of Dr. Swaminathan’s Disillusionment: A Case Study

Dr. Bharti Venkatesh

19 Challenges and Opportunities of E-Commerce and Its Role in

Management Education in India

Dr. Rajesh Sharma

20 A Comparative Study of Non Performing Assets Management of Selected

Units W.r.t. HDFC & PNB

Dr. Praveen Choudhury, Prof. Apoorv Bhatnagar

21 Terrorism ; Role Of Technology And Globalization

Dr Nisar Ahmad Meer

22 Sociological Profile Of Women Prisoners In Jammu And

kashmir

Shahid Ul Mushtaq

23 Advent And Establishment Of Islam In Kashmir: Chronicles In Kashmir

History

Muzafar Ahmad Mir

24 Early Life Of Sultan Sikandar; Advent, Reign And Succession

Muzafar Ahmad Mir

25 Energy Security Being a State Security

Dr Nisar Ahmad Meer

Oct-Dec, 2014

ISSN: 2320-8236

VOLUME: 2, ISSUE:4

OCTOBER- DECEMBER 2014

www.ircjournals.org

CONTENT

S.No

1

TITLE

Empirical Study on Effects of Enterprise Governance on Organizational

2

A Study On “Financial Inclusion – Just a Buzzword or a Reality”

3

A study on trust in online shopping of youth in Pune: A factor analysis

4

A Comparative Analysis of the Financial Ratios of Selected Banks in the

India for the period of 2011-2014

5

Characteristic Line the relationship between return of the stock and the

market: A study with reference to selected companies in the Indian Stock

Market

Risk and Return Strategy in Indian Stock market- A study on selected

portfolio

Marital Satisfaction and Well Being Among Fraternal Polyandrous and

Monogamous Tribal People of Kinnaur

Impact of occupational stress on job involvement in nursing personnel

Entrepreneurship in Health Care With Special Reference to Kerala State

Employee Job Satisfaction: A Review of Literature

6

7

8

9

10

11

23

24

25

Antisocial and Imperative Behavior In Adolescents: A Threat to Social Well

Being

Analysis of Literature to Deduce the Determinants of Organizational

Citizenship Behavior

An Introduction to Consumer Neuro-Marketing

A Conceptual Study to Know the Relationship between Information

Technology and Human Resource Information Systems

Problems and Suggestions Regarding SHGs – A Case study of Mewat

District of Haryana

A study about poverty conditions and food consumption pattern among

pregnant women residing in urban slums of Varanasi district

OTC Drug Promotion: Awareness and Attitude Among Indian Consumers

Challenges and Opportunities of E-Commerce and Its Role in Management

Education in India

A Comparative Study of Non Performing Assets Management of Selected

Units W.r.t. HDFC & PNB

Terrorism ; Role Of Technology And Globalization

Sociological Profile Of Women Prisoners In Jammu And Kashmir

Advent And Establishment Of Islam In Kashmir: Chronicles In Kashmir

History

Early Life Of Sultan Sikandar; Advent, Reign And Succession

Energy Security Being a State Security

Manage the Library with Strategic Management

26

Contemporary Issues in E-Tailing

27

A Saga of Dr. Swaminathan’s Disillusionment: A Case Study

12

13

14

15

16

17

18

19

20

21

22

AUTHOR’s

Dr M Arif Khattak,

Dr Syed Umar Farooq,

Shehiryar Ahmed,

Dr. Suresh Chandra

Bihari

Nihar Ranjan Samal

Vinay Kumar

Dr. Ujwala Dange

Rohit Bansal

Page No.

