Collision Shop Presentation Outline

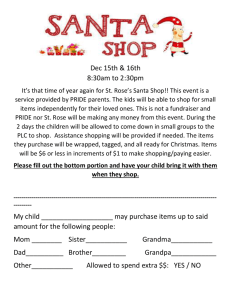

advertisement

The State of Dealership Collision Repair Shop Business In 2003 Prepared By: “You cannot change what is happening in your Dealership collision department until you decide to change your perspective of how to deal with it!” Dealership collision repair business has gone nearly full circle in the last decade. Dealers have seen both the good the bad and the ugly side of this business during this period. In the early 90’s GM and Ford dealers experienced a windfall from manufacturer warranty paintwork for their collision shops. Many dealers had warranty paint jobs backed up for more than 18 months. Manufacturers were paying dealers from $1500.00 to $3000.00 for each of these repairs. In addition to the warranty work, many shop managers were forcing customers to pay for repairing dents and dings before they would do the warranty repaints. This lulled many dealers and shop managers into thinking this gravy train would last forever. Managers, many whom had never before turned a profit in the body shop were looking like heroes on the financial statements. Dealers were investing capital in more paint booths, prep-decks, mixing rooms etc. Everyone was acting like this would never end. The net result of this was that in the mid 90’s when the warranty work started tapering off, dealers discovered that they had an excess of paint shop capacity. Plus, they had painters earning over $125,000.00 per year. These guys and gals were literally running the show! The managers were so afraid that they would upset the painters they were unable to implement any changes. This was a time when changes were needed the most. The net result was that dealers ended up going through several different collision shop managers. Usually, it took about three managers before they finally lost the painter due to a lack of work. After the painters left, the dealers were finally able to bring in a manager who could actually implement changes. Unfortunately by the time most dealership had gotten their act together, the bulk of the insurance business had moved to independents. Independents experienced huge gains in business during the mid 90’s. At this same time two other things happened that significantly impacted the collision business. © Copyright 2003 Edwards & Associates Consulting, Inc. First, the paint companies (with all of this warranty repaint business) started trying to buy market share. Paint companies were acting just like the dealers and conducting business as if the warranty work would never end. The net result is that paint went from being a product based on service to a commodity based on price. The paint companies responded to this shifting market by trying even harder to “buy” more business. Some of the deals they made were completely without any rational business thinking applied. I have one client who purchases about $350,000.00 in paint each year who negotiated a $1,000,000.00 cash incentive to buy materials from a paint supplier. The agreement was spread out over a ten-year period, but still, that’s a 1-million dollar discount on 3.5-million dollars in purchases. Plus, on top of the guarantee, they gave my client a guaranteed gross profit of 40%. Some of these paint company deals went beyond absurd before the paint companies woke up and said “no-more”. In fact a couple of companies had to fold up their tent and ended up selling out to larger companies. Secondly, the insurance companies were experiencing nirvana because the independent shops had no problem using aftermarket and / or salvage parts. Some areas of the country were using more than 50% aftermarket and salvage parts for all insurance repairs. This little anomaly caught the manufacturers completely off guard. They didn’t know what was happening until the proverbial bus had already run over them! This asleep at the wheel syndrome cost manufacturers not millions, but billions in lost parts sales. When these sleeping giants finally woke up it was almost too late. Thank goodness for them, the Illinois State Legal System saved the manufacturers butts! A judge in Illinois allowed a local lawsuit alleging use of aftermarket parts without proper notification to the policyholder to become a national class action suit. And, the rest as they say, is history. State Farms settlement in this matter changed aftermarket parts usage significantly. Almost overnight, usage of Original Equipment Parts went up nationwide. © Copyright 2003 Edwards & Associates Consulting, Inc. At the same time, dealers were starting to get their act together and began focusing their efforts on obtaining and / or building on their DRP relationships. Of course, nothing is ever easy. While dealers were getting their acts together the large independents were getting larger. In fact several consolidations occurred in the late 90’s and early in 2000 that had and will continue to have an impact on dealers share of the collision business. So far consolidation efforts have only gained enough momentum to keep dealers who want to be in the collision business on their toes. Independent Consolidation has had a much greater impact in the larger markets than in the secondary markets. However Independents in secondary markets are now consolidating and dealers in these markets have to compete with some very successful independent collision shops if they want to succeed. What does the future for the collision