Chapter 13 - Federal Direct Tax Services

advertisement

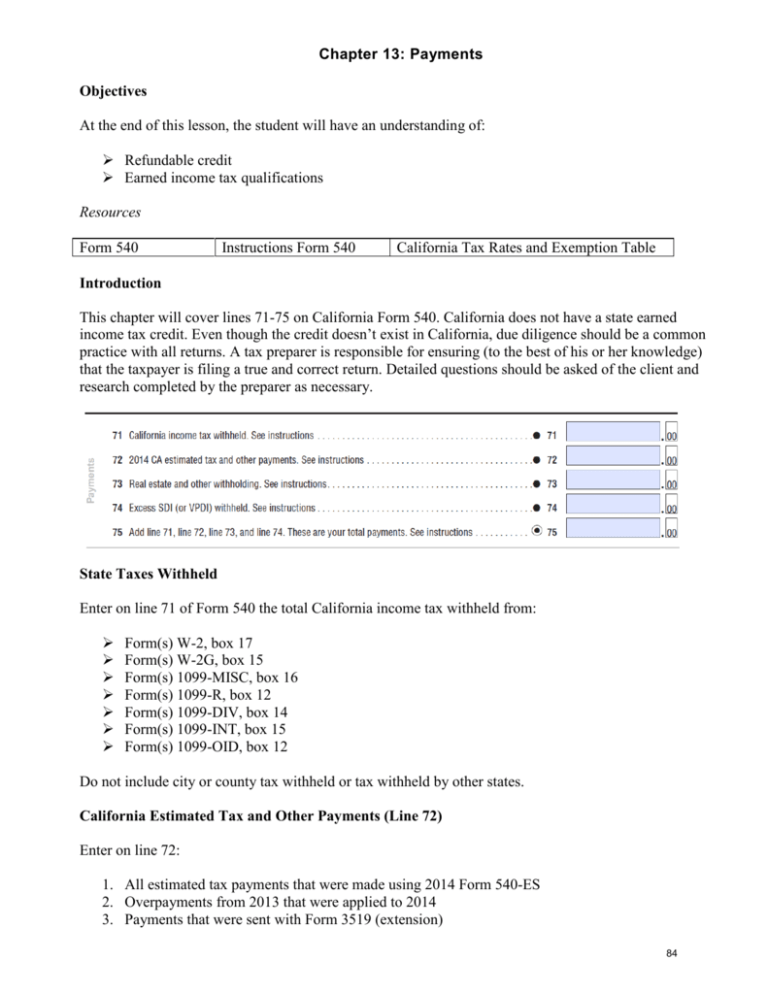

Chapter 13: Payments Objectives At the end of this lesson, the student will have an understanding of: Refundable credit Earned income tax qualifications Resources Form 540 Instructions Form 540 California Tax Rates and Exemption Table Introduction This chapter will cover lines 71-75 on California Form 540. California does not have a state earned income tax credit. Even though the credit doesn’t exist in California, due diligence should be a common practice with all returns. A tax preparer is responsible for ensuring (to the best of his or her knowledge) that the taxpayer is filing a true and correct return. Detailed questions should be asked of the client and research completed by the preparer as necessary. State Taxes Withheld Enter on line 71 of Form 540 the total California income tax withheld from: Form(s) W-2, box 17 Form(s) W-2G, box 15 Form(s) 1099-MISC, box 16 Form(s) 1099-R, box 12 Form(s) 1099-DIV, box 14 Form(s) 1099-INT, box 15 Form(s) 1099-OID, box 12 Do not include city or county tax withheld or tax withheld by other states. California Estimated Tax and Other Payments (Line 72) Enter on line 72: 1. All estimated tax payments that were made using 2014 Form 540-ES 2. Overpayments from 2013 that were applied to 2014 3. Payments that were sent with Form 3519 (extension) 84 4. Estimated tax payments that were made on the taxpayer’s behalf by an estate, trust, or S corporation on Schedule K-1 (541) or (100S) Estimated Tax Payments California estimated tax payments are comparable to the federal system and due on the same dates. Individuals who are required to make estimated payments and whose 2014 California AGI is more than $150,000 or $75,000 if filing married/RDP separately must figure estimated tax based on the lesser of 90 percent of the tax paid for 2013 or 110 percent of the tax paid for 2014, including AMT. Farmers and fishermen are excluded from this rule. The taxpayer must make estimated payments if he or she expects to owe at least $500 ($250 if married/RDP filing separately) after subtracting withholding and credits and the taxpayer expects the withholding and credits to be less than: 1. 90 percent of the tax shown on his or her 2014 tax return 2. The tax shown on the 2013 tax return, including AMT California exceptions to penalties for underpayment of estimated tax differ somewhat from the federal. Neither alternative minimum taxable income nor adjusted self-employment taxable income is included in the estimated tax computations for California. If the taxpayer and his or her spouse paid joint estimated tax payments but are now filing separate returns, either of them may claim the entire amount paid, or they may each claim part of the joint estimated payment(s). If they want the estimated tax payments to be divided, notify the FTB before the end of the tax year in which they will file separate returns so that the payments can be applied to the proper account. The FTB will accept in writing any divorce agreement (or court order settlement) or a statement showing the allocation of the payments along with a notarized signature of both taxpayers. The statements should be sent to: Joint Estimate Credit Allocation MS F225 Taxpayer Services Center Franchise Tax Board PO Box 942840 Sacramento, CA 94240-0040 Payment Due Dates Quarterly installments are due on April 15, June 15, September 15, and January 15. If the 15th of the month falls on a Saturday, Sunday, or legal holiday, the due date is the next business day. The fourth estimated payment due January 15 can be filed with the tax return by January 31. If the taxpayer qualifies, or if considered a farmer or fisherman, the taxpayer can pay all his or her estimated payments on January 15 or file and pay the tax by March 1 and pay no estimated penalties. Real Estate and Other Withholding (Line 73) Enter on line 73 any withholding from: 1. Form 593 2. Form 592-B 85 Do not include withholding from federal Forms W-2, W-2G, or 1099, or NCNR (Nonconsenting nonresidents) member’s tax from Schedule K-1 (568), line 15e. Excess SDI or VPDI Withheld (Line 74) In 2014, the employee CASDI (California State Disability Insurance) or VPDI (Voluntary Plan Disability Insurance) maximum rate is 1 percent of wages up to a maximum of $101,636 and generating a maximum withholding for CASDI of $1,016.36. If the taxpayer had more than one employer during 2014 and the employers withheld a combined total of more than $1,016.36, the taxpayer may claim a credit on the return for the amount over $1,016.36. If he or she had only one employer, the taxpayer will need to recover the excess SDI or VPDI withheld from the employer. For a joint return, the taxpayer and his spouse would calculate the excess on an individual basis. Excess SDI (or VPDI) Worksheet: Use Whole Dollars Only Follow the instructions below to figure the amount of income tax to enter on Form 540/540A, line 74. If the taxpayer files as married/RDP filing jointly, the excess must be figured separately for each individual. 