Options Trading: Payoff Diagrams & Strategies

advertisement

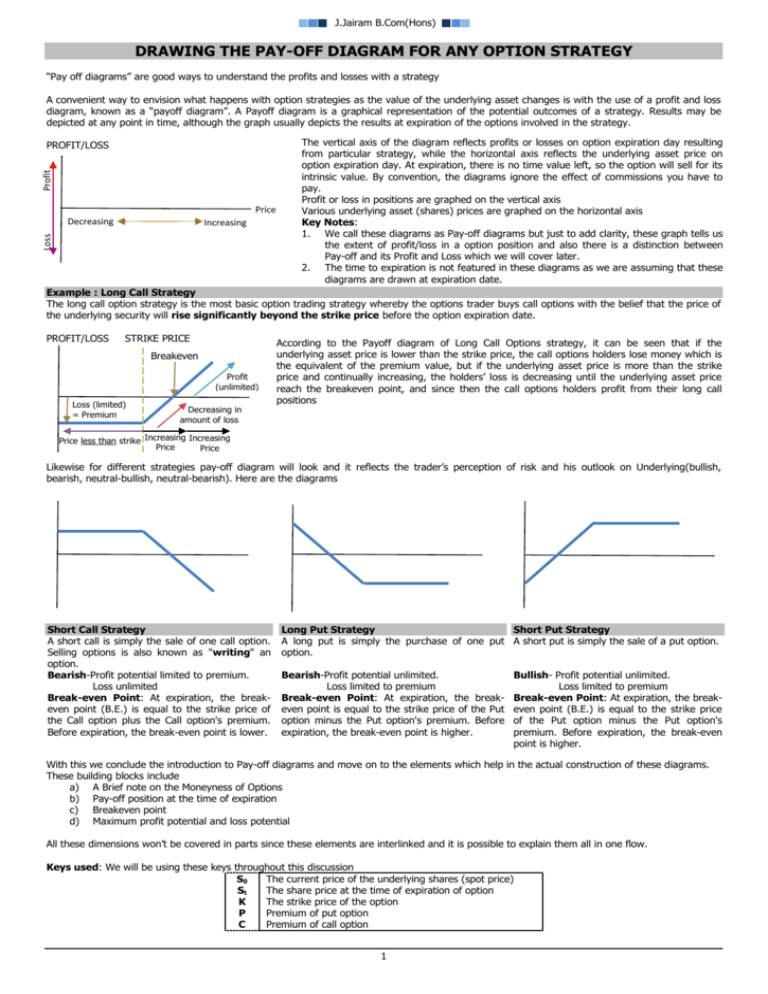

J.Jairam B.Com(Hons) DRAWING THE PAY-OFF DIAGRAM FOR ANY OPTION STRATEGY “Pay off diagrams” are good ways to understand the profits and losses with a strategy A convenient way to envision what happens with option strategies as the value of the underlying asset changes is with the use of a profit and loss diagram, known as a “payoff diagram”. A Payoff diagram is a graphical representation of the potential outcomes of a strategy. Results may be depicted at any point in time, although the graph usually depicts the results at expiration of the options involved in the strategy. Profit PROFIT/LOSS Price Decreasing Loss Increasing The vertical axis of the diagram reflects profits or losses on option expiration day resulting from particular strategy, while the horizontal axis reflects the underlying asset price on option expiration day. At expiration, there is no time value left, so the option will sell for its intrinsic value. By convention, the diagrams ignore the effect of commissions you have to pay. Profit or loss in positions are graphed on the vertical axis Various underlying asset (shares) prices are graphed on the horizontal axis Key Notes: 1. We call these diagrams as Pay-off diagrams but just to add clarity, these graph tells us the extent of profit/loss in a option position and also there is a distinction between Pay-off and its Profit and Loss which we will cover later. 2. The time to expiration is not featured in these diagrams as we are assuming that these diagrams are drawn at expiration date. Example : Long Call Strategy The long call option strategy is the most basic option trading strategy whereby the options trader buys call options with the belief that the price of the underlying security will rise significantly beyond the strike price before the option expiration date. PROFIT/LOSS STRIKE PRICE Breakeven Profit (unlimited) Loss (limited) = Premium Decreasing in amount of loss Price Premium Price less than strike Increasing Increasing Price Price Premium Premium According to the Payoff diagram of Long Call Options strategy, it can be seen that if the underlying asset price is lower than the strike price, the call options holders lose money which is the equivalent of the premium value, but if the underlying asset price is more than the strike price and continually increasing, the holders’ loss is decreasing until the underlying asset price reach the breakeven point, and since then the call options holders profit from their long call positions Likewise for different strategies pay-off diagram will look and it reflects the trader’s perception of risk and his outlook on Underlying(bullish, bearish, neutral-bullish, neutral-bearish). Here are the diagrams Short Call Strategy A short call is simply the sale of one call option. Selling options is also known as "writing" an option. Bearish-Profit potential limited to premium. Loss unlimited Break-even Point: At expiration, the breakeven point (B.E.) is equal to the strike price of the Call option plus the Call option's premium. Before expiration, the break-even point is lower. Long Put Strategy Short Put Strategy A long put is simply the purchase of one put A short put is simply the sale of a put option. option. Bearish-Profit potential unlimited. Loss limited to premium Break-even Point: At expiration, the breakeven point is equal to the strike price of the Put option minus the Put option's premium. Before expiration, the break-even point is higher. Bullish- Profit potential unlimited. Loss limited to premium Break-even Point: At expiration, the breakeven point (B.E.) is equal to the strike price of the Put option minus the Put option's premium. Before expiration, the break-even point is higher. With this we conclude the introduction to Pay-off diagrams and move on to the elements which help in the actual construction of these diagrams. These building blocks include a) A Brief note on the Moneyness of Options b) Pay-off position at the time of expiration c) Breakeven point d) Maximum profit potential and loss potential All these dimensions won’t