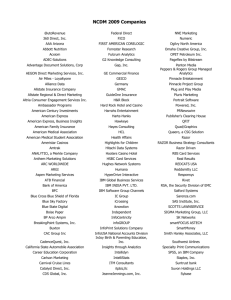

Choice of Entity for New Businesses

advertisement

Choice of Entity for New Businesses Shawn M. Lindsay shawn@hbclawyers.com | 503.968.1475 One of the initial decisions made by an entrepreneur is the selection of an entity for the business venture. This chart outlines some basic differences among the three main choices of entities: C corporations, S corporations, and limited liability companies (or LLCs). This outline is not comprehensive. There are some important differences, such as in the tax treatment of employee benefits, which are not discussed in this outline. This outline is only intended as an information guide and does not constitute legal advice. Please consult with a legal advisor on issues relating to choice of business entity. Number of Owners C Corporation No restriction. S Corporation 1 to 1001 Type of owners No restriction. Classes of ownership interests Multiple classes permitted. Business Activities No restriction. Individuals who are U.S. citizens or U.S. residents for tax purposes; estates, certain trusts and tax-­‐ exempt organizations. One class. However, there may be differences in voting rights. Certain financial and insurance businesses cannot be conducted as S corporations. Limited Liability Company No restriction, but in some states, an LLC needs to have two or more members. Oregon allows one-­‐member LLCs. No restriction. Multiple classes permitted in some states. No restriction. 1 There are some special rules about number of shareholders, e.g., husband and wife are counted as one shareholder for this purpose. Choice of Entity (Cont.) Transferability of ownership interests C Corporation No restriction except as imposed by shareholders agreement. S Corporation No restriction except as imposed by shareholders agreement. Management authority Vested in directors. Vested in directors. Levels of income tax Corporate level tax. Tax on shareholder level on dividend distribution. No tax at corporate level. Items of income or loss allocated and taxed to shareholders. Special allocation of income or loss N/A No. Page | 2 Limited Liability Company Admission of new members is generally by consent of majority of members, unless provided otherwise by LLC governing documents. In a member-­‐managed LLC: vested in members. In a manager-­‐managed LLC: vested in the managers. Certain important transactions require unanimous member consent, unless provided otherwise by LLC governing documents. No tax at company level. Generally treated as a partnership for tax purposes, unless the LLC elects to be taxed as a corporation. As a tax partnership, items of LLC income or loss are allocated and taxed to members. A one-­‐member LLC generally is treated as a sole proprietorship and disregarded for tax purposes, unless the LLC elects to be taxed as a corporation. Yes. Choice of Entity (Cont.) Deductibility of passed-­‐through losses C Corporation N/A Cash distribution Taxable to shareholder as dividend. Liquidation Gains or losses on corporate properties are recognized and taxed at corporate level. Shareholders would recognize capital gain or loss on their stock upon receiving the liquidating distributions. Gain on sale or exchange of ownership interest Capital gain. Self-­‐employment taxes on corporate profits N/A Page | 3 S Corporation Shareholders may deduct their allocable share of corporate losses only to the extent of their investment basis in the corporation (basis in stock plus basis in loan to corporation). At-­‐risk limitation and passive loss limitation also apply. Generally tax-­‐free to the shareholders to the extent of the tax basis in their stock. Gains or losses on corporate properties are recognized and flow through to shareholders. Shareholders would recognize capital gain or loss on their stock upon receiving the liquidating distributions to the extent of any difference between the amount of distributions and the tax basis in the stock (adjusted for passed-­‐ through items). Capital gain. Shareholders are not subject to employment taxes on corporate profits. Limited Liability Company Members may deduct their allocable share of company losses only to the extent of the tax basis in their LLC interest, which includes their allocable share of company debt. At-­‐risk limitation and passive loss limitation also apply. Generally tax-­‐free to the members to the extent of the tax basis in their LLC interests. Generally tax-­‐free to the members, except to the extent that the amounts of cash received exceed the tax basis in their LLC interests. May be treated as ordinary income to the extent deemed a sale of the member’s share of any unrealized receivables and appreciated inventory of the company. Unclear due to lack of statutory or regulatory guidance. Choice of Entity (Cont.) Merger and Acquisition C Corporation S Corporation Can enter into tax-­‐free merger or acquisition with another corporation. Can enter into tax-­‐free merger or acquisition with another corporation. Page | 4 Limited Liability Company In Oregon, an LLC can now readily combine with, or convert into, almost any other form of business entity. However, an LLC generally does not qualify for the tax-­‐ free reorganization provisions available to corporate mergers and acquisitions. If the LLC is incorporated before entering into a merger or acquisition with another corporation, the incorporation may be a taxable event for the LLC members.

![Your_Solutions_LLC_-_New_Business3[1]](http://s2.studylib.net/store/data/005544494_1-444a738d95c4d66d28ef7ef4e25c86f0-300x300.png)