Printed on February 18, 2016

PH&N Total Return Bond Fund

No. of Funds in Category

428

Fund Category

Canadian Fixed Income

Morningstar Rating™

QQQ

Investment Objective

Portfolio Analysis as of January 31, 2016

To provide stability of capital and maximum total return

by investing primarily in a well-diversified portfolio of

Canadian fixed income securities and derivatives based

on the value of fixed income instruments.

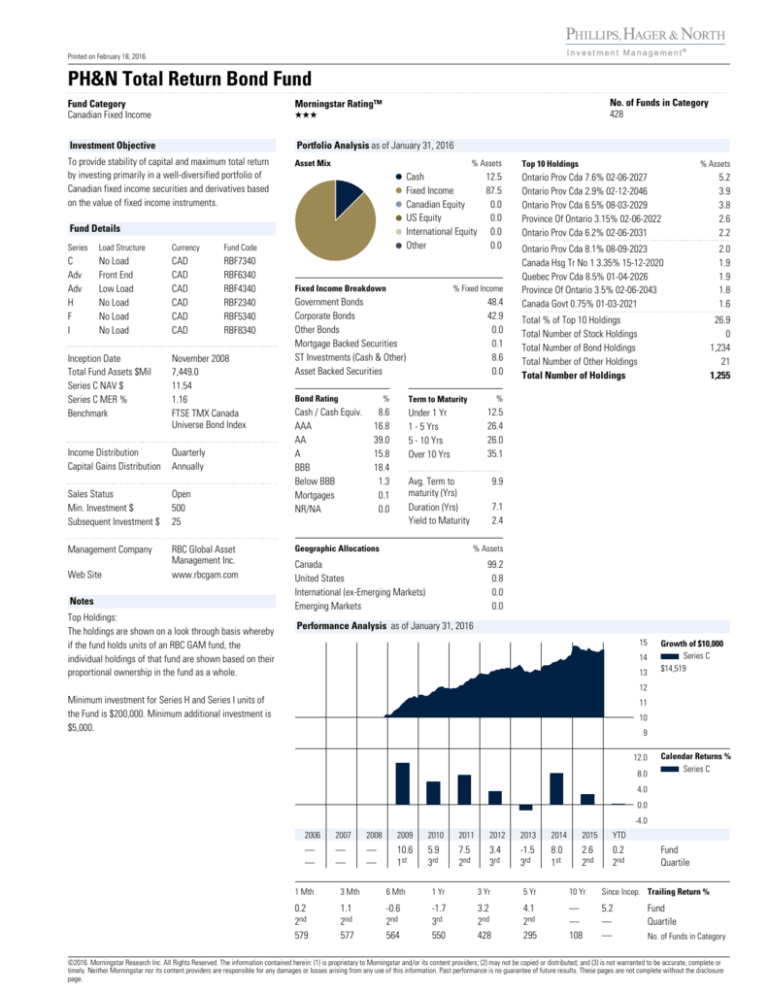

Asset Mix

% Assets

Cash

12.5

Fixed Income

87.5

Canadian Equity

0.0

US Equity

0.0

International Equity 0.0

Other

0.0

Fund Details

Series

Load Structure

Currency

Fund Code

C

Adv

Adv

H

F

I

No Load

Front End

Low Load

No Load

No Load

No Load

CAD

CAD

CAD

CAD

CAD

CAD

RBF7340

RBF6340

RBF4340

RBF2340

RBF5340

RBF8340

Inception Date

Total Fund Assets $Mil

Series C NAV $

Series C MER %

Benchmark

November 2008

7,449.0

11.54

1.16

FTSE TMX Canada

Universe Bond Index

Income Distribution

Capital Gains Distribution

Quarterly

Annually

Sales Status

Min. Investment $

Subsequent Investment $

Open

500

25

Management Company

RBC Global Asset

Management Inc.

www.rbcgam.com

Web Site

Notes

Top Holdings:

The holdings are shown on a look through basis whereby

if the fund holds units of an RBC GAM fund, the

individual holdings of that fund are shown based on their

proportional ownership in the fund as a whole.