be covered in parts since these elements are interlinked and it is possible to explain them all in one flow. Keys used: We will be using these keys throughout this discussion S0 The current price of the underlying shares (spot price) St The share price at the time of expiration of option K The strike price of the option P Premium of put option C Premium of call option 1 J.Jairam B.Com(Hons) Moneyness of an Option Moneyness is a term describing the relationship between the strike price of an option and the current trading price of its underlying security. In options trading, terms such as in-the-money, out-of-the-money and at-the-money describe the moneyness of options. KINDS OF OPTION IN-THE-MONEY (ITM) OUT-OF-THE-MONEY (OTM) AT-THE-MONEY (ATM) Call option St>K St<K St=K Put Option K>St K<St K=St Note We can also compare the strike price (K) and the spot price (S0) to find out the moneyness of the option today. In-the-Money (ITM) A call option is in-the-money when its strike price is below the current trading price of the underlying asset. A put option is in-the-money when its strike price is above the current trading price of the underlying asset. In-the-money options are generally more expensive as their premiums consist of significant intrinsic value on top of their time value. Out-of-the-Money (OTM) Calls are out-of-the-money when their strike price is above the market price of the underlying asset. Puts are out-of-the-money when their strike price is below the market price of the underlying asset. Out-of-the-money options have zero intrinsic value. Their entire premium is composed of only time value. Out-of-the-money options are cheaper than in-the-money options as they possess greater likelihood of expiring worthless. At-the-Money (ATM) An at-the-money option is a call or put option that has a strike price that is equal to the market price of the underlying asset. Like OTM options, ATM options possess no intrinsic value and contain only time value which is greatly influenced by the volatility of the underlying security and the passage of time. Often, it is not easy to find an option with a strike price that is exactly equal to the market price of the underlying. Hence, close-to-the-money or near-the-money options are bought or sold instead. Option Pay-off The premium is the price at which the contract trades. The premium is the price of the option and is paid by the buyer to the writer, or seller, of the option. In return, the writer of the call option is obligated to deliver the underlying security to an option buyer if the call is exercised or buy the underlying security if the put is exercised. The writer keeps the premium whether or not the option is exercised. The option price is constituted of 2 price components, the intrinsic value and the time value. Option price = Intrinsic Value + Time Value Intrinsic value: The intrinsic value of an option is the difference between the actual price of the underlying security and the strike price of the option. The intrinsic value of an option reflects the effective financial advantage which would result from the immediate exercise of that option. Condition Call Put Moneyness Intrinsic Value Moneyness Intrinsic Value S0>K In-The-Money S0 – K Out-of-The-Money 0 S0=K At-The-Money 0 At-The-Money 0 S0<K Out-of-The-Money 0 In-The-Money K – S0 Note: The Moneyness is always described from the perspective of the Option holder and not the writer of the option. And also the positions are reversed in the case of the writer of these options. When a call option is ITM at the time of expiration i.e. St>K the option writer will lose (St-K) Time Value or Extrinsic Value: When an option is trading at more than the intrinsic value, the difference is known as Extrinsic Value, or more commonly known as Time Value. It is determined by the remaining lifespan of the option, the volatility and the cost of refinancing the underlying asset (interest rates). Condition Call Put Moneyness Time Value Moneyness Time Value S0>K In-The-Money C – (S0 – K) Out-of-The-Money P S0=K At-The-Money C At-The-Money P S0<K Out-of-The-Money C In-The-Money P – (K – S0) Note: At the time of