1-6

Neeraj Gupta

Dr. Anil Vashisht

Ashwin Gedam

Anubhav Srivastava

36 - 41

Sunder Kala Negi

Hoshiar Singh

Dr. Deepa Pandey

SHYNI. MC

Prof(Dr) Ipseeta

Satpathy

Dr.Sasmita Mishra

Monalisa Mohapatra

Anu Teotia

47 - 57

Niharika Singh

Dr. Bajrang Kolekar

Dr. Ankur Goutam

Dr. Vibha Gupta

Ms. Sylvia R. Masih

Parul Mittal

80 - 88

7 - 18

19-23

24 - 35

42 - 46

58- 64

65 - 70

71 - 74

75 - 79

89 - 95

96 - 99

100 - 107

Kalpna Gupta

Sadhana Singh Rajpoot

Vipender Khatik

Dr. Rajesh Sharma

108 - 111

Dr. Praveen Choudhury

Prof. Apoorv Bhatnagar

Dr Nisar Ahmad Meer

Shahid Ul Mushtaq

Muzafar Ahmad Mir

118 - 122

Muzafar Ahmad Mir

Dr Nisar Ahmad Meer

Nawal Kisor Manoj, Dr.

Manoj Kumar Sinha

Babita Singla,

Dr. Manish Bansal

Dr. Bharti Venkatesh

132 - 135

136 - 137

138 - 141

112 - 114

115 - 117

123 - 124

125 - 128

129 - 131

142 - 147

148

7

ISSN: 2320-8236

VOLUME: 2, ISSUE:4

OCTOBER- DECEMBER 2014

www.ircjournals.org

Characteristic Line, The relationship between return of the stock and the

market: A study with reference to selected companies in the Indian stock

market

Neeraj Gupta

Dr. Anil Vashisht

Assistant lecturer,

Amity Business School,

Amity University, Gwalior (M.P.)

Dy.Director &HOI,

Amity Business School, Amity University,

Gwalior, Madhya Pradesh

Ashwin Gedam

Student (MBA III Semester),

Amity Business School,

Amity University, Gwalior- M.P

Abstract:

Market risk and return are important parameters to consider while investing into a market. To evaluate it beta and alpha are used. Among

them beta is an important factor which is used to determine the systematic risk involved with a security. It is used to estimate the expected

return of a stock. Alpha (αi) is a risk-adjusted measure of a return on an investment. It is the return in excess of the compensation for the

risk borne (Howells and Bain 2005: 172). The characteristic line is a regression line showing the relationship between return of a security

and the return of the market. In this paper, we have found the characteristic line of different companies under study.

Keywords: beta; alpha; characteristic line; risk; market return; stock return

Introduction

To estimate the expected return on investments in the stock market is a challenging and tedious job before any ordinary investor. For

taking suitable investment decisions different market models and techniques are being used. The past behavior of the price of a security

and the share price index play a very important role in security analysis. The straight line showing the relationship between the rate of

return of a security and the rate of market return is known as the security’s characteristic line. The slope of the characteristic line is called

the security’s beta. The concept of beta introduced by Markowitz (1959) is being widely used to measure the systematic risk involved in

an investment.

1.1 Security Characteristic line and beta

Definition of 'Characteristic Line'

It is a line formed by using regression analysis that summarizes a particular security’s systematic risk and rate of return. The rate of return is

dependent on the slope of the characteristic line, which is represented by the asset's beta.

Empirical studies showed that there is a linear relation between the share price index ‘X’ and Y(security stock). Let (X1, Y1), (X2, Y2), …

(Xn, Yn) be ‘n’ observations relating to X and Y made at ‘n’ consecutive periods of time. If ‘x’ denotes the percentage rate of return of the

price index and ‘y’ denotes that of the security, then the values of x and y are given by:

𝑋𝑖 +1−𝑋𝑖

(𝑌𝑖 +1−𝑌𝑖 )

𝑥𝑖 =

∗ 100 And 𝑦𝑖 =

∗ 100,

𝑋𝑖

𝑌𝑖

for i = 1, 2, 3,…, n-1

The equation of the characteristic line can be written as

y=α+βx

……………………. (1)

Where α and β are constants. The slope of characteristic line β is the security’s beta. At present, beta is taken as the measure of the sensitivity

of the security’s price Y with respect to market changes.

