Financial Calculus 1, Fall 13, Quiz 1

advertisement

Financial Calculus 1, Fall 13, Quiz 1

(constructing derivatives, reasoning by noarbitrage, one period binary model)

max

Pts

(1)

3

(2)

3

(3)

3

(4)

3

(5)

3

(6)

3

total

15

Name of student: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . SAMPLE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Write your name in the designated eld immediately after I hand you the exam sheets. Exchanging exams sheets

with other students will qualify as cheating. Do not look at the problems before I have handed out all exam sheets.

Every exam or quiz is closed book. On the desk you should have only a pen and these exam sheets. Remove anything

else from the desk. All electronic devices (phones, calculators, etc.) should be put away. If I spot anything else

but a pen and the exam I will take the extra stu to my desk until the end of the exam. You may use the back

sides of these sheets as scratch paper. Do not unstaple these sheets. During the exam you should work strictly

by yourself. Any communication with anybody else will be considered as cheating (even making your work easily

visible by someone else). For short quizzes there will be no visits to the restrooms while for longer exams you can

go once after my approval. When you are ready submit the exam and quietly leave the room. Even after you hand

in your exam you should not talk to anybody before you leave the room. You may ask clarifying questions but do

not expect me to tell you denitions that I expect you to know or to give you hints on a problem. As with anything

else be reasonable in asking - a question or two is o.k. but do not make it a habit. On longer exams I will stop

answering questions in the last 10-20 min.

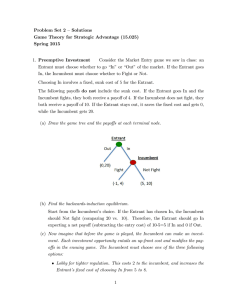

Figures (1) and (2) describe the payo at experation time of nancial derivatives of European type. Along the

horizontal axis is the price of the stock while along the vertical axis is the payo of the derivative instrument. Each

such derivative can be described as a porfolio of European calls and puts. Write the respective portfolios. Use the

notation C (K) and P (K) for the payos of a call and a put at experation time with strike price K . Recall that

C (K) (S) = max{0, S − K} and P (K) (S) = max{0, K − S}.

(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(3) in the window above plot the payo diagam of C (2) (S)

(4) in the window above plot the payo diagam of C (2) (S) + 2P (1) (S)

(5) Assume Alice has an asset that pays no income (say a unit of stock) the price of which today is S . Alice and

Bob today agree, signing a contract, that after one month Bob will buy the asset from Alice at the price F . This

is a forward contract. Assume that interest is continuously compounded at rate r, the market is liquid, and short

selling is allowed. What is the fair (or no-arbitrage, or rational) price F of this forward. (Giving a value for F is

not enough. You should describe the strategies to take advantage of arbitrage if the price is not the fair one.)

... see for example the subsection Rational

pricing

in http://en.wikipedia.org/wiki/Forward_contract

(6) one period binomial model ..................

(7) A perpetuity is stream of cash payments that continues forever. It entitles its holder to receive constant

payments c at equal intervals of time from now to the end of time. Assume the interest rate r is compounded at

the end of each time interval and is constant in time. What is the present value of such a cash ow?