BR Research - Investor Guide Pakistan

advertisement

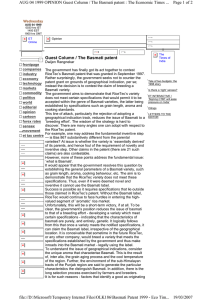

BR Research Newsletter Inside this: ANALYSES & COMMENTS BY BR RESEARCH • T-bill Auctions: Borrowing cost or yield curve? • Basmati dispatches to EU fading • Flip flopping two and three wheeler sales • Temporary relief in CNG price BR Research is the research wing of Pakistan’s premier financial newspaper, the daily Business Recorder. DISCLAIMER: All information and data used are from reliable source(s) and subjected to extensive research after diligent and reasonable efforts to determine the soundness of the source(s). This analysis is not for the benefit of or discredit to any person, scrip or tradable instrument. The content(s) of this analysis shall not be construed as an advice or recommendation to trade. No relationship of client will be created between Business Recorder and user of this information. Professional advice must be taken by the reader before making investment/trading decisions. BR disclaims any liability for investment(s) made or liability accrued on basis of this analysis. The content(s) including all opinion(s), statement(s) and information are subject to change without prior notice and/or intimation. FIND US: www.brecorder.com/br_research.html | Comments & Feedback at: research@br-mail.com | https://www.facebook.com/BRResearch | https://twitter.com/BRResearch09 Friday, December 13, 2013| BR Research Newsletter | BR Research Newsletter T-bill Auctions: Borrowing cost or yield curve? yield curve has actually worsened over time. 12-month paper that fetched an average participation of 35-40 percent in FY13 auctions is totally muffled in the current fiscal year. To add to ado, 6-month papers have also lost their appeal. But if the last MTB auction is any guide, the market shouldn’t alone be blamed for a broken yield curve. The government doesn’t appear interested either. After remaining silent for 6 consecutive auctions, 12-month paper attracted some participation in the last T-bill auction conducted on November 27 whereby four investors bade for the 12-month paper and weighted average bid yield clocked in at 9.89 percent. 6-month papers also attracted bids worth Rs1.2 billion with weighted average bid yield of 9.95 percent. The bid yields made sense as they were under discount rate and could compensate investors for the price risk. However, the government took a very myopic approach whereby it satiated its funding needs through 3-month papers and rejected the bids in 6-month and 12month tenors. By doing so, the government reduced in borrowing cost in the shortrun but in-turn ran a daunting roll-over risk. In fact, by rejecting the bids, the government gave the market a clear feeler of aggressive rate hikes in the coming months and in this way played its part in dejecting the long-term yield curve. Auction of government securities have been grassing on a similar story for quite some time now. Since the start of the current fiscal year, investors have a strong inclination towards short-term securities with 3-month papers remaining to be the investors’ favorite pick. Apparently, biasness came as a result of expectation of hawkish monetary policy which kept investors from parking their money in 6-month and 12month papers and later book losses as discount rate goes up. One exception to this trend was witnessed in the MTB auction conducted on July-24 where market preferred 6-month papers over 3-month papers as most of them expected that the monetary easing of 50 basis points executed in June monetary policy will subsist for 6 months before the monetary cycle take a u-turn. In such a scenario where market doesn’t want to risk their funds, achieving long-term yield curve appears beyond reach. In fact, the recent auction history shows that the 2 | BR Research Newsletter | Friday, December 13, 2013 Zero participation in the 12-month paper in the recent auction conducted on December 11 appears a consequence of the negative sentiments created in the last auction. Talking about the 6-month papers, the government could have locked Rs1 billion in the last auction at 9.95 percent and gave a direction to the market instead of accepting Rs300 million at 9.97 percent in the recent auction. While the acceptance of bids in the six-month paper this time around might attract some participation in this tenor in the coming auction but 12-month papers are still expected to bite the dust. All it takes adequate risk premium. What is more important short-term borrowing cost or yield curve - the government should think twice before the next auction. BR Research Newsletter Basmati dispatches to EU fading 500,000 Pakistan’s share has subsequently seen significant contraction, bottoming at around 18 percent in marketing year 2012-13 while India’s dispatches have seen a massive jump, surging by 84 percent between 2011 and 2013, as per data from the European Commission. One reason for the dwindling popularity of the Pakistani Basmati in the European market is the price differential between the two sourcing destinations. During the last fiscal, FAO reports that the average price of Pakistani 2 percent broken Basmati reached $1400/ ton- a substantial hike over export prices that prevailed during FY12. In comparison, the Indian’s have been selling their Basmati in Europe at a discount of nearly $300-$400 to Pakistani rice (with average prices in the last 3 years staying close to $1,050/ ton). Basmati exports to EU 400,000 300,000 200,000 100,000 0 Tons MY08 MY09 Pakistan MY10 India MY11 MY12 Total EU imports MY13 Faced with vicious competition, Pakistani rice exports on the whole have been under pressure this year. But no one has been feeling the burn more than the people who export the fragrant Basmati. The declining trend and the plight of the Pakistani Basmati has been covered in these columns ad nauseam; in the last three years alone, the country has lost around 40 per cent share in the global market -going down from 970,000 tons sent out in FY10 to 630,000 tons in FY13. And after Iran, Europe is another entry on the long list of markets where the Indian exports have slowly elbowed out the Pakistani competition. There was a time in the not too distant past when Pakistan and India accounted for almost equal shares of Basmati rice imports that entered Europe. At its height in MY 2011 (Oct-Sept), Pakistani dispatches made up for 47 percent of the total Basmati rice exported by European nations- despite the fact that the nation faced one of the deadliest floods in its history the same year, which wiped out standing paddy in most of Punjab. 