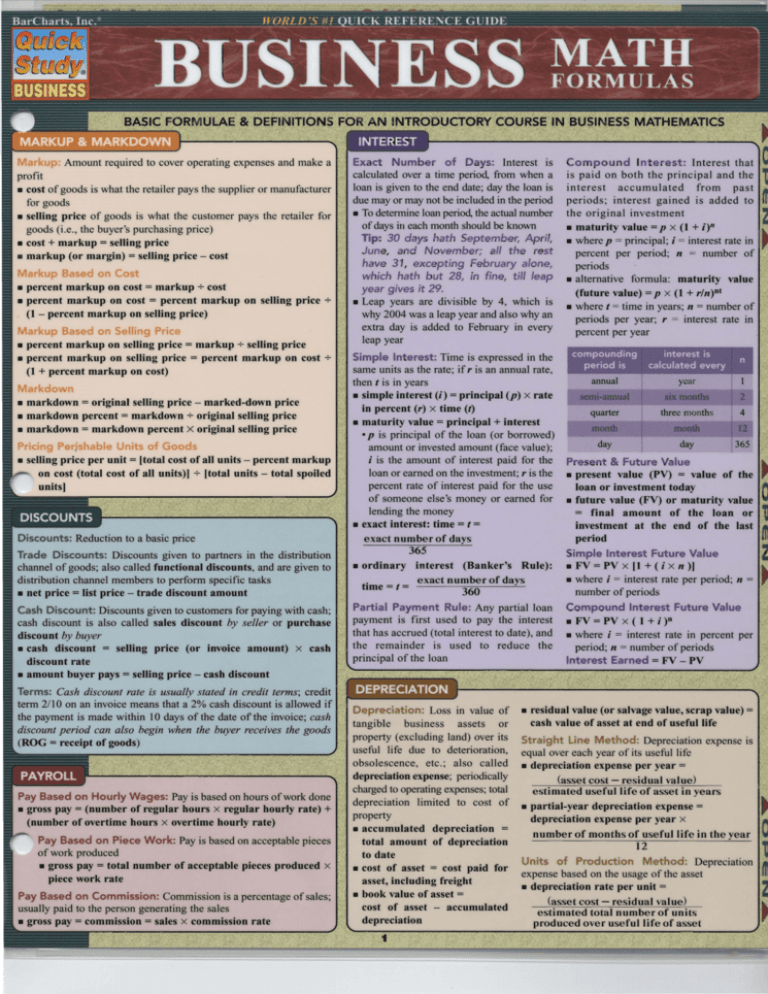

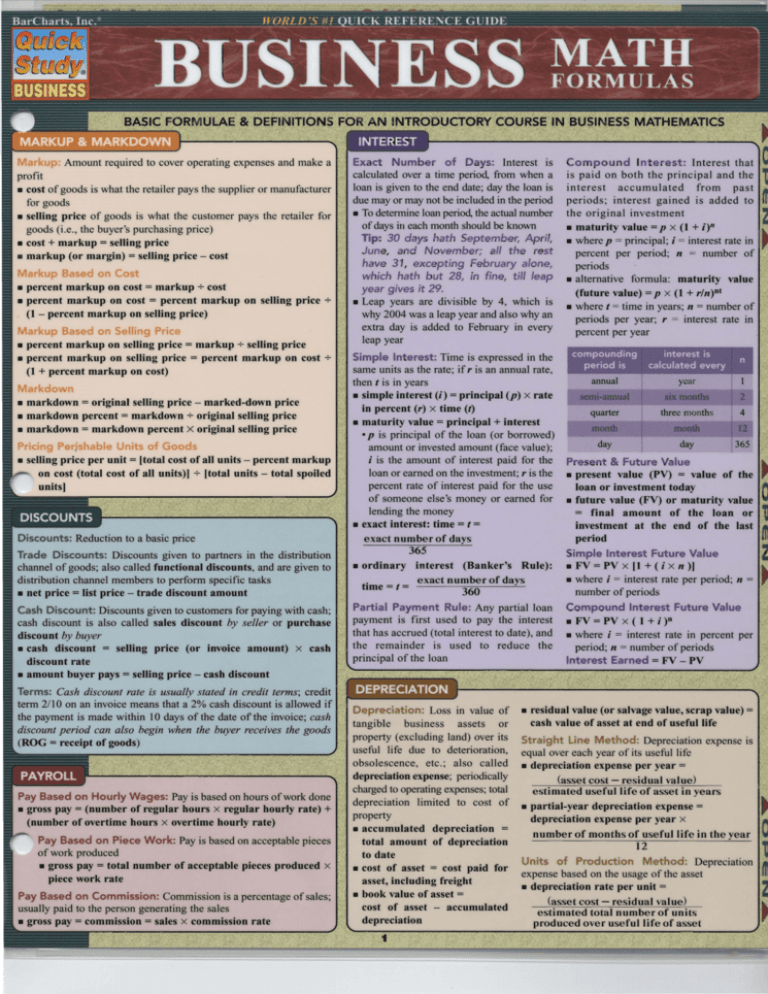

BASIC FORMULAE & DEFINITIONS FOR AN INTRODUCTORY COURSE IN BUSINESS MATHEMATICS

INTEREST

Amount required to cover operating expenses and make a

profit

• cost of goods is what the retailer pays the supplier or manufacturer

for goods

• selling price of goods is what the customer pays the retailer for

goods (i.e., the buyer's purchasing price)