Fixed Income Breakdown

% Fixed Income

Government Bonds

Corporate Bonds

Other Bonds

Mortgage Backed Securities

ST Investments (Cash & Other)

Asset Backed Securities

Bond Rating

%

Cash / Cash Equiv.

AAA

AA

A

BBB

Below BBB

Mortgages

NR/NA

48.4

42.9

0.0

0.1

8.6

0.0

% Assets

Ontario Prov Cda 7.6% 02-06-2027

Ontario Prov Cda 2.9% 02-12-2046

Ontario Prov Cda 6.5% 08-03-2029

Province Of Ontario 3.15% 02-06-2022

Ontario Prov Cda 6.2% 02-06-2031

5.2

3.9

3.8

2.6

2.2

Ontario Prov Cda 8.1% 08-09-2023

Canada Hsg Tr No 1 3.35% 15-12-2020

Quebec Prov Cda 8.5% 01-04-2026

Province Of Ontario 3.5% 02-06-2043

Canada Govt 0.75% 01-03-2021

2.0

1.9

1.9

1.8

1.6

Total % of Top 10 Holdings

Total Number of Stock Holdings

Total Number of Bond Holdings

Total Number of Other Holdings

Total Number of Holdings

26.9

0

1,234

21

1,255

%

Term to Maturity

8.6

16.8

39.0

15.8

18.4

1.3

0.1

0.0

Top 10 Holdings

12.5

26.4

26.0

35.1

Under 1 Yr

1 - 5 Yrs

5 - 10 Yrs

Over 10 Yrs

9.9

Avg. Term to

maturity (Yrs)

Duration (Yrs)

Yield to Maturity

Geographic Allocations

7.1

2.4

% Assets

Canada

United States

International (ex-Emerging Markets)

Emerging Markets

99.2

0.8

0.0

0.0

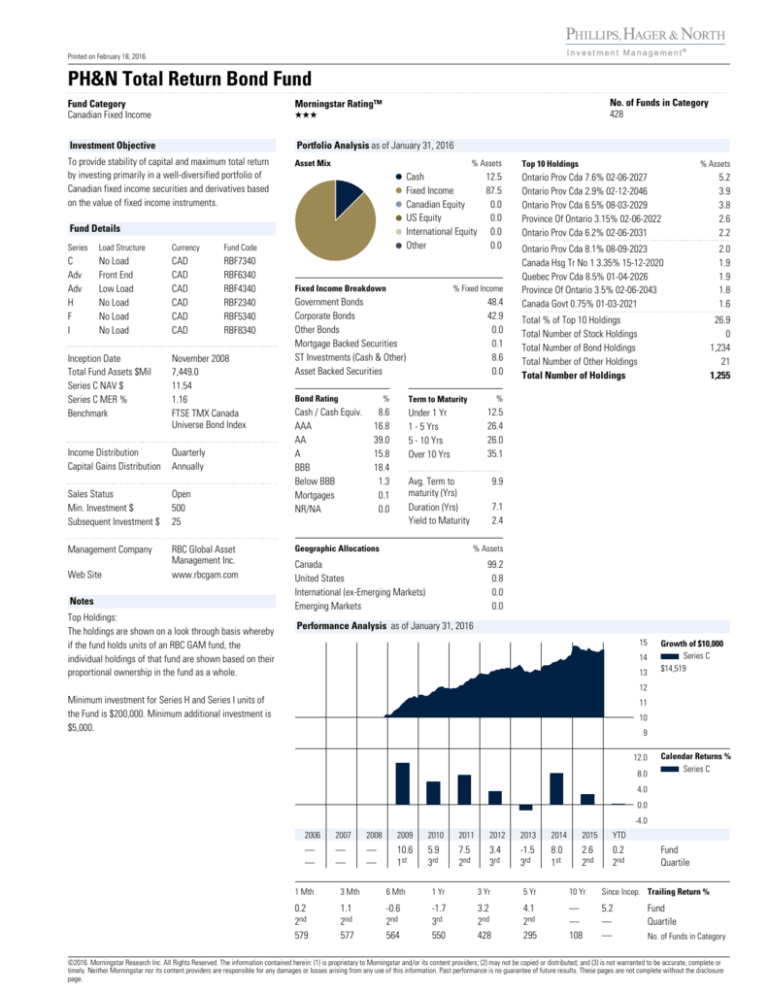

Performance Analysis as of January 31, 2016

15

14

13

Growth of $10,000

Series C

$14,519

12

Minimum investment for Series H and Series I units of

the Fund is $200,000. Minimum additional investment is

$5,000.

