Printed on February 18, 2016

RBC North American Value Fund

No. of Funds in Category

54

Fund Category

North American Equity

Morningstar Rating™

QQQ

Investment Objective

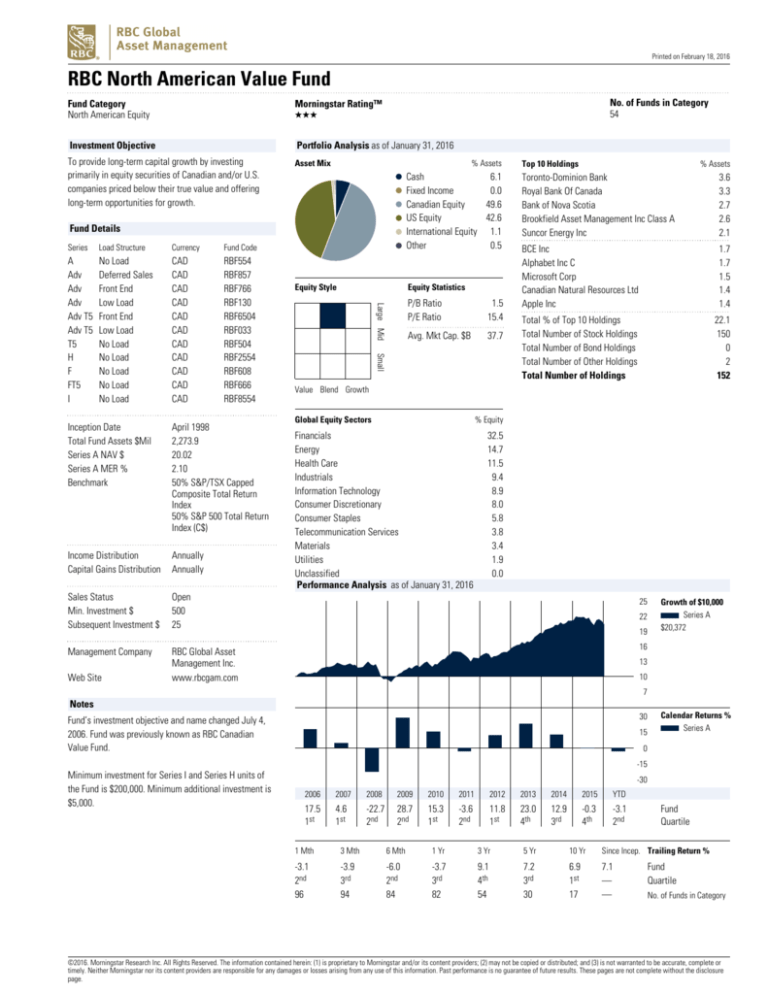

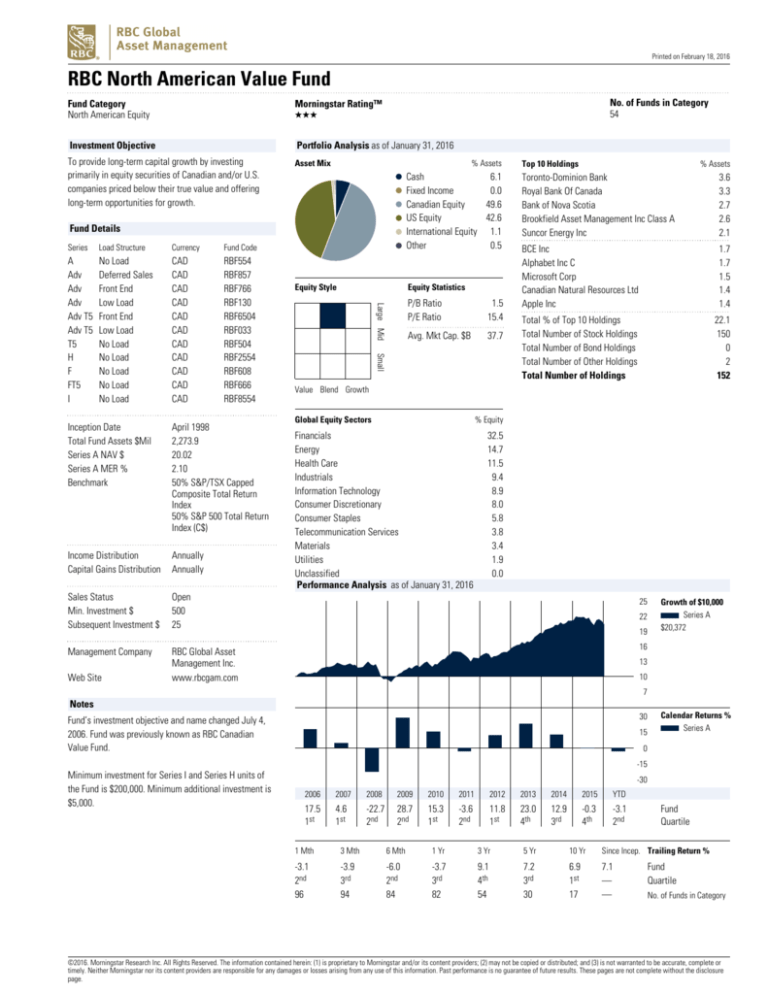

Portfolio Analysis as of January 31, 2016

To provide long-term capital growth by investing

primarily in equity securities of Canadian and/or U.S.

companies priced below their true value and offering

long-term opportunities for growth.

Asset Mix

% Assets

Cash

6.1

Fixed Income

0.0

Canadian Equity

49.6

US Equity

42.6

International Equity 1.1

Other

0.5

Fund Details

Currency

Fund Code

No Load

Deferred Sales

Front End

Low Load

Front End

Low Load

No Load

No Load

No Load

No Load

No Load

CAD

CAD

CAD

CAD

CAD

CAD

CAD

CAD

CAD

CAD

CAD

RBF554

RBF857

RBF766

RBF130

RBF6504

RBF033

RBF504

RBF2554

RBF608

RBF666

RBF8554

Inception Date

Total Fund Assets $Mil

Series A NAV $

Series A MER %

Benchmark

April 1998

2,273.9

20.02

2.10

50% S&P/TSX Capped

Composite Total Return

Index

50% S&P 500 Total Return

Index (C$)

Income Distribution

Capital Gains Distribution

Annually

Annually

Sales Status

Min. Investment $

Subsequent Investment $