• cost + markup = selling price

• markup (or margin) = selling price - cost

• percent markup on cost = markup + cost

• percent markup on cost = percent markup on selling price +

(I - percent markup on selling price)

• percent markup on selling price = markup + selling price

• percent markup on selling price = percent markup on cost +

(1 + percent markup on cost)

• markdown = original selling price - marked-down price

• markdown percent = markdown + original selling price

• markdown = markdown percent X original selling price

• selling price per unit = [total cost of all units - percent markup

on cost (total cost of all units)] + [total units - total spoiled

units]

DISCOUNTS

Discounts: Reduction to a basic price

Trade Discounts: Discounts given to partners in the distribution

channel of goods; also called functional discounts, and are given to

distribution channel members to perform specific tasks

• net price = list price - trade discount amount

r-------------------__ ~

Exact Number of Days: Interest is

calculated over a time period, from when a

loan is given to the end date; day the loan is

due mayor may not be included in the period

• To determine loan period, the actual number

of days ill each month should be known

Tip: 30 days hath September, April,

June, and November; all the rest

have 31, excepting February alone,

which hath but 28, in fine, till leap

year gives it 29.

• Leap years are divisible by 4, which is

why 2004 was a leap year and also why an

extra day is added to February in every

leap year

Simple Interest: Time is expressed in the

same units as the rate; if r is an annual rate,

then t is in years

• simple interest (i) = principal (p) x rate

in percent (r) x time (t)

• maturity value = principal + interest

• p is principal of the loan (or borrowed)

amount or invested amount (face value);

i is the amount of interest paid for the

loan or earned on the investment; r is the

percent rate of interest paid for the use

of someone else's money or earned for

lending the money

• exact interest: time = t =

exact number of days

365

• ordinary interest (Banker's Rule):

.

_ _ exact number of days

tIme - t 360

Cash Discount: Discounts given to customers for paying with cash;

cash discount is also called sales discount by seller or purchase

discount by buyer

• cash discount = selling price (or invoice amount) x cash

discount rate

• amount buyer pays = selling price - cash discount

Partial Payment Rule: Any partial loan

payment is first used to pay the interest

that has accrued (total interest to date), and

the remainder is used to reduce the

principal of the loan

Terms: Cash discount rate is usually stated in credit terms; credit

term 2/10 on an invoice means that a 2% cash discount is allowed if

the payment is made within 10 days of the date of the invoice; cash

discount period can a/so begin when the buyer receives the goods

(ROG = receipt of goods)

DEPRECIATION

PAYROLL

Pay Based on Hourly Wages: Pay is based on hours of work done

• gross pay = (number of regular hours x regular hourly rate) +

(number of overtime hours x overtime hourly rate)

Pay Based on Piece Work: Pay is based on acceptable pieces

of work produced

• gross pay = total number of acceptable pieces produced x

piece work rate

Pay Based on Commission: Commission is a percentage of sales;

usually paid to the person generating the sales

• gross pay = commission = sales x commission rate

Depreciation: Loss in value of

tangible business assets or

property (excluding land) over its

useful life due to deterioration,

obsolescence, etc.; also called

depreciation expense; periodically

charged to operating expenses; total

depreciation limited to cost of

property

• accumulated depreciation =

total amount of depreciation

to date

• cost of asset = cost paid for

asset, including freight

• book value of asset =

cost of asset - accumulated

depreciation

1

Compound Int erest: Interest that C

is paid on both the principal and the

interest accumulated from past

periods; interest gained is added to "

the original investment

• maturity value = p x (I + i)n

..

• wherc p = principal; i = interest rate in ,

percent per period; n = number of

periods

• alternative formula: maturity value

(future value) = p x (I + rln)nt

• where t = time in years; II = number of

periods per year; r = interest rate in

percent per year

1

2

compounding

period is

interest is calculated every

n

annual

quarter 4

IDGIIdl

day

day

365

Present & Future Value

..

• present value (PV) = value of the ,

loan or investment today

• future value (FV) or maturity value .

= final amount of the loan or

investment at the end of the last ~

period

II I

C

l

2

Simple Interest Future Value

• FV = PV x (I + (i x n)]

..

