Debt Retirement and Sinking Funds

advertisement

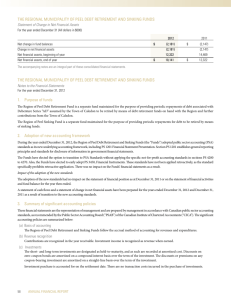

The Regional Municipality of Peel Notes to the Financial Statements For the year ended December 31, 2011 1. Purpose of funds The Region of Peel Debt Retirement Fund is a separate fund maintained for the purpose of providing periodic repayments of debt associated with Debenture Series “AD” assumed by the Town of Caledon to be retired by means of debt retirement funds. The Region of Peel Sinking Fund is a separate fund maintained for the purpose of providing periodic repayments for debt to be retired by means of sinking funds. 2. Summary of significant accounting policies These financial statements are the representation of management and are prepared by management in accordance with Canadian generally accepted accounting principles, as recommended by the Canadian Institute of Chartered Accountants. The significant accounting policies are summarized below: (a) Basis of accounting The Region of Peel Debt Retirement and Sinking Funds follow the accrual method of accounting for revenues and expenditures. (b) Revenue recognition Contributions are recognized in the year receivable. Investment income is recognized as revenue when earned. (c) Investments The short- and long-term investments are designated as held-to-maturity, and as such are recorded at amortized cost. Discounts on zero-coupon bonds are amortized on a compound interest basis over the term of the investment. The discounts or premiums on any coupon-bearing investment are amortized on a straight-line basis over the term of the investment. Investment purchase is accounted for on the settlement date. There are no transaction costs incurred in the purchase of investments. (d) Provision for actuarial requirements The provision for actuarial requirements for the Sinking Fund represents the amounts required which, together with interest compounded annually, will be sufficient to retire the related debt at maturity, based on contributions to the Sinking Fund to date. The actuarial requirements were calculated using a rate of 4 per cent per annum. The excess or deficiency of financial assets over these requirements is included in the fund balance. (e) Future accounting changes In December 2010, the CICA issued a new accounting framework applicable to not-for-profit organizations. Effective for fiscal years beginning on or after January 1, 2012, not-for-profit organizations will have to choose between International Financial Reporting Standards (IFRS) and Canadian accounting standards for not-for-profit organizations. The Debt Retirement Fund and the Sinking Fund currently plan to adopt the new accounting standards for not-for-profit organizations for the fiscal year beginning on January 1, 2012. The impact of transitioning to these new standards has not been determined at this time. 3. Allocation of surplus In 2011, there was no surplus declared payable to the Regional Municipality of Peel by the Debt Retirement and Sinking Fund Committee (2010 – $nil). 4.Contributions In 2011, there were no contributions made to the Debt Retirement Fund (2010 – $nil). Contributions to the Sinking Fund were $8,915 (2010 – $nil). 5. Financial instruments The Debt Retirement Fund is subject to market risk and interest rate price risk with respect to its investment portfolio. The financial assets of the Sinking Fund include cash and accrued interest only, and as such, are not subject to market risk and interest risk. 6. Capital management The Debt Retirement has a capital management process in place to measure and monitor its available capital and assess its adequacy. This capital management process aims to achieve two major objectives: ensures sufficient liquid resources to meet its funding requirements, and complies with the Region’s approved investment policy. As at December 31, 2011, the Debt Retirement Fund has met its objective of having sufficient liquid resources to meet its current obligations and complying with the Region’s approved investment policy. The sinking fund also has a capital management process in place to measure and monitor its available capital and assess its adequacy. This capital management process aims to achieve two major objectives: ensures sufficient resources to meet its actuarial requirements in accordance with the Municipal Act, 2001 and complies with the Region’s approved investment policy for the Sinking Fund. REGION OF PEEL 57 As at December 31, 2011, the Sinking Fund, while complying with the Region’s approved investment policy, had a shortfall of $17 (2010 – $nil) in meeting its objective of having sufficient resources to meet its actuarial obligations. This shortfall has been made up subsequent to year end by an additional contribution. 7. Principal repayment Annual principal repayments for Debenture Series “AD” issued on behalf of the Town of Caledon over the next five years and thereafter are due as follows: (All dollars in $000) 2012 $ 1,590 2013 1,694 2014 1,804 2015 1,921 2016 2,046 2017 and thereafter 12,994 Total $ 22,049 8. Investment portfolio Short-term investments consist of various municipal bonds bearing interest rates at 5.25 per cent to 6.60 per cent maturing in December 2012. Long-term investments consist of municipal bonds bearing interest rates at 4.90 per cent to 6.60 per cent maturing from December 2013 to November 2014. 58 ANNUAL FINANCIAL REPORT