The Impact of Global Laws on a

Records Retention Schedule

The Impact of Global Laws on a Records Retention Schedule

By Tom Corey and Laurie Fischer

• Multinational companies employ over 23 million workers in the United States.1

• 48% of private U.S. companies have an international presence.2

• 75% percent of mid-market companies say going global is an integral part of their growth strategy.3 • 1/4 of small businesses indicated they are involved in global business.4

Companies are going global, and records managers must now know, or question, which countries’ laws will impact

their record management policies; understand the laws of those countries; and create a records retention schedule, or

multiple records retention schedules, to address their company’s global operations. This article discusses the general

principles determining which countries may have jurisdiction, global regional differences in records retention laws,

and guidelines for creating a global record retention schedule.

Identifying potential jurisdiction

Nationality principle

Country jurisdiction is the ability of a court within a

specific country to hear an action, criminal or civil, against

a person or company and hold them accountable to that

country’s law.5 International law recognizes five general

principles of jurisdiction: territorial, nationality, effect,

protective, and universality.6 A review of these principles

will help provide some guidance to records managers in

evaluating their global footprint.

The nationality principle states that a country has

jurisdiction over the citizens and/or nationals of its country.8

Under this principle, a country has the right to regulate the

activities of its own citizens. The most common applications

of this principle are anti-bribery/foreign corruption laws.

These laws prosecute people and corporations for illegal

activities conducted in foreign countries in an effort to

promote a commercial interest.9 The nationality principle is

distinct from the territorial principle, which is based on the

location of the activity. When evaluating which countries

Territorial principle

The nationality

principle is used to

enforce citizens’

compliance with antibribery laws.

The Federal Trade

Commission (FTC) has

invoked the effects

principle in anti-trust

cases involving nonU.S. companies.

The territorial principle states that a country has jurisdiction

over conduct that takes place within the country.7 For

example, if a company has employees working in a

country, then the labor laws of that country apply. In some

cases, the records related to that labor are located in other

countries; perhaps when an international company has

a centralized HR department. The record requirements,

however, are not based on the location of the records, but

on the location where the labor occurred.

1

U.S. Department of Commerce, Bureau of Economic Analysis, Summary

Estimates for Multi-National Companies: Employment, Sales and Capital

Expenditures for 2010, April 18, 2012 (Available at http://www.bea.gov/

newsreleases/international/mnc/mncnewsrelease.htm, last viewed July 19,

2013)

2

PRNewswire, PwC Survey Finds US Family Businesses More Optimistic

About Growth Prospects Than Global Peers, Showing Greater Appetite for

New Ventures Than Two Years Ago, January 7, 2013 (Available at http://www.

prnewswire.com/news-releases/pwc-survey-finds-us-family-businessesmore-optimistic-about-growth-prospects-than-global-peers-showing-greaterappetite-for-new-ventures-than-two-years-ago-185868352.html, last viewed

July 19, 2013)

3

Dan Tiemann, KPMG LLP, Mid-Market Companies are Going Global,

December 2012 (Available at www.kpmg.com/.../mid-market-companies-aregoing-global.pdf last viewed July 19, 2013)

Factors influencing whether the territorial principle applies,

giving a country jurisdiction over a company, may include

the following:

•

•

4

UPS, Perceptions of Global Trade Survey, 2011

5

Restatement (Third) of the Law of Foreign Relations § 402 (1988)

Whether the company is incorporated or organized

within that country

6

Id.

7

Restatement (Third) § 402(1)(A)

Whether the company has an actual location within

that country

•

Whether there are company employees within

that country

•

Whether the company files taxes within that country

1-866-229-8700 | huronconsultinggroup.com/legal

8

Restatement (Third) § 402(2)

9

See The Organisation for Economic Co-operation and Development (OECD)

Anti-Bribery Convention (available at http://www.oecd.org/daf/anti-bribery/

anti-briberyconvention,last viewed July 19, 2013), and Unites State Foreign

Corrupt Practices Act, 15 U.S.C. § 78dd

2

The Impact of Global Laws on a Records Retention Schedule

government.15 In cases like this, record management

is essential to show that the company paid employees,

recorded injuries sustained while employed, and was

compliant with the law of the country where the activity

occurred.

might have jurisdiction under the Nationality Principle, a

company should look at the location of the company and its

agents and employees.

