How To Use Financial Statements

advertisement

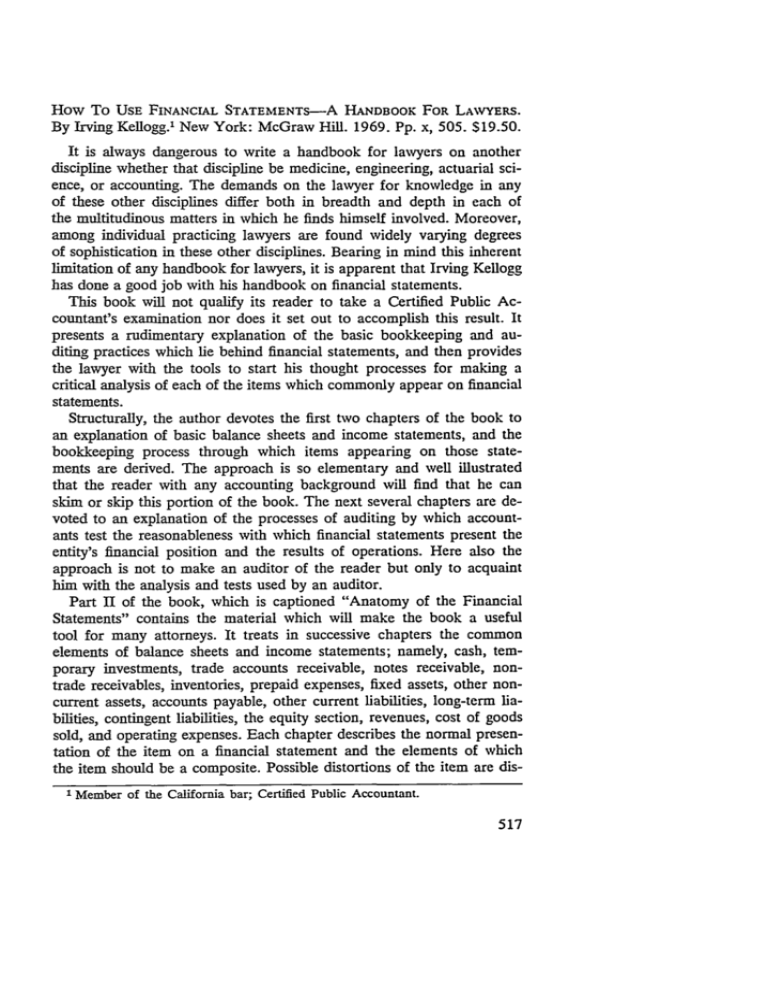

How To UsE FINANCIAL STATEMENTS-A HANDBOOK FOR LAWYERS. By Irving Kellogg.' New York: McGraw Hill. 1969. Pp. x, 505. $19.50. It is always dangerous to write a handbook for lawyers on another discipline whether that discipline be medicine, engineering, actuarial science, or accounting. The demands on the lawyer for knowledge in any of these other disciplines differ both in breadth and depth in each of the multitudinous matters in which he finds himself involved. Moreover, among individual practicing lawyers are found widely varying degrees of sophistication in these other disciplines. Bearing in mind this inherent limitation of any handbook for lawyers, it is apparent that Irving Kellogg has done a good job with his handbook on financial statements. This book will not qualify its reader to take a Certified Public Accountant's examination nor does it set out to accomplish this result. It presents a rudimentary explanation of the basic bookkeeping and auditing practices which lie behind financial statements, and then provides the lawyer with the tools to start his thought processes for making a critical analysis of each of the items which commonly appear on financial statements. Structurally, the author devotes the first two chapters of the book to an explanation of basic balance sheets and income statements, and the bookkeeping process through which items appearing on those statements are derived. The approach is so elementary and well illustrated that the reader with any accounting background will find that he can skim or skip this portion of the book. The next several chapters are devoted to an explanation of the processes of auditing by which accountants test the reasonableness with which financial statements present the entity's financial position and the results of operations. Here also the approach is not to make an auditor of the reader but only to acquaint him with the analysis and tests used by an auditor. Part II of the book, which is captioned "Anatomy of the Financial Statements" contains the material which will make the book a useful tool for many attorneys. It treats in successive chapters the common elements of balance sheets and income statements; namely, cash, temporary investments, trade accounts receivable, notes receivable, nontrade receivables, inventories, prepaid expenses, fixed assets, other noncurrent assets, accounts payable, other current liabilities, long-term liabilities, contingent liabilities, the equity section, revenues, cost of goods sold, and operating expenses. Each chapter describes the normal presentation of the item on a financial statement and the elements of which the item should be a composite. Possible distortions of the item are disI Member of the California bar; Certified Public Accountant. MAINE LAW REVIEW cussed and the generally accepted internal controls and auditing procedures with respect to the item are described. Of particular value are the checklists which will provide the thoughtful lawyer with a valuable tool in analyzing the items presented on the financial statement, and the internal controls or auditing procedures which should be applicable to the item. Whether the lawyer is considering a financial statement for the purposes of negotiation or for the purposes of preparing an examination of an accountant, these checklists should be extremely thought provoking and will serve much the same function as those contained in some of the better works on the handling of accident cases or the propounding of interrogatories, with which most lawyers are familiar. The third and last part of the book seems designed to demonstrate to the lawyer that an analysis of financial statements is necessary in many phases of his work. It contains a good explanation of many of the ratio tests which accountants and financial managers use in analyzing statements. It contains some useful drafting hints with respect to buy-sell agreements, profit sharing agreements, and partnership agreements. A chapter on the analysis of financial statements for the purposes of a divorce case is perhaps more theoretical than practical. This portion of the book will be of greatest interest to a lawyer involved in drafting an agreement with respect to the purchase or sale of the stock of a small corporation. The author demonstrates keen insight into the accounting pitfalls to be avoided in the process of such a drafting effort. The reader may discover that some of the "boiler plate" which customarily appears in such agreements takes on new meaning for him. There are many areas where law and accounting overlap which this book fails to treat. It does not adequately instruct the attorney with respect to the debt versus equity questions with which attorneys and accountants always wrestle in the formation of a corporation; nor does it treat the interesting legal and accounting questions inherent in determining the legality of a proposed stock redemption. Much more could have been said with respect to the handling of actions for partnership accounting and the area of trusts and estates where the interaction of legal and accounting theory is left unexplained. Throughout, accounting principles are simply stated and no attempt is made to examine the theory behind those principles, nor is attention focused on the numerous areas of the law in which generally accepted accounting principles have, in some cases, been embraced and in others rejected. In short, it is apparent that this book, unlike many of its predecessors, was written primarily for practicing lawyers and not as much for use in a law school course. While there are many areas of the law in which financial statements or accounting theory play a role which are left untouched, it is a tribute to the author that so much has been covered in so little space. The book does well that which it sets out to do, BOOK REVIEWS namely, to give the lawyer a good jumping off point in the analysis of any of the common categories of figures which appear on financial statements. JAMES R. FLAKER* *Member of the Maine bar.