1.2 Significance of Alpha

The alpha coefficient ( ) of the security refers to the expected excess return of the security over the expected rate of return (for example,

estimated by an equilibrium asset pricing model like the CAPM). It is the intercept of the security characteristic line (SCL). The alpha

coefficient indicates how an investment has performed after taking into consideration the risk involved. This is an assessment of alpha, if,

I.

Alpha(α) less than zero: the investment has earned too little for its risk (or, was too risky for the return)

II.

Alpha (α) equal to zero: the investment has earned a return adequate for the risk taken

III.

Alpha(α) greater than zero: the investment has a return in excess of the reward for the assumed risk

Alpha for the stock

Alpha for the stock (α) =Expected Return of the stock {E(A)}-Required Return {(A)} of the stock

The required rate of return can be calculated from the CAPM model, therefore, the Required Return (A) of the stock can be calculated as

Required Return (A) of the stock=Rf + β(Rm-Rf). …(2)

1.3 Significance of Beta

Beta is a measure of a stock's volatility in relation to the market. The market has a beta of 1.0, and individual stocks are ranked according to

how much they deviate from the market. A stock that swings more than the market over time has a beta above 1.0. If a stock moves less than

the market, the stock's beta is less than 1.0. High-beta stocks are supposed to be riskier but provide a potential for higher returns; low-beta

stocks pose less risk but also lower returns.

Here is a basic guide to various betas:

36

ISSN: 2320-8236

VOLUME: 2, ISSUE:4

OCTOBER - DECEMBER 2014

www.ircjournals.org

a. Negative beta: A beta less than 0, which would indicate an inverse relation to the market - is possible but highly unlikely. However,

some investors believe that gold and gold stocks should have negative betas because they tended to do better when the stock market

declines.

b. Beta of 0: Basically, cash has a beta of 0. In other words, regardless of which way the market moves, the value of cash remains

unchanged.

c. Beta between 0 and 1: Companies with volatilities lower than the market have a beta of less than 1 but more than 0.

d. Beta of 1: A beta of 1 represents the volatility of the given index used to represent the overall market, against which other stocks and

their betas are measured. The S&P 500 is such an index. If a stock has a beta of one, it will be in the same ratio and direction as the

index. So, an index fund that mirrors the S&P 500 will have a beta close to 1.

e. Beta greater than 1: This denotes a volatility that is greater than the broad-based index.

1.4 Characteristic line formation:

It is formed by taking realized excess return on market portfolio on X axis and the realized excess return on asset on Y axis. It is shown

in the following diagram (Fig1.):

Fig 1.

2. REVIEW OF LITERATURE

Blume (1971),Hamada (1972) and Alexander & Chervani (1980) challenged the stability of beta. They argued that beta varies over a

period of time. Black (1976) linked beta to leverage which changes owing to changes in the stock price. Mandelker & Rhee (1984)

related beta to decisions by the firm and thus a varying measure. The relationship between macro-economic variables and the firm’s

beta, as illustrated in the work of Rosenberg & Guy (1976) points to the varying character of beta. Since beta is evaluated as the

covariance between the stock returns and index returns, scaled down by the variance of the index returns and the index volatility is timevarying (Bollerslev et al. 1992), beta is not constant over a period of time. Roll et al (1994) point out the inefficiency of the CAPM for

estimating the expected returns using beta. The constancy nature of beta raises doubts about the suitability of using it as a measure of the

sensitivity of the security’s return corresponding to market returns. This led us to think of a suitable measure that reflects instantaneous

changes of the market. Even if x and y are related by (1), beta alone cannot be used to measure the sensitivity of the price of the security.

The parameter α also will play a major role unless its value is tested statistically insignificant.

Amongst many others, some studies of beta estimations concentrated on the stability of beta over time (Harvey 1989), an asset. The

studies on the impact of return interval on beta estimates point out the importance of the timescale issue. An early study by Levhari and

Levy (1977) shows that if the analyst uses a time horizon shorter than the true one, the beta estimates are biased. Handa (1989) report

that different beta estimates are possible for the same stock if different return intervals are considered.