expiration the time value of a call option or put option is 0 even if it is in-the-money and therefore the value of option will be equal to the intrinsic value at the time of expiration. For at-the-money and out-of-the-money options since the intrinsic value will be 0 the option premium will also be 0 and hence expires worthless. The intrinsic value at the time of expiration is also known as the option pay-off and this value subtracted by the premium paid when entering into the contract is called the net pay-off or the profit & loss of the option. This is the amount which is shown in the vertical axis of the Pay-off graph. The writer of the option does not receive any positive pay-off (the premium is received up-front so pay-off excludes the premium) since they cannot exercise so maximum pay-off is 0. But their maximum net pay-off equals the premium received (C or P). The pay-off is calculated at the time of expiration 2 J.Jairam B.Com(Hons) Advanced Strategies Simplified Don’t look surprised. With these few basics we can directly move onto the main part of actually constructing the pay-off of various advanced (combination) strategies. The strategies covered are : 1. Covered Call 2. Protective or Married Put 3. Collar 4. Iron Condor Since pay-off diagrams are constructed at the time of expiration of the option contract the price of the underlying shares (S t) can take only 3 possibilities i.e. St>K, St=K and St<K So we will express these possibilities in the form of a table which will help in finding the net pay-off at a particular possible price. This table will be called the Profit & Loss table. Strategy 1: Covered Call Underlying= XYZ Shares S0 = K = Rs.100 C = Rs.10 St – 90 10 10 Break- even point when Net Pay-off is 0 occurs when St= Rs.90 (Cost of shares – Premium received) Maximum Profit = Rs.10 (Strike price – Cost of shares + Premium received) Maximum Loss = Rs.90 when St is 0 Conclusion : An options strategy whereby an investor holds a long position in an asset and writes (sells) call options on that same asset in an attempt to generate increased income from the asset. This is often employed when an investor has a shortterm neutral view on the asset and for this reason holds the asset long and simultaneously has a short position via the option to generate income from the option premium. Pay-off Diagram of Covered Call Break even (S0 – C) Maximum Profit = K – S0 + C Maximum Loss = S0 – C Buy Shares today for Rs. S0 Sell at-the-money call options which have a strike price of Rs. K selling at Rs. C Therefore K=S0 PROFIT & LOSS TABLE FOR COVERED CALL STRATEGY Particulars K>St K=St K<St Pay off of written call 0 0 -(St – K) Pay off of shares invested St St St Investment in shares -(S0) -(S0) -(S0) Call Premium received C C C Net Pay-off St – S0 + C St – S0 + C K – S0 + C ILLUSTRATION K=S0(ATM) St – K/S0 + C C C Strike Price = K Strategy 2: Protective/Married Put Buy Shares today for Rs.S0 Buy at-the-money put options which have a strike price of Rs.K selling at Rs.P Therefore K=S0 Particulars K>St K=St K<St Pay off of holding put K - St 0 0 Pay off of shares invested St St St Investment in shares -(S0) -(S0) -(S0) Call Premium received -P -P -P Net Pay-off K – S0 - P St – S0 - P St – S0 - P ILLUSTRATION K=S0(ATM) -P -P St – K/S0 - P Underlying= XYZ Shares S0 = K = Rs.100 P = Rs.10 - 10 - 10 St – 110 Pay-off Diagram of Protective Put Strike Price = K Maximum Profit (Unlimited) Maximum Loss = K – S0 - P Break even (S0 + P) Break- even point when Net Pay-off is 0 occurs when St= Rs.110 (Cost of shares + Premium paid) Maximum Profit = Unlimited (Strike price – Cost of shares - Premium paid) Maximum Loss = Rs.10 when St is equal to or less than K Conclusion : This strategy consists of adding a long put position to a long stock position. The protective put establishes a 'floor' price under which investor's stock value cannot fall. If the stock keeps rising, the investor benefits from the upside gains. Yet no matter how low the stock might fall, the investor can exercise the put to liquidate the stock at the strike price This is also known as a "buy-write". 