• where i = interest rate per period; n = ,

number of periods

Compound Interest Future Value

• FV = PV x ( I + i )"

• where i = interest rate in percent per

period; n = number of periods

Interest Earned = FV - PV

• residual value (or salvage value, scrap value) =

cash value of asset at end of useful life

Straight line Method: Depreciation expense is

equal over eaeh year of its useful life

• depreciation expense per year =

(asset cost - residual value) estimated useful life of asset in years • partial-year depreciation expense =

depreciation expense per year x

number of months of useful life in the year

12

Units of Production Method: Depreciation

expense based on the usage of the asset

• depreciation rate per unit =

(asset cost - residual value)

estimated total number of units

produced over useful life of asset

~

C

1

III

II i

2

..

,

• depreciation expense per year = depreciation rate per unit X

number of units produced per year

Service Hours Method: Depreciation expense based on hours of

useful service

• depreciation rate per service hour =

(asset cost - residual value)

estimated total number of hours of useful service over useful life of asset • depreciation expense per year = depreciation rate per service hour

x number of service hours per year

Sum of Years-Digits Method: Depreciation expense is greater for

earlier years than for later years

• sum of years-digits = sum of the digits representing year of useful life

OR

sum of years-digits = N (~ +1), where N is the number of years of

useful life

• for an asset with six years of useful life, sum of years-digits = 1 + 2 +

3 + 4 + 5 + 6 = 21, or 6(;+1) =4{=21

• depreciation expense per year = (asset cost - residual value)

remaining useful life in years sum of years-digits x

Declining Balance Method: Depreciation expense declines steadily

over the useful life of the asset

• depreciation rate for double declining balance method = (100% 7

estimated number of years of useful life of the asset) x 2

• depreciation expense per year = book value of asset at the

beginning of the year x depreciation rate

• book value of asset at the beginning of a year = book value of asset

at the end of the previous year

• book va~ue at the end of a year = asset cost x (1 - depreciation

rate)n; n = estimated number of years of useful life of the asset

Cost of Goods Sold

• cost of goods sold = cost of goods available for sale - cost of ending inventory

Weighted Average Method: Used to calculate cost of ending inventory when the

goods available for sale were purchased at different costs at different points in time

.

.

cost of goods available for sale

• weIghted average cost per umt = number of units available for sale

• cost of ending inventory = units in ending inventory x weighted average

cost per unit

First In-First Out (FIFO) Method: Used to calculate cost of ending inventory when

the goods available for sale were purchased at different costs and at different points in

time; assumption is that goods purchased earliest into inventory are the ones that are

sold first; goods in ending inventOlY are those that were purchased most recent~v

• cost o f ending inventory = units in ending inventory X their corresponding

costs

Last In-First Out (LIFO) Method: Used to calculate cost of ending inventory

when the goods available for sale were purchased at different costs and at different

points in time; assumption is that goods purchased most recently into inventory are

the ones that are sold first; goods in ending inventory are those that were purchased

the earliest

• cost o f ending inventory = units in ending inventory x their corresponding

costs

Inventory Turnover: How often a business sells and replaces its inventory; usually

over a year

• inventory turnover at retail =

. net sales

.

average IOventory at retaIl

• average inventory at retail =

beginning inventory at retail + ending inventory at retail 2

cost of goods sold

.

• mventory turnover at cost = average .IOven t orya t cos t

• average inventory at cost =

beginning inventory at cost + ending inventory at cost 2

BASIC FINANCIAt REPORTS

Inco me St ateme nt (Profit and Loss [P & L! Statement): A financial report of

a business that shows net profit or loss for a specific period by reporting revenue and

expense items during that period of operations

Sales Tax: Tax paid on purchase of most goods and services, though

some are exempt from sales tax; it is applied to the net price (selling

price - trade discounts) but not to shipping charges; sales tax varies

between states; collected by the business and paid to the state

government

• sales tax = net price x sales tax rate

• purchase price = net price (1 + sales tax rate)

• actual sales

=

total sales

1+ sales tax rate

Excise Tax: Tax paid on specific goods and services, such as luxury

automobiles, gasoline and air travel

• excise tax = net price x excise tax rate

Property Tax: Levied on the assessed value of property by local

government to pay for services such as schools, fire and police services;

assessed value is a fraction of actual market value of the property that is

used for tax purposes

• property tax rate = estimated revenue from tax

total taxable assessed value

OR budgeted need of local government property tax rate =

total taxable assessed value • assessed value = market value x assessment rate

• property tax = assessed value x property tax rate

• mill rate: a mill is 1/1000 of a dollar or 0.001 dollar; tax rate in mills

is the tax per $1,000.00 of assessed value

Income St atement Items

• revenue from sales (or revenues, sales, income, turnover)