3.OBJECTIVE OF STUDY

To find out the alpha of the stock

To find out the beta of the stock

To find out the characteristic line of the selected stock for finding out the relationship between the return of the stock and the

return of the market.

4.RESEARCH METHODOLOGY

The period of study is taken from 1st July 2014 to 31st July 2014 covering all the working days of the NSE.

The sources of data for research paper are mainly secondary which is collected from the websites, documents, which are in

printed form like annual reports etc.

For this paper following seven companies have been selected for the study:

Characteristic Line, The relationship between return of the stock and the market: A study with reference to selected companies

in the Indian stock

Neeraj Gupta, Dr. Anil Vashisht, Ashwin Gedam

37

ISSN: 2320-8236

VOLUME: 2, ISSUE:4

OCTOBER - DECEMBER 2014

www.ircjournals.org

Table 1.Sectorwise name of companies

S.no.

Sector

1

Software

2.

Power sector

3.

Automobile sector

4.

Pharmaceuticals

5.

Financial sector

6.

Food industry

7.

Textile sector

Name of the company

TCS ltd.

NTPC ltd.

TATA MOTORS

CIPLA ltd.

KOTAK Mahindra Bank

Nestle Ltd.

WELSPUN ltd.

No. of companies

1

1

1

1

1

1

1

5.RESEARCH PLAN

5.1 Determination of company’s stock return (denoted by Y %)

The return on individual company stock for each day is calculated as :

𝑐𝑙𝑜𝑠𝑖𝑛𝑔 𝑝𝑟𝑖𝑐𝑒 𝑜𝑓 𝑐𝑜𝑚𝑎𝑛 𝑦 ′ 𝑠

𝑠𝑡𝑜𝑐𝑘 𝑜𝑛 𝑠𝑒𝑐𝑜𝑛𝑑 𝑑𝑎𝑦 −𝑐𝑙𝑜𝑠𝑖𝑛𝑔 𝑝𝑟𝑖𝑐𝑒 𝑜𝑓 𝑐𝑜𝑚𝑝𝑎𝑛 𝑦 ′ 𝑠

𝑠𝑡𝑜𝑐𝑘 𝑜𝑛 𝑓𝑖𝑟𝑠𝑡 𝑑𝑎𝑦

𝑐𝑙𝑜𝑠𝑖𝑛𝑔 𝑝𝑟𝑖𝑐𝑒 𝑜𝑓 𝑐𝑜𝑚𝑝𝑎𝑛𝑦 ′𝑠𝑠𝑡𝑜𝑐𝑘 𝑜𝑛 𝑓𝑖𝑟𝑠𝑡 𝑑𝑎𝑦

∗ 100 ….(3)

5.2 Determination of market return (denoted by X %):

The return on NSE market for each day is calculated as:

𝑐𝑙𝑜𝑠𝑖𝑛𝑔 𝑝𝑟𝑖𝑐𝑒 𝑜𝑓 𝑚𝑎𝑟𝑘𝑒𝑡

𝑜𝑛 𝑠𝑒𝑐𝑜𝑛𝑑 𝑑𝑎𝑦 −𝑐𝑙𝑜𝑠𝑖𝑛𝑔 𝑝𝑟𝑖𝑐𝑒 𝑜𝑓 𝑚𝑎𝑟𝑘𝑒𝑡

𝑜𝑛 𝑓𝑖𝑟𝑠𝑡 𝑑𝑎𝑦

𝑐𝑙𝑜𝑠𝑖𝑛𝑔 𝑝𝑟𝑖𝑐𝑒 𝑜𝑓 𝑚𝑎𝑘𝑒𝑡 𝑜𝑛 𝑓𝑖𝑟𝑠𝑡 𝑑𝑎𝑦

*100………… (4)

5.3 Estimation of Beta (β):

Beta is calculated by using formula:

