General Motors

advertisement

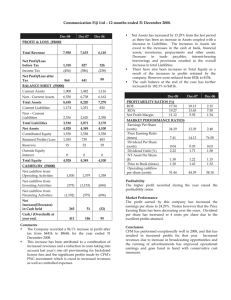

Yehuan Wu Chief executive officer: Daniel F. Akerson Location of home office: 300 Renaissance Center Detroit MI 48265 Ending date of latest fiscal year: 12/31/2012 Principal products or services: General motors is a vehicle manufacturer. Their main product is passenger vehicles such as cars, light trucks, and vans. Main geographic area of activity: Detroit. General Motors’ independent auditors: Deloitte & Touche LLP Auditors’ words about the General Motors: According to GM’s consolidated income statement of 2010, 2011 and 2012, the company’s net sales and revenues increased 10.8% at 2011 and increased 1.3% at 2012. Stock Price: $33.89, General Motors’ twelve months trading range: $ 32.99 – 33.93 with average volume 12.37 million shares. Dividend per share: 0 (Because the company didn’t issue dividend in the past year) Date of the above information : Stock Price May 31, 2013 7:53 p.m My opinion about the company’s stock : Hold 2012 2011 Gross profit 15256 150276 Income from operations (30363) 5656 Net income 6136 9287 The company’s income from operations decreases greatly in 2012, which accounts for the decline of net income in 2012. The format is single step General Motors’ gross profit decreased in the year 2012. Its income from operations and net income decreased in 2012. 2012 2011 Current Assets 69996 64923 Long-term Assets 37207 8436 Property, plant & equipment 31079 29795 Intangible Assets 8782 39033 Other Assets 2358 2416 Total Assets 149422 144603 Current Liabilities 53992 53226 Long-term Liabilities 45261 39944 Other Liabilities 13169 12442 Total Liabilities 112422 105612 Contributed capitals 26943 31808 Retained earnings 10057 7183 Shareholders’ Equity 37000 38991 Total Liabilities and Equity 149422 144603 According to GM’s Balance sheet of 2012 and 2011, the company’s total assets and total liabilities increase while shareholder’s equity decreases. The company’s Long-term assets increases greatly (about 30000 million) while Intangible assets decreases almost the same amount. 2012 2011 Cash flows from operating activities 10605 8166 Cash flows from investing activities (3505) (12740) Cash flows from financing activities (4741) (358) Cash and cash equivalents at end of period 18422 16071 Cash flows from operating activities is greater than the net income at 2012. Cash flows from operating activities is less than the net income at 2011. The company isn’t growing through investing activities. The company’s primary source of financing is Proceeds from issuance of debt (original maturities greater than three months) Overall, cash has increased in 2012. Significant Accounting Policies: 1.Revenue Recognition 2. Cash Equivalents 3. Allowance for Doubtful Accounts 4. Marketable Securities 5. Finance Receivables 6. Inventory 7. Equipment on Operating Leases, net 8. Property, net Topics of the notes to the financial statements : Note 1. Nature of Operations Note 2. Basis of Presentation Note 3. Significant Accounting Policies Note 4. Acquisition and Disposal of Businesses Note 5. GM Financial Finance Receivables, net Note 6. Securitizations Note 7. Marketable Securities Note 8. Inventories Note 9. Equipment on Operating Leases, net Note 10. Equity in Net Assets of Nonconsolidated Affiliates Note 11. Property, net Note 12. Goodwill Note 13. Intangible Assets, net Note 14. Restricted Cash and Marketable Securities Note 15. Variable Interest Entities Note 16. Accrued Liabilities, Other Liabilities and Deferred Income Taxes Note 17. Short-Term and Long-Term Debt Note 18. Pensions and Other Postretirement Benefits Note 19. Derivative Financial Instruments and Risk Management Note 20. Commitments and Contingencies Note 21. Income Taxes Note 22. Restructuring and Other Initiatives Note 23. Interest Income and Other Non-Operating Income, net Note 24. Stockholders’ Equity and Noncontrolling Interests Note 25. Earnings Per Share Note 26. Stock Incentive Plans Note 27. Ally Financial Note 28. Supplementary Quarterly Financial Information (Unaudited) Note 29. Segment Reporting Note 30. Supplemental Information for the Consolidated Statements of Cash Flows 2012 2011 Working Capital (CA-CL) 16004 (69996-53992) 11697 (64923-53226) Current Ratio (CA/CL) 1.30 (69996/53992) 1.22(64923/53226) Receivable turnover (Net Credit Sales/Average AR) 8.96 (93140/10395) 7.68 (76524/9964) Average days’ sales uncollected (365/RT) 41 (365/8.96) 48 (365/7.68) Inventory turnover (COGS/Average Invt) 8.85 (130220/14714) 7.87 (112730/14324) Average days’ inventory on hand (365/ Invt turn) 41 46 Operating cycle 82 (41+41) 94 (48+46) Payables turnover (Purchases/Average AP) 5.57 (140236/25160) 5.31 (130386/24551) Average days’ payables (365/pay 66 turn) 69 Working Capital and Current ratio increase in 2012 because General Motors’ current assets increase while current liabilities remain basically the same. The company’s receivable turnover increases by 1.28 in 2012 since its Net Credit Sales increase by 16616. General Motor’s inventory turnover increases in 2012 due to higher cost of goods sale in 2012 The company has a higher payable turnover since it purchases more in 2012. 2012 2011 Profit margin (Net Profit/Revenue) 4.08% (6136/150295) 6.23% (9287/148866) Asset turnover (Revenue/Assets) 1.01 (150295/149422) 1.03 (148866/144603) Return on assets (Net Income/Total Assets) 4.11% (6136/149422) 6.42% (9287/144603) Return on equity(Net income/Total SHE) 16.58% (6136/37000) 23.82% (9287/38991) The profit margin is lower in 2012 since the net profit decreases in this year. Asset turnover is lower in 2012 due to the higher asset in 2012. Return on assets and return on equity are both lower in 2012 as a result of the decline of net income. 2012 2011 Price/earnings per share 3.25 (2.63/0.81) 3.88 (3.80/0.98) Dividend yield 0 0 Price/earnings per share decreases in 2012 due to the decline of price Dividend yield is 0 in 2011 and 2012 since General Motors didn’t declare dividends in both years 2012 2011 Debt to equity (TL/Equity) 3.04 (112422/37000) 2.71 (105612/38991) Financing gap (Operation cyclesAverage days pay) 25 (95-69) Debt 16 (82-66) to equity increases in 2012 because the company’s total liabilities increases by 6807 Financing gap decreases in 2012 since the company has a higher operation cycle in 2011. In my opinion, the car industry in 2012 in USA has recovered faster then people’s expectations. Most of the car-producing companies are having a better performance in 2012. In addition, more cars’ consumers show up lead to a higher sale amount in car industry. 1.General Motors is going to invest more in China by focusing on products plants and people 1.General Motors is going to invest more in China by focusing on products plants and people. The company expects industry sales to grow another 7-8 percent in 2013 from Chinese market. http://media.gm.com/media/us/en/gm/news.detail.html/co ntent/Pages/news/cn/en/2013/Apr/0420_Growth.html 2. Improve customer satisfaction as evidenced by point of market share, not fractions. Each year GM spends billions in advertising and incentives in the name of marketing. Yet there exist far less expensive, and far more productive methods of acquiring and retaining customers. This plan calls for no capital investment and offers the opportunity for large reductions in marketing expense. http://www.generalwatch.com/future.cfm 1. In my opinion, the company has a backward financing development in 2012 . Even though its asset increases in 2012, the company’s liabilities increases greatly. In addition, General Motors has a lower net income in 2012. All these factors indicate that the company’s prospect is not good. 2.From my perspective, the company may have a lower asset in the future since the increase in liabilities in 2012. Moreover, the company will have a lower revenue in the future. Therefore, the net income will decrease in the future. 3. I wouldn’t recommend to buy General Motor’s share since the company hasn’t declared dividends in the past few years. What’s more, price/earnings per share decreases by 16.2% in 2012