• sales = number of items x Oist price - trade discount)

• net sales = sales - sales discount or cash discount

• cost o f goods sold COGS (or cost of sales) is the amount a product cost to

produce

• COGS = net purchase price + cost of acquiring, preparing and placement of

goods for sale

• gross profit on sales (or gross profit) = net sales - cost of goods sold

.

gross profit

• gross margm percent = net sales x 100

• operating expenses (including general and administrative expenses IG & AI) =

expenses to manage the business, and include salaries, legal and professional fees,

utilities, insurance, stationery supplies, property and payroll taxes

• sales and marketing expenses = expenses needed to sell products, and include

sales, salaries and commissions, advertising, freight and shipping

• R&D expenses = expenses incurred in research and development

• operating expense = G & A expense + sales & marketing expense + R&D

expense

• earnings before interest, taxes, depreciation and amortization (EBITDA)

OR

operating income = gross profit - operating expense

• operating margins percent =

;!IJa?:S x 100

• earnings before interest and taxes (EBIT) = EBITDA - depreciation and

amortization expenses

2

• earning before taxes (EBT) or pretax net income = EBIT - interest

expenses

• taxes include federal, state and local government taxes on income

• net income (or earnings) = EBT - taxes

Series of periodic payments usually made in equal amounts; payments

computed by compound interest methods; payments made at equal intervals oftime

• profit margin = net income x 100

net sales

payment dates

Balance Sheet

• assets - liabilities = owner's equity or shareholder's equity

• assets are items on a company's books that have a positive monetary

value; they typically include items of obvious value, such as cash or

equivalent investments (treasuries, CDs, money market), accounts

receivable, prepaid expenses, inventory of finished goods that are ready

for sale, depreciated real estate and equipment, and other intangibles,

such as goodwill, copyrights, trademarks and patents

• liabilities are monies owed; they typically include accounts payable, bank

and bond short-term debt (to be paid off within a year), and long-term debt

Basic Financi al St at ement Ratio s

• liquidity ratios: measures of ability jilr a business to meet short-term

obligations

• current ratio = current assets -;- current liabilities

• quick ratio = cash + accounts receivable -;- current liabilities

• activity ratios: measures ofefficiency in generating sales with assets

• days inventory

365

lOventory turnover

= .

• collection period

=

acco~nts receivable

credIt sales per day

cost of goods sold

.

• mventory turnover = average lOven

.

t ory

• asset turnover

net sales

total assets

• profitabili!y ratios: measures ofreturns

=

.return on sales

=

net income

net sales

.return on assets (ROA) = net income

total assets

• return on equity (ROE) = net in~ome

eqUIty

earnings available to

common stockholders

• earnings per share = -=-n~u=-=-m~b-"'e':":r--=o"-f:;;=sh;="'a-"'re-"s~o"'f';C'---common stock outstanding • price to earnings (P/E) ratio =

price per share of common stock

earnings per share

LIFE INSURANCE

Life Insurance: Insurance that pays a specified sum to the policyholder's

beneficiary at the time of the policyholder's death

• insured: person covered by policy

• policyholder/policy owner: person who owns policy

• premium: periodic payments made for insurance coverage

• face amount: proceeds received on the death o(the insured

• beneficiary(ies): person(s) who receivers) the face amount

Types of Life Insurance

• term life is life insurance coverage for a specified period oftime; can be

at a guaranteed rate or a guaranteed rate for a period of time and then a

projected rate; no cash value except face amount in event of death of

insured within the period of the insurance

• whole life is life insurance that has a guaranteed level premium (i.e., no

increases in premium) and a guaranteed cash value; also called

straight life or ordinary life

• universal life is life insurance that is permanent; premiums are not

guaranteed (i.e., may go up or down)

Period of time between two successive

Time between the beginning ofthe first payment period and the

end of the last payment period

Future dollar amount

of a series of annuity payments and the accrued interest

• annuity certain: term of annuity begins and ends on definite dates; has a

specified number of payments

• contingent annuity: term of annuity begins on a definite date, but ending date

is dependent on a future or uncertain event; no fixed number of payments

• perpetual annuity: term of annuity begins on a definite date, but has no ending

date; length of term is infinite

D

• ordinary annuity: periodic payments are made at the end of each payment

period

• deferred annuity: periodic payments are made at the end of each payment

period, but the term of the annuity begins after a specified period of time

• annuity due: periodic payments are made at the beginning of each payment

period

Je of an Ordinary Annuity

• using annuity tables

• future value of ordinary annuity = annuity payment per period x ordinary

annuity table factor

• using formula

• future value of ordinary annuity = annuity payment amount per period x

[<1+ij"-1 J

• where i = interest rate per period; n = number of payments during term of

annuity

Je of an Annuitv Due

• using annuity tables

• add 1 to the number of periods, and then read the table

• future value of annuity due = (annuity payment per period x ordinary

annuity table factor) - (one annuity payment amount)