Open

500

25

Management Company

RBC Global Asset

Management Inc.

www.rbcgam.com

Web Site

Equity Style

Equity Statistics

P/B Ratio

P/E Ratio

1.5

15.4

Avg. Mkt Cap. $B

37.7

Small

Load Structure

A

Adv

Adv

Adv

Adv T5

Adv T5

T5

H

F

FT5

I

Large Mid

Series

Top 10 Holdings

% Assets

Toronto-Dominion Bank

Royal Bank Of Canada

Bank of Nova Scotia

Brookfield Asset Management Inc Class A

Suncor Energy Inc

3.6

3.3

2.7

2.6

2.1

BCE Inc

Alphabet Inc C

Microsoft Corp

Canadian Natural Resources Ltd

Apple Inc

1.7

1.7

1.5

1.4

1.4

Total % of Top 10 Holdings

Total Number of Stock Holdings

Total Number of Bond Holdings

Total Number of Other Holdings

Total Number of Holdings

22.1

150

0

2

152

Value Blend Growth

Global Equity Sectors

% Equity

Financials

Energy

Health Care

Industrials

Information Technology

Consumer Discretionary

Consumer Staples

Telecommunication Services

Materials

Utilities

Unclassified

Performance Analysis as of January 31, 2016

32.5

14.7

11.5

9.4

8.9

8.0

5.8

3.8

3.4

1.9

0.0

25

22

19

Growth of $10,000

Series A

$20,372

16

13

10

7

Notes

30

Fund’s investment objective and name changed July 4,

2006. Fund was previously known as RBC Canadian

Value Fund.

