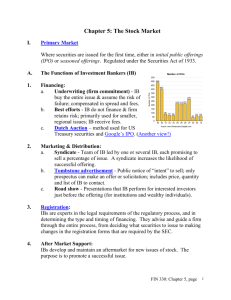

Dr. Ahmed Y. Dashti Chapter 5: Security Market Indicator Series

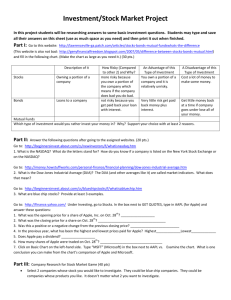

advertisement

Chapter 5: Security Market Indicator Series 3. Which of the following is true of the Dow Jones Industrial Average? A) The divisor must be adjusted for stock splits. B) It is a price-weighted average of 30 large industrial firms. C) It is a value-weighted average of 30 large industrial firms. D) It is an equally weighted average of 30 large industrial firms. E) A and B 4. Assume at these prices the value-weighted index constructed with the three stocks is 490. What would the index be if stock X were split 2 for 1 and stock Y 4 for 1? A) 490 B) 355 C) 275 D) 430 E) 500 39. The 500 stocks in the S&P 500: A. include 400 industrials, 40 utilities, 40 financial, and 20 transportation stocks. B. are chosen based upon industry representation, liquidity, and stability. b C. are the 500 largest companies according to market capitalization.. D. are the 500 largest listed companies according to market capitalization.. 8. A capitalization or value-weighted stock index, such as the S&P 500 weights each company: a. equally. b. by the price of a share of the stock. c. by the proportional value of its total common equity market value relative to the total equity value of 500 companies. d. by the proportion of its total asset size relative to the total assets of the 500 companies. 9. All but one of the following is a component of the Dow Jones Averages. a. Industrial Average b. Transportation Average c. Manufacturing Average d. Utilities Average 10. The S&P 500 stock index includes about _______ percent of the total U.S. market capitalization of list companies. a. ninety b. seventy-five c. fifty d. forty 14. If the Hang Seng index advances at a pace of 2% for the day, investors in which city are thrilled? a. Hong Kong b. Tokyo c. Kuwait d. Kuala Lumpur Dr. Ahmed Y. Dashti -1- Investment & Portfolio Management 12. Kuwaiti stock markets have little depth, which means it lacks a. a broad variety of investors. b. a large number of limit orders above and below the current price. c. the required accounting disclosure. d. adequate foreign exchange hedging opportunities. 43. At the NYSE, the auction process for each listed stock is assigned to a: A. specialist. a B. broker. C. dealer. D. member. 44. The New York Stock Exchange maintains an orderly market in roughly: A. 500 issues. B. 3,700 issues. b C. 7,400 issues. D. 25,000 issues. 45. Nasdaq is: A. an auction market. B. a negotiated market. b C. an agent auction market. D. the largest stock exchange in the U.S. 17. Which of the following statements is/are TRUE regarding the S&P 500? A. It is the market-value weighted indicator and is expressed in relative value with a multiplier of 10. B. It is the equally weighted indicator of market prices of 500 stocks. C. It is the market-value weighted indicator and is expressed as a percent. D. It is the geometric average of market prices of 500 stocks. 18. Which statement(s) is/are TRUE regarding the difference between DJIA and S&P 500? A. Since S&P 500 is market-value weighted, the Index will not be affected by the performance of an individual stock. B. Due to the long history of establishment, DJIA should be a better proxy of the general market movement. C. Financial stocks are included in DJIA, but not included in S&P 500. . D. DJIA is primarily used as the benchmark to measure the performance of professional money managers. E. None of the above statements are true. 15. If the market prices of each of the 30 stocks in Dow Jones Industrial Average all change by the same percentage amount during a given day, which stock will have the greatest impact on the DJIA ? (1991 CFA exam) a. The one whose stock trades at the highest dollar price per share. b. The one whose total equity has the highest market value. c. The one having the greatest amount of equity in its capital structure. d. The one having the lowest volatility. Dr. Ahmed Y. Dashti -2- Investment & Portfolio Management 16. In calculating the Standard & Poor’s stock price indexes, how are adjustments for stock splits made? (1990 CFA exam) a. By adjusting the divisor. b. Automatically, due to the manner in which the index is calculated. c. By adjusting the numerator. d. Quarterly, on the last trading day of each quarter. 65. NASDAQ National Market System is a. a self-regulating body of brokers and dealers that oversees Nasdaq and OTC practices. b. a combination of specialists in the auction markets and market makers in Nasdaq stocks, combined with the up-to-the-minute reporting of trades. c. a combination of specialists in Nasdaq stocks and the up-to-minute reporting of trades. d. a combination of the competing market makers in Nasdaq stocks and a reporting of trades similar to that which occurs on the NYSE. 66. SuperDOT is an electronic order routing system used a. on Nasdaq b. on Instinet c. in the third market d. on the NYSE 67. ECNs a. have extended evening trading hours for many investors so that they can now trade after hours b. have links to all discount brokers now doing business c pose no real threat to either the NYSE or to Nasdaq d. are not likely to have much of an impact on financial markets because the NYSE and Nasdaq have entrenched positions 68. One of the big advantages of Instinet for institutional investors is a. the help of brokers who act to bring two institutions together b. low commissions of about 6 or 7 cents a share c. being identified as the party buying or selling, which helps the institution to make favorable trades d. a combination of low costs and anonymous trading 7. Imagine the following stocks: P1 P2 P3 N1=N2 N3 ABC 50 60 30 10 20 XYZ 80 88 100 50 50 How much did the DJIA increase from period 1 to period 2? *a. 13.84% b. 12.71% Solution: DJIA1 = (50+80)/2=65, c. 11.53% DJIA2 = (60+88)/2= 74 d. 10.25% [ (74/65) – 1 ] x 100 = % increase Dr. Ahmed Y. Dashti -3- Investment & Portfolio Management 8. What was the DJIA divisor in period 3? a. 2.0367 *b. 1.8154 Solution: ignore the XYZ price increase, focus on the c. 1.6559 74 = (30+88)/X ABC stock split d. 1.4380. Solve for X = 1.594594594 9. How much did the DJIA increase from period 2 to period 3? *a. 10.17% b. 8.71% Solution: DJIA2 = (60+88)/2.0000= 74, c. 6.53% DJIA3 = (30+100)/1.595= 81.52 d. 4.00% [ (81.52/74) -1] x 100 = % increase 10. How much did the S&P500 index increase from period 1 to period 2? a. 15.28% b. 13.72% Solution: (60)(10)+(88)(50) / (50)(10) + (80)(50) *c. 11.11% d. 9.40% 11. How much did the S&P500 index increase from period 2 to period 3? a. 15.25% *b. 12.00% Solution: (30)(20)+(100)(50) / (60)(10) + (88)(50) c. 10.75% Note: no changes necessary to divisor d. 8.50% Dr. Ahmed Y. Dashti -4- Investment & Portfolio Management