1. Add amounts of SDI or VPDI withheld shown on Forms W-2. Enter the total here: 1. __________________ 2. 2014 SDI or VPDI limit: 2. _1,016.36____________ 3. Excess SDI or VPDI withheld. Subtract line 2 from line 1. Enter results here. Combine the amounts on line 3 and enter the total in whole dollars only on line 74. 3. ___________________ NOTE: If line 3 is zero or less, enter a zero on Form 540, line 74. Summary Tax payments come from various sources, income tax withholding, estimated payments, and real estate withholding. California does not have refundable tax credits like the federal. 86 Chapter 14: Refund, Amount Owed, and Third-Party Designee Objectives At the end of this lesson, the student will have an understanding of: How refunds are administered How to deal with amount owed Form 3582 Form 3567 Form 3519 What a third-party designee can do for the taxpayer on Form 3520 Resources Form 540 FTB Form 3519 FTB Form 3520 FTB Form 3567 FTB Form 3582 FTB 1001 Instructions Form 540 Instructions Form 3519 Instructions Form 3520 Instructions Form 3567 Instructions Form 3582 Introduction This chapter covers Form 540, lines 91-94, lines 111-114, and line 115. As with the federal return, California has the option for the taxpayer to designate a third-party designee. Different than the on the federal return, the third party designee is found below where the taxpayer signs the tax return. Overpaid Tax (Line 91) If the taxpayer has an amount on Form 540, line 71 that is more than the amount on line 64, he or she has payments and credits that are more than the tax owed. Subtract the amount on line 64 from the amount on line 75 and enter the overpaid tax on line 91, Form 540. The taxpayer can choose refund options just like the federal: 1. 2. 3. 4. Direct deposit from the Franchise Tax Board into a checking or savings account Refund check mailed to the taxpayer Bank product that is administered by a paid tax preparer Apply all or a portion of the refund to the 2015 estimated tax payments The taxpayer can choose different options for the federal and state refund. Amount Applied 2015 Estimated Tax (Line 92) 87 The taxpayer can apply none, all, or a portion of their tax refund (line 91) to the next year’s amount. The election to “roll over” a portion of the refund is made on line 92. Once the taxpayer makes this election, the overpayment cannot be applied to a deficiency after the due date of the return. Overpaid Tax Available (Line 93) If there is an amount in line 92, make sure to subtract from line 91 and enter the difference on line 93. The taxpayer has the ability to have their entire amount refunded or to make voluntary contributions (discussed in a prior chapter). Tax Due (Line 94) If the amount on line 75 is less than the amount on line 64, the taxpayer has an amount due. California conforms to the federal when the taxpayer underpaid his or her tax liability. The taxpayer could incur a penalty if: The tax due on line 94 is $500 or more ($250 or more if married/RDP filing separately) The amount of state income tax withheld on line 71 is less than 90 percent of the amount of the total tax on line 64 If this applies then the penalty amount would be reported on line 113. Payment Voucher FTB 3582 The taxpayer would use Payment Voucher FTB 3582 if the following apply: The taxpayer filed the tax return electronically The taxpayer has a balance due The taxpayer can choose one of the following payment options: 1. Web Pay; do not mail Form 3582 if this option is chosen 2. Credit card; do not mail Form 3519 if this option is chosen (convenience fee is 2.3 percent of the tax amount charged) 3. Check or money order; mail Form 3582 if this option is chosen If the taxpayer has filed the return electronically, the payment voucher is Form 3582. If the taxpayer is filing an extension and making a payment, use Form 3519. When to Make Your Payment 88 If taxpayers have a balance due on their tax return, they need to mail Form FTB 3582 to the FTB with their payment for the full amount by the due date. If the taxpayers cannot pay the full amount, they should pay as much as they can when they mail in Form FTB 3582 to minimize