• using formula

• future value of annuity due = annuity payment amount per period x

[O+i)O+I-IJ

i

- (one annuity payment amount)

• where i

annuity

=

interest rate per period; n

=

number of payments during term of

Ordinary Annuity

• using annuity tables

• present value of ordinary annuity = annuity payment per period x present

value of ordinary annuity table factor

• using formula

• present value of ordinary annuity = annuity payment amount per period x

[t-(IiO-oJ

• where i

annuity

=

interest rate per period; n

=

number of payments during term of

Fund into which periodic deposits are made so that the principal

is repaid on the maturity date (i.e., the amount of the annuity is the value of the

principal of the debt on the maturity date); deposits need /lot be of equal amounts

or made at equal intervals oftime; interest for the debt is not paid from the fund

• using sinking fund tables

• sinking fund payment per period = future value x sinking fund table factor

• using formula

Calculating Premiums: Using insurance tables; read tables according to

• sinking fund payment per period = futUre value x [(

age and gender of insured; insurance rates are generally per $1,000.00 of

coverage

• premium = (coverage amountll,OOO) x insurance rate

• where i

annuity

=

interest rate per period; n

=

i)1I

J

1+1 -I

number of payments during term of

A

Used mainly for consumcr loans; where m = number

of payments in one year, n = total number of scheduled payments in life of loan, C

= finance charges per payment period, P = principal or original loan amount

• monthly payment = [rate + (

r~~~n1h' -1 1X principal

1+ rate

Ratio of the jinance charge

to the average amount 0.( credit in use during the life ofthe loan;

expressed as a percentage rate per year; is a true cost of a loan;

meant to prevent lenders from advertising a low rate by hiding

fees; rules to compute APR are not clearly defined

• constant ratio method: APR =

• direct ratio method: APR

=

•

P~:~O

3P (n + ~H-CC (n + I ) ted by

a

.

mC(95n+9)

• n ratio method: APR = 12n(n+l)(4P+C)

'fS

Stocks: Shares of ownership in a company

• common stock gives the holder voting rights

• preferred stock does not allow the holder to have voting rights, but

instead, otTers preference in dividend payments

• dividends are payments to shareholders from projits

.

h

earnings available to shareholders

• earnmgs per s are = total number of shares outstanding

•

PIE'

. I

.

.

ratIO = pnce earnmg ratIO =

closing common stock price

earnings per share

• yearly interest = face value of bond x yearly interest rate

. Id - yearly interest

• current Yle bond price

b

•

d . Id total yearly interest

on Yle =

bond price

Mutual Funds: Monies invested in multiple entities (shares = ownership,

similar to stocks)

• net asset value (NAV) is dollar cost of one share of the mutual fund or

price per share ofthe mutualfund

. Id d"d d . Id yearly dividends per share

.

• stoc k Yle = IVI en Yle =

common s t oc k prIce

• NAV

- ending price+total dividend income received _ 1

• tota I return b egmnmg

. . prIce

.

•

Bonds: Promises of payment for monies loaned

• bondholders are creditors

• tIt

_ ending NAV +total distribution per NAV _ I to a re urn initial NAV =

8

614

~~"f,{Jj'!N 1 ~ ":\l'4~t!!t!~

(, (. I

~ '!H....J"i.

757

H'w,'

210

r"

943.

1\'1(

3

6

I\',f,j, I(.~ :: ~~(J!,(i!tt

t "fi,?l

,m, !" ~'~

~~ 'IJ' )i~"'IC ;"':-1-' ';1; .t~'J -," ',' :;" N;l

i1(J#IJ."',"A.m'~" i~~~k.W.~'-icf"'1!· ';"-'i."r"GiJ",,'i'1.YlJ!lII"~if.B~JitJuS. {.l.'Jti'-G1l;',::iJ!tii:mt.

-J"

numerator (number written above the line)

• denominator (number written below the line)

tori

~ori

5/ 2

is 5 divided by 2, which is 2 with a remainder of 1, resulting in a mixed number 21/2 • EX: 313 is 3 divided by 3, which is 1 with a remainder of 0,

resulting in a whole number 1

Mixed Number to Improper Fraction

• improper fraction =

(denominator of fraction part X whole number part)

+ numerator of fraction part denominator of fraction part (6X3)+5 23

6

6

Fraction Operations • reduction: converting the fraction to higher or lower terms by multiplying

or dividing the numerator and denominator by the same number (any

number other than zero); value ofthe fraction does not change

• EX:

eq ual

3~

the

d has

It

by S2

• lowest terms: when the numerator and denominator of a fraction do

not have a common divisor; also called simplest form

• EX:

• complex fraction: either the numerator, the denominator, or both are a

fraction

Ys

'%

• EX'

Mixed Number: Consists of a whole number and a fraction

• the sum of the two numbers (whole number + fraction)

• EX: A sum of 5 and 3/4 is written as the mixed number

ur the

• then

• EX' 21- 2177_1

. 28 - 2877 - 4

• improper fraction: numerator is greater than or equal to the denominator

• EX:

1. 6.7,

• EX' 1- 3x4_!1.