11

10

9

12.0

8.0

Calendar Returns %

Series C

4.0

0.0

-4.0

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

YTD

—

—

—

—

—

—

10.6

1st

5.9

3rd

7.5

2nd

3.4

3rd

-1.5

3rd

8.0

1st

2.6

2nd

0.2

2nd

Fund

Quartile

1 Mth

3 Mth

6 Mth

1 Yr

3 Yr

5 Yr

10 Yr

Since Incep. Trailing Return %

0.2

2nd

579

1.1

2nd

577

-0.6

2nd

564

-1.7

3rd

550

3.2

2nd

428

4.1

2nd

295

—

—

108

5.2

—

—

Fund

Quartile

No. of Funds in Category

©2016. Morningstar Research Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or

timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. These pages are not complete without the disclosure

page.

Printed on February 18, 2016

PH&N Total Return Bond Fund

Management Overview

Manager Bios

Performance Analysis Cont'd as of January 31, 2016

Investment Team

Distributions ($)/Unit

PH&N Fixed Income Team

With one of the largest bond desks in Canada consisting

of over 30 investment professionals, Phillips, Hager &

North Investment Management (PH&N IM) has been

managing bonds since 1970 and currently manages fixed

income portfolios according to strict quality and

diversification guidelines. PH&N IM’s strengths as a

bond manager are directly related to its depth of

resources – both people and technology – dedicated to

the management of fixed income portfolios.

Total Distributions

Interest

Dividends

Capital Gains

Return Of Capital

Best/Worst Periods %

YTD*

2015

2014

2013

2012

2011

2010

2009

2008

2007

2006

—

—

—

—

—

0.47

0.25

—

0.22

—

0.32

0.27

—

0.05

—

0.40

0.31

—

0.09

—

0.32

0.32

—

—

—

0.39

0.35

—

0.04

—

0.52

0.35

—

0.17

—

0.56

0.46

—

0.10

—

—

—

—

—

—

—

—

—

—

—

—

—

—

—

—

Ended

1 Yr

Ended

11-2009

1-2012

Best

14.3

1-2016

Worst

-1.7 11-2015

Average

5.1

No. of Periods

75

Pct. Positive

88.0

* Distributions are characterized into income type at year-end.

3 Yr

Ended

5 Yr

Ended

10 Yr

8.4

2.6

4.6

51

100.0

2-2014

10-2015

5.7

3.6

4.6

27

100.0

—

—

—

—

—

—

—

Quarterly Commentary as at December 31, 2015

With heightened volatility in the fixed income

market, we have been nimble in our strategies

within the Fund to take advantage of opportunities

as they appear (and disappear). In the fourth

quarter, we kept the Fund’s overall duration close

to its benchmark, but made tactical adjustments at

the margins as rates spiked mid-quarter and then

receded again. These adjustments worked well,

adding a small amount of relative performance

without leaving the Fund exposed to any

meaningful shifts in the general level of interest

rates, which are difficult to see coming in the

current environment.

We have also been nimble in our other strategies

in the Fund, such as our corporate positioning. This

has been the case all year; we reduced the Fund’s

corporate exposure in the summer, reinstated in

the fall and then partially reduced again this past

quarter as liquidity dried up as fear spread from

the high yield sector to safer, more conservative

issuers. We also continued to focus on less

cyclical industries and higher-quality issuers for

additional protection in case fear prevails and

corporate bonds sell off further, and kept the

allocation to high-yield bonds small.

The Fund continues to keep a meaningful

allocation in provincial bonds, especially Ontario,

the largest and most liquid issuer. We also have a

small position in inflation-linked bonds, which

appear attractive compared to their nominal

counterparts. Going forward, we expect volatility

to continue in the near term, and we are

conservatively positioned and ready to take

advantage of any opportunities that materialize.

©2016. Morningstar Research Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or

timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. These pages are not complete without the disclosure

page.