additional charges. To request monthly payments, file Form FTB 3567, Installment Agreement Request. If the taxpayer fails to pay the tax liability by April 15, 2015, a late payment penalty plus interest will accrue. The FTB may waive the late penalty assessment if the taxpayer has a reasonable cause. Use Tax (Line 95) This is not a total line, but a line to report purchases from out-of-state retailers where sales or use tax was not paid and the taxpayer uses those items in California. Some taxpayers are required to report business purchases. “Use taxes” for business purposes that have not been paid must be reported on the income tax return if the taxpayer: Has a California seller’s permit Is not required to hold a California seller’s permit, but receives at least $100,000 in gross receipts Is otherwise required to register with the state Board of Equalization for sales or use tax purposes. Failure to report and pay the use tax may result in the assessment of interest, penalties, and fees. Example: Barbara purchased a television for $2,000 from an out-of-state retailer that did not collect use tax. Barbara must use the Use Tax Worksheet to calculate the use tax due on the price of the television, since the price of the television is $1,000 or more. Amount Owed (Line 111) Add lines 94, 95, and 110 and enter the result on line 111. For the taxpayer to avoid a late filing penalty, the Form 540 series needs to be filed by the extended due date, even if payment is not paid. FTB mandates that the taxpayer remit payment electronically if the amount is more than $20,000. A waiver can be requested from filing mandatory e-pay if one of the following is true: The taxpayer has not made an estimated tax or extension payment in excess of $20,000 during the current or previous taxable year The total tax liability reported for the taxable year is not in excess of $80,000 The following are acceptable payment methods: Electronic funds withdrawal Web pay Credit card Check or money order Interest and Penalties (Lines 112 & 113) 89 California charges interest and penalties on all late tax payments. In addition, if other penalties are not paid within 15 days, interest will be charged from the date of the billing notice under the date of payment. Interest compounds daily, and the interest rate is adjusted twice a year. If the state tax return is filed after the due date and payment was due on the return, the taxpayer may owe interest and penalties. Interest and penalties are entered on line 112, and line 113 reports an underpayment of estimated taxes. Line 112 Interest is charged on filing a tax return late or making a payment late from the original due date of the return. The current interest rate for underpayment of personal income tax and estimated tax is 3 percent. Line 113 The taxpayer may be subject to underpayment of estimated tax if: The withholding and credits are less than 90 percent of current tax year liability Withholding and credits are less than 100 percent of the prior year tax liability (110 percent if AGI is more than $150,000 or $75,000 if married/RDP filing separately) Taxpayer did not pay enough through withholding to keep the amount owed under $500 ($250 if married/RDP filing separately. Like the federal return, the FTB can calculate the tax and send a bill if the taxpayer chooses. Total Amount Due (Line 114) If there is an amount on line 111, add lines 111, 112, and 113 and enter the result on line 114. If no entry on line 111, continue to line 115. Installment Agreement (Form 3567) The FTB will ask the taxpayer to pay his or her balance due prior to verifying eligibility for an installment agreement. If the taxpayer does not have the financial ability to immediately pay in full, he or she may be eligible to make installment payments over time. The FTB will verify taxpayers’ eligibility status when they submit the request for an installment agreement. The taxpayers will qualify for the installment agreement if the following conditions apply: The tax liability owed does not exceed $25,000. The installment period for payment does not exceed 60 months. The taxpayer has filed all required valid personal income tax returns. The taxpayer does not have an existing installment agreement. 