. 4-4X4 -16

Types of Fractions

• proper fraction: numerator is less than the denominator

• EX:

total value of portfolio number of shares outstanding in the fund 6

If d . Id _ income distribution per share

mutua un Yle NA V

• EX:

Whole Numbers: Set of all positive integers (1, 2, 3, ... ), zero (0), and

negative integers (-I, -2, -3, ...); integers are whole numbers

• numeric representation: $8,614,757,210,943.36 was the U.S. National

Debt on 12/27/06; National Debt is the amount of money that the U.S.

Treasury Department has borrowed to date in order to meet Congress's

expenditures beyond its income

• in words: eight trillion. six hundred and fourteen billion, seven hundred

and fifty-seven million, two hundred and ten thousand, nine hundred and

forty-three dollars and thirty-six cents

are

53/4

Converting Fractions: Improper fractions may be turned into whole

numbers or mixed numbers

• divide the numerator by the denominator; if there is a remainder, then the

result is a mixed fraction; if the remainder is zero, then the result is a

whole number

i or 1~

• GCD or HCF: divide the numerator and denominator of a fraction by

their greatest common divisor (GCD) to reduce it to its lowest terms;

GCD is also called the highest common factor (HCF)

• EX: GCD or HCF of 63 and 294 is 21

• to calculate:

• step 1: divide the larger number in the fraction by the smaller number

(divide 294 by 63, quotient 4, remainder 42)

• step 2: if there is a remainder in step I, then divide the smaller

number in the fraction by the remainder in step I (divide 63 by 42, quotient I, remainder 21) • step 3: ifthere is a remainder in step 2, then divide the remainder in step

I by the remainder in step 2 (divide 42 by 21, quotient 2, remainder 0)

• step 4: continue dividing each remainder by its succeeding

remainder until the remainder is zero

-9

lilill

Review Skills Basics

• step 5: the last divisor (the last non-zero remainder) is the GCD or

HCF (which is 2 1)

• 63 = 63721 ~21-l

294

294' -14

• LCD or LCM: lowest common denominator (LCD) of a group of

fractions is the least common multiple (LCM) of the denominators of

those fractions

• EX: Calculate the L CD or L CM of 8, 24 and 45; when there is no

common factor in a group of numbers, then the LCM is the product

of the numbers; LCM is 8 X 24 X 45 = 8,640

• EX: Calculate the LCD or LCM of 6, 15, 42; when there are

common factors in a group of numbers, then the numbers are

repeatedly divided by their common prime factor; at least two

numbers should be divided in each step; the LCM is the product of

the prime numbers and the final quotients:

2) 6, 15,42

3) 3,5,21

1,5,7

LCM = 2 X 3 X 1 X 5 X 7 = 210

Adding Fractions: The denominator of the sum is the least common

mUltiple (LCM) of the individual denominators, and the numerator of

the sum is the sum of the individual numerators

• add the integers and the fractions separately when adding mixed

numbers

• EX: 3/4 + 2/3 + 6/7 3/4 = 3

X

21/4 X 21 = 63/84 , 2/3 = 2

=6

X

12/7 X 12 =

617

X

191/

84

= 223/

84

Subtracting Fractions: The denominator of the difference is the least

common mUltiple (LCM) of the individual denominators, and the

numerator of the difference is the difference of the individual numerators

• subtract the integers and the fractions separately when subtracting

mixed numbers

• convert the mixed number into an improper fraction before subtracting

when the fractional part of the number you are subtracting is larger

than the fractional part of the number you are subtracting from

• EX: 4/5 - 1/7 = 28/ 35 - 5135 = 23/35 (LeM of 5 and 7 is 35) Multiplying Fractions: The numerator of the product is the product of

the individual numerators, and the denominator of the product is the

product of the individual denominators

• convert mixed numbers into improper fractions and then

multiply:

d

aXe bxd • EX.. 3/7 X 2/9 = 7x9

2x3 = 6/63 = 2/21

Dividing Fractions

• dividend -i- divisor = dividend

•

~

b

-i-

~= ~

d

b

• EX: 3/7 -i-

X

2/9

X

reciprocal of the divisor

~ = a Xd

e

bXe

= 3/7 X

Rule From

To

Example

Fractions

Decimals Div ide and round as needed

Move decimal poiat two P DecimaIa Percents

Percents

to

the riabt aDd add za'OI if ~

tMa Idd perceat symbol ( Move decimal point two pl aces to Decimals the left and add zeros when needed, 64.48% is 0.6448 then delete percent symbol (% ) 28/3 X 28 = 56/84 , (LCM of 4,3, 7 = 84)

