Stephen Cecchetti - Department of Economics Sciences Po

advertisement

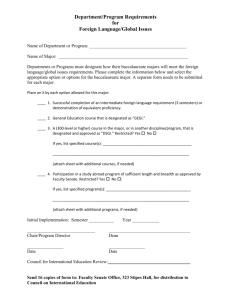

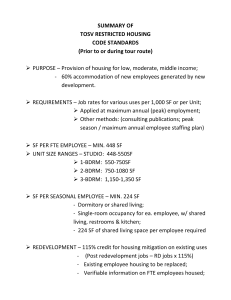

Assessing the macroeconomic impact of OTC derivatives regulatory reform Banque de France-Sciences Po and BNP Paribas seminar Paris, 29-30 October 2013 Stephen G. Cecchetti Economic Advisor and Head of the Monetary and Economic Department* *The views expressed here are those of the presenter and do not necessarily reflect those of the BIS or the Macroeconomic Assessment Group on Derivatives. Restricted Hedge Fund's Collapse Met With a Shrug By Steven Mufson Washington Post Staff Writer Wednesday, September 20, 2006 Founded in, Amaranth Advisors claimed to employ a “multistrategy approach to investing that allows nimble portfolio managers to seize opportunities in whatever markets seem to be most promising at the time.” However, the hedge fund’s downfall was largely due to huge losses in a single sector: natural gas. After making $1 billion in 2005 on rising energy prices and owning up to $9 billion in assets under management, the company completely collapsed in 2006 after losing more than $6 billion on natural gas futures. This is the third biggest trading loss on record. The biggest is $9 billion by Bank of Tokyo Mitsubishi in October 2008, and the second largest is $7.2 billion by Societe Generale in January 2008. Restricted 2 THE MARKETS Business/Financial Desk; Section A Seeing a Fund as Too Big to Fail, New York Fed Assists Its Bailout By GRETCHEN MORGENSON The speculative investment fund rescued by a consortium of Wall Street banks this week made complex bets on international financial markets with a total value drastically higher than previously estimated, financiers who studied its books said yesterday. They said that the fund, Long-Term Capital Management, used its $2.2 billion in capital from investors as collateral to buy $125 billion in securities, and then used those securities as collateral to enter into exotic financial transactions valued at $1.25 trillion, with all figures as of the end of August. Restricted 3 Last updated:September 17, 2008 6:26 pm US to take control of AIG By Francesco Guerrera in London, Aline van Duyn in New York and Krishna Guha in Washington The US Federal Reserve announced that it would lend AIG up to $85bn in emergency funds in return for a government stake of 79.9 per cent and effective control of the company – an extraordinary step meant to stave off a collapse of the giant insurer that plays a crucial role in the global financial system. We later learned that AIG had taken on $446 billion in notional credit risk exposure as a seller of credit risk protection via credit default swaps. This exposure was largely unhedged and uncollateralised. Restricted 4 1 short wrt 2 2 is long wrt 1 1 2 3 short wrt 1 1 is long wrt 3 2 short wrt 3 3 is long wrt 2 3 All parties are net zero in bilateral positions! Restricted 5 1 short wrt 2 2 is long wrt 1 1 2 2 blows up 3 short wrt 1 1 is long wrt 3 2 short wrt 3 3 is long wrt 2 3 Restricted 6 Default! 1 3 short wrt 1 1 is long wrt 3 Default! 3 Restricted 7 1 Can 1 & 2 survive alone? 3 short wrt 1 1 is long wrt 3 3 Restricted 8 Overview Motivation Approach Benefits Costs Main results Caveats Conclusions Restricted 9 Motivation Crisis revealed severe shortcomings in OTCD markets Counterparty risk Lack of transparency A range of regulatory reforms in response Mandatory central clearing for standardised derivatives More stringent capital and margining requirements for OTC derivatives Question: how does all this add up? Restricted 10 Approach Compare long-term costs and benefits of OTCD reform Output gains/losses as common metrics Benefits: foregone output loss as crises become less frequent Costs: reduced economic activity resulting from higher prices of risk transfer Suite of models used to estimate costs and benefits Robustness of results Data limitations Restricted 11 Benefits Pre-crisis Derivatives dealers Shock • Valuation losses • Margin calls Post regulatory reforms Central clearing • Netting • Collateralisation OTC • Extra capital • Extra margin requirements • Stronger capital buffers • Better risk management due to greater transparency • Reduced counterparty credit risk • Less frequent and less procylical margin calls Financial system • Rising leverage • Funding stress • Heightened risk aversion • Less increase in leverage • Reduced risk of funding stress • Less procyclicality • Greater confidence • Defaults • Runs Real economy • Credit crunch • Output losses • Negative wealth • Unemployment effects • Loss of confidence • Much less • Foregone frequent crises output loss Restricted 12 Benefits (contd.) Foregone output loss Annual probability of crisis of 0.26% Median cost of banking crisis of 60% of GDP Equals annual GDP gain of 0.16% Restricted 13 Costs Central clearing • Netting • Collateralisation OTC • Extra capital • Extra margin requirements Derivatives dealer • Cost of extra capital • Cost of extra collateral • Operating fees Financial system • Less trading and market making • Additional collateral demand • Higher cost of capital Real economy • Increase in bank • Output loss credit spreads Restricted 14 Costs (contd.) Output loss Compute sum of costs of increased margin and capital requirements and operating costs Translate these in changes in bank lending spreads Use macro models to estimate change in long-run GDP Restricted 15 Main results Macroeconomic benefits and costs of OTC derivatives regulatory reforms Change in expected annual GDP after full implementation and effects of reforms; in per cent Low-costs scenario (high netting) Central scenario High-costs scenario (low netting) Benefits1 +0.16 +0.16 +0.16 Costs2 –0.03 –0.04 –0.07 Net benefits +0.13 +0.12 +0.09 Reduction in output losses from financial crises, computed as the estimated decline in the probability of financial crises propagated by OTC derivatives exposures multiplied by the average cost of past financial crises. 2 Effect on GDP of higher prices of financial services, as evaluated by a range of macroeconomic models. The table reports the GDP-weighted median effect calculated by these models. 1 Table 1 Restricted 16 Caveats Non-quantified effects Transparency Risk-taking and risk management Criticisms Multilateral netting and creditor subordination Collateralisation and credit risk Concerns Collateral availability Cyclicality of margins Restricted 17 Conclusion MAGD important step to fully understanding the macro implications of OTCD reforms Remaining uncertainties: Lack of access to firm-level OTCD exposures data Lack of modelling techniques that allow for joint analysis of costs and benefits Still, unambiguous conclusion that economic benefits of OTCD reforms are likely to exceed their costs Restricted 18 Thank you! Restricted 19