Effects principle

Under the effects principle, a country has jurisdiction when

the actions of a party cause injury to another party in that

country.10 Under the effects principle, the country where

the injury occurred has jurisdiction. This principle applies

in product liability cases, for example. The effect principle

also applies in cases where the product is a web service.

Examples of web services that invoke the effects principle

include intellectual property infringements and cases where

the content (e.g., adult material) is illegal in the country

where the material is received. When considering whether

the effects principle applies, a company should look at

where its products and/or services are marketed and sold.

In sum, as a general rule, if a company or organization

actively pursues or engages in commerce within a

jurisdiction, either by people, product or service, then it

is subject to the laws and regulations of that jurisdiction.

A good rule to follow is if you want the protection and

privileges of a jurisdiction, you must apply the rules and

regulations of that jurisdiction.

Protective principle

The protective principle gives countries the right to protect

their national functions.11 The activities may occur inside

or outside of the country and may be by citizens of any

country. Examples of matters where the protective principle

applies include counterfeiting of national currency or

state seal, forging government documents, espionage, or

conspiracy to violate a country’s immigration or customs

laws. If a company’s activities threaten the state function of

a country, then the protective principle will apply and that

country will have jurisdiction.

Regional international distinctions

Both Spain and the

United Kingdom invoked

the universality principle

to bring charges against

Chilean President

Augusto Pinochet.

Once a company determines it is potentially subject to the

jurisdiction of a country, it should become familiar with the

laws of that country. This includes the company’s record

manager, who must become familiar with the country’s

laws to ensure the records retention schedule is compliant

with those laws. Often this requires specialized help, such

as a local attorney or firm familiar with records laws in that

country.

If you want the

protection and privileges

of a jurisdiction, you

must apply the rules and

regulations of

that jurisdiction.

The following section discusses some distinctions in laws

that impact records management in different regions

throughout the world. This analysis includes record

management issues associated with personally identifiable

or sensitive information (PII) and legal status of electronic

records, retention requirements associated with corporate

filings, customs, labor, and tax, and other considerations

such as statutes of limitations.

Universality principle

The universality principle recognizes the right of any state

to bring criminal proceedings regarding certain crimes,

irrespective of the location of the crime and the nationality

of the perpetrator or the victim.12 “It is based on the

notion that certain crimes are so harmful to international

interests that states are entitled – and even obliged – to

bring proceedings against the perpetrator, regardless of the

location of the crime and the nationality of the perpetrator

or the victim.”13 Normally these crimes include heinous

actions such as genocide, torture, or slavery.

United States and Canada

In both the United States and Canada, electronic records

are generally acceptable when records are legally required

to be kept.16

10

Restatement (Third) § 402(1)(C)

11

Restatement (Third) § 402(3)

12

Xavier Philippe, The Principles of Universal Jurisdiction and Complementarity:

How Do the Two Principles Intermesh? 88 Int’l Rev. of Red Cross 375, 377

(June 2006)

13

Typically these are crimes committed by governments or

government officials, but corporations become complicit in

these crimes when companies provide services that further

or advance these crimes.14 For example, the United States

claimed jurisdiction in a case against a pipeline company

when, to build a pipeline for Burma’s military, the company

used employees tortured and enslaved by Burma’s

Id. (citing Mary Robinson, ‘Foreword,’ The Princeton Principles on Universal

Jurisdiction, Princeton University Press, Princeton, 2001, p. 16)

14

Kendra Magraw, Corporate-Complicity Liability Under the Principle of Universal

Jurisdiction, 18 Minn. J. Int’l L. 458 (2009)

15

Id. at 472 (referencing Doe v. Unocal Corp., 403 F.3d 708 (9th Cir. 2005))

16

See 15 U.S.C. § 7001 and State Versions and Canadian Provincial Versions of

Electronic Transaction Act

17

See 16 C.F.R. § 318 et. seq. and State Versions

3

Countries may use the

protective principle to

protect the integrity of

their currency.