industry look like? For Dealers, the wonderful thing about this business is that collision shops are providing a service for customers who have “already pre-paid” for the service! Every morning, approximately 8% of the millions of people who drive vehicles will find something to HIT! And, if the weather changes for the worse, then this number doubles to approximately 15%. Collision repair always has been and always will be an excellent business to be involved in. You just have to remember that just like any other business however, collision customers will continue to go where they are wanted and they will stay where they are appreciated. Dealers who want to be successful have got to take the collision shop off of their back burner and make it a part of their overall operating strategy. To be successful, facilities must be upgraded. Reception areas have to look like a Doctors office. Outside areas have to look like an office park. And shop areas must be upgraded with new “dust free” equipment. Measuring and pulling equipment has to be state of the art and technicians have to know how to use this equipment. © Copyright 2003 Edwards & Associates Consulting, Inc. Insurance companies have to be treated as “partners” with the common goal of successfully taking care of customers needs. Management has to be taught how to think strategically and manage tactically. Estimators have to be trained to act as professional sales representatives for the dealership. Insurance companies will continue to look for ways to reduce their costs. This is at the heart of the capitalistic system and quite simply, it is a prerequisite for success in any business. In order to be truly successful, a business must constantly strive to reduce costs so that those reduced costs can be passed along to customers in exchange for greater market share. For some reason, too many Collision Shop Managers seem to think that the insurance companies are not supposed to do this. They think and act as if the insurance companies should give them anything they ask for, without question, in order to repair a customer’s vehicle. This mentality will have to go! Managers will have to learn to please both customer, the one driving the vehicle, and the one paying the bill. Insurance Direct Repair Programs have proven to be an excellent method for reducing insurance company costs. They have allowed the insurers to reduce staff and equipment while giving the shops greater decision authority. These programs have also been effective in reducing cycle times, which in turn reduces the insurance companies rental vehicle expense. Insurance companies will continue to look for ways to further reduce their costs. The rental programs that they are running with Enterprise rental and others has improved (reduced) their costs and provided the insurance companies with better control over this part of the process. As for direct ownership of collision shops most insurance companies are taking a “wait and see” approach to Allstate’s investment in Sterling Collision Centers. So far, it appears that Sterling has a distinct dis-advantage in that other insurance companies are reluctant to send their customers to a Sterling Shop for fear that they will discover that in fact, an Allstate owned shop is repairing their Farmers Insured Vehicle. This scenario gets real messy for the insurance companies and for Sterling it presents a unique challenge of “How do we stay busy when Allstate customers are not wrecking their vehicles”. So far, they have solved this issue by only locating in areas where they have a high concentration of customers. But even this is risky. Only time will tell whether or not this venture actually reduced Allstate’s costs. © Copyright 2003 Edwards & Associates Consulting, Inc. My guess is that this will not work out over the long haul for two reasons. Number 1, this industry operates on an average net profit of 8%. While 8% net is great for a gigantic company with millions in annual sales, it is not much for a company that sells only hundreds of thousands! The return is barely sufficient to cover the replacement costs for buildings and fixtures over the long haul. Second, auto manufacturers have proven time and time again that they cannot run retail establishments and I feel strongly that insurance companies will discover sooner or later that they are better suited to selling insurance than they are at repairing damaged vehicles. Paint companies also have a stake in this deal as well. I have to mention that I have never really understood why a supplier who supplies approximately 5% to 8% of the items needed to repair a damaged vehicle can exert so much influence on the industry. I honestly believe that the paint companies miss-read what was happening in the 90’s with all of the manufacturer repaints being done under warranty and began managing their business like this would never end. Now, they are like the “drug addict” trying to get themselves off the drugs. They forgot how to sell products based on Features, Advantages and Benefits and as a result, are having to re-learn what they once knew. They are trying to stop but they just can’t! Dupont was one of the first to learn how to “just say no” and their bottom line results are showing it. Other paint companies are still struggling with the need to actually sell their products. In my opinion, if you have been procrastinating about building a new shop or upgrading your current facilities and you “thought” your paint supplier would help offset the cost for you. You have procrastinated too long! The right paint supplier can still be an excellent partner. They can help you reduce your paint usage cost, train entry level painters to become full-fledged painters (at half of what you’re paying super-painter today) and they can relieve you of the burden of maintaining a huge inventory of paint supplies and materials. Just do not expect them to provide all of the inventory and paint mixing help and give you a million dollars too! © Copyright 2003 Edwards & Associates Consulting, Inc. Success Paradigms for “MOMENTUM” in the collision repair business 1. Upgrade your reception areas; they need to look like a doctor’s office or a hotel lobby. 