b

Conversions

72/84

3/ + 2/ + 6/ = 63/ + 56/ + 72/ = 63+56+72 =

4

3

7

84

84

84

84

~x~ =

• division by multiples of 10: move the decimal to the left by the same

number of spaces as the number of zeros

• EX: 0.27 -i- 1,000 = 0.00027

• multiplication by multiples of 10: move the decimal to the right by the

same number of spaces as the number of zeros; add zeros if there are no

digits to the right

• EX: 0.27 X 1,000 = 270

Percent: To convert any whole number or decimal number to a

percentage, move the decimal point two places to the right (adding zeros

if necessary) and add a percentage symbol (% ) at the end of the num ber

• rounding percents follow s the same rules as rounding decimals [see

Decimals]

• EX: 2 is 200%, 0.15 is 15%,0.2846 is 28.46%

9/ 2 =

27/14 = 113/ 14

Decimals

Format: 0.2368

• rounding: to round 0.2368 to two places, first identify the digit at the

place you want to round (here, it is 3), then identify the next digit to the

right (here, it is 6); if this digit is greater than or equal to 5, the digit at the

place of rounding is increased by I- if not, it remains the same (because

6 is greater than 5, the digit 3 is increased by I); the decimal 0.2368 is

rounded to 0.24; similarly, rounding 0.1239 to two places is 0.12

Basic Algebra

Basic Terms: While arithmetic operations use numbers and fractions based

on the 10 Arabic numerals 0 through 9, algebra uses letters, symbols,

numerals and equations

Signs: Plus (+) sign is used to represent positive numbers (greater than zero);

the minus (- ) sign is used to represent negative numbers (less than zero)

Absolute Value: Value of any number, disregarding its sign

• absolute value is denoted by the sign II

• EX: 1+51 = I-51 = 5

Expressions & Terms: Any symbol or combination of symbols that

represents a number is called an algebraic expression ; when an expression

has many parts, the parts are connected by + and - signs, and each such part,

together with its sign, is called a term; a monomial is an expression with

one term, a binomial has two terms, and a polynomial is an expression with

more than one term

Factors & Coefficients: When two or more numbers are mUltiplied, each

of the numbers or their product is called a factor of the resulting term

• any individual factor in a term is the coefficient of the remaining factors

of that term

• EX: 5x is a term, 5 is the (numerical) coefficient of x

• EX: Rxy is a term, 8 is the (numerical) coefficient of xy, y is the (literal)

coefficient of Rx

Power: Product of equal factors is called a power of that factor

• EX: 2 X 2 X 2 = third power of 2 = 23

• EX: a X a X a X a x a = fifth power of a = as

Basic Algebraic Rules: Consider the numbers a, b, c, d

- (- a) =

+a

(-a) (-b) = + ab

(-a) (+b) = - ab

a+b=b+a

a + (b + c) = (a + b) + c

axb=bxa

a x (b x c) = (a x b) x c

jf a = band c = b, then a

If a = band c = d, then a

If a = band c = d, then a

If a = band c = d, then a

=c

+c = b +d

- c=b- d

x c=bx d

Ifa = band c = d, then ale =

bId'

when c is not equal to zero

Review Skills Basics

Adding Numbers with Same Sign: Add the absolute

values of the numbers to get the sum and then prefix the

common sign

• EX: (+5) + (+6) = +11; (-3) + (-5) =-8

Basic Statistics

Adding Numbers with Opposite Signs: Add the

absolute values of the numbers with like signs, then

subtract smaller absolute value from the larger absolute

value, and prefix the sign of the larger value

• EX: (+5) + (-4) + (+3) + (-2) = (+8) + (-6) = +2

Measures of Central Tendency are mean, median and mode

• mean (arithmetic mean or average)

• mean of a set of numbers = sum of the numbers/number of items

• mean is very sensitive to extreme values among the set of numbers; it is usually represented by

the lowercase Greek letter mu (/1) for a set of numbers (population) and x-bar (x) for a

sample (subset of those numbers)

• EX: Mean of 6,4,2,7,9 = (6 + 4 + 2 + 7 + 9) + 5 = 28/5 = 5.6

Adding & Subtracting Algebraic Expressions: Terms

in an expression with the same factors are called like terms;

adding or subtracting polynomials is done by adding or

subtracting the numerical coefficients of like terms

• EX: (2a + 5b - 6) + (3a - 2b + 8) - (a + 2b - 4)

= (2a + 3a - a) + (5b - 2b - 2b) + (-6 + 8 + 4)

