Unjust, Unfair and Unconscionable Contracts

advertisement

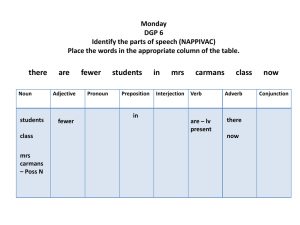

Consumer Credit Legal Service (WA) Inc. Faith Cheok (Principal Solicitor) Georgina Molloy (Solicitor) Edward Souti (Paralegal) Is this unjust? Faith Cheok Consider: Karamihos v Bendigo Bank Mr & Mrs K borrowed $1.2 million from Bendigo Bank, secured over their home. They used $957K to pay off their existing BOQ loan, gave $100K to their daughter & used the rest for their café business. Within 2 years, they suffered ill health and closed down their café business. Mr & Mrs K defaulted. Bendigo Bank sued to repossess their home. Mr & Mrs K counter-sued; claiming the loan contract was unjust. Consider: Karamihos v Bendigo Bank Background • They were 72yo & 73yo at the time of the loan • Greek immigrants with limited English ability • They could barely understand written English • No negotiations; no legal/financial advice before they signed the documents • They had worked hard all their lives; had run their café business for 27 yrs Old age…no income, no home Unjust contracts [Unjust transactions] Edward Souti (Volunteer paralegal) National Credit Code • Covers consumer credit transactions including: – home loans – personal loans – pay day loans – credit cards – consumer leases Making a complaint Section 76: Unjust contracts • Under section 76 of the National Credit Code, a consumer can apply for the “reopening” an unjust transaction. • What does “reopen” mean? What does “unjust” mean? • Unjust includes unreasonable, harsh or oppressive. The contract itself Surrounding circumstances S 76 approach Public Interest Circumstances of the case S 76(2) factors What is the public interest? The protection of consumers. The need to hold parties to their bargains. 16 factors to consider Factors… • The relative bargaining power of the parties: • Could the consumer protect their own interests because of age or physical or mental condition. More factors… • Form/language of contract (complex and ambiguous language?). • Whether or not independent legal or expert advice was obtained. Some more factors… • Are the obligations necessary to protect the interests of the bank? • Was any unfair pressure, undue influence or unfair tactics used to get the consumer to enter into the contract? – Examples? Even more factors • Accurate explanation of the nature and effect of the contract. • Ensuring that the consumer understands that explanation. Case example 1: Mrs C CIO Determination 24 September 2014 • Mrs C signed two loan contracts for $250,000 • For her son to buy 2 adjoining blocks to build houses • Mrs C was 65 yo; a widow; born in Egypt; could barely read or write English • Mrs C’s sole income = Centrelink age pension. • Son “took care of everything” • One loan was secured to her home. She didn’t know that. • Q: Unjust? CIO’s considerations • 65 yo; no formal education; very limited English ability. • Limited loan experience. Both previous loans arranged by late husband. • Clearly no ability to understand the loan contracts • Heavily influenced by her son. Expected he would act in her best interests. • No legal or expert advice obtained Case example 2: Mr & Mrs K Steve Karamihos and Aristea Karamihos v Bendigo and Adelaide Bank Limited [2013] NSWSC 172 • Mr & Mrs K borrowed $1.2 million from Bendigo Bank, secured over their home. They used $957K to pay off their existing BOQ loan, gave $100K to their daughter & used the rest for their restaurant business. • Within 2 years, they suffered ill health and closed down their business. • Mr & Mrs K defaulted. Bendigo Bank sued to repossess their home. • Mr & Mrs K counter-sued; claiming the loan contract was unjust. Case example 2: Mr & Mrs K Steve Karamihos and Aristea Karamihos v Bendigo and Adelaide Bank Limited [2013] NSWSC 172 Background • Mr and Mrs K were 72yo & 73 yo at the time of the loan • Greek immigrants with limited English ability; • Could barely understand written English. • No negotiations; no legal/financial advice before they signed the documents. • Had worked hard all their lives; had run their café business for 27 yrs. • Q: Unjust? Court’s considerations: 1. Public interest – Protection of aged borrowers. Why is this important? 2. Other factors: – Mr and Mrs K could not read or understand the contracts, or understand the risks they faced in the event of sickness and retirement. – Consequences of non-compliance – Loss of family home. – They received no legal advice. – Relative lack of bargaining power and absence of any negotiation. Unjust! Overturned on appeal • Why? (Hint: Remember the public interest?) Responsible lending laws • Where? Chapter 3 NCCP Act • What? – Before entering into a credit contract, a credit provider must make reasonable inquiries about: • Financial situation, • Requirements and objectives, – Reasonable steps to verify financial situation – Make assessment about whether the credit contract is “not unsuitable” • Crossover? Differences? Key points to consider • Not easy to prove unjustness • Unjust to layman not the same as unjust to the court • Overlap between unjustness and responsible lending principles Unconscionable conduct Georgina Molloy Unconscionable conduct What does this mean? How can you use unconscionable conduct arguments to help your clients? Source: Google images “Unconscionable” dictionary meaning Source: Google images Legal cause of action? Image: High Court of Australia, Canberra. Source: peo.gov.au Unconscionable conduct 3 specific elements • The person had a ‘special disability’ when dealing with the stronger party; • The person’s special disability was known to the stronger party; and • The stronger party obtained an ‘unconscionable’ advantage from the transaction. Rules in Amadio Commercial Bank of Australia Ltd v Amadio [1983] Source: Google images Mr and Mrs Amadio’s special disability Elderly Limited English Limited business experience Reliance on their son Vincenzo Unconscionable conduct (the test again) 3 specific elements • Mr and Mrs Amadio had a ‘special disability’ when dealing with the Bank; • Mr and Mrs Amadio’s special disability was known to the stronger party (the Bank); and • The Bank obtained an ‘unconscionable’ advantage from the transaction. Recent WA cases Perpetual Trustees Victoria Ltd v Burns [2015] Source: https://au.news.yahoo.com/thewest/wa/a/28667886/court-win-for-disabled-couple/ Special disability? Faith Burns • mental disability • unwell physically • limited ability to read and write Dale Burns • blind in one eye • illiterate Source of income for both Faith and Dale • disability support pensions • no prospect of gaining employment or additional income Unconscionable conduct • The Burns suffered from a special disability or disadvantage with respect to the other party (Perpetual) at the time of entering into the transaction; • the other party (Perpetual) knew of that special disadvantage or disability, or was wilfully ignorant of it; and • the other party (Perpetual) had unconscientiously taken advantage of their position. Result for Mr and Mrs Burns • Mortgage set aside • The Burns still had to pay the principal with a lower level interest • Debt now unsecured Source: Google images Key points to remember 3 elements Unconscionable conduct has specific legal meaning • Special disability of weaker party • Stronger party has knowledge of disability • Stronger party takes unconscionable advantage Questions?