β=

∑𝑋𝑌 −𝑛𝑋 𝑚𝑒𝑎𝑛 𝑌 𝑚𝑒𝑎𝑛

∑𝑋 2 −𝑛 𝑋 𝑚𝑒𝑎𝑛 2

….. (5)

here ,

XY=product of individual stocks return with market index return

X(mean)=average of the market index return

Y(mean)=average of the companies stocks return

n=total number of working days

5.4 Estimation of Alpha (α):

Alpha is calculated by using formula:

𝛼 = 𝑌 𝑚𝑒𝑎𝑛 − 𝛽𝑋 𝑚𝑒𝑎𝑛

here, X(mean)= average of the market return

Y(mean)= average of the companies stocks return

β =systematic risk

…..(6)

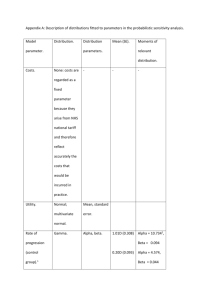

6. DATA EVALUATION AND FINDINGS

Table2.

Company C

TCS

NTPC

TATA MOTORS

CIPLA Ltd.

KOTAK Bank

NESTLE

WELSPUN

Y(mean)

0.374

-0.286

-0.025

0.210

0.371

0.188

1.284

XY(sum)

8.509

22.640

19.705

6.238

11.279

6.560

19.261

Beta

0.551

1.576

1.352

0.409

0.741

0.433

1.209

Alpha

0.342

-0.375

-0.102

0.186

0.328

0.163

1.215

The characteristic lines of the companies are as follows:

TCS: Y= 0.342+0.551X

NTPC: Y= -0.375+1.576X

TATA MOTORS: Y= -0.102+1.352X

CIPLA pharmaceuticals: Y= 0.186+0.409X

Characteristic Line, The relationship between return of the stock and the market: A study with reference to selected companies

in the Indian stock

Neeraj Gupta, Dr. Anil Vashisht, Ashwin Gedam

38

ISSN: 2320-8236

VOLUME: 2, ISSUE:4

OCTOBER - DECEMBER 2014

www.ircjournals.org

KOTAK MAHINDRA bank: Y= 0.328+0.741X

NESTLE ltd.: Y= 0.163+0.433X

WELSPUN Ltd.: Y= 1.215+1.209X

7. INFERENCES

Table3. Inferences from the characteristic line obtained of companies

Beta

0<β<1

β>1

>0

α inference

the investment has a return in excess of the reward for the assumed risk

the investment has earned too little for its risk (or, was too risky for the

return)

the investment has earned too little for its risk (or, was too risky for the

return)

the investment has a return in excess of the reward for the assumed risk

0<β<1

β inference

volatility lower than the market

Volatility that is greater than the broadbased index. (risky stock)

Volatility is greater than the broad-based

index.(risky stock)

volatility lower than the market

>0

the investment has a return in excess of the reward for the assumed risk

0<β<1

Volatility lower than the market

>0

>0

the investment has a return in excess of the reward for the assumed risk

the investment has a return in excess of the reward for the assumed risk

0<β<1

β>1

volatility lower than the market

Volatility is greater than the broad-based

index.(risky stock)

Company name

TCS

NTPC Ltd.

Alpha

>0

<0

TATA MOTORS

<0

CIPLA

pharmaceuticals

KOTAK

MAHINDRA

NESTLE Ltd.

WELSPUN

India Ltd.

β>1

8.LIMITATIONS

1. The value of the beta change over a period of time. Therefore, the return of the stock calculated using the characteristic line may not

be same always.

2. The period of study is small therefore more scope of changes in characteristic line is always there.

9. CONCLUSION

The beta of the NTPC Ltd., TATA motors Ltd. and the WELSPUN Ltd is more than one therefore they are high risky stocks as

compared to the market. The characteristic line of the selected stock has been found by putting the values of α and β in the equation

y=α+βx . The return of the selected stocks can be found out by putting value of the market return in their respective characteristic line.