3 J.Jairam B.Com(Hons) Strategy 3: Collar Buy Shares today for Rs.S0 Buy out-of-the-money put and sell out-of-the-money call options with strike prices of Rs.Kp and Rs.Kc for Rs.P and Rs.C respectively. Therefore Kc > Kp Pay-off Diagram of Collar BREAK EVEN ( S0 + P – C) Break- even point when Net Pay-off is 0 occurs when St= Rs.100 (Cost of shares + Put Premium paid – Call Premium received) Maximum Profit = Rs.10 (Strike price of Call Option – Cost of shares - Premium paid on Put Option – Premium received on Call Option) Maximum Loss = Rs.10 (Strike price of Put Option – Cost of shares - Premium paid on Put Option – Premium received on Call Option) Conclusion : A collar is an options strategy of holding an underlying asset, writing a call option and purchasing a put option on the same asset (of equivalent quantities). Usually, both options are out of the money when the strategy is created, which means the strike prices are such that they wouldn't be exercised. to liquidate the stock at the strike price. This is also known as a "buy-write". Maximum Profit = Kc- S0 + C - P Maximum Loss = Kp- S0 + C - P Kp Kc Particulars Payoff of written call Payoff of holding put Payoff of shares invested Investment in shares Call Premium received Put Premium paid Net Pay-off ILLUSTRATION Underlying Shares of XYZ S0 = Rs.100 OTM Kc = Rs.110 OTM Kp = Rs.90 Call premium = Rs.5 Put Premium = Rs.5 St < Kp < Kc 0 Kp - St St -(S0) C -P Kp – S0 + C - P Kp -S0 +C -P 90 -(100) +5 -(5) St = Kp < Kc Kp < St < Kc 0 0 St -(S0) C -P St – S0 + C - P St St -S0 -(100) +C +5 -P -(5) St – S0 St – 100 St = Kp 90 – 100 -(10) -(10) 0 0 St -(S0) C -P St – S0 + C - P St St -(100) -S0 +5 +C -5 -P St -100 Kp < Kc = St 0 0 St -(S0) C -P St – S0 + C - P St St -S0 -(100) +C +5 -P -5 St – S0 St – 100 110 - 100 St = Kc 10 Kp < Kc < St -(St - Kc) 0 St -(S0) C -P Kc – S0 + C - P Kc -S0 +C -P 110 -(100) +5 -5 10 Strategy 4: Iron Condor Pay-off Diagram of Iron Condor BREAK EVEN 1 (KP1 – C – P) BREAK EVEN 2 (KC1 + C + P) MAXIMUM PROFIT (C + P) KP1 KP2 Particulars Payoff of call KC1 Payoff of call KC2 Payoff of put KP1 Payoff of put KP2 Net call received(C) Net put received(P) Net Pay-off ILLUSTRATION XYZ Shares S0 = Rs.100 KP2 = Rs.80 KP1 = Rs.90 KC1 = Rs.110 KC2 = Rs.120 C1(10) – C2(7.5) C =Rs.2.5 P1(7.5) – P2(5) P = Rs.2.5 KC1 KC2 St≤KP2<KP1<KC1<KC2 0 0 -(KP1 – St) KP2 - St C P KP2 – KP1 + C + P 80 -(90) +2.5 +2.5 -(5) Suppose price of underlying is Rs.S0 Sell out-of-the-money puts with strike price of Rs.KP1 selling at Rs.P1 Buy out-of-money puts with strike price of KP2 (less than KP1) valued at Rs.P2 P1 > P2 (So Net put premium received Rs.P) Sell out-of-the-money calls with strike price of Rs.KC1 selling at Rs.C1 Buy out-of-money puts with strike price of KC2 (more than KC1) valued at Rs.C2 C1 > C2 (So Net call premium received Rs.C) Break- even point when Net Pay-off is 0 occurs twice at St= Rs.85 (Strike price of written put – net call premium – net put premium) St=Rs.115 (Strike price of written call + net call premium + net put premium) Maximum Profit = Rs.5 (net call premium + net put premium) Maximum Loss = Rs.10 (Strike price of holding Put – Strike price of written put + net call premium +Net put premium) Or Maximum Loss =Rs.10 (Strike price of written call– Strike price of holding call + net call premium +Net put premium) whichever is higher KP2<St≤KP1<KC1<KC2 0 0 -(KP1 – St) 0 C P St – KP1 + C + P St -90 +2.5 +2.5 St - 85 KP2< KP1<St≤KC1<KC2 0 0 0 0 C P C+P 2.5 +2.5 5 KP2< KP1< KC1< St≤KC2 -(St – KC1) 0 0 0 C P KC1 – St + C + P 110 -St +2.5 +2.5 115 - St KP2< KP1< KC1< KC2< St -(St – KC1) St – KC2 0 0 C P KC1 – KC2 + C + P 110 -120 +2.5 +2.5 -(5) Conclusion:An advanced options strategy that involves buying and holding four different options with different strike prices. The iron condor is constructed by holding a long and short position in two different strangle strategies. A strangle is created by buying or selling a call option and a put option with different strike prices, but the same expiration date. The potential for profit or loss is limited in this strategy because an offsetting strangle is positioned around the two options that make up the strangle at the middle strike prices. 4