2. Upgrade your office areas; they need to look as clean, neat and organized as your main dealership offices. 3. Upgrade your managers skills, they need to know how this business works from everyone involved perspective. Managers need to understand the value of systems management that utilizes tracking and monitoring to ensure that goals and objectives are being met. 4. Upgrade your equipment, you must have laser-measuring systems, a frame rack that works, down draft paint booths that are properly heated and serviced regularly. 5. Change your pay plans to reward sales growth, customer satisfaction, reduced cycle times, increased sales and net profits. 6. Get involved with your manager in meeting with your major insurance company “partners” and agents in your market area regularly. 7. Begin reviewing the monthly reports that your insurance DRP partners send to your manager. 8. Begin attending the insurance DRP program meetings that are held monthly and quarterly in your market. 9. Begin monitoring key performance indicators from your collision shop manager, daily. 10. Implement Edwards & Associates performance guidelines / standards for your shop. © Copyright 2003 Edwards & Associates Consulting, Inc. Edwards & Associates Body Shop Performance Targets Item Goal Labor Gross Profit 65% Parts Gross Profit 36% Materials Gross Profit 45% Materials Net Profit 30% Sublet Gross Profit 10% Total Gross Profit 48% Technician Proficiency 170% Open Repair Orders Less Than 50% of Average Months Repair Orders Written 50% Receivables Less Than 50% of Average Months Total Shop Sales 50% DRP Ranking in Top Ten Percent of DRP Shops in Your Market Area 10% Walk In Estimate Closing Ratio 70% or Better 70% + DRP Estimate Closing Ratio 90% of Assignments 90% + Dollar Value of Estimates Written Should Be Within $300 + or - Estimates Sold Average Repair Cycle Time $300 4.5 Days CSI Survey Results 95% + Total Sales Annual Growth 10% + Support Salaries as % of Gross 40% Semi Fixed as % of Gross 20% Fixed as % of Gross 15% Net as % of Gross 25% If you would like a Free Profit Potential Analysis of your dealerships Collision Center, please fill out the attached input form and fax it to our office. You will receive your free report in approximately 5 working days. © Copyright 2003 Edwards & Associates Consulting, Inc. Dealer Collision Shop Profit Potential Analysis Collision Shop Name Street Address City Phone Number Completed By State Zip Fax Number Date Financial Information Month of Statement Y.T.D. Total Collision Shop Labor Sales Y.T.D. Total Collision Shop Labor Gross Y.T.D. Collision Shop Retail Parts Sales Y.T.D. Collision Shop Retail Parts Gross Y.T.D. Sublet Sales Y.T.D. Sublet Gross Y.T.D. Paint & Materials Sales Y.T.D. Paint & Materials Gross Y.T.D. Total Collision Shop Non-Production Personnel Expense Y.T.D. Total Collision Shop Semi-Fixed Expense Y.T.D. Total Collision Shop Fixed Expense Y.T.D. Retail Labor Rate Number of Repair Orders Closed Number of Paint Stalls Number of Metal Stalls Number of Paint Craftsmen Number of Metal Craftsmen Daily Clock Hours Worked by Each Craftsmen Number of Estimators Fax: 704-454-5213 © Copyright 2003 Edwards & Associates Consulting, Inc. Y.T.D. Edwards & Associates Collision Shop Management Tools / Programs Available to Automobile Dealers Advanced Collision Shop Management Course o Length 3-days covers how to obtain and grow DRP business, how to increase Cycle times, and how to structure your shop for a profit. o Cost $995.00 Estimator Selling Skills Enhancement course o Length 2-days covers estimating for profit, managing DRP’s for more assignments, convincing the customer to let your shop handle their repair from A to Z. o Cost $450.00 Master Mind Groups for Collision Shop Managers o Similar to a 20-group program, comprised of managers from like size shops. Meetings are held twice each year in the spring and fall. o Cost $1,800.00 per year Collision Shop Management Training Program and Operating System o This program is conducted on-site in your dealership by and E&A consultant. Includes up to 8 days on on-site consulting and up to one year of coaching and counseling by and E&A Consultants o Cost $11,200.00 Plus Travel Expenses Work Flow Management System to manage the flow of work going through your shop while helping increase business. o One years supply of forms with instructions for use o Cost $75.00 per pad of 50 © Copyright 2003 Edwards & Associates Consulting, Inc. If you would like more information please contact us at: Edwards & Associates Consulting, Inc. 5615 Harrisburg Industrial Park Drive Harrisburg, NC 28075 Phone: 1-800-979-9904 Fax: 704-454-5213 © Copyright 2003 Edwards & Associates Consulting, Inc.