10. APPENDIX

Table4.TCS data

Date

1-july-14

2-july-14

3-july-14

4-july-14

7-july-14

8-july-14

9- july-14

10 july-14

11 july-14

14 july-14

15 july-14

16 july-14

17 july-14

18 july-14

21 july-14

22 july-14

23 july-14

24 july-14

25 july-14

28 july-14

30 july-14

31 july-14

Closing

price of

TCS

2390.75

2401.6

2417.9

2410.5

2488.55

2449.45

2398.15

2351.8

2394.45

2426.25

2399.3

2401.85

2381.95

2441.2

2463.75

2532.4

2586.15

2595.2

2605.75

2589.3

2595.05

2580.05

Table5.NTPC limited data

Market return of TCS

(Y)%

0.453832

0.678714

-0.30605

3.237917

-1.5712

-2.09435

-1.93274

1.813505

1.328071

-1.11077

0.106281

-0.82853

2.487458

0.923726

2.786403

2.122492

0.349941

0.40652

-0.6313

0.222068

-0.57802

Mean Y=0.374,

sum=7.863

Date

1-july-14

2-july-14

3-july-14

4-july-14

7-july-14

8-july-14

9- july-14

10 july-14

11 july-14

14 july-14

15 july-14

16 july-14

17 july-14

18 july-14

21 july-14

22 july-14

23 july-14

24 july-14

25 july-14

28 july-14

30 july-14

31 july-14

Closing

price of

NTPC ltd.

154.6

159.75

157.35

158.55

161.35

153

150.65

151.15

149.7

147.8

145.6

146.65

150.4

149.7

148

149.85

149.6

149.7

148.95

149.05

149.8

145.05

Market return of

NTPC ltd.(Y%)

3.331177

-1.50235

0.762631

1.766004

-5.17509

-1.53595

0.331895

-0.95931

-1.26921

-1.4885

0.721154

2.557109

-0.46543

-1.1356

1.25

-0.16683

0.066845

-0.501

0.067137

0.503187

-3.17089

Mean Y= -0.286 ,

Sum= -6.013

Characteristic Line, The relationship between return of the stock and the market: A study with reference to selected companies