Printed on February 18, 2016

PH&N Total Return Bond Fund

Disclosure

RBC Funds, PH&N Funds and RBC Corporate

Class Funds are offered by RBC Global Asset

Management Inc. and distributed through

authorized dealers.

Commissions, trailing commissions,

management fees and expenses all may be

associated with mutual fund investments.

Please read the prospectus or Fund Facts

document before investing. Except as

otherwise noted, the indicated rates of return

are the historical annual compounded total

returns including changes in unit value and

reinvestment of all distributions and do not

take into account sales, redemption,

distribution or optional charges or income

taxes payable by any unitholder that would

have reduced returns. Mutual fund securities

are not guaranteed or covered by the Canada

Deposit Insurance Corporation or by any other

government deposit insurer. For money

market funds, there can be no assurances

that the fund will be able to maintain its net

asset value per unit at a constant amount or

that the full amount of your investment in the

fund will be returned to you. The value of

mutual funds change frequently and past

performance may not be repeated.

Phillips, Hager & North Investment

Management (PH&N IM) is a division of RBC

Global Asset Management Inc. (RBC GAM).

RBC GAM is the fund manager and the

principal portfolio adviser of PH&N Funds and

BonaVista Funds. The principal distributor of

PH&N Funds and BonaVista Funds is Phillips,

Hager & North Investment Funds Ltd.

(PH&NIF), which uses the trade name PH&N

Investment Services. RBC GAM is an indirect,

wholly-owned subsidiary of Royal Bank of

Canada.

This document has been compiled by RBC

Global Asset Management Inc. (RBC GAM)

from sources believed to be reliable, but no

representations or warranty, express or

implied, are made by RBC GAM, its affiliates

or any other person as to its accuracy,

completeness or correctness. All opinions

and estimates constitute RBC GAM's

judgment as of the date of this document, are

subject to change without notice and are

provided in good faith but without legal

responsibility. The Top Ten/25 Holdings may

change due to ongoing portfolio transactions

within the fund. The Prospectus and other

information about the underlying investment

funds are available at www.sedar.com.

MER (%) for RBC Funds and PH&N Funds is

based on actual expenses for the full-year

period, January 1 to December 31, 2015,

expressed on an annualized basis.

MER (%) for RBC Corporate Class Funds is

based on actual expenses for the half-year

period, April 1 to September 30, 2015,

expressed on an annualized basis.

Graphs are only used to illustrate the effects

of the compound growth rate and do not

reflect future values of any fund or returns on

investment of any fund.

The fund profile is provided for informational

purposes only. Particular investments and/or

trading strategies should be evaluated

relative to each individual’s investment

objectives. The information contained in the

fund profile is not, and should not be

construed as, investment or tax advice. You

should not act or rely on the information

contained in the fund profile without seeking

the advice of an appropriate professional

advisor.

Quartile rankings are determined by

Morningstar Research Inc., an independent

research firm, based on categories

maintained by the Canadian Investment

Funds Standards Committee (CIFSC). Quartile

rankings are comparisons of the performance

of a fund to other funds in a particular

category and are subject to change monthly.

The quartiles divide the data into four equal

segments expressed in terms of rank (1, 2, 3

or 4). This is the Morningstar quartile ranking

of Series C units of the Fund as of January

31, 2016. Morningstar ratings are overall

ratings reflecting risk adjusted performance

as of January 31, 2016. The ratings are

subject to change every month. The ratings

are calculated for funds with a minimum of 3

years of performance, calculated from the

funds' 1 and 3 year average annual returns

measured against a 91-day Treasury Bill

return with appropriate fee adjustments. The

top 10% of the funds in a category receive 5

stars (high); if the funds fall in the next

22.5%,they receive 4 stars (above average); a

place in the middle 35% earns a fund 3 stars

(neutral or average); those in the next 22.5%

receive 2 stars (below average); and the

lowest 10% get 1 star (low). Ratings are just

one factor to consider when investing. For

more information, please see www.

morningstar.ca.

® / ™ Trademark(s) of Royal Bank of Canada.

Used under licence. © RBC Global Asset

Management Inc. 2016

©2016. Morningstar Research Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or

timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. These pages are not complete without the disclosure

page.