Companies have a responsibility to protect PII, and must

notify those impacted by a potential breach of that PII.17 In

the U.S., the laws promote safe handling of PII by placing

liability and notification requirements on the holder if there

is a breach. The U.S. approach is essentially a back-end

approach, addressing the issue only when a liability or

problem occurs, creating a financial burden on the holder of

PII to remedy the problem.

and retention requirements. The list can have nearly

2,000 record types with specified retention periods.21 In

addition to areas familiar to record managers in the United

States, the covered records include information technology,

building maintenance, correspondence, and various types

of contracts. Generally speaking, in the former Soviet

countries, if a company has a document (electronic or hard

copy), there is a specific retention requirement addressing

that specific type of document.

The federal governments in both Canada and the United

States provide retention requirements for corporate records

and customs documents. The federal governments, states,

provinces, and territories stipulate retention requirements

associated with labor (payroll, unemployment, health and

safety), environment, and tax. The United States and Canada

also have limitation periods for certain causes of actions

that companies may consider when determining a retention

period.

Some former Soviet Bloc and Eastern European countries

also impose long retention times on labor-related records.

In the United States and in most regions, retention

requirements for labor records (excluding certain medical

health records) typically range from three to 10 years.

In some of the former Soviet Bloc and Eastern European

countries, companies are required to maintain many

standard employment records for 75, 100, or 150 years, or

indefinite periods.22

Western Europe/European Union

Latin and South American countries

For countries within the European Union (EU), one of

the most distinguishing record management concepts

addresses the issue of handling PII. Unlike the back-end

U.S. approach, which addresses the issue only when a

liability or problem occurs, the EU regulates PII on the front

end, placing specific requirements on the actual handling of

PII. Among the restrictions are requirements that the holder

safely dispose of the PII when the company achieves the

purpose for which the PII was collected.18 For example, if PII

is used to determine whether a company should issue credit

to a person, once the company makes that decision, the

company should safely dispose of the PII.

In Europe the handling

of personally sensitive

or identifiable

information is a major

issue.

Many former Soviet

countries have detailed

record retention

requirements.

General distinctions in Latin and South America include their

approach to electronic records, handling of PII, and their

reliance on a general limitation period for record retention. In

the U.S. and in most regions, when a law requires a record,

an electronic version of that record satisfies the record

requirement unless specified otherwise.23 Many countries

in Latin and South America have not accepted electronic

versions of records and often require hard copies, with

supplemental electronic records being optional.24

As discussed above, in Europe, holders of PII are required

to dispose of the information when it is no longer needed.

In Latin and South America, by contrast, some countries

impose specific maximum periods for PII, such as two or

five years.25 Companies are free to dispose of the records

Also, under EU regulations, a company within the EU may

not transfer PII to another country that does not comply with

EU privacy regulations.19 In response to this requirement,

the U.S. Department of Commerce established a selfcertifying approach (“safe harbor”) to bridge the differences

between the disparate approaches and provide U.S.

companies a streamlined way to meet European privacy

regulations.20

18

European Parliament and of the Council of 24 October 1995, Directive 95/46/

EC, § II, Art. 7(f) (note – EU Directives are then implemented by member-state

laws or regulations)

19

U.S. Dept. of Comm., U.S.-EU Safe Harbor Program (available at http://export.

gov/safeharbor/eu/eg_main_018365.asp, last viewed July 19, 2013)

Eastern Europe/former Soviet Bloc countries

21

Examples of countries with this type of list include Georgia, Kyrgyzstan,

Lithuania, Moldova, Russia and Ukraine

The former Soviet Bloc countries have more developed

record retention requirements than other regions. For

example, in the United States and in most regions, there

are retention requirements for specific industries, and

generally for customs, environment, labor, and tax. In the

former Soviet countries, however, almost every type of

document has a defined retention period. Many of the

former Soviet countries have one law with a list of record

1-866-229-8700 | huronconsultinggroup.com/legal

Id. at § IV, Art. 25(1)

20

22

Referencing labor laws in Bosnia and Herzegovina, Bulgaria, Kyrgyzstan,

Macedonia, Montenegro, Romania, Serbia, and Slovenia

23

15 U.S.C. § 7001 and State Versions

24

Referencing various record management laws in Bolivia, Guatemala, Mexico

and Uruguay

4

25

Referencing Argentina, Brazil, Nicaragua, and Uruguay

26

Mexico Cd. of Comm., Art. 1047

The Impact of Global Laws on a Records Retention Schedule

before that time, but they may not hold on to the information

for a longer period.