in the Indian stock

Neeraj Gupta, Dr. Anil Vashisht, Ashwin Gedam

39

ISSN: 2320-8236

VOLUME: 2, ISSUE:4

OCTOBER - DECEMBER 2014

Table6.TATA MOTORS data

Date

Closing price of

TATA MOTORS

1-july-14

2-july-14

3-july-14

4-july-14

7-july-14

8-july-14

9- july-14

10 july-14

11 july-14

14 july-14

15 july-14

16 july-14

17 july-14

18 july-14

21 july-14

22 july-14

23 july-14

24 july-14

25 july-14

28 july-14

30 july-14

31 july-14

450.8

455.8

469.75

469.45

478.85

470

457.25

453.15

445.95

456

462.9

470.3

475.3

475.3

474.95

486.7

484.85

485.25

461.1

453.85

451.35

446.75

Table7.CIPLA pharmaceuticals data

Market return of

TATA MOTORS

(Y)%

1.109139

3.060553

-0.06386

2.002343

-1.84818

-2.71277

-0.89666

-1.58888

2.253616

1.513158

1.598617

1.063151

0

-0.07364

2.473945

-0.38011

0.0825

-4.97682

-1.57233

-0.55084

-1.01916

Mean =-0.025,

sum=-0.526

Table8.KOTAK MAHINDRA BANK

Date

1-july-14

2-july-14

3-july-14

4-july-14

7-july-14

8-july-14

9- july-14

10 july-14

11 july-14

14 july-14

15 july-14

16 july-14

17 july-14

18 july-14

21 july-14

22 july-14

23 july-14

24 july-14

25 july-14

28 july-14

30 july-14

31 july-14

Closing

price of

KOTAK

BANK

884.35

893.15

891.2

882.2

870.9

872.25

864.25

866.45

858.35

855.35

871.55

885.05

914.9

935.85

941.2

949.2

932.8

938.65

944.7

941.2

974.25

953.7

www.ircjournals.org

Market return of

KOTAK bank

0.995081

-0.21833

-1.00987

-1.28089

0.155012

-0.91717

0.254556

-0.93485

-0.34951

1.893962

1.548964

3.372691

2.289868

0.571673

0.849979

-1.72777

0.627144

0.644543

-0.37049

3.511475

-2.10931

Mean = 0.371,

sum=7.796

Date

1-july-14

2-july-14

3-july-14

4-july-14

7-july-14

8-july-14

9- july-14

10 july-14

11 july-14

14 july-14

15 july-14

16 july-14

17 july-14

18 july-14

21 july-14

22 july-14

23 july-14

24 july-14

25 july-14

28 july-14

30 july-14

31 july-14

Closing

price of

CIPLA

437.25

444.3

447.7

449.3

449.65

442

436.25

436.05

436

432.65

431.85

432.15

437.05

441.35

438.3

441.25

442

439.55

445.65

440.95

448.2

456.5

Table9.NESTLE Ltd. data:

Date

Closing

price of

NESTLE

1-july-14

4933.85

2-july-14

4989.40

3-july-14

4997.95

4-july-14

4973.95

7-july-14

5022.90

8-july-14

4983.20

9- july-14

5007.00

10 july-14

4954.35

11 july-14

4992.00

14 july-14

4957.70

15 july-14

4946.50

16 july-14

4970.55

17 july-14

4994.80

18 july-14

5012.80

21 july-14

5038.55

22 july-14

5203.00

23 july-14

5171.80

24 july-14

5149.10

25 july-14

5166.00

28 july-14

5186.60

30 july-14

5181.85

31 july-14

5128.35

Market return of

CIPLA (Y)%

1.61235

0.765249

0.357382

0.077899

-1.70132

-1.3009

-0.04585

-0.01147

-0.76835

-0.18491

0.069469

1.133866

0.983869

-0.69106

0.673055

0.169972

-0.5543

1.387783

-1.05464

1.644177

1.851852

Mean = 0.210,

sum=4.414

Market return on

NESTLE (Y)%

1.125896

0.171363

-0.4802

0.984127

-0.79038

0.477605

-1.05153

0.759938

-0.6871

-0.22591

0.486202

0.487874

0.360375

0.513685

3.263836

-0.59965

-0.43892

0.328213

0.398761

-0.09158

-1.03245

Mean = 0.188,

sum=3.960

Characteristic Line, The relationship between return of the stock and the market: A study with reference to selected companies

