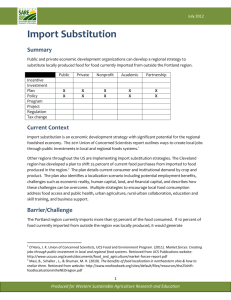

A Reconsideration of Import Substitution

advertisement