15

Calendar Returns %

Series A

0

-15

Minimum investment for Series I and Series H units of

the Fund is $200,000. Minimum additional investment is

$5,000.

-30

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

YTD

17.5

1st

4.6

1st

-22.7

2nd

28.7

2nd

15.3

1st

-3.6

2nd

11.8

1st

23.0

4th

12.9

3rd

-0.3

4th

-3.1

2nd

Fund

Quartile

1 Mth

3 Mth

6 Mth

1 Yr

3 Yr

5 Yr

10 Yr

Since Incep. Trailing Return %

-3.1

2nd

96

-3.9

3rd

94

-6.0

2nd

84

-3.7

3rd

82

9.1

4th

54

7.2

3rd

30

6.9

1st

17

7.1

—

—

Fund

Quartile

No. of Funds in Category

©2016. Morningstar Research Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or

timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. These pages are not complete without the disclosure

page.

Printed on February 18, 2016

RBC North American Value Fund

Management Overview

Manager Bios

Performance Analysis Cont'd as of January 31, 2016

Stuart Kedwell

Distributions ($)/Unit

RBC Global Asset Management Inc.

Total Distributions

Interest

Dividends

Capital Gains

Return Of Capital

Stuart Kedwell is Senior Vice President and Co-Head,

Canadian Equity Committee. He has been in the

investment industry since 1997.

YTD*

2015

2014

2013

2012

2011

2010

2009

2008

2007

2006

—

—

—

—

—

0.23

—

0.04

0.19

—

0.95

—

—

0.95

—

1.07

—

—

1.07

—

0.62

—

0.01

0.61

—

0.21

—

—

0.21

—

1.26

—

—

1.26

—

0.58

—

—

0.58

—

—

—

—

—

—

1.80

—

—

1.80

—

1.70

—

—

1.70

—

Doug Raymond

Ended

1 Yr

Ended

RBC Global Asset Management Inc.

Best/Worst Periods %

Doug Raymond is Senior Vice President and Co-Head,

Canadian Equity Committee. He has been in the

investment industry since 1985.

2-2010

3-2006

Best

38.2

2-2009

2-2009

Worst

-24.6

Average

9.3

No. of Periods

202

Pct. Positive

74.3

* Distributions are characterized into income type at year-end.

3 Yr

Ended

5 Yr

Ended

10 Yr

21.3

-5.4

8.9

178

91.0

2-2014

4-2003

16.8

0.6

8.6

154

100.0

3-2013

8-2010

10.4

5.7

8.3

94

100.0

Quarterly Commentary as at December 31, 2015

RBC North American Value Fund (Series A)

returned 4.0% in Q4 vs. 4.8% for its benchmark.

positions in Ross Stores and Carnival Corp aided

relative performance.

The Canadian Health Care sector posted negative

returns due to a negative quarter for Valeant

Pharmaceuticals. All 10 U.S. sectors posted

positive absolute performance during the quarter,

helped by a weakening Canadian dollar.

Underweight exposure to the U.S. Consumer

Staples sector hindered performance. A lack of

exposure to both Coca-Cola and Philip Morris

International detracted relative performance, as

both companies had positive performance over the

quarter.

An underweight position in Valeant

Pharmaceuticals aided relative returns in the

Canadian Health Care sector, as the company's

stock came under pressure from increased

regulatory scrutiny over its drug pricing practices

and its partnership with mail-order pharmacy

Philidor RX Services.

Asset weighting in the U.S. and Canadian

Consumer Discretionary sectors aided

performance. Underweight exposure to the sector

in Canada along with overweight exposure in the

U.S. aided returns. In the U.S., overweight

An improvement in the performance of Canadian

equity markets will require a bigger contribution

from stocks in the Financials and Energy sectors.

For that to happen energy prices will have to move

higher, in the view of the portfolio manager. For

growth, Canada also depends on the U.S., where a

stronger labour market and improving housing

market indicate an improving economy. The

interest rate policy divergence between the U.S.