= 4a + b + 6

• median

• median of a set of numbers is the central or middle number in the set when the numbers are

arranged according to their magnitude or size

• EX: Median value of 6,4,2,7,9 is the middle value among 2, 4, 6, 7, 9; so, median = 6

• for an even number of items, the median is the average of the two middle numbers

• EX: Median value of 6,4,3, 2, 7, 9 is the average of the two middle numbers of 2,3,4,6,7,

9, which is the average of 4, 6; so, median = 5

Multiplying Algebraic Expressions

• monomial x monomial = product of the numerical

coefficients x product of literal factors

• mode

• mode of a set of numbers is the number that occurs most frequently in the set

• EX: Mode of 6,4,2,7,7,6,7,4,7,9 is 7 as it occurs the most times

• if two numbers occur the most number of times, the set is bimodal; if many numbers occur the

most number of times, the set of numbers is multimodal; if all numbers appear only once, then

there is no mode

• EX: 6ab x 8c = 48 abc

• polynomial x monomial = each term of the

polynomial x the monomial, then add the resulting

partial products

• EX: (5a + 8b) x 2c = lOac + 16bc

• polynomial x polynomial = each term of one

polynomial x each term of the other polynomial; then

add each of the partial products

• EX: (6a + 4b) x (2c + 5d) = 12ac + 8bc + 30ad + 20bd

Dividing Algebraic Expressions

• monomial + monomial = quotient of numerical

coefficients x quotient of literal coefficients

• EX: 36ac + 6c =

e6/6) x

(ac/c)

= 6a

• polynomial + monomial = each term of the

polynomial + the monomial, then add the partial

quotients

• EX: (24ab + 6ac + 42bc) + (6abc)

+ (6ac/6abc) + (42bc/6abc)

+ I/b + 7/a

= (24ab/6abc)

= 4/c

Measures of Dispersion are range, percentile, quartile, variance and standard deviation

• range of a set of numbers is the difference between the highest and lowest values

• EX: Range of 2, 6, 4, 8,3,9, 7 is (9 - 2) = 7

• percentile for a value n is found by dividing the number of items less than n by the total number

of items, and then multiplying this by 100

• quartile

• QI is the first quartile (25 th percentile) when 1/4 of the items are below the value QI

• Q2 is the second quartile (50 th percentile) when 1/2 of the items are below the value Q2; Q2

corresponds to the median

• Q3 is the third quartile (or 75 th percentile) when 3/4 of the items are below the value Q3

• EX: If 45 out of 50 students in a class have scores less than 85 on an exam, then a student with a score of 85 is in the 90 th percentile 1(45/50) x 100 = 90% I • EX: What are the quartiles for the set of numbers 2,4,7,3,5,8,9, 10?

Arranging the numbers in ascending order: 2, 3, 4, 5, 7, 8, 9, 10; arranging them into four equal

parts: 2, 3; 4, 5; 7, 8; 9,10

QI = (3+4)/2 = 3.5, value under which there are 1/4 of the items

Q2 = (5+7)/2 = 6, value under which there are 1/2 of the items

Q3 = (8+9)/2 = 8.5, value under which there are 3/4 of the items

• variance & standard deviation of a set of numbers measures the ,\pread of" the data ahout the

mean of those numbers; the standard deviation is equal to the square root of the variance, and has

the same units as the original numbers

• standard deviation is usually represented by the lowercase Greek letter sigma (0'), and variance by S2

• for a set of n numbers (population):

variance

= S2=-k'i(Xi-jJ.)2; standard deviation = ( I =

;=1

i=1

n

• EX: Calculate the standard deviation of 3, 6, 15, 19, 27

n=5,jJ.= 7%=14,(I=j3~O =8.72

• Frequency Distribution: A set of numbers or data arranged in ascending order is called an array;

the number of times a specific number is repeated in a data set or array is called its frequency;

when a set of numbers are grouped into several groups, the groups are called classes, the size of

the class is called the class interval; the number of items in each class is called its frequency, and

the grouped data is called a frequency distribution

US $5.95 CAN $8,95

Author: Ravi Behara, PhD,

NOTE: This QuickStudy" guide is intended for infonnational purposes only,

Due to its condensed fonnat, this guide cannot cover every aspect of the subject;

mther, it is intended for use in conjunction with course work and assigned texts.

Neither BarCharts, Inc., its writers, editors nor design staff, are in any way

responsible or liable for the use or misuse ofthe infonnation contained in this guide.

All rights reserved. No part of this publication may be reproduced or

transmitted in any form, or by any means, electronic or mechanical, including

photocopy. recording, or any information storage and retrieval system,

without written permission from the publisher.

© 2007 BarCharts, Inc. 0308

11111=111

free dfwn~adS &

nun re

o..!.titles at

qUlc 5 uuy.com