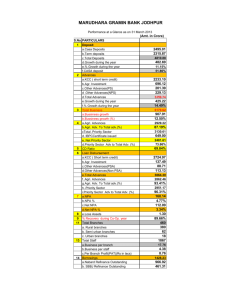

Performance at a glance as on 31st March 2015

advertisement

MARUDHARA GRAMIN BANK JODHPUR Performance at a Glance as on 31 March 2015 (Amt. in Crore) S.No. PARTICULARS 1 2 3 Deposit a.Casa Deposits 3,217.63 b.Term deposits 3,114.45 c.Total Deposits 6,332.09 d.Growth during the year 574.13 e.% Growth during the year 9.97% f.CASA deposit 50.81% Advances a.KCC ( short term credit) 3,213.63 b.Agr. Investment 792.35 c.Other Advances(PS) 305.75 d .Other Advances(NPS) 260.54 d.Total Advances 4,572.27 e.Growth during the year 499.33 f.% Growth during the year 12.26% Total Business a.Bussiness growth 1,073.46 b.Bussiness growth (%) 10.92% a.Agri. Advances 4,005.98 b.Agri. Adv. To Total adv.(%) 87.61% cTotal .Priority Sector 4,311.73 d. IBPCCertificate issued 1,200.00 e. Net Priority Sector 3,111.73 d.Priority Sector Adv to Total Adv. (%) 68.06% 5 CD Ratio 72.21% 6 Loan Disbursement 4 a.KCC ( Short term credit) 3,893.25 b.Agr. Investment 182.33 c.Other Advances(PSA) 64.08 d.Other Advances(Non PSA) 159.33 e.Total Advances 4,298.99 (Amt. in Crore) S.No. PARTICULARS f..Agri. Advances 4,075.58 g.Agri. Adv. To Total adv.(%) 94.80% h..Priority Sector 4,139.66 i.Priority Sector Adv to Total Adv. (%) 96.29% a.NPA 208.65 b.NPA % 4.56% c.Net NPA 117.39 d.Net NPA % 2.57% 8 e.Loss Assets 0.58 9 % Recovery during Co-Op. year 79.47% Total Branches 601 a. Rural branches 492 b. Semi urban branches 80 c. Urban branches 29 Total Staff 2,205 a.Business per branch 18.14 b.Business per staff 4.95 c.Per Branch Profit(PAT)(Rs in lacs) 14.87 Borrowings 1,948.03 a.Nabard Refinance Outstanding 1,948.03 7 11 13 14 b. SBBJ Refinance Outstanding S.No. PARTICULARS 15 Total Investments 3,852.23 16 Capital Adequacy Ratio 11.12% 34 Capital 6.00 a. share of govt of india 50% b. share of sponsore bank 35% c. share of govt of rajasthan 15% 35 Authorised capital 6.00 36 Issued ,subscribed and paid up capital 6.00 37 Share capital Deposit 175.93 38 Reserve and surplus 407.08