3 | BR Research Newsletter | Friday, December 13, 2013 A number of factors explain this price disparity. Stagnated yields, rising costs of inputs, poor access to the right seeds and the crippling prices of electricity (which drive up prices of husking and sorting) have all brought up the total costs of production for farmers in Pakistan. Meanwhile Indian Basmati prices have remained buoyed off the back of their government’s policies, higher supplies and development of new disease resistant varieties. Currently, a quota-free preferential regime allows for imports of 9 varieties of husked Basmati rice originating in India or Pakistan to enter the EU duty-free. Of these 9 varieties, Pakistan mass produces only two, meanwhile the rest hail almost exclusively from India. Abid Ilyas Dar from Engro Eximp tells BR Research that India’s rapid growth in the EU also stems from a production shift to the long grain 1121 Basmati– a very popular type of rice that retains the same fragrance and taste but has nearly triple the yield of the more traditional Super Kernel. Pakistan’s Basmati dispatches however are still almost entirely comprised of the Super kernel rice- which is facing rapidly declining yields at home and shaky demand in the EU. Going forward, the one small blip of hope that Pakistani Basmati exporters see on the horizon is the relaxation of trade sanctions that were imposed on Iran. Market sources expect some demand shifting back as India loses its competitive edge in a market it had single-handedly wrangled out from under Pakistani exporters. Europe however is going to be a difficult market to exploit in the near term and we should expect a further decline in the number of dispatches as the marketing year progresses. BR Research Newsletter Flip flopping two and three wheeler sales Smaller players fought hard for the remaining portion of the pie, with Sohrab and Qingqi taking turns in eating the share of Hero and Ravi two wheelers from last year. Sales figures for DYL motorcycles were unavailable for November; however, as per the four-month period ending October-CY13, the company saw sales decline by 66 percent, compared to the same period last year. The company sold 14,500 fewer units from more than twenty-two thousand in CY12. According to figures published by Pakistan Automotive Manufacturers Association (PAMA), two and three wheelers sales in November posted a mixed bag of performance, with total sales clocking in at 62,347 units, recording a 1.5 percent decline compared to the corresponding month from last year. In the three-wheeler category, Feb-13 saw Sohrab Motors shifting gears, drawing from three -wheeler production to increase focus on the two-wheeler bike market. The vacuum left by Sohrab’s withdrawal saw demand to spike for Qingqi and Sazgar Engineering, with Sazgar recording 28.46 percent growth in sales during November compared to last year. Two-wheeler motorcycles constituted a major chunk of these sales, with threewheeler forming a meager 4.5 percent of total production and sales. This breakup is in lines with historical market share for the two categories, with three wheelers demand inching forward in the past few years, albeit at a snail’s pace. Within the two-wheeler category, Pak Suzuki took the growth trophy home as the company stepped up its effort to boost its motorcycle business. In the past the company has faced difficulty in sinking its teeth in the motorcycle market dominated by the 70cc engine capacity. To recall, Pak Suzuki only manufactures bikes with 110cc and 150cc engine, which enjoy a niche market. The company sold 700 more units in November, up 52 percent from 1,330 units last year. The category leader Atlas Honda came out to be the biggest loser in absolute terms, as fewer Honda branded bikes were seen on the road. However, motorcycle sales are notorious for flip-flopping on a monthly basis, and hence it may be too soon to the ring the alarm bells. Atlas Honda monthly bike sales usually fluctuate in the band of fifty to sixty thousand units, on average constituting more than 80 percent share of the two wheeler market. Historically, monthly motorcycle sales have hovered between sixty to seventy thousand units, with an eight month stellar performance recorded during CY11 when demand broke the 80,000 units barrier briefly, thanks to record growth in agricultural income during the previous years. Ever since, demand has flat-lined, with flashes of improvement following dismal troughs in irregular cycles. 4 | BR Research Newsletter | Friday, December 13, 2013 Over all, the three-wheeler demand diminished by 5.59 percent, with production exceeding demand more than two hundred units for the five month period ending November. Only time will tell whether the three-wheeler sales will post a flip-flop similar to seen in its cousin two-wheeler market or not. BR Research Newsletter Temporary relief in CNG price “A country without energy is a country paralysed”, said the now ex Chief Justice of Pakistan, Iftikhar Muhammad Chaudhry, in what was his one of the last judgement of a distinguished career. The case came to a quick conclusion by Pakistan standards, in nine hearings, as the CJ disposed off the case on the eve of his last day at office. T he judgement covers aspects from CNG pricing t petrol prices, electricity tariffs to Nepra’s inefficient role and is an interesting read. Should the government abide by the ruling, CNG prices are bound to go down by the 17th of December. The government at present collects a total of 26 percent GST on the sale of CNG, of which the additional 9 percent is placed under value addition. Recall that earlier on June 21, 2013, the Supreme Court had ordered the government to issue revised notification of CNG to collect GST at 16 percent, but it was later observed that the government failed to comply with the orders. In the 39 page judgement, the honourable bench has not accepted the attorney General and FBR contentions and maintained that the sale price of CNG is indeed increased by virtue of the additional 9 percent tax. Earlier, the FBR had told the SC that there was no discrimination in collection of GST on CNG and that the levy was not increased and it was just the mode of collection that was altered. Not that CNG makes a massive proportion of government’s indirect tax collection, but the court’s order might force the government to tackle the issue tactfully. It would not do a great harm if Ogra issues a revised price notification with lower prices, as the calendar year is drawing to its end. Moreover, CNG supply is already very limited in the winter season, making the call all so easier. Ogra is expected to announce new gas prices come New Year, so it is advisable that the government increase the cost of CNG to the stations, instead of toying and tinkering with the sales tax rate, if it is serious in discouraging the use of gas in transport sector. 5 | BR Research Newsletter | Friday, December 13, 2013