90 In the installment agreement, the taxpayer agrees to: Make timely monthly payments until the tax liability is paid in full Maintain adequate funds in their bank account File all required valid personal income tax returns in a timely manner Pay all future income tax balances in a timely manner Pay a $34 installment agreement fee. The FTB will add the fee to the taxpayer’s balance due (fee amount subject to change without notice) Certify that he or she has a financial hardship if the tax liability exceeds $10,000, or the installment agreement period for payment exceeds 36 months, or both Confirm that the withholding rates for Forms EED DE 4 and IRS W-4 on file with their employer are correct. If the withholding rates are incorrect, make changes accordingly Make any required estimated payments if incomes received are from sources other than wages The FTB can approve or reject taxpayers’ requests based on their ability to pay and their compliance history. The FTB may file liens and request financial statements as a condition for approval. If taxpayers misrepresent or fail to prove their financial condition, the FTB may reject their installment agreement. Refund or No Amount Due (Line 115) Enter the amount from line 93 on line 115; if there are no entries on lines 110, 112, or line 13, then the amount is the taxpayer’s refund. If there are entries on lines 95, 110, 112, or line 13, then the amount needs to be added together. If the amount is more than line 93, then subtract line 93 from the sum of line 95, 110, 112 and 113 and enter result on line 114. This is the amount owed. If the amount is less than the sum of lines 95, 110, 112 and 113 from line 93 and enter on line 115, this is the refund amount. Line 116 and 117 The taxpayer can have the refund directly deposited into two separate accounts by indicating the routing number (RTN) and the account number on the lines. Do not attach a voided check or deposit slip if mailing the return. The box for the type of account, checking or savings, need to be indicated. As with the federal return, the routing numbers must be nine digits—the first two digits must be 01 through 12 or 21 through 32. 91 Signing the Return Sign the tax return in the space provided. Provide the name and the phone number of the person to contact if the FTB has any questions about the tax return. Also, include the best time of day to call. This information will allow the FTB to provide better service in processing the taxpayer’s return. California conforms to federal in how the income tax return should be signed. Paid Preparer’s Information If the return is prepared by a person for pay, that tax professional needs to fill in this section on Form 540. The tax professional must sign and complete the area at the bottom of side two, including his or her identification number. The IRS requires a paid tax preparer to get and use a preparer tax identification number (PTIN). If the preparer has a federal employer identification number (FEIN), it should be entered only in the space provided. A paid preparer must give the taxpayer a copy of the tax return to keep for his or her records. 92 Third-Party Designee California conforms to the federal rules in regards to the third-party designee. Assembling the Return Like the federal return, the FTB has an order for the forms to be attached together when mailing the return to the state. Form 540 has five sides, and all of the sides must be mailed to the state, even if there are no entries on the pages. There are situations in which the taxpayer needs to attach a copy of the federal return to the state return. If the taxpayer has forms or schedules attached to the federal return then the federal return needs to be attached behind the state return. The following are examples of federal forms that would require Form 1040 to be attached to the state tax return: Schedule A Schedule B Form 2441 93 Power of Attorney FTB Form 3520 is the California form to give a representative authorization to act on the taxpayer’s behalf. Federal Form 2848 can be used but needs to be modified to apply to FTB matters. If the taxpayer uses Form 2848, this form provides authorization for: Representation before FTB Executing any of the following: Waivers Consents Closings agreements When using Form 3520, the taxpayer can give the individual specific privileges in Part 5. Some of the specific authorizations are: Talk to FTB agents about the taxpayer’s account Receive and inspect a taxpayer’s confidential tax information Represent taxpayer in FTB matters Waive the California statute of limitations (SOL) Execute settlement and closing agreements Request information the FTB received from the IRS Generally the POA remains in effect until the taxpayer revokes it. See Instructions Form 3520 for more information. Summary As with the federal return, FTB Form 540 has been discussed line by line. Even though the explanation is for the long form, knowing and understanding how the tax return flows is very important. 94