Current member states include the United Arab Emirates,

Bahrain, Saudi Arabia, Oman, Qatar, and Kuwait.30 For

those countries, the GCC impacts retention requirements for

customs records: the GCC Customs Union, created in 2003,

includes retention requirements associated with the import

and export of goods.31

Latin and South America do not have many retention

requirements, but they do have well accepted norms of

retention that rely heavily on general limitation of action

periods. Mexico is a classic example of this, where

companies often defer to a 10-year retention period for

many records based on the general 10-year statute of

limitation that applies to many different types of actions.26

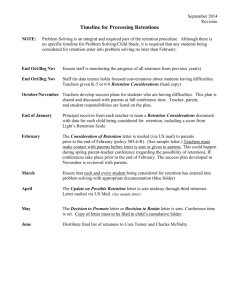

Creating a global records retention schedule

Creating a global records retention schedule or schedules

is a daunting task for today’s record manager. Nevertheless,

the variety of jurisdictions a company may be subject to

and the differences among these countries’ requirements

make this task necessary. Three potential approaches to

creating a global records retention schedule are: (1) create

a schedule for each country, (2) create a base schedule

and apply exceptions where required by law, and (3) create

regional schedules. The first two steps in the creation any

of these global schedules are to determine which countries

have probable jurisdiction and therefore impact the

company’s record retention schedule, and then to identify

each of those countries’ legal requirements associated with

record management.

Asia Pacific

The record management requirements of Asian Pacific

countries seem to parallel many of the general principles

used in other regions.27 For example, companies may

not hold PII longer than necessary, but there are not the

EU’s heavy restrictions with regard to the transfer of PII to

countries with different standards.

Asian Pacific countries generally have accounting

regulations that are common to most countries throughout

the world, but uncommon in the U.S. In the U.S., there are

implied requirements for accounting records through tax

assessment laws, but unless a company is specifically

regulated (either by industry or the Securities and Exchange

Commission), there are no real accounting retention

requirements. For most Asian countries and countries

throughout the world, if a company is registered in that

country, it is normally obligated to maintain accounting

records for ten years. Countries can audit these accounting

records for a number of purposes, including investigations

into anti-bribery/foreign corruption activities.

Individual country schedules

Under this approach, a company creates a separate records

retention schedule for each country where the company

engages in commerce. This approach has several benefits.

First, the schedule is better able to address the actual scope

of operations in each country. For example, if a company

is incorporated in but has no employees in that country,

it may not need to include labor records in the schedule.

Second, the schedule is better able to address the nuances

of that country’s laws. This approach also has some

downsides, however. One downside is a lack of corporate

uniformity. If a corporation is trying to have uniform policies,

then a separate schedule with separate policies for each

Middle East/Central Asia/North Africa

Many of the countries in Middle East, Central Asia, and

North Africa have legal concepts based on Islamic laws and

traditions known as Sharia Law. Sharia, which comes from

the word “path” in Arabic, guides all aspects of Muslim life,

including daily routines, familial and religious obligations,

and financial dealings.28 Some countries in this region

govern using dual secular and Sharia systems, while

others rely more on one or the other. For example, Saudi

Arabia relies heavily on Sharia law. As a result, in Saudi

Arabia there are few laws specifying retention periods and

limitation of action periods do not apply. However, in the

United Arab Emirates, the record management policies are

similar to those of Western Europe and Asia Pacific.