Federal Reserve and the Bank of Canada is likely

to widen if commodity prices remain weak, which

could add further pressure to the Canadian dollar.

©2016. Morningstar Research Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or

timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. These pages are not complete without the disclosure

page.

Printed on February 18, 2016

RBC North American Value Fund

Disclosure

RBC Funds, PH&N Funds and RBC Corporate

Class Funds are offered by RBC Global Asset

Management Inc. and distributed through

authorized dealers.

Commissions, trailing commissions,

management fees and expenses all may be

associated with mutual fund investments.

Please read the prospectus or Fund Facts

document before investing. Except as

otherwise noted, the indicated rates of return

are the historical annual compounded total

returns including changes in unit value and

reinvestment of all distributions and do not

take into account sales, redemption,

distribution or optional charges or income

taxes payable by any unitholder that would

have reduced returns. Mutual funds are not

guaranteed or covered by the Canadian

Deposit Insurance Corporation or by any other

government deposit insurer. For money

market funds, there can be no assurances

that the fund will be able to maintain its net

asset value per unit at a constant amount or

that the full amount of your investment in the

fund will be returned to you. The value of

mutual funds change frequently and past

performance may not be repeated.

This document has been compiled by RBC

Global Asset Management Inc. (RBC GAM)

from sources believed to be reliable, but no

representations or warranty, express or

implied, are made by RBC GAM, its affiliates

or any other person as to its accuracy,

completeness or correctness. All opinions

and estimates constitute RBC GAM's

judgment as of the date of this document, are

subject to change without notice and are

provided in good faith but without legal

responsibility. The Top Ten/25 Holdings may

change due to ongoing portfolio transactions

within the fund. The Prospectus and other

information about the underlying investment

funds are available at www.sedar.com.

MER (%) for RBC Funds and PH&N Funds is

based on actual expenses for the full-year

period, January 1 to December 31, 2015,

expressed on an annualized basis.

MER (%) for RBC Corporate Class Funds is

based on actual expenses for the half-year

period, April 1 to September 30, 2015,

expressed on an annualized basis.

Graphs are only used to illustrate the effects

of the compound growth rate and do not

reflect future values of any fund or returns on

investment of any fund.

The fund profile is provided for informational

purposes only. Particular investments and/or

trading strategies should be evaluated

relative to each individual’s investment

objectives. The information contained in the

fund profile is not, and should not be

construed as, investment or tax advice. You

should not act or rely on the information

contained in the fund profile without seeking

the advice of an appropriate professional

advisor.

Quartile rankings are determined by

Morningstar Research Inc., an independent

research firm, based on categories

maintained by the Canadian Investment

Funds Standards Committee (CIFSC). Quartile

rankings are comparisons of the performance

of a fund to other funds in a particular

category and are subject to change monthly.

The quartiles divide the data into four equal

segments expressed in terms of rank (1, 2, 3

or 4). This is the Morningstar quartile ranking

of Series A units of the Fund as of January

31, 2016. Morningstar ratings are overall

ratings reflecting risk adjusted performance

as of January 31, 2016. The ratings are

subject to change every month. The ratings

are calculated for funds with a minimum of 3

years of performance, calculated from the

funds' 1 and 3 year average annual returns

measured against a 91-day Treasury Bill

return with appropriate fee adjustments. The

top 10% of the funds in a category receive 5

stars (high); if the funds fall in the next

22.5%,they receive 4 stars (above average); a

place in the middle 35% earns a fund 3 stars

(neutral or average); those in the next 22.5%

receive 2 stars (below average); and the

lowest 10% get 1 star (low). Ratings are just

one factor to consider when investing. For

more information, please see www.

morningstar.ca.

® / ™ Trademark(s) of Royal Bank of Canada.

Used under licence. © RBC Global Asset

Management Inc. 2016

©2016. Morningstar Research Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or

timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. These pages are not complete without the disclosure

page.