in the Indian stock

Neeraj Gupta, Dr. Anil Vashisht, Ashwin Gedam

40

ISSN: 2320-8236

VOLUME: 2, ISSUE:4

OCTOBER - DECEMBER 2014

Table10.WELSPUN India limited data

DATE

Closing

Market return on

price of

WELSPUN Ltd.(Y)%

WELSPUN

1-july-14

183.85

2-july-14

193

4.976883

3-july-14

196.85

1.994819

4-july-14

206.65

4.97841

7-july-14

216.95

4.984273

8-july-14

221.75

2.212491

9- july-14

215.8

-2.6832

10 july-14

211.65

-1.92308

11 july-14

203.6

-3.80345

14 july-14

207.2

1.768173

15 july-14

209.3

1.013514

16 july-14

204.55

-2.26947

17 july-14

207.15

1.271083

18 july-14

205.3

-0.89307

21 july-14

215.55

4.992694

22 july-14

221.45

2.737184

23 july-14

220.7

-0.33868

24 july-14

231.7

4.984141

25 july-14

234.55

1.230039

28 july-14

232.3

-0.95928

30 july-14

239.75

3.20706

31 july-14

238.55

-0.50052

Mean Y=1.284,

sum=26.980

www.ircjournals.org

Date

1-july-14

2-july-14

3-july-14

4-july-14

7-july-14

8-july-14

9- july-14

10 july-14

11 july-14

14 july-14

15 july-14

16 july-14

17 july-14

18 july-14

21 july-14

22 july-14

23 july-14

24 july-14

25 july-14

28 july-14

30 july-14

31 july-14

Table11.NSE data

Closing

Market return of

price of

NSE (X)%

NSE

7634.7

7725.15

1.184722

7714.8

-0.13398

7751.6

0.477005

7787.15

0.458615

7623.2

-2.10539

7585

-0.5011

7567.75

-0.22742

7459.6

-1.42909

7454.15

-0.07306

7526.65

0.972613

7624.4

1.298719

7640.45

0.210508

7663.9

0.306919

7684.2

0.264878

7767.85

1.088597

7795.75

0.359173

7830.6

0.447038

7790.45

-0.51273

7748.7

-0.53591

7791.4

0.55106

7721.3

-0.89971

Mean

X=0.057,sum=1.201

X^2

1.403567

0.01795

0.227534

0.210328

4.432674

0.251103

0.051721

2.0423

0.005338

0.945975

1.68667

0.044314

0.094199

0.07016

1.185044

0.129005

0.199843

0.262894

0.287202

0.303667

0.809478

Sum=14.660

REFERENCES

[1] Antony, Jeevanand(2011), The Elasticity of the Price of Stock and its Beta, Journal of Applied Quantitative Methods,Vol.2(No.3); 2007.

[2] Dr.George Thomas, Bainy George ,An empirical Analysis Of Beta in Indian Stock Market,Abhinav National monthly Refereed Journal of Research in

Commerce and Management, Vol.no.1,Issue no.10.

[3] Muhammad Junaid Iqbal, Dr. Syed Zulfiqar Ali Shah, Determinants Of Systematic Risk Journal of Economics Volume-4, No.1, ISSN- 2218- 8118-2220-6043.

[4] Mandimika Neville, Volatility and the Risk-Return Relationship on the South African Equity Market, Thesis work, DEPARTMENT OF ECONOMICS AND

ECONOMIC HISTORY RHODES UNIVERSITY, GRAHAMSTOWN.

[5] Ramazan Gen¸cay, Faruk Sel¸cuk and Brandon Whitcher, Systematic risk and timescales. QUANTITATIVE FINANCE VOLUME 3 (2003) 108–116

REFERENCE LINKS

http://upload.wikimedia.org/wikipedia/commons/4/43/SCL-plot.PNG

http://financialdictionary.thefreedictionary.com/characteristic+line

http://www.investopedia.com/terms/c/characteristicline.asp

http://www.nseindia.com/

http://people.duke.edu/~charvey/classes/ba350/riskman/rm13.gif

http://wenku.baidu.com/view/b158e8ef4afe04a1b071de12.html

http://www.zacks.com/education/articles.php?id=58

http://highered.mheducation.com/sites/dl/free/.../Peirson11e_Ch07.pdf

http://contentpro.seals.ac.za/iii/cpro/app?id=8446765932962219.

http://instruct.uwo.ca/economics/.../Capital%20Asset%20Pricing%20Model.pdf

http://www.sciedu.ca/journal/index.php/rwe/article/download/4331/2490

http://businessperspectives.org/journals.../imfi_en_2008_04_cont_Celik.pdf

http://www.investopedia.com/articles/stocks/04/113004.asp

http://shodhganga.inflibnet.ac.in/

http://wwwf.imperial.ac.uk/~bwhitche/papers/qf.pdf

http://finance.zacks.com/investing-for-beginners/

http://www.bogleheads.org/wiki/Risk_and_return

Characteristic Line, The relationship between return of the stock and the market: A study with reference to selected companies

in the Indian stock

Neeraj Gupta, Dr. Anil Vashisht, Ashwin Gedam

41