27

Countries reviewed include China (incl. Hong Kong), Indonesia, Japan,

Malaysia, Philippines, South Korea, Taiwan, Thailand, and Vietnam

28

Council on Foreign Relations, Islam: Governing Under Sharia, Jan. 9, 2013

(available at http://www.cfr.org/religion/islam-governing-under-sharia/p8034,

last viewed July 19, 2013)

29

Gulf Cooperation Council Website http://www.gcc-sg.org/eng/ (last viewed July

19, 2013)

30

Gulf Corporation Member States (available at http://www.gcc-sg.org/eng/

indexc64c.html?action=GCC, last viewed July 19, 2013)

31

Implementation Procedures for the GCC Customs Union (available at http://

www.gcc-sg.org/eng/index9038.html?action=Sec-Show&ID=93, last viewed

July 19, 2013)

Another consideration in the Middle East is the impact of

the Gulf Cooperation Council (GCC).29 The GCC is a regional

authority, similar in scope (without the currency) to the EU.

32

Attributed to Lao-tzu (c. 604-c. 531 BC), founder of Taoism

5

Many Latin American

countries still rely

heavily on hard copies

of records.

Sharia law plays an

important role in many

Islamic countries, but

provides little record

retention guidance.

country hinders that objective. This approach is also timeconsuming, and it is expensive to create and maintain many

schedules if a company does business in a number of

countries. Separate country schedules are good, however,

for companies with unique and independent operations in

each country.

using a regional approach. For countries within a region that

have longer retention requirement for certain records, the

schedule can note exceptions. While this approach takes

a great deal of organization, it is an efficient method for

companies with a large multi-national presence.

Conclusion

Base schedules with exceptions

The Tao proverb states that “the journey of a thousand

miles starts with a single step.”32 For companies facing

the challenges of records management in a globalized

environment, the first step is determining which countries

may have jurisdiction over them, their products, or their

services, and how that jurisdiction impacts their records

retention schedule. To avoid obstacles in the road,

companies should recognize that countries treat record

management differently, and therefore need to examine

each of those countries’ laws and regulations that impact

their schedules. Based on this information, companies

can determine the best path for their global retention

schedules. Like all great journeys, the route to a global

retention schedule never really ends. Companies change,

laws change, and as a result, records retention schedules

change. Companies should constantly re-examine their

schedules so as to stay on the right course.

A base schedule is one schedule used by the whole

company, including international offices. By using a base

schedule, a company is able to create a schedule that

satisfies a sufficient amount of legal requirements to make

the schedule efficient, and to promote company uniformity.

For countries with longer retention requirements, the

schedule includes an exception field. Organizations in

countries impacted by the exception field are required to

maintain the excepted records longer than organizations

in other countries. This approach is more desirable than

just choosing the longest retention period. Some countries

have excessively long retention period for records that

are costly to retain, and there can be additional indirect

costs related to locating and producing them in the event

of litigation. While schedules created with this approach

tend to be based on the legal and business concepts of the

company’s home country and sometimes do not take into

account regional differences, it is an efficient method if is

the company has a limited multi-national presence.

Regional schedules

Companies should

constantly re-examine

their records retention

schedules so as to stay

on the right course.

By examining the similarity of laws within certain regions, a

company can create a limited number of regional schedules

that capture the legal concepts of the countries in which it

operates, and still promotes uniformity. To be clear, there is

no such thing as “regional law.” Each country has its own

laws and regulations and the company needs to be aware

of those laws for the countries where it operates, but a

company can capture most of those laws in a few schedules

SeeThingsDifferently.

1-866-229-8700

huronconsultinggroup.com/legal

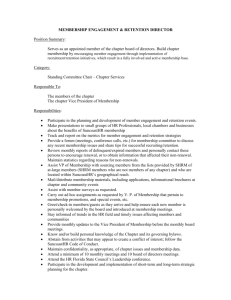

Huron Legal provides advisory and business services to assist law departments and law firms to enhance organizational effectiveness and reduce

legal spend. Huron Legal advises on and implements strategy, organizational design and development, outside counsel management, operational

efficiency, and discovery solutions, and provides services relating to the management of matters, contracts, documents, records, digital evidence

and e-discovery.

© 2013 Huron Consulting Group Inc. All Rights Reserved. Huron is a management consulting firm and not a CPA firm, and does not provide

attest services, audits, or other engagements in accordance with standards established by the AICPA or auditing standards promulgated by the

Public Company Accounting Oversight Board (“PCAOB”). Huron is not a law firm; it does not offer, and is not authorized to provide, legal advice

or counseling in any jurisdiction.

6