Accounting Practices and Procedures Manual

advertisement

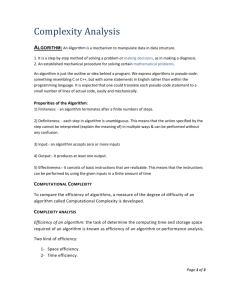

Accounting Practices and Procedures Manual As of March 2013 TABLE OF CONTENTS Statements of Statutory Accounting Principles (SSAP) - Volume I In October 2010, the Statutory Accounting Principles (E) Working Group adopted a proposal to remove 100% superseded SSAPs and nullified interpretations (INTs) from Volume I of the Manual and include these items within a new Appendix H in Volume III. Under this approach, only current authoritative guidance is located in Volume I of the Manual, while preserving the historical reference needed for accounting purposes. If a SSAP or interpretation has been superseded, it is included in Appendix H. No. 1 2 3 4 5R 6 7 9 11 12 15 16R 17 19 20 21 22 23 24 25 26 27 29 30 32 34 35R 36 37 38 Title Preamble ........................................................................................................................... Disclosure of Accounting Policies, Risks & Uncertainties, and Other Disclosures ......... Cash, Drafts, and Short-term Investments ........................................................................ Accounting Changes and Corrections of Errors ............................................................... Assets and Nonadmitted Assets ....................................................................................... Liabilities, Contingencies and Impairments of Assets ..................................................... Uncollected Premium Balances, Bills Receivable for Premiums, and Amounts Due From Agents and Brokers .......................................................................................... Asset Valuation Reserve and Interest Maintenance Reserve ........................................... Subsequent Events ............................................................................................................ Postemployment Benefits and Compensated Absences ................................................... Employee Stock Ownership Plans .................................................................................... Debt and Holding Company Obligations ......................................................................... Electronic Data Processing Equipment and Accounting for Software ............................ Preoperating and Research and Development Costs ........................................................ Furniture, Fixtures and Equipment; Leasehold Improvements Paid by the Reporting Entity as Lessee; Depreciation of Property and Amortization of Leasehold Improvements .............................................................................................................. Nonadmitted Assets .......................................................................................................... Other Admitted Assets ..................................................................................................... Leases ............................................................................................................................... Foreign Currency Transactions and Translations ............................................................ Discontinued Operations and Extraordinary Items .......................................................... Accounting for and Disclosures about Transactions with Affiliates and Other Related Parties ......................................................................................................................... Bonds, Excluding Loan-Backed and Structured Securities .............................................. Disclosure of Information about Financial Instruments with Off-Balance-Sheet Risk and Financial Instruments with Concentrations of Credit Risk ................................. Prepaid Expenses .............................................................................................................. Investments in Common Stock (excluding investments in common stock of subsidiary, controlled, or affiliated entities) .............................................................. Investments in Preferred Stock (including investments in preferred stock of subsidiary, controlled, or affiliated entities) .............................................................. Investment Income Due and Accrued ............................................................................... Guaranty Fund and Other Assessments ............................................................................ Troubled Debt Restructuring ............................................................................................ Mortgage Loans ................................................................................................................ Acquisition, Development and Construction Arrangements ............................................ © 1999-2013 National Association of Insurance Commissioners i Page P-1 1-1 2-1 3-1 4-1 5R-1 6-1 7-1 9-1 11-1 12-1 15-1 16R-1 17-1 19-1 20-1 21-1 22-1 23-1 24-1 25-1 26-1 27-1 29-1 30-1 32-1 34-1 35R-1 36-1 37-1 38-1 Table of Contents No. 39 40 41 42 43R 44 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61R 62R 63 64 65 66 67 68 69 70 71 72 73 74 76 78 83 84 86 90 92 93 94R 95 Title Reverse Mortgages ........................................................................................................... Real Estate Investments .................................................................................................... Surplus Notes .................................................................................................................... Sale of Premium Receivables ........................................................................................... Loan-Backed and Structured Securities ........................................................................... Capitalization of Interest .................................................................................................. Uninsured Plans ................................................................................................................ Joint Ventures, Partnerships and Limited Liability Companies ....................................... Policy Loans ..................................................................................................................... Classifications and Definitions of Insurance or Managed Care Contracts in Force ......... Life Contracts ................................................................................................................... Deposit-Type Contracts .................................................................................................... Property Casualty Contracts–Premiums ........................................................................... Individual and Group Accident and Health Contracts ..................................................... Unpaid Claims, Losses and Loss Adjustment Expenses .................................................. Separate Accounts ............................................................................................................ Title Insurance .................................................................................................................. Mortgage Guaranty Insurance .......................................................................................... Credit Life and Accident and Health Insurance Contracts ................................................ Financial Guaranty Insurance ........................................................................................... Life, Deposit-Type and Accident and Health Reinsurance .............................................. Property and Casualty Reinsurance .................................................................................. Underwriting Pools and Associations Including Intercompany Pools ............................. Offsetting and Netting of Assets and Liabilities .............................................................. Property and Casualty Contracts ...................................................................................... Retrospectively Rated Contracts ...................................................................................... Other Liabilities ................................................................................................................ Business Combinations and Goodwill .............................................................................. Statement of Cash Flow .................................................................................................... Allocation of Expenses ..................................................................................................... Policy Acquisition Costs and Commissions ..................................................................... Surplus and Quasi-Reorganizations .................................................................................. Health Care Delivery Assets—Supplies, Pharmaceuticals and Surgical Supplies, Durable Medical Equipment, Furniture, Medical Equipment and Fixtures, and Leasehold Improvements in Health Care Facilities .................................................... Accounting for the Issuance of Insurance-Linked Securities Issued by a Property and Casualty Insurer Through a Protected Cell ................................................................. Reporting on the Costs of Start-Up Activities .................................................................. Multiple Peril Crop Insurance .......................................................................................... Mezzanine Real Estate Loans .......................................................................................... Certain Health Care Receivables and Receivables Under Government Insured Plans .... Accounting for Derivative Instruments and Hedging, Income Generation, and Replication (Synthetic Asset) Transactions ................................................................ Accounting for the Impairment or Disposal of Real Estate Investments ......................... Accounting for Postretirement Benefits Other than Pensions, A Replacement of SSAP No. 14 ...................................................................................................................... Accounting for Low Income Housing Tax Credit Property Investments ......................... Accounting for Transferable State Tax Credits ............................................................... Exchanges of Nonmonetary Assets, A Replacement of SSAP No. 28—Nonmonetary Transactions ................................................................................................................ © 1999-2013 National Association of Insurance Commissioners ii Page 39-1 40-1 41-1 42-1 43R-1 44-1 47-1 48-1 49-1 50-1 51-1 52-1 53-1 54-1 55-1 56-1 57-1 58-1 59-1 60-1 61R-1 62R-1 63-1 64-1 65-1 66-1 67-1 68-1 69-1 70-1 71-1 72-1 73-1 74-1 76-1 78-1 83-1 84-1 86-1 90-1 92-1 93-1 94R-1 95-1 Table of Contents No. 97 100 101 102 103 104 Title Investments in Subsidiary, Controlled and Affiliated Entities, A Replacement of SSAP No. 88 ............................................................................................................... Fair Value Measurements ................................................................................................. Income Taxes, A Replacement of SSAP No. 10R and SSAP No. 10 ............................... Accounting for Pensions, A Replacement of SSAP No. 89 .............................................. Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities .................................................................................................................... Share-Based Payments ..................................................................................................... Page 97-1 100-1 101-1 102-1 103-1 104-1 INDEX to Statements of Statutory Accounting Principles - Volume I ................................... Page 1 GLOSSARY to Statements of Statutory Accounting Principles - Volume I .......................... Page 17 Appendix A – Excerpts of NAIC Model Laws – Volume I No. A-001 A-010 A-200 A-205 A-225 A-235 A-250 A-255 A-270 A-440 A-585 A-588 A-620 A-628 A-630 A-641 A-695 A-785 A-791 A-812 A-815 A-817 A-818 A-820 A-821 A-822 Title Investments of Reporting Entities .................................................................................... Minimum Reserve Standards for Individual and Group Health Insurance Contracts....... Separate Accounts Funding Guaranteed Minimum Benefits Under Group Contracts ..... Illustrative Disclosure of Differences Between NAIC Statutory Accounting Practices and Procedures and Accounting Practices Prescribed or Permitted by the State of Domicile ...................................................................................................................... Managing General Agents ................................................................................................ Interest-Indexed Annuity Contracts ................................................................................. Variable Annuities ........................................................................................................... Modified Guaranteed Annuities ....................................................................................... Variable Life Insurance .................................................................................................... Insurance Holding Companies ......................................................................................... Universal Life Insurance .................................................................................................. Modified Guaranteed Life Insurance ............................................................................... Accelerated Benefits ........................................................................................................ Title Insurance .................................................................................................................. Mortgage Guaranty Insurance .......................................................................................... Long-Term Care Insurance ............................................................................................... Synthetic Guaranteed Investment Contracts .................................................................... Credit for Reinsurance ..................................................................................................... Life and Health Reinsurance Agreements ........................................................................ Smoker/Nonsmoker Mortality Tables for Use in Determining Minimum Reserve Liabilities .................................................................................................................... Recognition of Preferred Mortality Tables for Use in Determining Minimum Reserve Liabilities .................................................................................................................... Preneed Life Insurance Minimum Standards for Determining Reserve Liabilities and Nonforfeiture Values.............................................................................................. Determining Reserve Liabilities for Credit Life Insurance Model Regulation ................ Minimum Life and Annuity Reserve Standards ............................................................... Annuity Mortality Table for Use in Determining Reserve Liabilities for Annuities ........ Asset Adequacy Analysis Requirements .......................................................................... © 1999-2013 National Association of Insurance Commissioners iii Page A001-1 A010-1 A200-1 A205-1 A225-1 A235-1 A250-1 A255-1 A270-1 A440-1 A585-1 A588-1 A620-1 A628-1 A630-1 A641-1 A695-1 A785-1 A791-1 A812-1 A815-1 A817-1 A818-1 A820-1 A821-1 A822-1 Table of Contents No. A-830 Title Page Valuation of Life Insurance Policies (Including the Introduction and Use of New Select Mortality Factors)............................................................................................. A830-1 Appendix B - Interpretations of Emerging Accounting Issues Working Group - Volume I In 2009, the Emerging Accounting Issues (E) Working Group reached a consensus to incorporate “rejected” and “non-applicable” FASB EITFs that do not provide additional statutory accounting guidance in a listing within a designated interpretation. This interpretation (INT 99-00) includes reference of all FASB EITFs, including those previously included in Appendix B as a statutory accounting interpretation, that were 1) rejected as not applicable to statutory accounting; 2) rejected without providing additional statutory guidance; or 3) rejected on the basis of issues rejected in a SSAP. INT 99-00 will be updated as needed to reference future GAAP interpretations as appropriate. In October 2010, the Statutory Accounting Principles (E) Working Group adopted a proposal to remove 100% superseded SSAPs and nullified interpretations (INTs) from Volume I of the Manual and include these items within Appendix H in Volume III. Under this approach, only current authoritative guidance is located in Volume I of the Manual, while preserving the historical reference needed for accounting purposes. If a SSAP or interpretation has been superseded, it is included in Appendix H. No. INT 99-00 INT 00-03 INT 00-20 INT 00-24 INT 00-26 INT 00-28 INT 00-32 INT 01-18 INT 01-25 INT 01-31 INT 02-22 INT 03-02 INT 03-12 INT 04-17 INT 04-21 INT 05-04 INT 05-05 INT 05-06 Title Compilation of Rejected EITFs ................................................................................. Illustration of the Accounting/Reporting of Deposit-Type Contracts in Accordance with SSAPs No. 51, 52 and 56 ......................................................... Application of SEC SAB No. 99, Materiality to the Preamble of the AP&P Manual.................................................................................................................. EITF 98-13: Accounting by an Equity Method Investor for Investee Losses When the Investor Has Loans to and Investments in Other Securities of the Investee and EITF 99-10: Percentage Used to Determine the Amount of Equity Method Losses ..................................................................................................... EITF 98-3: Determining Whether a Nonmonetary Transaction Involves Receipt of Productive Assets or of a Business ...................................................................... EITF 99-12: Determination of the Measurement Date for the Market Price of Acquirer Securities Issued in a Purchase Business Combination ........................ EITF 00-8: Accounting by a Grantee for an Equity Instrument to Be Received in Conjunction with Providing Goods or Services ................................................... Consolidated or Legal Entity Level – Limitations on EDP Equipment, Goodwill and Deferred Tax Assets Admissibility ............................................................... Accounting for U.S. Treasury Inflation-Indexed Securities ...................................... Assets Pledged as Collateral ..................................................................................... Accounting for the U.S. Terrorism Risk Insurance Program .................................... Modification to an Existing Intercompany Pooling Arrangement ............................ EITF 02-4: Determining Whether a Debtor’s Modification or Exchange of Debt Instruments is within the Scope of FASB Statement No. 15 ............................... Impact of Medicare Modernization Act on Postretirement Benefits ........................ EITF 02-09: Accounting for Changes that Result in a Transferor Regaining Control of Financial Assets Sold ......................................................................... Extension of Ninety-day Rule for the Impact of Hurricane Katrina, Hurricane Rita and Hurricane Wilma .......................................................................................... Accounting for Revenues Under Medicare Part D Coverage ................................... Earned But Uncollected Premium ............................................................................. © 1999-2013 National Association of Insurance Commissioners iv Page 99-00-1 00-03-1 00-20-1 00-24-1 00-26-1 00-28-1 00-32-1 01-18-1 01-25-1 01-31-1 02-22-1 03-02-1 03-12-1 04-17-1 04-21-1 05-04-1 05-05-1 05-06-1 Table of Contents No. INT 06-02 INT 06-07 INT 06-12 INT 06-13 INT 06-14 INT 07-01 INT 07-03 INT 08-02 INT 08-03 INT 08-04 INT 08-05 INT 08-06 INT 08-07 INT 08-08 INT 08-10 INT 09-03 INT 09-05 INT 09-08 Title Accounting and Reporting for Investments in a Certified Capital Company (CAPCO) ............................................................................................................. Definition of Phrase “Other Than Temporary” ......................................................... Tax Deposits Submitted in Accordance with Section 6603 of the Internal Revenue Service (IRS) Code .............................................................................................. EITF 01-2: Interpretations of APB Opinion No. 29 .................................................. Reporting of Litigation Costs Incurred for Lines of Business in which Legal Expenses Are the Only Insured Peril ................................................................... Application of the Scientific (constant yield) Method in Situations of Reverse Amortization ........................................................................................................ EITF 06-3: How Taxes Collected from Customers and Remitted to Governmental Authorities Should Be Presented in the Income Statement (That is, Gross versus Net Presentation) ...................................................................................... EITF 06-8: Applicability of the Assessment of a Buyer's Continuing Investment under FASB Statement No. 66 for Sales of Condominiums ................................ EITF 06-9: Reporting a Change in (or the elimination of) a Previously Existing Difference between the fiscal Year-End of a Parent Company and That of a Consolidated Entity or between the Reporting Period of an Investor and That of an Equity Method Investee .............................................................................. EITF 07-3: Accounting for Nonrefundable Advance Payments for Goods or Services Received for Use in Future Research and Development Activities ...... EITF 02-11: Accounting for Reverse Spinoffs ......................................................... FSP EITF 00-19-2: Accounting for Registration Payment Arrangements ................ EITF 07-6: Accounting for the Sale of Real Estate Subject to the Requirements of FASB Statement No. 66 When the Agreement Includes a Buy-Sell Clause ....... INT 08-08: Balance Sheet Presentation of Funding Agreements Issued to a Federal Home Loan Bank .................................................................................... Contractual Terms of Investments and Investor Intent ............................................. EITF 08-7: Accounting for Defensive Intangible Assets .......................................... EITF 08-3: Accounting by Lessees for Maintenance Deposits ................................. Accounting for Loans Received under the Federal TALF Program ......................... Page 06-02-1 06-07-1 06-12-1 06-13-1 06-14-1 07-01-1 07-03-1 08-02-1 08-03-1 08-04-1 08-05-1 08-06-1 08-07-1 08-08-1 08-10-1 09-03-1 09-05-1 09-08-1 Appendix C - Actuarial Guidelines - Volume II No. I II III IV V VI VII VIII Title Actuarial Guidelines Table of Contents ....................................................................... Interpretation of The Standard Valuation Law Respect to the Valuation of Policies Whose Valuation Net Premiums Exceed the Actual Gross Premium Collected ................................................................................................................ Reserve Requirements With Respect to Interest Rate Guidelines on Active Life Funds Held Relative to Group Annuity Contracts ................................................. Interpretation of Minimum Cash Surrender Benefit Under Standard Nonforfeiture Law For Individual Deferred Annuities................................................................. Actuarial Interpretation Regarding Minimum Reserves For Certain Forms of Term Life Insurance............................................................................................... Interpretation Regarding Acceptable Approximations For Continuous Functions...... Interpretation Regarding Use of Single Life or Joint Life Mortality Tables 20 June 1983 ............................................................................................................... Interpretation Regarding Calculation of Equivalent Level Amounts........................... The Valuation of Individual Single Premium Deferred Annuities .............................. © 1999-2013 National Association of Insurance Commissioners v Page C-4 C-9 C-10 C-12 C-13 C-16 C-18 C-20 C-22 Table of Contents No. IX IX-A IX-B IX-C X XI XII XIII XIV XV XVI XVII XVIII XIX XX XXI XXII XXIII XXIV XXV XXVI XXVII XXVIII XXIX XXX XXXI XXXII XXXIII XXXIV XXXV XXXVI XXXVII Title Form Classification of Individual Single Premium Immediate Annuities For Application of the Valuation and Nonforfeiture Laws .......................................... Use of Substandard Annuity Mortality Tables In Valuing Impaired Lives Under Structured Settlements ........................................................................................... Clarification of Methods Under Standard Valuation Law For Individual Single Premium Immediate Annuities, Any Deferred Payments Associated Therewith, Some Deferred Annuities, and Structured Settlements Contracts ...... Use of Substandard Annuity Mortality Tables in Valuing Impaired Lives Under Individual Single Premium Immediate Annuities .................................................. Guideline For Interpretation of NAIC Standard Nonforfeiture Law For Individual Deferred Annuities................................................................................................. Effect of an Early Election By an Insurance Company of an Operative Date Under Section 5-C of the Standard Nonforfeiture Law For Life Insurance ..................... Interpretation Regarding Valuation and Nonforfeiture Interest Rates ......................... Guideline Concerning the Commissioners’ Annuity Reserve Valuation Method ....... Surveillance Procedure For Review of the Actuarial Opinion For Life and Health Insurers................................................................................................................... Illustrations Guideline For Variable Life Insurance Model Regulation ...................... Calculation of CRVM Reserves On Select Mortality and/or Split Interest ................. Calculation of CRVM Reserves When Death Benefits Are Not Level ....................... Calculation of CRVM Reserves On Semi-Continuous, Fully Continuous or Discounted Continuous Basis ................................................................................ 1980 CSO Mortality Table With Ten-Year Select Mortality Factors .......................... Joint Life Functions For 1980 CSO Mortality Table ................................................... Calculation of CRVM Reserves When (B) Is Greater Than (A) and Some Rules For Determination of (A) ....................................................................................... Interpretation Regarding Nonforfeiture Values For Policies With Indeterminate Premiums ............................................................................................................... Guideline Concerning Variable Life Insurance Separate Account Investments .......... Guidelines For Variable Life Nonforfeiture Values .................................................... Calculation of Minimum Reserves and Minimum Nonforfeiture Values For Policies With Guaranteed Increasing Death Benefits Based On an Index ............ JUNE 3, 1989—Election of Operative Dates Under Standard Valuation Law and Standard Nonforfeiture Law .................................................................................. Accelerated Benefits .................................................................................................... Statutory Claim Reserves For Group Long-Term Disability Contracts With A Survivor Income Benefit Provision ....................................................................... Guideline Concerning Reserves of Companies in Rehabilitation ................................ Guideline for the Application of Plan Type to Guaranteed Interest Contracts (GICs) With Benefit Responsive Payment Provisions Used to Fund Employee Benefit Plans .......................................................................................................... Valuation Issues Vs. Policy Form Approval ................................................................ Reserve for Immediate Payment of Claims .................................................................. Determining CARVM Reserves For Annuity Contracts With Elective Benefits ........ Variable Annuity Minimum Guaranteed Death Benefit Reserves ............................... The Application of the Commissioners Annuity Reserve Method to Equity Indexed Annuities .................................................................................................. The Application of the Commissioners Reserve Valuation Method to Equity Indexed Life Insurance Policies ............................................................................. Variable Life Insurance Reserves For Guaranteed Minimum Death Benefits............. © 1999-2013 National Association of Insurance Commissioners vi Page C-23 C-24 C-27 C-31 C-34 C-36 C-37 C-38 C-40 C-42 C-44 C-45 C-46 C-47 C-48 C-54 C-55 C-56 C-57 C-64 C-68 C-70 C-75 C-76 C-78 C-80 C-81 C-83 C-90 C-102 C-112 C-124 Table of Contents No. XXXVIII XXXIX XL XLI XLII XLIII XLIV XLV XLVI Title The Application of the Valuation of Life Insurance Policies Model Regulation (“Model”) ............................................................................................................... Reserves For Variable Annuities With Guaranteed Living Benefits ........................... Guideline For Valuation Rate of Interest For Funding Agreements and Guraranteed Interest Contracts (GICs) With Bail-Out Provisions ........................ Projection of Guaranteed Nonforfeiture Benefits Under CARVM ............................. The Application of the Model Regulation Permitting the Recognition of Preferred Mortality Tables For Use In Determining Minimum Reserve Liabilities ............. CARVM For Variable Annuities ................................................................................. Group Term Life Waiver of Premium Disabled Life Reserves ................................... The Application of the Standard Nonforfeiture Law For Life Insurance to Certain Policies Having Intermediate Cash Benefits ......................................................... Interpretation of the Calculation of the Segment Length With Respect to the Life Insurance Policies Model Regulation Upon a Change in the Valuation Mortality Rates Subsequent to Issue...................................................................... Actuarial Guidelines – Appendices .............................................................................. C-1 Appendix to Guidelines—Maximum Reserve Valuation and Maximum Life Policy Nonforfeiture Interest Rates................................................. C-2 Interpretations of the Emerging Actuarial Issues (E) Working Group.......... Actuarial INT 12-01 ................................................................................ Actuarial INT 12-02 ................................................................................ Actuarial INT 12-03 ................................................................................ Actuarial INT 12-04 ................................................................................ Actuarial INT 12-05 ................................................................................ Actuarial INT 12-06 ................................................................................ Actuarial INT 12-07 ................................................................................ Actuarial INT 12-08 ................................................................................ Actuarial INT 12-09 ................................................................................ Actuarial INT 12-10 ................................................................................ Actuarial INT 12-11 ................................................................................ Actuarial INT 12-12 ................................................................................ Actuarial INT 12-13 ................................................................................ Actuarial INT 12-14 ................................................................................ Actuarial INT 12-15 ................................................................................ Actuarial INT 12-16 ................................................................................ Actuarial INT 12-17 ................................................................................ Actuarial INT 12-18 ................................................................................ Actuarial INT 12-19 ................................................................................ Actuarial INT 12-20 ................................................................................ Actuarial INT 12-22 ................................................................................ Actuarial INT 12-23 ................................................................................ Actuarial INT 12-24 ................................................................................ Page C-131 C-148 C-150 C-154 C-156 C-161 C-243 C-251 C-254 C-256 C-257 C-281 C-282 C-283 C-284 C-285 C-286 C-288 C-289 C-290 C-291 C-292 C-293 C-294 C-295 C-296 C-297 C-298 C-299 C-300 C-301 C-302 C-303 C-304 C-305 Appendix D - GAAP Cross-Reference to SAP - Volume II Title Accounting Standards Updates ........................................................................................................ Pre-FASB Codification Category A - FASB Statements and Interpretations, APB Opinions, and AICPA Accounting Research Bulletins ...................................................................................... Pre-FASB Codification Category B - FASB Technical Bulletins, FASB Staff Positions, AICPA Industry Audit and Accounting Guides, and AICPA Statements of Position ............................ © 1999-2013 National Association of Insurance Commissioners vii Page D-1 D-7 D-39 Table of Contents Title Pre-FASB Codification Category C - Consensus positions of the FASB Emerging Issues Task Force and AICPA Practice Bulletins .......................................................................................... Pre-FASB Codification Category D - AICPA Accounting Interpretations ...................................... FASB Codification to Pre-Codification GAAP ............................................................................... Page D-62 D-105 D-107 Appendix E - Issue Papers - Volume II includes Issue Papers 1-84 Volume III includes Issue Papers 85-145 No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 16 17 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 Title Vol. II Consolidation of Majority-Owned Subsidiaries ................................................................ Definition of Cash.............................................................................................................. Accounting Changes .......................................................................................................... Definition of Assets and Nonadmitted Assets ................................................................... Definition of Liabilities, Loss Contingencies and Impairments of Assets ........................ Amounts Due From Agents and Brokers ........................................................................... Asset Valuation Reserve and Interest Maintenance Reserve ............................................ Accounting for Pensions .................................................................................................... Subsequent Events ............................................................................................................. Uncollected Premium Balances ......................................................................................... Compensated Absences ..................................................................................................... Accounting for Drafts Issued and Outstanding.................................................................. Employers’ Accounting for Postemployment Benefits ..................................................... Employers’ Accounting for Postretirement Benefits Other Than Pensions ...................... Electronic Data Processing Equipment and Software ....................................................... Preoperating and Research and Development Costs ......................................................... Furniture, Fixtures and Equipment .................................................................................... Gain Contingencies ............................................................................................................ Bills Receivable For Premiums ......................................................................................... Leases................................................................................................................................. Property Occupied by the Company .................................................................................. Discontinued Operations and Extraordinary Items............................................................ Accounting for and Disclosures about Transactions with Affiliates and Other Related Parties ........................................................................................................................... Bonds, Excluding Loan-Backed and Structured Securities .............................................. Disclosure of Information about Financial Instruments with Concentration of Credit Risk............................................................................................................................... Short-term Investments ...................................................................................................... Prepaid Expenses (excluding deferred policy acquisition costs and other underwriting expenses, income taxes and guaranty fund assessments) ............................................ Investments in Common Stock (excluding investments in common stock of subsidiary, controlled, or affiliated entities) .................................................................................. Leasehold Improvements Paid by the Reporting Entity as Lessee .................................... Investments in Preferred Stock (excluding investments in preferred stock of subsidiary, controlled, or affiliated entities) ............................................................... Disclosures about Fair Value of Financial Instruments..................................................... Investment Income Due and Accrued ................................................................................ Accounting for Guaranty Fund and Other Assessments .................................................... Troubled Debt Restructurings............................................................................................ Mortgage Loans ................................................................................................................. Acquisition, Development and Construction Arrangements ............................................. © 1999-2013 National Association of Insurance Commissioners viii Page IP 1-1 IP 2-1 IP 3-1 IP 4-1 IP 5-1 IP 6-1 IP 7-1 IP 8-1 IP 9-1 IP 10-1 IP 11-1 IP 12-1 IP 13-1 IP 14-1 IP 16-1 IP 17-1 IP 19-1 IP 20-1 IP 21-1 IP 22-1 IP 23-1 IP 24-1 IP 25-1 IP 26-1 IP 27-1 IP 28-1 IP 29-1 IP 30-1 IP 31-1 IP 32-1 IP 33-1 IP 34-1 IP 35-1 IP 36-1 IP 37-1 IP 38-1 Table of Contents No. 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 59 65 66 67 68 69 71 72 73 74 75 76 77 78 80 81 82 83 84 Title Reverse Mortgages ............................................................................................................ Real Estate Investments ..................................................................................................... Surplus Notes ..................................................................................................................... Sale of Premium Receivables ............................................................................................ Loan-backed and Structured Securities ............................................................................ Capitalization of Interest.................................................................................................... Repurchase Agreements, Reverse Repurchase Agreements and Dollar Repurchase Agreements................................................................................................................... Accounting for Investments in Subsidiary, Controlled and Affiliated Entities................. Uninsured Plans ................................................................................................................. Investments in Joint Ventures, Partnerships and Limited Liability Companies................ Policy Loans ...................................................................................................................... Classifications and Definitions of Insurance or Managed Care Contracts in Force.......... Life Contracts .................................................................................................................... Deposit-Type Contracts ..................................................................................................... Property Casualty Contracts–Premiums ............................................................................ Individual and Group Accident and Health Contracts....................................................... Unpaid Claims, Losses and Loss Adjustment Expenses ................................................... Universal Life-Type Contracts, Policyholder Dividends, and Coupons ........................... Title Insurance ................................................................................................................... Credit Life and Accident and Health Insurance Contracts ................................................ Property and Casualty Contracts ....................................................................................... Accounting for Retrospectively Rated Contracts .............................................................. Depreciation of Property and Amortization of Leasehold Improvements ......................... Business Combinations and Goodwill ............................................................................... Financial Guaranty Insurance ............................................................................................ Policy Acquisition Costs and Commissions ...................................................................... Statutory Surplus ............................................................................................................... Nonmonetary Transactions ................................................................................................ Life, Deposit-Type and Accident and Health Reinsurance ............................................... Property and Casualty Reinsurance ................................................................................... Offsetting and Netting of Assets and Liabilities ............................................................... Disclosure of Accounting Policies, Risks & Uncertainties, and Other Disclosures ......... Employee Stock Ownership Plans ..................................................................................... Debt.................................................................................................................................... Foreign Currency Transactions and Translations .............................................................. Stock Options and Stock Purchase Plans........................................................................... Accounting for Income Taxes............................................................................................ Quasi-reorganizations ........................................................................................................ 85 86 87 88 89 90 92 94 95 96 Vol. III Derivative Instruments ....................................................................................................... Securitization ..................................................................................................................... Other Admitted Assets ....................................................................................................... Mortgage Guaranty Insurance ........................................................................................... Separate Accounts ............................................................................................................. Nonadmitted Assets ........................................................................................................... Statement of Cash Flow ..................................................................................................... Allocation of Expenses ...................................................................................................... Holding Company Obligations .......................................................................................... Other Liabilities ................................................................................................................. © 1999-2013 National Association of Insurance Commissioners ix Page IP 39-1 IP 40-1 IP 41-1 IP 42-1 IP 43-1 IP 44-1 IP 45-1 IP 46-1 IP 47-1 IP 48-1 IP 49-1 IP 50-1 IP 51-1 IP 52-1 IP 53-1 IP 54-1 IP 55-1 IP 56-1 IP 57-1 IP 59-1 IP 65-1 IP 66-1 IP 67-1 IP 68-1 IP 69-1 IP 71-1 IP 72-1 IP 73-1 IP 74-1 IP 75-1 IP 76-1 IP 77-1 IP 78-1 IP 80-1 IP 81-1 IP 82-1 IP 83-1 IP 84-1 IP 85-1 IP 86-1 IP 87-1 IP 88-1 IP 89-1 IP 90-1 IP 92-1 IP 94-1 IP 95-1 IP 96-1 Table of Contents No. 97 99 100 101 103 104 105 106 107 108 109 110 111 112 113 114 116 118 119 121 122 123 124 125 126 127 128 129 131 132 133 134 Title Underwriting Pools and Associations Including Intercompany Pools .............................. Nonapplicable GAAP Pronouncements............................................................................. Health Care Delivery Assets—Supplies, Pharmaceuticals and Surgical Supplies, and Durable Medical Equipment ........................................................................................ Health Care Delivery Assets—Furniture, Medical Equipment and Fixtures, and Leasehold Improvements in Health Care Facilities ..................................................... Accounting for the Issuance of Insurance-Linked Securities Issued by a Property and Casualty Insurer through a Protected Cell ................................................................... Reinsurance Deposit Accounting - An Amendment to SSAP No. 62R—Property and Casualty Reinsurance ................................................................................................... Reporting on the Costs of Start-Up Activities ................................................................... Real Estate Sales – An Amendment to SSAP No. 40—Real Estate Investments ............. Certain Health Care Receivables and Receivables Under Government Insured Plans ..... Multiple Peril Crop Insurance ........................................................................................... Depreciation of Nonoperating System Software – An Amendment to SSAP No. 16— Electronic Data Processing Equipment and Software.................................................. Life Contracts, Deposit-Type Contracts and Separate Accounts, Amendments to SSAP No. 51—Life Contracts, SSAP No. 52—Deposit-Type Contracts, and SSAP No. 56—Separate Accounts .............................................................................................. Software Revenue Recognition ....................................................................................... Accounting for the Costs of Computer Software Developed or Obtained for Internal Use and Web Site Development Costs ...................................................................... Mezzanine Real Estate Loans .......................................................................................... Accounting for Derivative Instruments and Hedging Activities ..................................... Claim Adjustment Expenses, Amendments to SSAP No. 55—Unpaid Claims, Losses and Loss Adjustment Expenses ................................................................................. Investments in Subsidiary, Controlled and Affiliated Entities, A Replacement of SSAP No. 46 ........................................................................................................................ Capitalization Policy, An Amendment to SSAP Nos. 4, 19, 29, 73, 79 and 82 .............. Accounting for the Impairment or Disposal of Real Estate Investments ........................ Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities ................................................................................................................... Accounting for Pensions, A Replacement of SSAP No. 8 .............................................. Treatment of Cash Flows When Quantifying Changes in Valuation and Impairments, an Amendment of SSAP No. 43 ................................................................................ Accounting for Low Income Housing Tax Credit Property Investments ........................ Accounting for Transferable State Tax Credits ............................................................... Exchanges of Nonmonetary Assets, A Replacement of SSAP No. 28—Nonmonetary Transactions ............................................................................................................... Settlement Requirements for Intercompany Transactions, An Amendment to SSAP No.25—Accounting for and Disclosures about Transactions with Affiliates and Other Related Parties ................................................................................................. Share-Based Payment, A Replacement of SSAP No. 13—Stock Options and Stock Purchase Plans ........................................................................................................... Accounting for Certain Securities Subsequent to an Other-Then-Temporary Impairment ................................................................................................................. Accounting for Pensions, A Replacement of SSAP No. 89 ............................................ Accounting for Postretirement Benefits Other Than Pensions, A Replacement of SSAP No. 14 .............................................................................................................. Servicing Assets/Liabilities, An Amendment of SSAP No. 91 ....................................... © 1999-2013 National Association of Insurance Commissioners x Page IP 97-1 IP 99-1 IP 100-1 IP 101-1 IP 103-1 IP 104-1 IP 105-1 IP 106-1 IP 107-1 IP 108-1 IP 109-1 IP 110-1 IP 111-1 IP 112-1 IP 113-1 IP 114-1 IP 116-1 IP 118-1 IP 119-1 IP 121-1 IP 122-1 IP 123-1 IP 124-1 IP 125-1 IP 126-1 IP 127-1 IP 128-1 IP-129-1 IP 131-1 IP 132-1 IP 133-1 IP 134-1 Table of Contents No. 135 137 138 140 141 143 144 145 Title Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others ......................................................... Transfer of Property and Casualty Reinsurance Agreements in Run-off ........................ Fair Value Measurements ................................................................................................ Substantive Revisions to SSAP No. 43—Loan-Backed and Structured Securities......... Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities ................................................................................................................... Prospective-Based Guaranty Fund Assessments ............................................................. Substantive Revisions To SSAP No. 91R: Securities Lending ....................................... Accounting for Transferable and Non-Transferable State Tax Credits........................... Page IP 135-1 IP 137-1 IP 138-1 IP 140-1 IP 141-1 IP 143-1 IP 144-1 IP 145-1 Appendix F - Policy Statements - Volume III Title NAIC Policy Statement on Maintenance of Statutory Accounting Principles.................................. NAIC Policy Statement on Comments to GAAP Exposure Drafts ................................................... NAIC Policy Statement on Statutory Accounting Principles Maintenance Agenda Process ........... NAIC Policy Statement on Emerging Accounting Issues Agenda Process ...................................... NAIC Policy Statement on the Impact of Statements of Statutory Accounting Principles on NAIC Publications ..................................................................................................................... NAIC Policy Statement on Coordination of the Accounting Practices and Procedures Manual and the Annual Statement Blank ............................................................................................... Page F-1 F-3 F-5 F-9 F-11 F-13 Appendix G – Implementation Guide (Guide) for the Annual Financial Reporting Model Regulation (Model) - Volume III Title Definitions ......................................................................................................................................... General Requirements Related to Filing and Extensions for Filing of Annual Audited Financial Reports and Audit Committee Appointment ............................................................................. Qualifications of Independent Certified Public Accountant ............................................................ Communication of Internal Control Related Matters Noted in an Audit .......................................... Requirements for Audit Committees ................................................................................................ Management’s Report of Internal Control over Financial Reporting .............................................. Exemptions and Effective Dates ....................................................................................................... Appendix 1 ........................................................................................................................................ Page G-2 G-4 G-4 G-10 G-11 G-13 G-17 G-22 Appendix H – Superseded SSAPs and Nullified Interpretations Superseded SSAPs No. 8 10 10R 13 14 18 28 31 33 Title Page Pensions.............................................................................................................................. H-8-1 Income Taxes ..................................................................................................................... H-10-1 Income Taxes—A Temporary Replacement of SSAP No. 10 ........................................... H-10R-1 Stock Options and Stock Purchase Plans ........................................................................... H-13-1 Postretirement Benefits Other Than Pensions .................................................................. H-14-1 Transfers and Servicing of Financial Assets and Extinguishments of Liabilities ............. H-18-1 Nonmonetary Transactions ................................................................................................ H-28-1 Derivative Instruments ....................................................................................................... H-31-1 Securitization...................................................................................................................... H-33-1 © 1999-2013 National Association of Insurance Commissioners xi Table of Contents No. 45 46 75 77 79 80 81 82 85 87 88 89 91R 96 98 99 Title Page Repurchase Agreements, Reverse Repurchase Agreements and Dollar Repurchase Agreements ................................................................................................................ H-45-1 Investments in Subsidiary, Controlled, and Affiliated Entities.......................................... H-46-1 Reinsurance Deposit Accounting—An Amendment to SSAP No. 62R—Property and Casualty Reinsurance ................................................................................................... H-75-1 Real Estate Sales—An Amendment to SSAP No. 40—Real Estate Investments .............. H-77-1 Depreciation of Nonoperating System Software —An Amendment to SSAP No. 16— Electronic Data Processing Equipment and Software ............................................... H-79-1 Life Contracts, Deposit-Type Contracts and Separate Accounts, Amendments to SSAP No. 51—Life Contracts, SSAP No. 52—Deposit-Type Contracts, and SSAP No. 56—Separate Accounts .............................................................................. H-80-1 Software Revenue Recognition .......................................................................................... H-81-1 Accounting for the Costs of Computer Software Developed or Obtained for Internal Use and Web Site Development Costs ...................................................................... H-82-1 Claim Adjustment Expenses, Amendments to SSAP No. 55—Unpaid Claims, Losses and Loss Adjustment Expenses.................................................................................... H-85-1 Capitalization Policy, An Amendment to SSAP Nos. 4, 19, 29 and 73 ............................. H-87-1 Investments in Subsidiary, Controlled and Affiliated Entities, A Replacement of SSAP No. 46 ............................................................................................................... H-88-1 Accounting for Pensions, A Replacement of SSAP No. 8 ................................................. H-89-1 Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities .................................................................................................................... H-91R-1 Settlement Requirements for Intercompany Transactions, An Amendment to SSAP No. 25—Accounting for and Disclosures about Transactions with Affiliates and Other Related Parties ................................................................................................... H-96-1 Treatment of Cash Flows When Quantifying Changes in Valuation and Impairments, an Amendment of SSAP No. 43 ................................................................................. H-98-1 Accounting for Certain Securities Subsequent to an Other-Than-Temporary Impairment ................................................................................................................... H-99-1 Nullified Interpretations No. INT 99-01 INT 99-02 INT 99-03 INT 99-04 INT 99-10 INT 99-14 INT 99-16 INT 99-17 INT 99-18 INT 99-21 Title Accounting for Tax Benefits of Operating Losses and Tax Credits in QuasiReorganizations ................................................................................................. Accounting for Collateral in Excess of Debt Principal .......................................... Accounting for Investment in Subsidiary, Controlled or Affiliated (SCA) Entities with Subsequent Downstream Investment in an Insurance Company ........................................................................................................... Recognition of Prepayment Penalties Upon Adoption of Codification .................. EITF 97-8: Accounting for Contingent Consideration Issued in a Purchase Business Combination ....................................................................................... EITF 96-19: Debtor’s Accounting for a Modification or Exchange of Debt Instruments ........................................................................................................ EITF 97-11: Accounting for Internal Costs Relating to Real Estate Property Acquisitions ....................................................................................................... EITF 97-12: Accounting for Increased Share Authorizations in an IRS Section 423 Employee Stock Purchase Plan under APB Opinion No. 25 ..................... EITF 97-13: Accounting for Costs Incurred in Connection with a Consulting Contract or an Internal Project That Combines Business Process Reengineering and Information Technology Transformation ........................... EITF 98-7: Accounting for Exchanges of Similar Equity Method Investments .... © 1999-2013 National Association of Insurance Commissioners xii Page H-99-01-1 H-99-02-1 H-99-03-1 H-99-04-1 H-99-10-1 H-99-14-1 H-99-16-1 H-99-17-1 H-99-18-1 H-99-21-1 Table of Contents No. INT 99-22 INT 99-23 INT 99-24 INT 99-25 INT 99-26 INT 99-27 INT 99-28 INT 99-29 INT 00-01 INT 00-02 INT 00-04 INT 00-05 INT 00-06 INT 00-08 INT 00-10 INT 00-11 INT 00-12 INT 00-21 INT 00-22 INT 00-23 INT 00-27 INT 00-29 INT 00-30 INT 00-31 INT 01-01 INT 01-03 INT 01-04 INT 01-05 INT 01-07 INT 01-10 INT 01-11 INT 01-12 INT 01-14 INT 01-16 INT 01-17 INT 01-19 Title EITF 98-8: Accounting for Transfers of Investments That Are in Substance Real Estate .......................................................................................................... Disclosure of Premium Deficiency Reserves ........................................................... Accounting for Restructuring Charges ................................................................... Accounting for Capital Improvements ..................................................................... Offsetting Pension Assets and Liabilities ............................................................... Nonadmitting Installment Receivables..................................................................... Accounting for SCA Mutual Funds, Broker-Dealers and Similar Entities Under SSAP No. 46 ................................................................................................... Classification of Step-Up Preferred Stock .............................................................. Investment in Foreign SCA Entity ........................................................................ Accounting for Leveraged Leases Involving Commercial Airplanes Under SSAP No. 2 —Leases........................................................................................ Student Loan Insurance .......................................................................................... Exemption to Merger Disclosure in SSAP No. 3 ................................................... EITF 97-14: Accounting for Deferred Compensation Arrangements Where Amounts Earned Are Held in a Rabbi Trust and Invested ................................ EITF 98-5: Accounting for Convertible Securities with Beneficial Conversion Features or Contingently Adjustable Conversion Ratios .................................. EITF 98-14: Debtor’s Accounting for Changes in Line-of-Credit or RevolvingDebt Arrangements ........................................................................................... EITF 98-15: Structured Notes Acquired for a Specified Investment Strategy ....... EITF 99-4: Accounting for Stock Received from the Demutualization of a Mutual Insurance Company .............................................................................. Disclose Requirement of SSAP No. 10 Paragraphs 17 & 18 ................................ Application of SSAP No. 10 to Admissibility of Deferred Tax Assets ................. Reinsurance of Deposit Type Contracts .................................................................. EITF 98-9: Accounting for Contingent Rent .......................................................... EITF 99-17: Accounting for Advertising Barter Transactions ............................... Application of SSAP No. 51 Paragraph 6 to Waiver of Deduction on Flexible Premium Universal Life Insurance Policies ...................................................... Application of SSAP No. 55 Paragraph 13 to Health Entities ............................... Application of SSAP No. 6 Paragraph 9.a. to de minimus Receivable Balances of Group Accident and Health Policies ............................................................. Assets Pledged as Collateral or Restricted for the Benefit of a Related Party........ SSAP Nos. 18 and 33 and Issues Surrounding Securitizations ............................. Classification of Accrued Interest on Policy Loans ............................................... EITF 98-2: Accounting by a Subsidiary or Joint Venture for an Investment in the Stock of Its Parent Company or Joint Venture Partner ............................... EITF 00-1: Investor Balance Sheet and Income Statement Display under the Equity Method for Investments in Certain Partnerships and Other Ventures... EITF 00-10: Accounting for Shipping and Handling Fees and Costs .................... EITF 00-14: Accounting for Certain Sales Incentives ........................................... EITF 00-16: Recognition and Measurement of Employer Payroll Taxes on Employee Stock-Based Compensation.............................................................. Measurement Date for SSAP No. 8 Actuarial Valuations ...................................... Accounting for Nonqualified Retirement Plans, Nonvested Ancillary Benefits Within Retirement Plans, and Protected Benefits Such as Early Retirement Subsidies in Retirement Plans .......................................................................... Measurement of Deferred Tax Assets Associated with Nonadmitted Assets ......... © 1999-2013 National Association of Insurance Commissioners xiii Page H-99-22-1 H-99-23-1 H-99-24-1 H-99-25-1 H-99-26-1 H-99-27-1 H-99-28-1 H-99-29-1 H-00-01-1 H-00-02-1 H-00-04-1 H-00-05-1 H-00-06-1 H-00-08-1 H-00-10-1 H-00-11-1 H-00-12-1 H-00-21-1 H-00-22-1 H-00-23-1 H-00-27-1 H-00-29-1 H-00-30-1 H-00-31-1 H-01-01-1 H-01-03-1 H-01-04-1 H-01-05-1 H-01-07-1 H-01-10-1 H-01-11-1 H-01-12-1 H-01-14-1 H-01-16-1 H-01-17-1 H-01-19-1 Table of Contents No. INT 01-20 INT 01-21 INT 01-22 INT 01-23 INT 01-24 INT 01-26 INT 01-27 INT 01-28 INT 01-29 INT 01-32 INT 01-33 INT 02-01 INT 02-02 INT 02-03 INT 02-04 INT 02-05 INT 02-06 INT 02-07 INT 02-08 INT 02-09 INT 02-10 INT 02-11 INT 02-15 INT 02-17 INT 02-18 INT 02-19 INT 02-20 INT 02-21 INT 03-01 INT 03-03 INT 03-05 INT 03-16 INT 03-17 Title Utilization of Tax Planning Strategies for the Admissibility of Deferred Tax Assets ............................................................................................................... SSAP Nos. 16R, 19, 68 and 79 – Reestablishment of Previously Expensed Software and Furniture, Fixtures and Equipment and Goodwill ...................... Use of Interim Financial Statements in Computing Reporting Entity’s Investment in Subsidiary Under the GAAP Equity Method ............................ Prepaid Legal Insurance Premium Recognition ..................................................... Application of SSAP No. 46 and 48 to Certain Noninsurance Subsidiary, Controlled or Affiliated Entities ....................................................................... SSAP No. 51 and Reserve Minimum or Required Amount ................................... Accounting Change versus Correction of Error ..................................................... Margin for Adverse Deviation in Claim Reserve ................................................... SSAP No. 59 and Application to Credit Life ......................................................... EITF 01-10: Accounting for the Impact of the Terrorist Attacks of September 11, 2001 ............................................................................................................. Extension of 9-Month Rule in SSAP No. 62R ....................................................... Disclosure Requirements Under SSAP for Differences Between A-785 and Individual State Requirements as a Result of September 11............................. SSAP No. 6 and Billing of Premium Before Effective Date ................................... Accounting for the Impact of the Terrorist Attacks of September 11th on Commercial Mortgage Loans ............................................................................ Recognition of CARVM and CRVM Expense Allowances by the Assuming Reinsurer in a Modified Coinsurance Agreement ............................................. Accounting for Zero Coupon Convertible Bonds.................................................... Indemnification in Modeled Trigger Transactions .................................................. Definition of Phrase “Other Than Temporary” ...................................................... Application of A-791 to YRT Reinsurance of a Block of Business........................ A-785 and Syndicated Letters of Credit .................................................................. Statutory Audit Report Notes and the Reporting Requirements Related to Disclosures Containing Multiple Year Information .......................................... Recognition of Amounts Related to Earned but Unbilled Premium ....................... EITF 00-11: Lessors’ Evaluation of Whether Leases of Certain Integral Equipment Meet the Ownership Transfer Requirements of FASB Statement 13 ....................................................................................................................... EITF 01-13: Income Statement Display of Business Interruption Insurance Recoveries ......................................................................................................... Accounting for the Intangible Asset as Described in SSAP No. 8 Paragraphs 9.d.v. and 9.f. .................................................................................................... EITF 01-1: Accounting for a Convertible Instrument Granted or Issued to a Nonemployee for Goods or Services or a Combination of Goods or Services and Cash .............................................................................................. Due Date for Installment Premium Under an Agency Relationship ....................... Accounting for Prepaid Loss Adjustment Expenses and Claim Adjustment Expenses ............................................................................................................ Application of SSAP No. 35 to the Florida Hurricane Catastrophe Fund .............. Admissibility of Investments Recorded Based on the Audited GAAP Equity of the Investee when a Qualified Opinion is Provided .......................................... EITF 01-07: Creditor’s Accounting for a Modification or Exchange of Debt Instruments ........................................................................................................ Contribution of Stock .............................................................................................. Classification of Liabilities from Extra Contractual Obligation Lawsuits.............. © 1999-2013 National Association of Insurance Commissioners xiv Page H-01-20-1 H-01-21-1 H-01-22-1 H-01-23-1 H-01-24-1 H-01-26-1 H-01-27-1 H-01-28-1 H-01-29-1 H-01-32-1 H-01-33-1 H-02-01-1 H-02-02-1 H-02-03-1 H-02-04-1 H-02-05-1 H-02-06-1 H-02-07-1 H-02-08-1 H-02-09-1 H-02-10-1 H-02-11-1 H-02-15-1 H-02-17-1 H-02-18-1 H-02-19-1 H-02-20-1 H-02-21-1 H-03-01-1 H-03-03-1 H-03-05-1 H-03-16-1 H-03-17-1 Table of Contents No. INT 03-18 INT 04-01 INT 04-02 INT 04-03 INT 04-05 INT 04-07 INT 04-10 INT 04-12 INT 04-13 INT 04-15 INT 04-18 INT 04-20 INT 09-04 Title Accounting for a Change in the Additional Minimum Liability in SSAP No. 8—Pensions (SSAP No. 8) ............................................................... Applicability of New GAAP Disclosures Prior to NAIC Consideration ................. Surplus Notes Issued by Entities Under Regulatory Action .................................... Clarification for Calculating the Additional Minimum Pension Liability Under SSAP No. 89—Accounting for Pensions, A Replacement of SSAP No. 8, paragraph 16.f. ................................................................................................... Clarification of SSAP No. 5R Guidance on when a Judgment is Deemed Rendered............................................................................................................. EITF 02-15: Determining Whether Certain Conversions of Convertible Debt to Equity Securities Are Within the Scope of FASB Statement No. 84 ................ EITF 02-18: Accounting for Subsequent Investments in an Investee after Suspension of Equity Method Loss Recognition ............................................... EITF 03-4: Determining the Classification and Benefit Attribution Method for a "Cash Balance" Pension Plan .......................................................................... EITF 03-5: Applicability of AICPA Statement of Position 97-2 to NonSoftware Deliverables in an Arrangement Containing More-ThanIncidental Software ............................................................................................ EITF 03-07: Accounting for the Settlement of the Equity-Settled Portion of a Convertible Debt Instrument That Permits or Requires the Conversion Spread to Be Settled in Stock (Instrument C of Issue No. 90-19)...................... EITF 00-21: Revenue Arrangements with Multiple Deliverables............................ EITF 01-08: Determining Whether an Arrangement Contains a Lease ................... Application of the Fair Value Definition ................................................................. © 1999-2013 National Association of Insurance Commissioners xv Page H-03-18-1 H-04-01-1 H-04-02-1 H-04-03-1 H-04-05-1 H-04-07-1 H-04-10-1 H-04-12-1 H-04-13-1 H-04-15-1 H-04-18-1 H-04-20-1 H-09-04-1